Shem Oirere , Africa Correspondent08.10.18

The Southern Africa Coatings Show that ended on May 31 in Johannesburg brought together coatings industry raw material manufacturers, suppliers, distributors, chemists and contractors making it the biggest such event in sub-Saharan Africa.

Local and international exhibitors took advantage of the three-day show organized by DMG Events, South African Paint Manufacturing Association (SAPMA) and Oil and Colour Chemists’ Association of South Africa (OCCA) to showcase their raw materials, coatings and paints products, technology for applying the products on surfaces, and also services that support the industry in addition to utilizing the opportunity to promote recently innovated products.

“The show is much bigger than the inaugural 2015 edition that was organized by Sapma and OCCA,” said Deryck Spence, executive director, SAPMA, an organization that also used the event to celebrate its 80th anniversary. “The partnership between SAPMA, OCCA and DMG Events was very successful at the Southern African Coatings Show because of the high participation of both local and international coatings and paints companies.

“What SAPMA managed to do was to bring the local companies affiliated to the association and who produce more than 85 percent of the paint manufactured in South Africa and approximately 70 percent of raw material suppliers, as well as a significant sector of the retail market while DMG Events brought in international industry players and so I think it was a good mix,” Spence added.

DMG Events, which previously acquired Johannesburg-based Pan African exhibition organizer Exhibition Management Services Pty Ltd and operates 12 events across the continent, expressed satisfaction with the success of the show that attracted more than 1,700 people, an increase from the 1,400 that attended the 2015 event.

“There were about 150 stands at the show with some shared by three or four exhibitors made up of a mix of local and international companies,” said Kieran Proverbs, DMG Events marketing manager. “DMG saw the potential in the Southern African Coatings Show and when we took up as the lead organizer we thought we could bring on board more international industry players with SAPMA and OCCA using their local network to mobilize South African companies.”

The 2018 Southern Africa Coatings Show was the first organized by DMG, which has 80 percent stake in the event with SAPMA and OCCA having 10 percent each.

“This year’s show has been quite a success and we will definitely be hosting the event again in 2020,” said Proverbs.

Although most of the local and international companies participating at the show expressed optimism they will form long-term business networks with potential customers, some said their expectations were much higher than what they achieved by the end of the show.

“Many of the business deals are never made at forums such as the Southern African Coatings event. I think it provides us with an opportunity to meet and get to know better potential customers who can later make a follow-up and probably sign a business deal in the future,” said Waleed Nabil, the regional sales manager Middle East & Africa for Egypt-based Egyptian-Canadian company Delta Specialties which deals in coatings, graphic arts and plastics industries.

“Traffic to the Delta Specialties stand at the show was quite good and we look forward to future business deals from the inquiries we received at the information we gave out during the three days.”

Other participants such as Munich-based chemical group WACKER, used the show as an opportunity to showcase its new coatings solutions of SILRES BS 6920 and SILRES BS 710.

“One of the highlights of this year’s coatings show will be SILRES BS 6920, an alpha-silane-terminated polyether which cures on contact with moisture and has a very low viscosity,” said Sweeny Samarawickrama, corporate communications manager for Middle East & Africa.

During the show, WACKER also presented its new anti-graffiti concentrate SILRES BS 710 which the company said is a one-part silicone rubber formulation which cures to form a silicone elastomer at room temperature and upon exposure to moisture.

“The Southern Africa Coatings Show is a good forum for us to meet potential customers and demonstrate to them the quality of the products we have especially with the increasing competition from China and India,” said Jean Marc Vidal, head of sales for Middle East & Africa at Italy-based Corobo SpA.

“Going into the future competition in the coatings and paints industry is going to be more on quality and not necessarily on pricing.”

South Africa-based Surface Coating Technologies’ (SCT) Technical Sales Manager Werner Oberholzer said this year’s show provided an opportunity for the company to reach out to new and existing customers and tell them why quality should form the basis of their investment in coatings and paints.

“Buying cheap can be expensive in the long run because of the many repairs, replacements and also downtime of equipment,” he added.

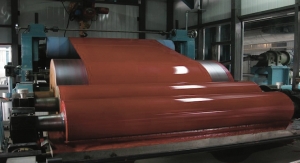

SCT, which is based in Johannesburg, imports, supplies, and services spray systems and fluid handling equipment including finishing technology for applying heavy-duty industrial coatings.

Chinese company Hangzhou Alpha Technology (OKCHEM) used this year’s coatings show to woo Africa-based coatings and paints users to embrace online purchasing, especially from the Chinese market.

OKCHEM, an e-commerce platform specializes in chemical product trade, and wants to ride on the increasing technology uptake in Africa especially smartphones to entrench its e-commerce option for buyers of raw materials, coatings and paints and also those in need of logistical services to move their products across the globe, per the company’s Marketing Manager Jimmy Lou.

The challenges of skills shortages, automation of operations, elimination of lead paints, the VOC debate and sources of capital to grow business and innovate dominated the presentations by the 33 industry experts and government officials at this year’s coatings event.

