Yogender Singh, India/Asia-Pacific Correspondent06.04.18

Paint India exhibition and conference was held in India’s financial capital, Mumbai, from March 8-10, 2018. The three-day event saw a gathering of more than 240 exhibitors from India, China, ASEAN countries and Europe. The event witnessed an attendance of more than 5,200 visitors according to the organizers. Coatings World attended the three day event and spoke to a number of key stakeholders at the exhibition.

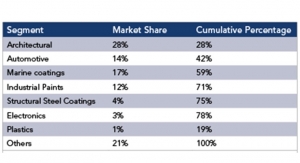

The Indian paint and coating industry is expected to grow steadily in the short and medium term on the back of strong growth in Indian economy. India’s young population represents a huge opportunity as more young Indians join the workforce and will have disposable income available. The trend toward nuclear family augurs well for the paint industry.

Decorative paints segment is expected to witness higher growth going forward. The fiscal incentives given by the government to the housing sector have immensely benefited the housing sector. This will benefit key players in the long term.

Although the demand for industrial paints is lukewarm, it is expected to increase going forward. This is on account of increasing investments in infrastructure. Domestic and global auto majors have long term plans for the Indian market, which augur well for automotive paint manufacturers. Increased industrial paint demand, especially powder coatings and high performance coatings will also propel growth for Indian paint majors in the short and medium term.

Despite, the huge size of Indian paints and coating market, the per capita usage of these products is still very low in India. Nitin Tewari, territory sales manager with Akzo Nobel India Limited told Coatings World: “The per capita paint consumption in India which is a little over four kgs is still very low as compared to the developed western nations. Therefore, as the country develops and modernizes, the per capita paint consumption is bound to increase. Most of the larger paint companies like us are taking a number of initiatives to educate the consumers about the benefits of using higher value added products.”

Considered as laggards in terms of using state of the art process technology in paint and coating production, Indian paint producers have started to invest in advanced technology in last few years. Though, the technology usage is limited to organized sector producers. Netzsch India private limited, a subsidiary of NETZSCH Group with interests in the progressive cavity pumps grinding and dispersion and thermal analysis at its manufacturing facility at Industrial estate Ambattur is optimistic about the role of state of the art technology in Indian paint industry. According to Vivek Norman, “Indian paint industry is heavily investing in advanced process equipment. While, a few years back, you could count users of advanced technology on your fingers. But, in last few years, paint industry has realized the importance of advanced technology.”

Indian paint industry, which is comprised of organized and a huge unorganized sector [accounts for 35 percent of the total volume] is expecting to reduce the proportion of unorganized sector with the implementation of Goods & Service Tax (GST). In the unorganized segment, there are about 2,000 units having small and medium sized paint manufacturing plants. Speaking on the sidelines of the event, Ajay Arora, territory sales manager at Shalimar Paints told CW, “ It is no secret that unorganized sector has a huge share of Indian paints and coatings market. In fact, these producers have a huge share in the decorative market. In a number of cases, it has been observed that some of these producers are also supplying sub-standard products at cheap prices, which has been a deterrent for organized sector producers in rural markets, where low prices of the products is the most important criterion of purchase.

“With the implementation of GST (India implemented GST from 1st July 2017) organized sector producers like us are expected to make huge gains. A number of unorganized sector producers will disappear in next two years as compliance would become difficult for these producers in coming days,” he added.

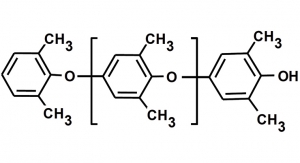

Speaking to CW, Kumar Iyer, sales head of Coatings, Adhesives and Specialties at Covestro (formerly Bayer Material Science) India said, “Our company has provided a number of products for last 80 years for comfortable upholstered furniture, safe car seats, protective coatings and lightweight composites. We are working closely with end-users in India in terms of and educating them about the benefits of PU over other traditionally used materials and developing materials specifically for Indian market. We are committed to the further development of sustainable PU based solutions and will further drive the development of high performance, high efficiency coating raw materials specifically for Indian market.”

Sachin Dhamanaskar, national sales manager of Elementis Specialties India, a subsidiary of UK-based global specialty chemicals company, Elementis PLC, which provides high value functional additives to the paints & coatings industry said, “Usage of high quality raw materials is on the rise in Indian paints and coatings industry. Growing awareness among the end users and demand of high quality products has been the major demand driver of the high valued added speciality products in the country.”

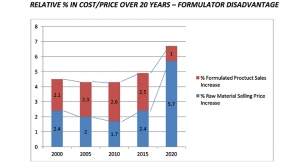

Rising crude oil prices in the last few months have been a major cause of concern for Indian paint and coating producers as more than half of the raw materials used in the paint industry are petro-based. Sharing the concern with CW, Priya Pillay from WACKER, India noted, “Fluctuation in crude oil prices is an inevitability for paints and coating producers across the globe. We have also enjoyed a couple of halcyon years, when crude prices remained in a very comfortable range. Rising raw material prices lead to increase in the prices of coating products , which has a negative effect on overall demand. But, this is a situation, where paint producers and raw material suppliers have little control over.”

