Annirban Bhattacharya, Senior Research Analyst, MarketsandMarkets Research Private Limited11.06.17

Polyurethane sealants are organic compounds formed by the reaction of a glycol with an isocyanate and used for sealing and waterproofing decks, wood flooring and trims. Polyurethane sealants can be one- or two-component systems. One-component systems are used primarily for sealing roofs, for electrical cable and in plumbing. Two-component polyurethanes are used mainly for outdoor end-use industries where property development must be fast. They are generally used for construction (e.g., sealing curtain walls and in expansion joints). Both one- and two-component systems can be used for underwater end use industries, using special primers.

The polyurethane sealants market is segmented into one- and two-component systems based on type. One-component systems are primarily used for sealing roofs, for electrical cable and in plumbing. Two-component polyurethanes are used mainly for outdoor applications where property development must be fast. They are generally used for construction applications (sealing curtain walls and in expansion joints). Both the systems can be used for underwater applications, using special primers.

Globally, more than 90 percent of automobiles are produced with bonded windshields and rear windows using one-component polyurethane sealants.

One-component systems offer ease of preparation before installation and require exposure to moisture in the air to cure. Two-component systems are typically used for waterproofing applications. These sealants have extended shelf life, cure quickly and uniformly without exposure to the atmosphere, and are often colorless.

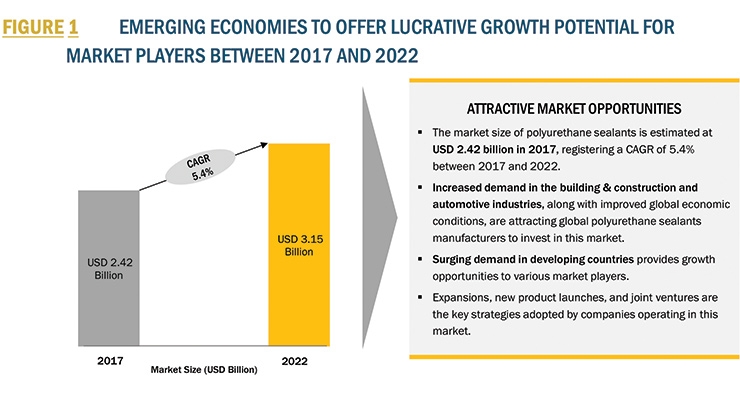

The market size of polyurethane sealants is estimated at $2.42 billion in 2017, which is projected to reach USD 3.15 billion by 2022, at a CAGR of 5.4 percent, during the forecast period. The growing building and construction, automotive, marine and general industrial end use industries in developing countries are driving the polyurethane sealants market. However, volatility in crude oil prices and rise in raw material prices are expected to restrict the overall growth of the market during the forecast period.

The growth of the market is primarily driven by increasing building and construction activities and awareness of environmental hazards in emerging economies such as India, China, the Middle East, Thailand, Indonesia, Brazil and Argentina. China continues to lead the market in Asia-Pacific as well as globally. Increase in purchasing power parity, availability of raw materials, low-cost labor, Asia’s increasing trade relations with other regions, and private sector involvement are some of the major factors driving the polyurethane sealants market.

