Osamu Kirihara, Xilin Li and Douglas Bohn, Orr & Boss Consulting Incorporated08.10.20

It has been a rocky year in the global paint and coatings market. The paint and coatings market in Asia has been no exception. We started off the year thinking that global volume in the coatings market would grow by 2.8% and value would grow by 4.4% and that Asia would grow slightly faster at 3.3% volume and 4.6% value growth rate. This moderate growth scenario was similar to the one that occurred in 2019 where the Asian paint and coatings market grew by 2.4% in volume and 3.3% in value terms. This moderate growth scenario that we envisioned at the beginning of January has been shaken up considerably. Overall, we expect the Asian and global coatings industries to only be down in volume terms this year but the degree of declines vary by country and segment as this global recession and recovery has been very uneven with some geographies and segments doing relatively well and others not as well.

2019 in Review:

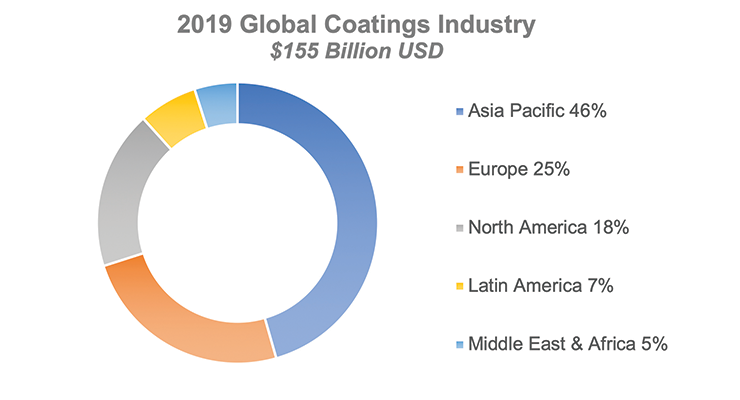

Before we discuss what is happening in the markets in 2020, we would like to review the 2019 market data. Orr & Boss estimates the global coatings market in 2019 was $155 billion in value and 41.5 million liters in volume.

Asia Pacific is by far the largest region in the world. It comprised 46% of the value of the global coatings industry and is nearly twice the size of the next largest region, Europe which comprises 25% of the value of the global coatings industry.

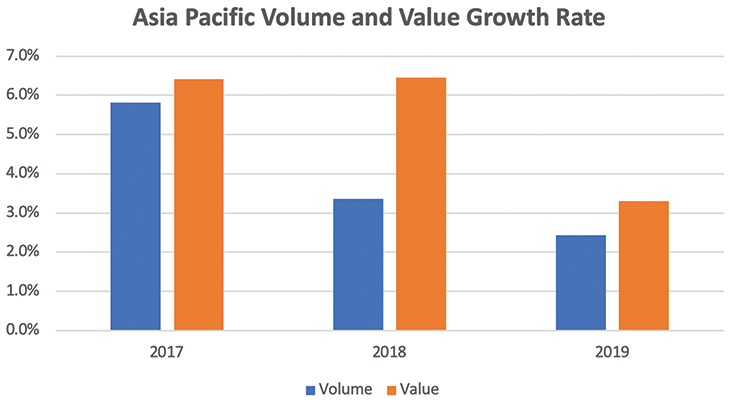

The Asian coatings market was estimated to have grown by 2.4% volume and 3.3% value growth rate in 2019. As the graph below indicates, both of these are below previous years growth rates. The lower 2019 growth rates were the result of lower economic growth in most Asian countries including China, India, South Korea. Despite these lower growth rates, Asia still accounted for most of the growth in the global coatings market.