“The skills shortages in the coatings industry is a very sensitive and confusing subject as is the identification of those skills shortages depending on which side of the equation you sit in,” said Spence.

He explained the challenges facing the training of professionals in South Africa’s coatings and paints industry on the back of lack of harmonized training programs by both the public and private sector.

The SAPMA executive director said although South Africa introduced a skills levy to train employees for business to improve productivity under a partnership between government and private sector, the initiative was short lived as “Department of Higher Education and Training took over the responsibility for the levy and the allocation of funds arising from the levy.”

Kansai Plascon Pty Ltd’s Chief Operating Officer Carlos Costa said the time has come for a deliberate shift towards automation of Africa’s coatings and paints industry for better performance and increased output.

“Automation is critical in coatings and paints industry as it leads to the performance of tasks much faster, more efficiently and increases productivity and variety of products and with it increases the demand for human workers to do other tasks around it that are not automated,” he said.

“Technology is strategic for business development and growth because it eliminates inefficiencies that eat into a company’s profit. Technological change is not a bad thing as it presents new opportunities for growth,” Costa continued.

“If we do not automate in South Africa coatings industry, local labor will be replaced by paint which will be produced cheaper and much faster overseas,” he concluded.

But the biggest debate dominating Africa’s coatings and paints industry is the elimination of lead paints and lack of clarity on volatile organic compounds (VOC).

“Currently, there is very little consistency with regards to VOC definitions, categories and methods used,” said Bobby Bhugwandin, technical director at Kansai Plascon.

“For South Africa and Africa in general, this is complicated by having no clear guidelines from any governing bodies hence the dilemma faced by many producers on which limits to follow.”

An emerging trend globally is that of consumers warming up to property or products that support social and environmental causes, according to Grahame Cruickshanks, managing executive, Market Development & Training Green Building Council of South Africa.

“Green buildings outperform non-green buildings in every area of benefit, and match them on cost,” he said.

“Research proves green building deliver a better return on investment than non-green buildings (and) the evidence that global green building continues to double every three years proves that the advantages are too valuable to ignore.”

South Africa’s department of environmental affairs hopes to eliminate lead paint by the end of 2018 according to Noluzuko Gwayi, the department’s senior policy director for Strategic Approach to International Chemicals Management (SAICM).

“South Africa has a legal framework supported by the Constitution on the elimination of lead paint,” she said.

Gwayi said South Africa has banned lead in paints and importation of leaded paint while supporting the increased local production of unleaded paint.

“The department of health is leading the implementation of the resolutions on lead that include ensuring reduction of lead from 600 parts per a million (ppm) to 90ppm to accommodate naturally occurring lead,” she noted.

Local and international exhibitors took advantage of the three-day show organized by DMG Events, South African Paint Manufacturing Association (SAPMA) and Oil and Colour Chemists’ Association of South Africa (OCCA) to showcase their raw materials, coatings and paints products, technology for applying the products on surfaces, and also services that support the industry in addition to utilizing the opportunity to promote recently innovated products.

“The show is much bigger than the inaugural 2015 edition that was organized by Sapma and OCCA,” said Deryck Spence, executive director, SAPMA, an organization that also used the event to celebrate its 80th anniversary. “The partnership between SAPMA, OCCA and DMG Events was very successful at the Southern African Coatings Show because of the high participation of both local and international coatings and paints companies.

“What SAPMA managed to do was to bring the local companies affiliated to the association and who produce more than 85 percent of the paint manufactured in South Africa and approximately 70 percent of raw material suppliers, as well as a significant sector of the retail market while DMG Events brought in international industry players and so I think it was a good mix,” Spence added.

DMG Events, which previously acquired Johannesburg-based Pan African exhibition organizer Exhibition Management Services Pty Ltd and operates 12 events across the continent, expressed satisfaction with the success of the show that attracted more than 1,700 people, an increase from the 1,400 that attended the 2015 event.

“There were about 150 stands at the show with some shared by three or four exhibitors made up of a mix of local and international companies,” said Kieran Proverbs, DMG Events marketing manager. “DMG saw the potential in the Southern African Coatings Show and when we took up as the lead organizer we thought we could bring on board more international industry players with SAPMA and OCCA using their local network to mobilize South African companies.”

The 2018 Southern Africa Coatings Show was the first organized by DMG, which has 80 percent stake in the event with SAPMA and OCCA having 10 percent each.

“This year’s show has been quite a success and we will definitely be hosting the event again in 2020,” said Proverbs.

Although most of the local and international companies participating at the show expressed optimism they will form long-term business networks with potential customers, some said their expectations were much higher than what they achieved by the end of the show.

“Many of the business deals are never made at forums such as the Southern African Coatings event. I think it provides us with an opportunity to meet and get to know better potential customers who can later make a follow-up and probably sign a business deal in the future,” said Waleed Nabil, the regional sales manager Middle East & Africa for Egypt-based Egyptian-Canadian company Delta Specialties which deals in coatings, graphic arts and plastics industries.

