Doug Bohn, Consultant, Orr and Boss08.09.17

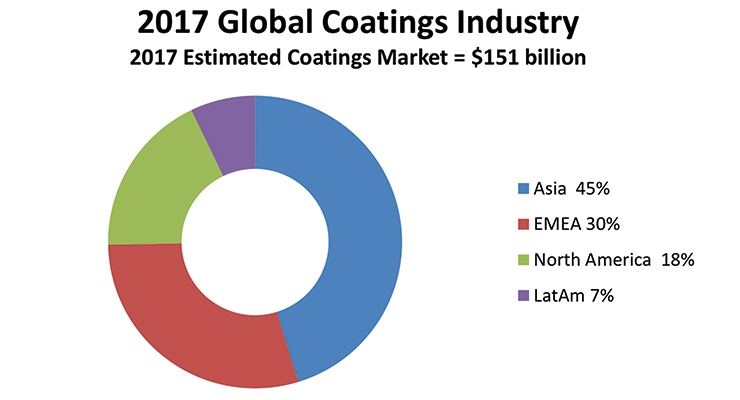

Asia is the largest and fastest growing coatings market in the world. Given the importance of the Asian market it is important for all companies operating in our industry to understand the market drivers. It is not just the large multinational coatings companies that need to be aware of the market. Recently, Orr & Boss has noticed that many regional and medium-sized coatings companies are getting more active in Asia. If your company is already active in Asia what is the outlook for the market? If your company is considering becoming active in the Asian coatings markets, is now the right time? The key factors to consider as you think about these questions include the Asian Economic Outlook, the Asian Coatings Market Outlook, as well as key trends that are occurring in the market.

Asian Economic Outlook

The outlook for Asian economies remains positive. The Asian economies will continue to be the fastest growing economies in the world, although generally their growth rate has slowed slightly over the last several years. China is the largest coatings market in the world. As recently as 2014, its GDP had been growing above 7 percent per year. Most projections now indicate that its GDP growth rate will be between 6.0 and 6.5 percent through 2019. This is still a very strong growth rate but not quite as strong as several years ago. Japan is the third largest coatings market in Asia. Its GDP growth is expected to continue to be tepid at less than 1 percent per year. On the other hand, there are some Asian economies that are expected to grow faster than they have in the recent past. For example, India’s GDP growth rate is expected to be in the 7-8 percent per year for the next several years. Some economists even believe that India will take over as the Asian growth leader from China. While that may be true, India is still a much smaller economy than China; the Chinese economy is nearly 5 times that of India in GDP terms. In any case, we do think that India will be a good growth market in the coming years. The economies in Southeast Asia like Indonesia and Thailand are generally expected to do slightly better in the coming years as well. So in short, the largest economy in the region, China, is expected to continue to grow at a fast rate, albeit at a slightly slower pace than it had been growing a few years ago, and the other Asian countries are expected to continue growing at solid rates. Thus, the expectation is that the Asian economic growth rates will continue to lead the world.

Asian Coatings Market

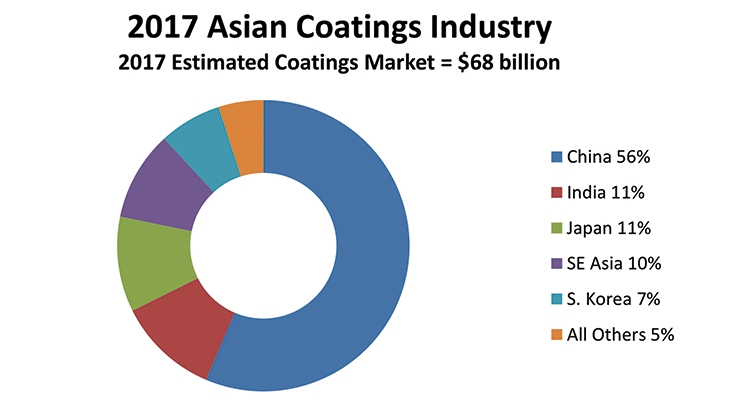

Asia is the largest coatings market in the world. Orr & Boss estimates that the 2017 Asian coatings market will be $68 billion which makes it nearly 45 percent of the global coatings market.

Within Asia, there are three countries that drive most of the demand; China, India and Japan account for 78 percent of the Asian Coatings demand. China is by far the most important country. It accounts for 56 percent of the coatings demand. India is now the second largest coatings market in the region. As discussed above, it is a growing economy and that is resulting in increased growth in its coatings market. Japan is the third.