Asia Pacific Market:

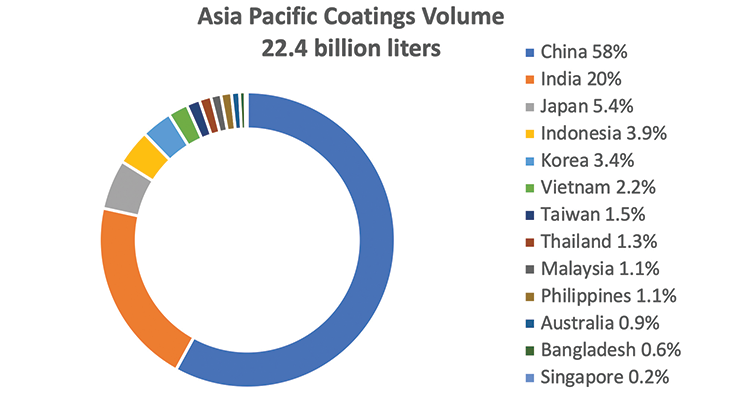

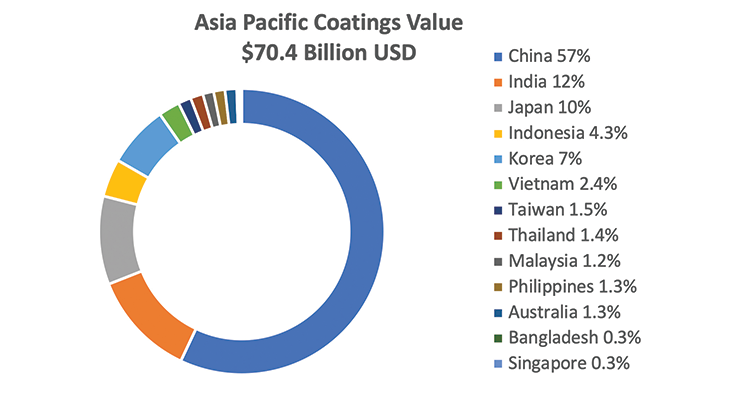

Sometimes we think of the Asia Pacific coatings market as one market but it really is an amalgamation of several markets. China is the largest part of the Asian market comprising nearly 60% of the volume and value. The next largest markets are India and Japan. These top three markets account for 83% of the volume and 79% of the value.

The markets within Asia behave somewhat differently depending upon the sub-region. We normally break down Asia into five major sub-regions. Each of these five sub-regions have their own characteristics. These are:

Greater China: This region includes China, Taiwan, Hong Kong, and Macau with mainland China being by far the largest part of this market. Greater China comprises about 60% of both the volume and value of the market. Being the largest market, China is the most diverse of the various Asian markets for paint and coatings. The market consists of a large decorative coatings market but also has large markets for the various industrial coatings market segments.

Japan & Korea: These two countries are 8.8% of the volume and 17% of the value of the Asia Pacific coatings market. The value of this market is nearly 2X the volume. This is because the coatings markets in these countries are the most expensive markets and generally speaking the paints and coatings sold into these markets are of high quality which allow them to command a higher price.

South Asia: This sub-region includes India, Bangladesh, Myanmar, Nepal, and Bhutan. India is by far the largest market. In total this region comprises 21% of volume and 13% of the value. In recent years, this sub-region has become the fastest growing region of Asia. Even though its coatings market is much smaller than that of Greater China, it is an interesting market because it is the fastest growing of the Asia Pacific paint and coatings markets.

Southeast Asia (SEA): This sub-region includes Indonesia, Vietnam, Thailand, Malaysia, the Philippines, Singapore, Cambodia, and Laos. These markets comprise 10% of the volume and 11% of the value of the Asia Pacific coatings market. Similar to South Asia, these markets offer some good growth potential. The decorative coatings markets in these countries comprise a relatively high percentage of the coatings markets in these countries. Decorative coatings comprise about 70% of the paint and coatings market volume in these countries versus 50% for Asia Pacific as a whole.

Australia and New Zealand (ANZ): These two countries along with the surrounding island countries in the Pacific comprise about 1% of the volume and 1.5% of the value. It is the smallest sub-region. In many ways the paint markets in these countries resemble those of North America and Western Europe with some regional differences.

2020 Estimates:

The pandemic has had a significant impact on the paint and coatings markets in all of these countries. Overall, we expect the Asia Pacific paint and coatings markets to decline by about 2% in volume terms this year.

