Phil Phillips and Gary Shawhan, Contributing Editors01.07.19

Charting a successful growth path for your business begins with identifying and understanding the company’s core competencies and overall strengths. Sorting through and prioritizing the best paths forward requires management to first establish a set of business goals and objectives and a time frame within which they want to accomplish them.

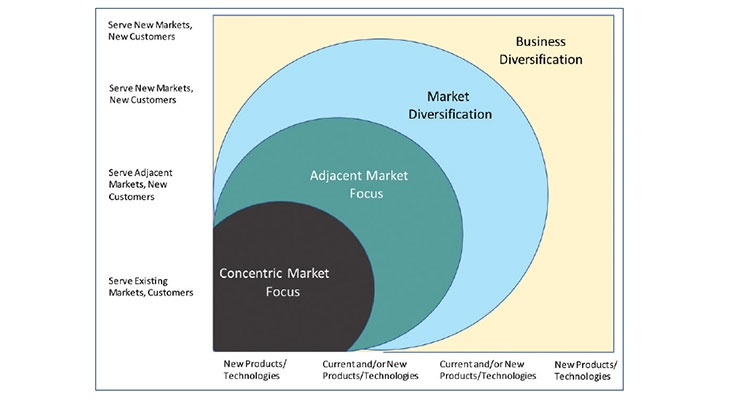

Figure 1 highlights four alternative strategies that represent distinct pathways that can be contemplated by management to achieve established business goals and objectives. In this article, we examine the general characteristics and considerations for choosing one or more of these paths as a growth strategy.

Concentric Markets

Concentric markets are those that can be identified as representing a significant share of the company’s present business revenue and profit. Targeting concentric markets for growth is the safest path as current resources, products and services are already in place. In addition, market knowledge, awareness of trends and unmet needs and an understanding of the present competitive environment exist.

Among the strategic options normally considered in addressing growth in concentric markets includes targeting new customers or capturing share gain within current market spaces. Targeting unmet needs or product/process improvements that can deliver a net value to specific accounts are options frequently considered. These unmet needs can be addressed through internally directed R&D.

Alternatively, Licensing-in new technology that can bring improvements in product performance and potential competitive advantages can expand options and/or shorten the time-frame within which these improvements can be made market ready.

By themselves, concentric growth strategies are normally limited in the size of the revenue growth (and profits) that can be generated. When the strategic growth goals and objectives for the business are high, concentric market strategic normally become a compliment to other more broad-based initiatives.

Adjacent Markets

Adjacent markets are those where there are identifiable, common threads to the company’s current business. This may include such things as similar product/performance requirements, resourcing needs and technical support expectations by customers coupled with time-to-market realities.

Of particular importance, when focusing company growth on an adjacent market strategy, is a commonality in the channels-to-market between current and targeted market segments. This element takes advantage of the company’s core competencies, reputation and brand identity. The strategic intent is to expand the size of the company’s overall business opportunity while maximizing the use of current resources and shortening the time-to-market as much as possible.

Pursuing an adjacent market growth strategy can be addressed through additions of products/technology or by selectively targeting individual accounts in specific market spaces who have a similar need for products or services currently offered. In either case, identifying unmet needs is a key element in strategy development. Relying on internal R&D to deliver differentiated products is one option. Licensing-in technology, directed at providing products that address identified unmet needs, is an alternative which allows companies to reach beyond their internal product development capabilities.

Targeting geographic growth is an alternative adjacent market growth strategy. In this case, it is important that the geography being targets be supportable now with similar products and support services to be considered within this strategic scope. When reasonable parody (including customer needs) does not exist between the current geographies served and the target geographies then this strategy should be addressed as a diversification initiative.

Adjacent market growth strategies are a very good option for companies that have established a strong position and reputation within their present markets. Electing to focus company growth plans on adjacent markets are often easier to implement. This is especially true for smaller or medium-sized businesses depending on the scope and type of markets they currently serve. A key determinant, in this case, is the size of overall company business goals and growth expectations along with the time-frame within which these goals are to be met.

Market Diversification

A market diversification strategy becomes an important consideration for companies that have a narrowly focused business or those that have businesses that have matured to a point that they do not provide a viable path for profitable growth. Taking this approach may also be the consequence of having a sufficiently high market share where there is little additional room for share gain.

Businesses that serve highly specialized market segments also may fit into this category. In general, each of these scenarios suggests that there is a need for the company to diversify in some manner to achieve measurable growth going forward. Staying the current course, will not do the job.

Developing successful market diversification strategies does not eliminate the importance of having some identifiable links to the existing business and core competencies. These links could be found in the similarity of formulations used in these new market spaces, the types of substrates that need to be coated, similar performance requirements within these additional markets, etc. In any case, finding one or more threads that connect the core competencies of the company between existing markets served and new market targets is a critical consideration in considering diversification.

Channels-to-market is also a very important element in strategy development. Sorting out the market segment options for growth needs to put a high value on those markets that currently have some ties to the current channels-to-market. Developing new channels-to-market, in unfamiliar territory, is not an easy thing to do especially within a reasonable time-frame.

Partnerships, joint ventures or acquisition come into play as options when diversifying into new markets where some of the elements needed to facilitate a workable plan can be achieved through the combination of two entities. Grass roots product development, targeting diverse markets outside of the existing core business, is normally not a workable option unless accompanies by relevant links to the company’s existing business.

