Terry Knowles, European Correspondent08.20.23

Looking over material for the latest Coatings World Top Companies report yielded indications that for most companies demand was returning to pre-pandemic levels, and certainly the pandemic shook up a lot of the industry and industry patterns. A detailed examination of the performance of Europe’s top two companies in the first half of 2023 brings out some interesting trends.

For example, the return of the automotive sector to better health has boosted PPG in a more obvious way than AkzoNobel, but AkzoNobel has performed better in the EMEA decorative market in the first half of 2023 than PPG. Simultaneously both companies report good growth in the aerospace sector, which had been all but grounded during the COVID period, leading to sizeable drops in demand.

What also emerges from looking into the results is an easing in raw material supplies and concerns about consumer sentiment in Europe, potentially against a backdrop of higher winter fuel prices in the months ahead.

Pricing initiatives emerge as the clearest performance driver at AkzoNobel especially in light of currency exchanges tending to reduce gains and Asia was the strongest geography across the first half of 2023. Decorative Paints’ sales across the EMEA region rose by 3% in the first half of 2023.

In terms of its overseas performance, AkzoNobel has been flourishing with higher sales volumes in China and India, but lower sales volumes in Vietnam. Despite the Chinese volume increase, revenues were down.

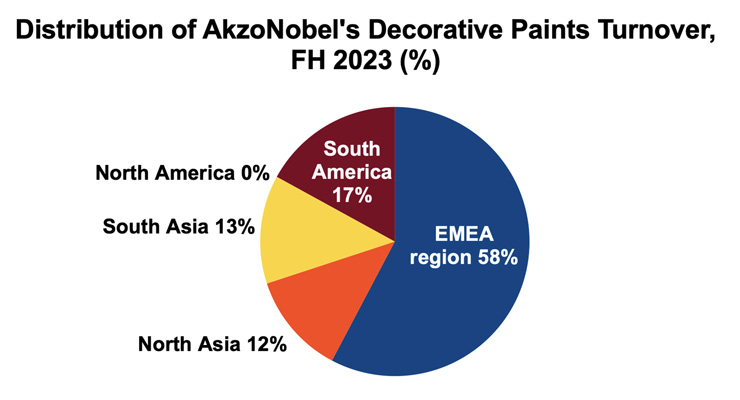

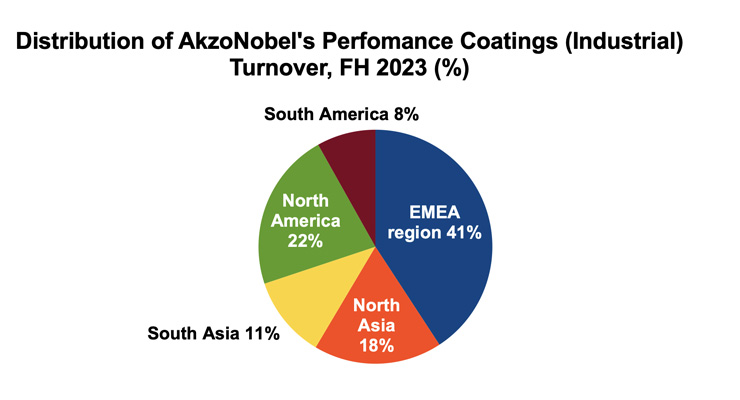

A newly available breakdown of the AkzoNobel’s turnover distribution according to region for both its decorative and performance (industrial) operations illuminates its relative regional strengths. The native EMEA region is the leading destination for both decorative and industrial (in the widest definition) coatings, but with its recent run of decorative-sector acquisitions, Latin America is the second-largest area for decorative paints, while North America is the second-largest area for area for industrial coatings (the company having eschewed its option of participating in the North American decorative sector years ago).

Conversely, Latin America is the company’s smallest market for industrial coatings, and in both cases the regional breakdown shows that the North Asian and South Asian markets are in the middle both lists. Industrial coatings sales are more prominent in North Asia than South Asia but in the decorative area this order is reversed.

The recent completion of its takeover of the former Huarun paint business in China from Sherwin-Williams will soon enhance AkzoNobel’s North Asian decorative presence with additional sales of €100 million. Recently its EMEA operations benefited from the purchase of the decorative arm Kansai Paint had been building there before deciding to dispose of it and look elsewhere – Europe, mainly.

AkzoNobel expects the ongoing macro-economic uncertainties to continue and weigh on organic volume growth. The company will focus on margin management, cost reduction, working capital normalization and de-leveraging.

The softer global economic climate and a slower Chinese recovery have impacted volumes sold at PPG, although prices were higher per unit across PPG’s entire product portfolio. Mexican peso gains helped to counter the effects of the deteriorating Chinese yuan.

In PPG’s Industrial Coatings business, which house the automotive OEM, packaging coatings and industrial coatings operations, only the automotive OEM was seen growing in the second quarter. The global automotive assembly industry continues in its post-lockdown growth but still remains below 2019 levels. Industrial coatings proper and packaging coatings experienced declines of 4-6%.

In the company’s Performance Coatings operations, the second-quarter results proved a mixed bag, with aerospace, protective and marine and refinish coatings sales all climbing well. The decorative markets of the EMEA region experienced 10% lower sales, which it expects to reverse in the third quarter of the year. This was attributed to lower re-modeling demand and weaker consumer confidence in Europe. Meanwhile the comparatively new Traffic Solutions business also saw a decline in demand (not more than 3% decline) which the company does not see reversing in the third quarter.

All of these trends culminated in PPG Industries progressing its turnover from US$ 8,999 million to US$ 9,252 million, an increase of 2.8%. Taking into account all of the usual factors, net income at PPG Industries between the first half of 2022 and the same for 2023 rose from US$ 459 million to US$ 754 million, and that’s an increase of 64%!