“Traffic to the Delta Specialties stand at the show was quite good and we look forward to future business deals from the inquiries we received at the information we gave out during the three days.”

Other participants such as Munich-based chemical group WACKER, used the show as an opportunity to showcase its new coatings solutions of SILRES BS 6920 and SILRES BS 710.

“One of the highlights of this year’s coatings show will be SILRES BS 6920, an alpha-silane-terminated polyether which cures on contact with moisture and has a very low viscosity,” said Sweeny Samarawickrama, corporate communications manager for Middle East & Africa.

During the show, WACKER also presented its new anti-graffiti concentrate SILRES BS 710 which the company said is a one-part silicone rubber formulation which cures to form a silicone elastomer at room temperature and upon exposure to moisture.

“The Southern Africa Coatings Show is a good forum for us to meet potential customers and demonstrate to them the quality of the products we have especially with the increasing competition from China and India,” said Jean Marc Vidal, head of sales for Middle East & Africa at Italy-based Corobo SpA.

“Going into the future competition in the coatings and paints industry is going to be more on quality and not necessarily on pricing.”

South Africa-based Surface Coating Technologies’ (SCT) Technical Sales Manager Werner Oberholzer said this year’s show provided an opportunity for the company to reach out to new and existing customers and tell them why quality should form the basis of their investment in coatings and paints.

“Buying cheap can be expensive in the long run because of the many repairs, replacements and also downtime of equipment,” he added.

SCT, which is based in Johannesburg, imports, supplies, and services spray systems and fluid handling equipment including finishing technology for applying heavy-duty industrial coatings.

Chinese company Hangzhou Alpha Technology (OKCHEM) used this year’s coatings show to woo Africa-based coatings and paints users to embrace online purchasing, especially from the Chinese market.

OKCHEM, an e-commerce platform specializes in chemical product trade, and wants to ride on the increasing technology uptake in Africa especially smartphones to entrench its e-commerce option for buyers of raw materials, coatings and paints and also those in need of logistical services to move their products across the globe, per the company’s Marketing Manager Jimmy Lou.

The challenges of skills shortages, automation of operations, elimination of lead paints, the VOC debate and sources of capital to grow business and innovate dominated the presentations by the 33 industry experts and government officials at this year’s coatings event.

“The skills shortages in the coatings industry is a very sensitive and confusing subject as is the identification of those skills shortages depending on which side of the equation you sit in,” said Spence.

He explained the challenges facing the training of professionals in South Africa’s coatings and paints industry on the back of lack of harmonized training programs by both the public and private sector.

The SAPMA executive director said although South Africa introduced a skills levy to train employees for business to improve productivity under a partnership between government and private sector, the initiative was short lived as “Department of Higher Education and Training took over the responsibility for the levy and the allocation of funds arising from the levy.”

Kansai Plascon Pty Ltd’s Chief Operating Officer Carlos Costa said the time has come for a deliberate shift towards automation of Africa’s coatings and paints industry for better performance and increased output.

“Automation is critical in coatings and paints industry as it leads to the performance of tasks much faster, more efficiently and increases productivity and variety of products and with it increases the demand for human workers to do other tasks around it that are not automated,” he said.

“Technology is strategic for business development and growth because it eliminates inefficiencies that eat into a company’s profit. Technological change is not a bad thing as it presents new opportunities for growth,” Costa continued.

“If we do not automate in South Africa coatings industry, local labor will be replaced by paint which will be produced cheaper and much faster overseas,” he concluded.

But the biggest debate dominating Africa’s coatings and paints industry is the elimination of lead paints and lack of clarity on volatile organic compounds (VOC).

“Currently, there is very little consistency with regards to VOC definitions, categories and methods used,” said Bobby Bhugwandin, technical director at Kansai Plascon.

“For South Africa and Africa in general, this is complicated by having no clear guidelines from any governing bodies hence the dilemma faced by many producers on which limits to follow.”

An emerging trend globally is that of consumers warming up to property or products that support social and environmental causes, according to Grahame Cruickshanks, managing executive, Market Development & Training Green Building Council of South Africa.

“Green buildings outperform non-green buildings in every area of benefit, and match them on cost,” he said.

“Research proves green building deliver a better return on investment than non-green buildings (and) the evidence that global green building continues to double every three years proves that the advantages are too valuable to ignore.”

South Africa’s department of environmental affairs hopes to eliminate lead paint by the end of 2018 according to Noluzuko Gwayi, the department’s senior policy director for Strategic Approach to International Chemicals Management (SAICM).

“South Africa has a legal framework supported by the Constitution on the elimination of lead paint,” she said.

Gwayi said South Africa has banned lead in paints and importation of leaded paint while supporting the increased local production of unleaded paint.

“The department of health is leading the implementation of the resolutions on lead that include ensuring reduction of lead from 600 parts per a million (ppm) to 90ppm to accommodate naturally occurring lead,” she noted.