Usage of environmentally friendly paints and coating products has been gaining market share in Indian market in recent years. However, a significant part of this demand is driven by environmental regulations according to Mukesh Madhup of 3M, India.

The Indian paint and coating industry is expected to grow steadily in the short and medium term on the back of strong growth in Indian economy. India’s young population represents a huge opportunity as more young Indians join the workforce and will have disposable income available. The trend toward nuclear family augurs well for the paint industry.

Decorative paints segment is expected to witness higher growth going forward. The fiscal incentives given by the government to the housing sector have immensely benefited the housing sector. This will benefit key players in the long term.

Although the demand for industrial paints is lukewarm, it is expected to increase going forward. This is on account of increasing investments in infrastructure. Domestic and global auto majors have long term plans for the Indian market, which augur well for automotive paint manufacturers. Increased industrial paint demand, especially powder coatings and high performance coatings will also propel growth for Indian paint majors in the short and medium term.

Despite, the huge size of Indian paints and coating market, the per capita usage of these products is still very low in India. Nitin Tewari, territory sales manager with Akzo Nobel India Limited told Coatings World: “The per capita paint consumption in India which is a little over four kgs is still very low as compared to the developed western nations. Therefore, as the country develops and modernizes, the per capita paint consumption is bound to increase. Most of the larger paint companies like us are taking a number of initiatives to educate the consumers about the benefits of using higher value added products.”

Considered as laggards in terms of using state of the art process technology in paint and coating production, Indian paint producers have started to invest in advanced technology in last few years. Though, the technology usage is limited to organized sector producers. Netzsch India private limited, a subsidiary of NETZSCH Group with interests in the progressive cavity pumps grinding and dispersion and thermal analysis at its manufacturing facility at Industrial estate Ambattur is optimistic about the role of state of the art technology in Indian paint industry. According to Vivek Norman, “Indian paint industry is heavily investing in advanced process equipment. While, a few years back, you could count users of advanced technology on your fingers. But, in last few years, paint industry has realized the importance of advanced technology.”

Indian paint industry, which is comprised of organized and a huge unorganized sector [accounts for 35 percent of the total volume] is expecting to reduce the proportion of unorganized sector with the implementation of Goods & Service Tax (GST). In the unorganized segment, there are about 2,000 units having small and medium sized paint manufacturing plants. Speaking on the sidelines of the event, Ajay Arora, territory sales manager at Shalimar Paints told CW, “ It is no secret that unorganized sector has a huge share of Indian paints and coatings market. In fact, these producers have a huge share in the decorative market. In a number of cases, it has been observed that some of these producers are also supplying sub-standard products at cheap prices, which has been a deterrent for organized sector producers in rural markets, where low prices of the products is the most important criterion of purchase.

“With the implementation of GST (India implemented GST from 1st July 2017) organized sector producers like us are expected to make huge gains. A number of unorganized sector producers will disappear in next two years as compliance would become difficult for these producers in coming days,” he added.

Speaking to CW, Kumar Iyer, sales head of Coatings, Adhesives and Specialties at Covestro (formerly Bayer Material Science) India said, “Our company has provided a number of products for last 80 years for comfortable upholstered furniture, safe car seats, protective coatings and lightweight composites. We are working closely with end-users in India in terms of and educating them about the benefits of PU over other traditionally used materials and developing materials specifically for Indian market. We are committed to the further development of sustainable PU based solutions and will further drive the development of high performance, high efficiency coating raw materials specifically for Indian market.”

Sachin Dhamanaskar, national sales manager of Elementis Specialties India, a subsidiary of UK-based global specialty chemicals company, Elementis PLC, which provides high value functional additives to the paints & coatings industry said, “Usage of high quality raw materials is on the rise in Indian paints and coatings industry. Growing awareness among the end users and demand of high quality products has been the major demand driver of the high valued added speciality products in the country.”

Rising crude oil prices in the last few months have been a major cause of concern for Indian paint and coating producers as more than half of the raw materials used in the paint industry are petro-based. Sharing the concern with CW, Priya Pillay from WACKER, India noted, “Fluctuation in crude oil prices is an inevitability for paints and coating producers across the globe. We have also enjoyed a couple of halcyon years, when crude prices remained in a very comfortable range. Rising raw material prices lead to increase in the prices of coating products , which has a negative effect on overall demand. But, this is a situation, where paint producers and raw material suppliers have little control over.”

Usage of environmentally friendly paints and coating products has been gaining market share in Indian market in recent years. However, a significant part of this demand is driven by environmental regulations according to Mukesh Madhup of 3M, India.