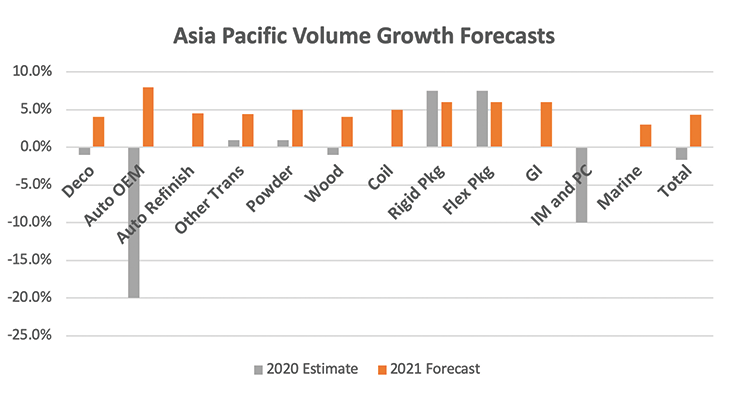

But this masks some pretty significant differences among the various segments. Packaging coatings, which is a relatively small segment, is expected to show some strong growth as consumers are not traveling and have to stay at home during lockdown, this led to significant growth in this market. It should be said that these markets were growing fast before the pandemic due to a rising middle class of consumers in these countries and the corresponding increase in demand for consumer packaged goods. Auto OEM coatings are expected to show the largest decline as automotive production is expected to decline by about 20% this year in Asia. Industrial Maintenance and Protective Coatings (IM & PC) is expected to decline this year as well as the low oil prices results in less demand for these coatings in the oil and gas segments.

In general, we expect that these markets will rebound in 2021 as the economies recover. But growth will be relatively moderate at an expected 4% growth rate. We expect that auto OEM and the other industrial coatings segments will partially recover in 2021 but these markets will not make up all the ground lost in 2020. The other industrial markets are expected to recover their lost volume and grow a bit in 2021. The chart below shows our estimates for growth rates of the various segments in Asia in 2020 as well as forecasts for 2021.

Not only do the individual segments vary but the geographies vary in growth rate too. A short summary of each region is given below.

China: Total coatings volume was down 30% in Q1. We think that it has partially recovered in Q2 and was down in the 5-10% range in Q2. We expect that in the second half of the year, growth will be robust and the market will recover its lost ground this year.

Japan & Korea: We expect the Japan and Korea markets to be to be down in the 0 to -5% range this year. In Japan, the sales of paints in Q1 declined by 5-6 % from 2019 values. Due to the state of emergency declared by the Japanese government, GDP declined by 23% in April and May. Paint shipments declined a corresponding 20% in Q2. We expect that the market will partially recover in the 2nd half of the year. We also expect that the Japanese market will partially recover next year while the Korean market will fully recover its losses from this year in 2021.

Southeast Asia: We expect the Southeast Asian paint and coatings markets to be down 0 to -5% this year. Next year, we expect strong growth to return to the markets in the 5-10% range.

South Asia: We expect this market to be down -5 to -10% this year. Within India, we think that the Indian decorative paint market was down 50% in Q2. We expect Q3 to be about even with Q3 of 2019 and Q4 to show some growth. For the non-decorative industrial coatings market, we estimate that it was down in the 50-80% range in Q2 depending upon the segment. We expect Q3 to be up about 10% with Q3 2019 and Q4 up about in the 10-20% range. For the entire Indian paint market (both decorative and industrial), we expect it to be down in the 5-10% range this year. We expect the other countries in South Asia (Sri Lanka, Bangladesh, Nepal, and Pakistan) to perform similarly.

Australia and New Zealand (ANZ): We think that ANZ markets were down about 15% in Q2. The decorative were strong in these countries in Q2 as consumers that stayed home worked on home improvement project. We saw this occur in North America and Europe as well. For the non-decorative industrial coatings’ markets in ANZ, we think that they were down 30-40% in Q2. We expect that the paint markets in ANZ will recover in the 2nd half and will finish the year down in the 0 to 5% range with decorative coating be about flat with 2019 and the industrial coatings markets being down about 10%. In 2021, we expect ANZ to nearly fully recover its lost ground.