PPG’s president and CEO, Tim Knavish, summarized the company’s outlook moving from the cusp of the second quarter and into the third quarter saying, “We anticipate that the global macroeconomic environment will remain generally consistent with the second quarter including continued tepid global industrial production, along with some incremental slowing in U.S. architectural residential repaint due to significantly lower existing home sales. Given the strength and momentum we have experienced year to date in several of our businesses, such as aerospace coatings and automotive OEM coatings, we expect our diverse portfolio mix to provide us with continued resiliency.

On a regional basis, we anticipate modest sequential demand improvement in China and aggregate European demand to stabilize, albeit at current lower absolute levels. In addition, our supply chain and raw material availability has returned to pre-pandemic levels, and in some instances there is excess supply.”

For example, the return of the automotive sector to better health has boosted PPG in a more obvious way than AkzoNobel, but AkzoNobel has performed better in the EMEA decorative market in the first half of 2023 than PPG. Simultaneously both companies report good growth in the aerospace sector, which had been all but grounded during the COVID period, leading to sizeable drops in demand.

What also emerges from looking into the results is an easing in raw material supplies and concerns about consumer sentiment in Europe, potentially against a backdrop of higher winter fuel prices in the months ahead.

AkzoNobel

Top-level details for AkzoNobel’s performance showed that overall volumes of paints and coatings sold in the first half of the year amounted to 2% less than the previous corresponding period, with overall gains on prices totalling 6%, almost all of which were wiped out by unfavorable exchange rates. Consequently, the company’s first-half sales totalled € 5,398 million, which it reported as flat in comparison with €5,378 million in the previous first-half period. Operating income for the first half performed better, rising by 10% from €479 million to €529 million.Pricing initiatives emerge as the clearest performance driver at AkzoNobel especially in light of currency exchanges tending to reduce gains and Asia was the strongest geography across the first half of 2023. Decorative Paints’ sales across the EMEA region rose by 3% in the first half of 2023.

In terms of its overseas performance, AkzoNobel has been flourishing with higher sales volumes in China and India, but lower sales volumes in Vietnam. Despite the Chinese volume increase, revenues were down.

A newly available breakdown of the AkzoNobel’s turnover distribution according to region for both its decorative and performance (industrial) operations illuminates its relative regional strengths. The native EMEA region is the leading destination for both decorative and industrial (in the widest definition) coatings, but with its recent run of decorative-sector acquisitions, Latin America is the second-largest area for decorative paints, while North America is the second-largest area for area for industrial coatings (the company having eschewed its option of participating in the North American decorative sector years ago).

Conversely, Latin America is the company’s smallest market for industrial coatings, and in both cases the regional breakdown shows that the North Asian and South Asian markets are in the middle both lists. Industrial coatings sales are more prominent in North Asia than South Asia but in the decorative area this order is reversed.

The recent completion of its takeover of the former Huarun paint business in China from Sherwin-Williams will soon enhance AkzoNobel’s North Asian decorative presence with additional sales of €100 million. Recently its EMEA operations benefited from the purchase of the decorative arm Kansai Paint had been building there before deciding to dispose of it and look elsewhere – Europe, mainly.

AkzoNobel expects the ongoing macro-economic uncertainties to continue and weigh on organic volume growth. The company will focus on margin management, cost reduction, working capital normalization and de-leveraging.

PPG Industries

One of the major differences between PPG Industries and AkzoNobel is the former’s participation as one of the big three in the automotive OEM sector, and this has been a major driving force in PPG’s more positive sales progression, along with the aerospace sector. Like AkzoNobel, the company has been forced to acknowledge that global industrial output has been shrinking which is bad news for the industrial coatings sector proper, while at the same time pricing pressures on raw materials have begun to relax.The softer global economic climate and a slower Chinese recovery have impacted volumes sold at PPG, although prices were higher per unit across PPG’s entire product portfolio. Mexican peso gains helped to counter the effects of the deteriorating Chinese yuan.

In PPG’s Industrial Coatings business, which house the automotive OEM, packaging coatings and industrial coatings operations, only the automotive OEM was seen growing in the second quarter. The global automotive assembly industry continues in its post-lockdown growth but still remains below 2019 levels. Industrial coatings proper and packaging coatings experienced declines of 4-6%.

In the company’s Performance Coatings operations, the second-quarter results proved a mixed bag, with aerospace, protective and marine and refinish coatings sales all climbing well. The decorative markets of the EMEA region experienced 10% lower sales, which it expects to reverse in the third quarter of the year. This was attributed to lower re-modeling demand and weaker consumer confidence in Europe. Meanwhile the comparatively new Traffic Solutions business also saw a decline in demand (not more than 3% decline) which the company does not see reversing in the third quarter.

All of these trends culminated in PPG Industries progressing its turnover from US$ 8,999 million to US$ 9,252 million, an increase of 2.8%. Taking into account all of the usual factors, net income at PPG Industries between the first half of 2022 and the same for 2023 rose from US$ 459 million to US$ 754 million, and that’s an increase of 64%!

PPG’s president and CEO, Tim Knavish, summarized the company’s outlook moving from the cusp of the second quarter and into the third quarter saying, “We anticipate that the global macroeconomic environment will remain generally consistent with the second quarter including continued tepid global industrial production, along with some incremental slowing in U.S. architectural residential repaint due to significantly lower existing home sales. Given the strength and momentum we have experienced year to date in several of our businesses, such as aerospace coatings and automotive OEM coatings, we expect our diverse portfolio mix to provide us with continued resiliency.

On a regional basis, we anticipate modest sequential demand improvement in China and aggregate European demand to stabilize, albeit at current lower absolute levels. In addition, our supply chain and raw material availability has returned to pre-pandemic levels, and in some instances there is excess supply.”