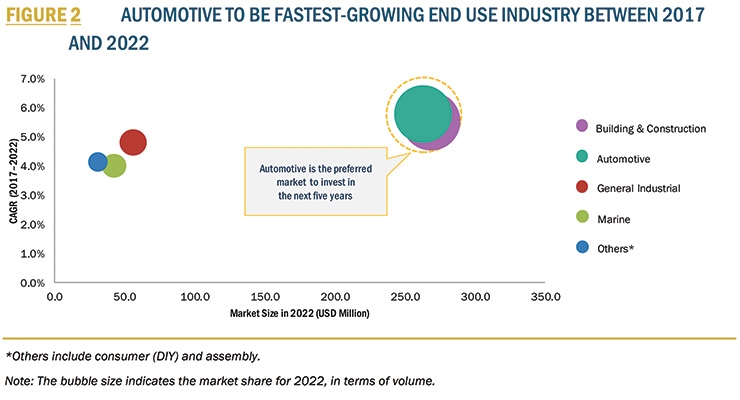

Demand From Various End-Use Industries Drives Polyurethane Sealants Market

Polyurethane sealants possess better tintability, adhesion and abrasion resistance than other sealants. These sealants dry quickly and are moisture-cured sealants that are commonly used in building and construction, automotive, marine, general industrial and other end-use industries. On drying, they produce a very tough elastic-type seal. They also seal and stick well to masonry, wood and metals. They are highly compatible with plastic and rubber. Polyurethane can harden much quicker than urethane and can be used to mend vehicles, especially those made from fiberglass. It seals and mends fiberglass extremely well, creating a very strong bond.

In building and construction segment, polyurethane sealants are mainly used in ceramic tile and flooring installation, pipe cement, roofing and wall coverings. The revival of the building and construction industry in North America, along with the infrastructure, building and construction of smart cities, and rebuilding efforts after a spate of natural disasters such as earthquake and tsunamis in Asia-Pacific are expected to drive the polyurethane sealants market in the building and construction industry in the region.

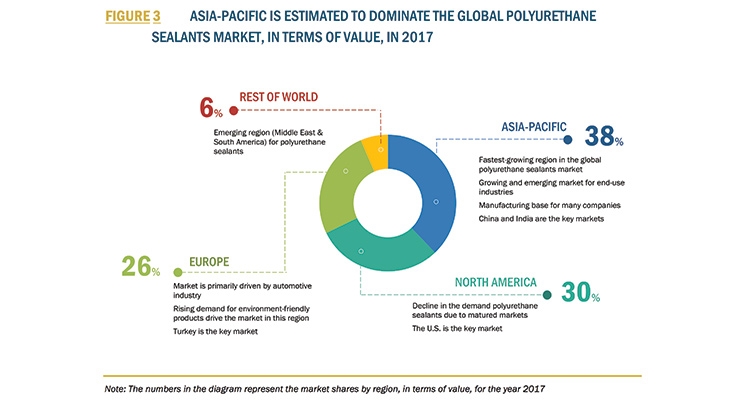

Large Population Creates New Growth Opportunities For Polyurethane Sealants Market In Asia-Pacific

Asia-Pacific is the largest polyurethane sealants market, followed by Europe and North America. The growth of the market in Asia-Pacific is mainly attributed to the high economic growth rate, followed by heavy investment across various industries such as building and construction and automotive and transportation. The economic growth was, to some extent, dampened by the global economic meltdown of 2008 and 2009. However, this did not have the same level of impact on the Asia-Pacific region as it had on the rest of the world. Another economic growth factor is increasing population in countries such as China and India. With a population of around 3.6 billion people in about 48 countries in 2015, the region accounts for almost one-third of the global gross domestic product (GDP) measured in terms of purchasing power parity (PPP).

Also, various companies are shifting their production units to the region because of low-cost of production and proximity to emerging markets such as India, Thailand, Indonesia, and Malaysia.

Thus, the market size of Polyurethane Sealants in Asia-Pacific is projected to grow from $916.4 million in 2017 to $1,303.0 in 2022, at a CAGR of around 7 percent during the forecast period.

North America and Europe have reached a maturity stage, where the demand for polyurethane sealants is stagnant. The market is saturated, and most manufacturers are exploring new high-growth markets. In the global polyurethane sealants market, the key to surviving the intense market competition is to differentiate products, ensure competitive pricing and maintain brand name. Manufacturers are also competing to launch innovative products that comply with various environmental regulations.

According to the industry experts, the polyurethane sealants market in Europe is saturated to an extent and is losing its market share to Asia-Pacific countries, such as China and India. The manufacturers are responding to the competitive challenges by establishing production facilities in countries where the cost of production is low.

Similarly, the European polyurethane sealants manufacturers have shifted their production facilities and are tapping into new markets as there is slow growth in the already developed markets.