Key Trends

There are several key trends occurring in the Asian coatings market that are important. The first trend is the continued growth in the region. As discussed above, we expect that the Asia Pacific region will continue to drive overall global coatings growth. Another key trend is that paint manufacturers are more and more being required to be the solution provider. By that we mean that they are forced to combine the service with the products. The final end user just looks at the results. This is especially true in China. For example, as competition heats-up in the architectural coatings market, more and more paint producers are actually doing the painting job as well. They are doing this with trained contractors as partners. As a result of the trend to be a solution provider, some Chinese paint makers are also teaming up with other material suppliers like ceramic tiles, kitchen cabinets and flooring companies to be able to provide all of the individual customers’ decorating needs. Similar to coatings markets around the world, Asian industrial coatings customers are requesting coatings systems with fewer layers and lower cure temperatures. This helps improve productivity but also results in the coating being viewed as more environmentally friendly since the entire system results in less material and energy consumption. Speaking of environmentally friendliness, another major trend is that going green will definitely be a continued theme in Asia. China will start to charge a tax on VOC emission for low-solids solventborne paint.

Overall Outlook

The overall outlook for the Asian coatings market remains strong although growth will not be quite as high as it was a few years ago. Despite the slightly lower growth rates, the economic forecast for Asia remains very strong compared to the rest of the world. China will continue to be a very important part of the market and its growth will remain strong. India may grow at a faster rate than China going forward so it might provide some interesting opportunities for coatings companies.

Finally, there are several important trends affecting the Asian coatings market. These trends include the trend of coatings companies becoming more of a solution provider, coatings that can be applied in fewer layers and lower cure temperatures (these are especially important in the industrial coatings segments) as well as an increased trend toward environmentally friendly coatings. CW

Asian Economic Outlook

The outlook for Asian economies remains positive. The Asian economies will continue to be the fastest growing economies in the world, although generally their growth rate has slowed slightly over the last several years. China is the largest coatings market in the world. As recently as 2014, its GDP had been growing above 7 percent per year. Most projections now indicate that its GDP growth rate will be between 6.0 and 6.5 percent through 2019. This is still a very strong growth rate but not quite as strong as several years ago. Japan is the third largest coatings market in Asia. Its GDP growth is expected to continue to be tepid at less than 1 percent per year. On the other hand, there are some Asian economies that are expected to grow faster than they have in the recent past. For example, India’s GDP growth rate is expected to be in the 7-8 percent per year for the next several years. Some economists even believe that India will take over as the Asian growth leader from China. While that may be true, India is still a much smaller economy than China; the Chinese economy is nearly 5 times that of India in GDP terms. In any case, we do think that India will be a good growth market in the coming years. The economies in Southeast Asia like Indonesia and Thailand are generally expected to do slightly better in the coming years as well. So in short, the largest economy in the region, China, is expected to continue to grow at a fast rate, albeit at a slightly slower pace than it had been growing a few years ago, and the other Asian countries are expected to continue growing at solid rates. Thus, the expectation is that the Asian economic growth rates will continue to lead the world.

Asian Coatings Market

Asia is the largest coatings market in the world. Orr & Boss estimates that the 2017 Asian coatings market will be $68 billion which makes it nearly 45 percent of the global coatings market.

Within Asia, there are three countries that drive most of the demand; China, India and Japan account for 78 percent of the Asian Coatings demand. China is by far the most important country. It accounts for 56 percent of the coatings demand. India is now the second largest coatings market in the region. As discussed above, it is a growing economy and that is resulting in increased growth in its coatings market. Japan is the third.

Key Trends

There are several key trends occurring in the Asian coatings market that are important. The first trend is the continued growth in the region. As discussed above, we expect that the Asia Pacific region will continue to drive overall global coatings growth. Another key trend is that paint manufacturers are more and more being required to be the solution provider. By that we mean that they are forced to combine the service with the products. The final end user just looks at the results. This is especially true in China. For example, as competition heats-up in the architectural coatings market, more and more paint producers are actually doing the painting job as well. They are doing this with trained contractors as partners. As a result of the trend to be a solution provider, some Chinese paint makers are also teaming up with other material suppliers like ceramic tiles, kitchen cabinets and flooring companies to be able to provide all of the individual customers’ decorating needs. Similar to coatings markets around the world, Asian industrial coatings customers are requesting coatings systems with fewer layers and lower cure temperatures. This helps improve productivity but also results in the coating being viewed as more environmentally friendly since the entire system results in less material and energy consumption. Speaking of environmentally friendliness, another major trend is that going green will definitely be a continued theme in Asia. China will start to charge a tax on VOC emission for low-solids solventborne paint.

Overall Outlook

The overall outlook for the Asian coatings market remains strong although growth will not be quite as high as it was a few years ago. Despite the slightly lower growth rates, the economic forecast for Asia remains very strong compared to the rest of the world. China will continue to be a very important part of the market and its growth will remain strong. India may grow at a faster rate than China going forward so it might provide some interesting opportunities for coatings companies.

Finally, there are several important trends affecting the Asian coatings market. These trends include the trend of coatings companies becoming more of a solution provider, coatings that can be applied in fewer layers and lower cure temperatures (these are especially important in the industrial coatings segments) as well as an increased trend toward environmentally friendly coatings. CW