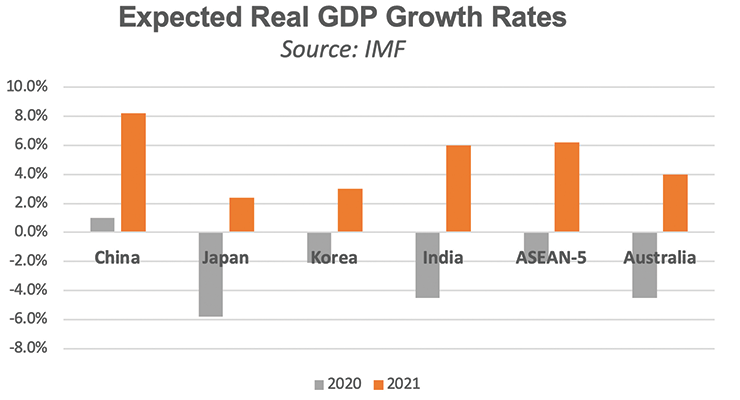

The above forecast assumes that no large-scale lockdowns will be needed but rather only localized lockdowns will be enforced. If we need to return to large scale or countrywide lockdowns, the above estimates are probably overly optimistic. We are expecting the overall economies to recover this year and follow the forecast given below that were published by the IMF.

Future of the Coatings Market:

The pandemic is likely to have some longer-term impacts on the Asian coatings’ markets. Some of the changes to the market may be:

Consolidation: The Asian coatings market is much more fragmented than the North American or European coatings market. This is especially true in China as well as Southeast Asia and other parts of Asia. Before the global recession, we thought that the Asian paint and coatings market was ripe for consolidation. The global recession may speed this process up. Will the global recession result in many of the smaller and medium sized paint and coatings companies being acquired? Some of these smaller and medium sized companies may not be able to handle the financial stress of the recession. If your company is interested in expanding in Asia and have longer term interest, now may be a good time to begin exploring acquisitions in Asia.

DIY versus Professional: The Asian markets have a significantly smaller DIY market than in North America or Europe. This is especially true of China, Southeast Asia, and India. Will the pandemic change people’s behavior? In other words, will consumers in these countries still want a painting contractor to enter their homes to paint their homes? Or will the paint industry, through an education campaign, be able to make any headway into growing a DIY market in these countries? We do not know the answers to these questions but we think that there might be an opportunity for an increased DIY market.

Raw Material Prices: Oil prices have declined significantly this year. Although they have rebounded recently. But the average oil price in 2020 is still down 37% from 2019. In the past when we have seen oil prices decline at this level, we have seen raw material prices decline in the 10-15% range after about 6-12 months. We would expect something similar to occur this time.

Anti-viral and Anti-Microbial Coatings: Interest in anti-viral and anti-microbial coatings have grown significantly this year. We expect that interest in these products will continue to grow for the rest of 2020 and into 2021.

Infrastructure: Infrastructure related coatings will likely do well in 2020 and into 2021. China and other governments are considering significant investments in infrastructure to stimulate their economies. This will likely lead to an increase in demand for infrastructure related coatings.

Summary:

It has been a tough year so far for the Asia Pacific coatings markets. But we think that the worst is behind us and gradually the economies and paint & coatings markets will start to recover. In 2021, we think that the Asia Pacific coatings market will return to closer to its pre-pandemic growth levels of about 4% growth. On the positive side, we also think that the low oil prices will lead to lower raw material prices and think that there will be growth opportunities in the anti-viral & anti-microbial as well as infrastructure coatings market. We also think that the pandemic may have a significant impact on the Asia Pacific coatings market going forward. Consolidation trends may pick up as the financial stress of the recession hits smaller and medium sized coatings companies harder. We also think that there might be an opportunity to increase the size of the DIY paint market in the Asian markets as consumers are hesitant to allow contractors into their homes.

2019 in Review:

Before we discuss what is happening in the markets in 2020, we would like to review the 2019 market data. Orr & Boss estimates the global coatings market in 2019 was $155 billion in value and 41.5 million liters in volume.

Asia Pacific is by far the largest region in the world. It comprised 46% of the value of the global coatings industry and is nearly twice the size of the next largest region, Europe which comprises 25% of the value of the global coatings industry.

The Asian coatings market was estimated to have grown by 2.4% volume and 3.3% value growth rate in 2019. As the graph below indicates, both of these are below previous years growth rates. The lower 2019 growth rates were the result of lower economic growth in most Asian countries including China, India, South Korea. Despite these lower growth rates, Asia still accounted for most of the growth in the global coatings market.