Growing Demand For Low Voc, Green, And Sustainable Sealants

Owing to a rising trend in various end user segments to use eco-friendly or green products, the demand for green sealants or those with low VOCs is increasing. Stringent regulations implemented by USEPA (United States Environmental Protection Agency), Europe’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced manufacturers to make ecofriendly sealants with low VOC levels. Shifting toward a more sustainable product portfolio has provided the industry a significant growth opportunity.

There is growing trend in the global construction market for more environmentally friendly or green buildings; this seems promising for the development of green and more sustainable sealant solutions. Such green sealant solutions are made from renewable, recycled, remanufactured, or biodegradable materials and use of these environmentally responsible products also benefits the health of the occupant.

The polyurethane sealants industry in Asia-Pacific is growing rapidly, and is shifting toward green and sustainable technologies. Therefore, polyurethane sealants are expected to replace the conventional systems and emerge as a stronger and effective way of sealing similar and dissimilar substrates. CW

Report Details

Polyurethane Sealants Market by Type (One-Component, Two-Component), End-Use Industry (Building & Construction, Automotive, General Industrial, Marine), and Region - Global Forecast to 2022. Report Code: CH 5363

Annirban Bhattacharya, Senior Research Analyst MarketsandMarkets Research Private Limited

A technically proficient and result driven professional with approximately 5 years of experience in the CASE (Coatings, Polyurethane Sealants, Sealants, and Elastomers) industry. He holds rich experience in technology, market research experience in CASE domain, and leads a cross functional team of consultants for projects with major chemical companies with actionable insights. Most of the projects are in the sales & marketing, business development, and strategic planning and implementation functions; Key consulting projects undertaken are distribution channel optimization, new product development, new market entry strategy, pricing strategy, growth strategy, identification of acquisition targets, and due diligence of targets. He can be reached at annirban.bhattacharya@marketsandmarkets.com.

The polyurethane sealants market is segmented into one- and two-component systems based on type. One-component systems are primarily used for sealing roofs, for electrical cable and in plumbing. Two-component polyurethanes are used mainly for outdoor applications where property development must be fast. They are generally used for construction applications (sealing curtain walls and in expansion joints). Both the systems can be used for underwater applications, using special primers.

Globally, more than 90 percent of automobiles are produced with bonded windshields and rear windows using one-component polyurethane sealants.

One-component systems offer ease of preparation before installation and require exposure to moisture in the air to cure. Two-component systems are typically used for waterproofing applications. These sealants have extended shelf life, cure quickly and uniformly without exposure to the atmosphere, and are often colorless.

The market size of polyurethane sealants is estimated at $2.42 billion in 2017, which is projected to reach USD 3.15 billion by 2022, at a CAGR of 5.4 percent, during the forecast period. The growing building and construction, automotive, marine and general industrial end use industries in developing countries are driving the polyurethane sealants market. However, volatility in crude oil prices and rise in raw material prices are expected to restrict the overall growth of the market during the forecast period.

The growth of the market is primarily driven by increasing building and construction activities and awareness of environmental hazards in emerging economies such as India, China, the Middle East, Thailand, Indonesia, Brazil and Argentina. China continues to lead the market in Asia-Pacific as well as globally. Increase in purchasing power parity, availability of raw materials, low-cost labor, Asia’s increasing trade relations with other regions, and private sector involvement are some of the major factors driving the polyurethane sealants market.

Demand From Various End-Use Industries Drives Polyurethane Sealants Market

Polyurethane sealants possess better tintability, adhesion and abrasion resistance than other sealants. These sealants dry quickly and are moisture-cured sealants that are commonly used in building and construction, automotive, marine, general industrial and other end-use industries. On drying, they produce a very tough elastic-type seal. They also seal and stick well to masonry, wood and metals. They are highly compatible with plastic and rubber. Polyurethane can harden much quicker than urethane and can be used to mend vehicles, especially those made from fiberglass. It seals and mends fiberglass extremely well, creating a very strong bond.