Business Diversification

A business diversification strategy represents a major departure from the present business and not reliant on core competencies as a determinant of a decision to go forward. Key elements, in this case, are the size of the opportunity and the markets ability to provide opportunity for sustained profitable growth. In most cases, when pursing this course, some tie does need to exist with the present business that when presented to the marketplace makes sense to potential customers in the new market space as to the company’s value and commitment as a new participant.

Acquisition is most often the preferred path forward in this case. Many of the needed products/technologies and accompanying core competencies are immediately accessed. While the initial investment is large, the ability to achieve impact against growth goals for the business within a relatively short time-frame is unquestionable faster.

Figure 1 highlights four alternative strategies that represent distinct pathways that can be contemplated by management to achieve established business goals and objectives. In this article, we examine the general characteristics and considerations for choosing one or more of these paths as a growth strategy.

Concentric Markets

Concentric markets are those that can be identified as representing a significant share of the company’s present business revenue and profit. Targeting concentric markets for growth is the safest path as current resources, products and services are already in place. In addition, market knowledge, awareness of trends and unmet needs and an understanding of the present competitive environment exist.

Among the strategic options normally considered in addressing growth in concentric markets includes targeting new customers or capturing share gain within current market spaces. Targeting unmet needs or product/process improvements that can deliver a net value to specific accounts are options frequently considered. These unmet needs can be addressed through internally directed R&D.

Alternatively, Licensing-in new technology that can bring improvements in product performance and potential competitive advantages can expand options and/or shorten the time-frame within which these improvements can be made market ready.

By themselves, concentric growth strategies are normally limited in the size of the revenue growth (and profits) that can be generated. When the strategic growth goals and objectives for the business are high, concentric market strategic normally become a compliment to other more broad-based initiatives.

Adjacent Markets

Adjacent markets are those where there are identifiable, common threads to the company’s current business. This may include such things as similar product/performance requirements, resourcing needs and technical support expectations by customers coupled with time-to-market realities.

Of particular importance, when focusing company growth on an adjacent market strategy, is a commonality in the channels-to-market between current and targeted market segments. This element takes advantage of the company’s core competencies, reputation and brand identity. The strategic intent is to expand the size of the company’s overall business opportunity while maximizing the use of current resources and shortening the time-to-market as much as possible.

Pursuing an adjacent market growth strategy can be addressed through additions of products/technology or by selectively targeting individual accounts in specific market spaces who have a similar need for products or services currently offered. In either case, identifying unmet needs is a key element in strategy development. Relying on internal R&D to deliver differentiated products is one option. Licensing-in technology, directed at providing products that address identified unmet needs, is an alternative which allows companies to reach beyond their internal product development capabilities.

Targeting geographic growth is an alternative adjacent market growth strategy. In this case, it is important that the geography being targets be supportable now with similar products and support services to be considered within this strategic scope. When reasonable parody (including customer needs) does not exist between the current geographies served and the target geographies then this strategy should be addressed as a diversification initiative.

Adjacent market growth strategies are a very good option for companies that have established a strong position and reputation within their present markets. Electing to focus company growth plans on adjacent markets are often easier to implement. This is especially true for smaller or medium-sized businesses depending on the scope and type of markets they currently serve. A key determinant, in this case, is the size of overall company business goals and growth expectations along with the time-frame within which these goals are to be met.

Market Diversification

A market diversification strategy becomes an important consideration for companies that have a narrowly focused business or those that have businesses that have matured to a point that they do not provide a viable path for profitable growth. Taking this approach may also be the consequence of having a sufficiently high market share where there is little additional room for share gain.

Businesses that serve highly specialized market segments also may fit into this category. In general, each of these scenarios suggests that there is a need for the company to diversify in some manner to achieve measurable growth going forward. Staying the current course, will not do the job.

Developing successful market diversification strategies does not eliminate the importance of having some identifiable links to the existing business and core competencies. These links could be found in the similarity of formulations used in these new market spaces, the types of substrates that need to be coated, similar performance requirements within these additional markets, etc. In any case, finding one or more threads that connect the core competencies of the company between existing markets served and new market targets is a critical consideration in considering diversification.

Channels-to-market is also a very important element in strategy development. Sorting out the market segment options for growth needs to put a high value on those markets that currently have some ties to the current channels-to-market. Developing new channels-to-market, in unfamiliar territory, is not an easy thing to do especially within a reasonable time-frame.

Partnerships, joint ventures or acquisition come into play as options when diversifying into new markets where some of the elements needed to facilitate a workable plan can be achieved through the combination of two entities. Grass roots product development, targeting diverse markets outside of the existing core business, is normally not a workable option unless accompanies by relevant links to the company’s existing business.

Business Diversification

A business diversification strategy represents a major departure from the present business and not reliant on core competencies as a determinant of a decision to go forward. Key elements, in this case, are the size of the opportunity and the markets ability to provide opportunity for sustained profitable growth. In most cases, when pursing this course, some tie does need to exist with the present business that when presented to the marketplace makes sense to potential customers in the new market space as to the company’s value and commitment as a new participant.

Acquisition is most often the preferred path forward in this case. Many of the needed products/technologies and accompanying core competencies are immediately accessed. While the initial investment is large, the ability to achieve impact against growth goals for the business within a relatively short time-frame is unquestionable faster.