Yogender Malik, India Correspondent03.12.24

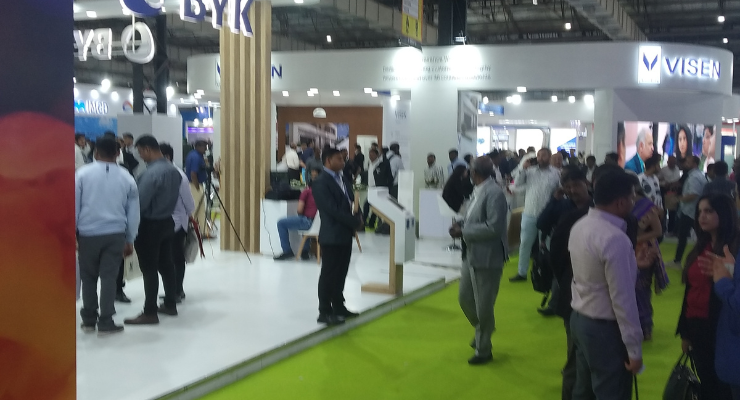

The three days PaintIndia 2024 exhibition was held at Mumbai during February 22-24. Inaugurated by a who’s who of Indian paint and coating industry, including Anuj Jain, MD of Kansai Nerolac Paints, Amit Syngle, MD of Asian Paints. K.S Dhingra, ED, Berger Paints, and Rahul Ligade of JSW Paints, the three day event was attended by stakeholders in Indian paint industry, raw material suppliers, technology suppliers and others. Coatings World was present in Mumbai to report on the proceeding of the biennial gathering of paint industry stakeholders in the capital city of Maharashtra.

Spread over three halls over an area of 18,500 square meters, the event has more than 500 exhibitors from paints & coatings, inks, construction chemicals, adhesive/sealants, raw materials, and technology.

Paint India Congress, a paper presentation based programme covering four area – high-performance coatings, water-borne and bio-based coatings, architectural coatings, and cutting edge ingredients and technologies- was also held during the event.

Jason Gonsalves, President of Indian Paint Association said during the opening ceremony of the event, “The Indian paint industry is estimated to be USD 8.5billion in value terms and 6.3 million MTPA by volume. The architectural segment, which accounts for nearly 70% of the paint industry is the largest segment, while industrial segment accounts for 30% of the total consumption. Paint & coating industry has bright prospects in the country. Though, thee are still many supply-chain issues, fluctauating raw material prices, shortages etc., but the long term story looks great.”

Demand from both, architectural and industrial segments, has grown steadily during past few years. Rapid urbanisation, shortening of repainting exercise, rising disposable income, government’s thrust on infrastructure development in a major way, and Housing for All have been the major factors in varying degrees behind the robust demand of paint & coating products in the country in these years.

Vijay Dagli, President of Indian Small Scale Paint Association ( ISSPA) told, “ Indian paint industry is growing steadily during the last few years. Small and very small scale paint producers have made rapid progress in terms of reach and offering of the products in these years. Earlier, a number of people had the perception that small scale paint producers can only produce inferior quality paint products, but this misconception has disappeared during last few years.”

Small and medium size paint producers hold a chunk of market in the architectural coating segment in India. Share of these producers have remained constant at about 35% of the total market over the years. The constant share of these small scale producers indicate that they have grown in proportion to the overall paint & coating industry in the country.

Oliver Peters, Head of Applied Research & Technology, Architectural and Floor Coatings of Germany based company Evonik shares his insight on architectural coatings market. He says, “ Interest in more durable architectural coatings is growing, which don’t only aim at pure wet abrasion resistance, but also address effects such as scuff and burnish resistance. The market is also driven by more sustainable products and regulatory changes.”

Spread over three halls over an area of 18,500 square meters, the event has more than 500 exhibitors from paints & coatings, inks, construction chemicals, adhesive/sealants, raw materials, and technology.

Paint India Congress, a paper presentation based programme covering four area – high-performance coatings, water-borne and bio-based coatings, architectural coatings, and cutting edge ingredients and technologies- was also held during the event.

Jason Gonsalves, President of Indian Paint Association said during the opening ceremony of the event, “The Indian paint industry is estimated to be USD 8.5billion in value terms and 6.3 million MTPA by volume. The architectural segment, which accounts for nearly 70% of the paint industry is the largest segment, while industrial segment accounts for 30% of the total consumption. Paint & coating industry has bright prospects in the country. Though, thee are still many supply-chain issues, fluctauating raw material prices, shortages etc., but the long term story looks great.”

Demand from both, architectural and industrial segments, has grown steadily during past few years. Rapid urbanisation, shortening of repainting exercise, rising disposable income, government’s thrust on infrastructure development in a major way, and Housing for All have been the major factors in varying degrees behind the robust demand of paint & coating products in the country in these years.

Vijay Dagli, President of Indian Small Scale Paint Association ( ISSPA) told, “ Indian paint industry is growing steadily during the last few years. Small and very small scale paint producers have made rapid progress in terms of reach and offering of the products in these years. Earlier, a number of people had the perception that small scale paint producers can only produce inferior quality paint products, but this misconception has disappeared during last few years.”

Small and medium size paint producers hold a chunk of market in the architectural coating segment in India. Share of these producers have remained constant at about 35% of the total market over the years. The constant share of these small scale producers indicate that they have grown in proportion to the overall paint & coating industry in the country.

Oliver Peters, Head of Applied Research & Technology, Architectural and Floor Coatings of Germany based company Evonik shares his insight on architectural coatings market. He says, “ Interest in more durable architectural coatings is growing, which don’t only aim at pure wet abrasion resistance, but also address effects such as scuff and burnish resistance. The market is also driven by more sustainable products and regulatory changes.”