In building and construction segment, polyurethane sealants are mainly used in ceramic tile and flooring installation, pipe cement, roofing and wall coverings. The revival of the building and construction industry in North America, along with the infrastructure, building and construction of smart cities, and rebuilding efforts after a spate of natural disasters such as earthquake and tsunamis in Asia-Pacific are expected to drive the polyurethane sealants market in the building and construction industry in the region.

Large Population Creates New Growth Opportunities For Polyurethane Sealants Market In Asia-Pacific

Asia-Pacific is the largest polyurethane sealants market, followed by Europe and North America. The growth of the market in Asia-Pacific is mainly attributed to the high economic growth rate, followed by heavy investment across various industries such as building and construction and automotive and transportation. The economic growth was, to some extent, dampened by the global economic meltdown of 2008 and 2009. However, this did not have the same level of impact on the Asia-Pacific region as it had on the rest of the world. Another economic growth factor is increasing population in countries such as China and India. With a population of around 3.6 billion people in about 48 countries in 2015, the region accounts for almost one-third of the global gross domestic product (GDP) measured in terms of purchasing power parity (PPP).

Also, various companies are shifting their production units to the region because of low-cost of production and proximity to emerging markets such as India, Thailand, Indonesia, and Malaysia.

Thus, the market size of Polyurethane Sealants in Asia-Pacific is projected to grow from $916.4 million in 2017 to $1,303.0 in 2022, at a CAGR of around 7 percent during the forecast period.

North America and Europe have reached a maturity stage, where the demand for polyurethane sealants is stagnant. The market is saturated, and most manufacturers are exploring new high-growth markets. In the global polyurethane sealants market, the key to surviving the intense market competition is to differentiate products, ensure competitive pricing and maintain brand name. Manufacturers are also competing to launch innovative products that comply with various environmental regulations.

According to the industry experts, the polyurethane sealants market in Europe is saturated to an extent and is losing its market share to Asia-Pacific countries, such as China and India. The manufacturers are responding to the competitive challenges by establishing production facilities in countries where the cost of production is low.

Similarly, the European polyurethane sealants manufacturers have shifted their production facilities and are tapping into new markets as there is slow growth in the already developed markets.

Growing Demand For Low Voc, Green, And Sustainable Sealants

Owing to a rising trend in various end user segments to use eco-friendly or green products, the demand for green sealants or those with low VOCs is increasing. Stringent regulations implemented by USEPA (United States Environmental Protection Agency), Europe’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced manufacturers to make ecofriendly sealants with low VOC levels. Shifting toward a more sustainable product portfolio has provided the industry a significant growth opportunity.

There is growing trend in the global construction market for more environmentally friendly or green buildings; this seems promising for the development of green and more sustainable sealant solutions. Such green sealant solutions are made from renewable, recycled, remanufactured, or biodegradable materials and use of these environmentally responsible products also benefits the health of the occupant.

The polyurethane sealants industry in Asia-Pacific is growing rapidly, and is shifting toward green and sustainable technologies. Therefore, polyurethane sealants are expected to replace the conventional systems and emerge as a stronger and effective way of sealing similar and dissimilar substrates. CW

Report Details

Polyurethane Sealants Market by Type (One-Component, Two-Component), End-Use Industry (Building & Construction, Automotive, General Industrial, Marine), and Region - Global Forecast to 2022. Report Code: CH 5363

Annirban Bhattacharya, Senior Research Analyst MarketsandMarkets Research Private Limited

A technically proficient and result driven professional with approximately 5 years of experience in the CASE (Coatings, Polyurethane Sealants, Sealants, and Elastomers) industry. He holds rich experience in technology, market research experience in CASE domain, and leads a cross functional team of consultants for projects with major chemical companies with actionable insights. Most of the projects are in the sales & marketing, business development, and strategic planning and implementation functions; Key consulting projects undertaken are distribution channel optimization, new product development, new market entry strategy, pricing strategy, growth strategy, identification of acquisition targets, and due diligence of targets. He can be reached at annirban.bhattacharya@marketsandmarkets.com.