Asia Pacific Market:

Sometimes we think of the Asia Pacific coatings market as one market but it really is an amalgamation of several markets. China is the largest part of the Asian market comprising nearly 60% of the volume and value. The next largest markets are India and Japan. These top three markets account for 83% of the volume and 79% of the value.

The markets within Asia behave somewhat differently depending upon the sub-region. We normally break down Asia into five major sub-regions. Each of these five sub-regions have their own characteristics. These are:

Greater China: This region includes China, Taiwan, Hong Kong, and Macau with mainland China being by far the largest part of this market. Greater China comprises about 60% of both the volume and value of the market. Being the largest market, China is the most diverse of the various Asian markets for paint and coatings. The market consists of a large decorative coatings market but also has large markets for the various industrial coatings market segments.

Japan & Korea: These two countries are 8.8% of the volume and 17% of the value of the Asia Pacific coatings market. The value of this market is nearly 2X the volume. This is because the coatings markets in these countries are the most expensive markets and generally speaking the paints and coatings sold into these markets are of high quality which allow them to command a higher price.

South Asia: This sub-region includes India, Bangladesh, Myanmar, Nepal, and Bhutan. India is by far the largest market. In total this region comprises 21% of volume and 13% of the value. In recent years, this sub-region has become the fastest growing region of Asia. Even though its coatings market is much smaller than that of Greater China, it is an interesting market because it is the fastest growing of the Asia Pacific paint and coatings markets.

Southeast Asia (SEA): This sub-region includes Indonesia, Vietnam, Thailand, Malaysia, the Philippines, Singapore, Cambodia, and Laos. These markets comprise 10% of the volume and 11% of the value of the Asia Pacific coatings market. Similar to South Asia, these markets offer some good growth potential. The decorative coatings markets in these countries comprise a relatively high percentage of the coatings markets in these countries. Decorative coatings comprise about 70% of the paint and coatings market volume in these countries versus 50% for Asia Pacific as a whole.

Australia and New Zealand (ANZ): These two countries along with the surrounding island countries in the Pacific comprise about 1% of the volume and 1.5% of the value. It is the smallest sub-region. In many ways the paint markets in these countries resemble those of North America and Western Europe with some regional differences.

2020 Estimates:

The pandemic has had a significant impact on the paint and coatings markets in all of these countries. Overall, we expect the Asia Pacific paint and coatings markets to decline by about 2% in volume terms this year.

But this masks some pretty significant differences among the various segments. Packaging coatings, which is a relatively small segment, is expected to show some strong growth as consumers are not traveling and have to stay at home during lockdown, this led to significant growth in this market. It should be said that these markets were growing fast before the pandemic due to a rising middle class of consumers in these countries and the corresponding increase in demand for consumer packaged goods. Auto OEM coatings are expected to show the largest decline as automotive production is expected to decline by about 20% this year in Asia. Industrial Maintenance and Protective Coatings (IM & PC) is expected to decline this year as well as the low oil prices results in less demand for these coatings in the oil and gas segments.

In general, we expect that these markets will rebound in 2021 as the economies recover. But growth will be relatively moderate at an expected 4% growth rate. We expect that auto OEM and the other industrial coatings segments will partially recover in 2021 but these markets will not make up all the ground lost in 2020. The other industrial markets are expected to recover their lost volume and grow a bit in 2021. The chart below shows our estimates for growth rates of the various segments in Asia in 2020 as well as forecasts for 2021.

Not only do the individual segments vary but the geographies vary in growth rate too. A short summary of each region is given below.

China: Total coatings volume was down 30% in Q1. We think that it has partially recovered in Q2 and was down in the 5-10% range in Q2. We expect that in the second half of the year, growth will be robust and the market will recover its lost ground this year.

Japan & Korea: We expect the Japan and Korea markets to be to be down in the 0 to -5% range this year. In Japan, the sales of paints in Q1 declined by 5-6 % from 2019 values. Due to the state of emergency declared by the Japanese government, GDP declined by 23% in April and May. Paint shipments declined a corresponding 20% in Q2. We expect that the market will partially recover in the 2nd half of the year. We also expect that the Japanese market will partially recover next year while the Korean market will fully recover its losses from this year in 2021.

Southeast Asia: We expect the Southeast Asian paint and coatings markets to be down 0 to -5% this year. Next year, we expect strong growth to return to the markets in the 5-10% range.

South Asia: We expect this market to be down -5 to -10% this year. Within India, we think that the Indian decorative paint market was down 50% in Q2. We expect Q3 to be about even with Q3 of 2019 and Q4 to show some growth. For the non-decorative industrial coatings market, we estimate that it was down in the 50-80% range in Q2 depending upon the segment. We expect Q3 to be up about 10% with Q3 2019 and Q4 up about in the 10-20% range. For the entire Indian paint market (both decorative and industrial), we expect it to be down in the 5-10% range this year. We expect the other countries in South Asia (Sri Lanka, Bangladesh, Nepal, and Pakistan) to perform similarly.

Australia and New Zealand (ANZ): We think that ANZ markets were down about 15% in Q2. The decorative were strong in these countries in Q2 as consumers that stayed home worked on home improvement project. We saw this occur in North America and Europe as well. For the non-decorative industrial coatings’ markets in ANZ, we think that they were down 30-40% in Q2. We expect that the paint markets in ANZ will recover in the 2nd half and will finish the year down in the 0 to 5% range with decorative coating be about flat with 2019 and the industrial coatings markets being down about 10%. In 2021, we expect ANZ to nearly fully recover its lost ground.

The above forecast assumes that no large-scale lockdowns will be needed but rather only localized lockdowns will be enforced. If we need to return to large scale or countrywide lockdowns, the above estimates are probably overly optimistic. We are expecting the overall economies to recover this year and follow the forecast given below that were published by the IMF.

Future of the Coatings Market:

The pandemic is likely to have some longer-term impacts on the Asian coatings’ markets. Some of the changes to the market may be:

Consolidation: The Asian coatings market is much more fragmented than the North American or European coatings market. This is especially true in China as well as Southeast Asia and other parts of Asia. Before the global recession, we thought that the Asian paint and coatings market was ripe for consolidation. The global recession may speed this process up. Will the global recession result in many of the smaller and medium sized paint and coatings companies being acquired? Some of these smaller and medium sized companies may not be able to handle the financial stress of the recession. If your company is interested in expanding in Asia and have longer term interest, now may be a good time to begin exploring acquisitions in Asia.

DIY versus Professional: The Asian markets have a significantly smaller DIY market than in North America or Europe. This is especially true of China, Southeast Asia, and India. Will the pandemic change people’s behavior? In other words, will consumers in these countries still want a painting contractor to enter their homes to paint their homes? Or will the paint industry, through an education campaign, be able to make any headway into growing a DIY market in these countries? We do not know the answers to these questions but we think that there might be an opportunity for an increased DIY market.

Raw Material Prices: Oil prices have declined significantly this year. Although they have rebounded recently. But the average oil price in 2020 is still down 37% from 2019. In the past when we have seen oil prices decline at this level, we have seen raw material prices decline in the 10-15% range after about 6-12 months. We would expect something similar to occur this time.

Anti-viral and Anti-Microbial Coatings: Interest in anti-viral and anti-microbial coatings have grown significantly this year. We expect that interest in these products will continue to grow for the rest of 2020 and into 2021.

Infrastructure: Infrastructure related coatings will likely do well in 2020 and into 2021. China and other governments are considering significant investments in infrastructure to stimulate their economies. This will likely lead to an increase in demand for infrastructure related coatings.

Summary:

It has been a tough year so far for the Asia Pacific coatings markets. But we think that the worst is behind us and gradually the economies and paint & coatings markets will start to recover. In 2021, we think that the Asia Pacific coatings market will return to closer to its pre-pandemic growth levels of about 4% growth. On the positive side, we also think that the low oil prices will lead to lower raw material prices and think that there will be growth opportunities in the anti-viral & anti-microbial as well as infrastructure coatings market. We also think that the pandemic may have a significant impact on the Asia Pacific coatings market going forward. Consolidation trends may pick up as the financial stress of the recession hits smaller and medium sized coatings companies harder. We also think that there might be an opportunity to increase the size of the DIY paint market in the Asian markets as consumers are hesitant to allow contractors into their homes.