11.05.18

U.S. President Donald Trump on Sept. 7, 2018, warned that he was ready to slap tariffs on virtually all Chinese imports into the U.S., threatening duties on another $267 billion of goods on top of $200 billion in imports primed for levies in coming days.

These impending actions would sharply escalate the developing trade war with Beijing over the U.S. demand for major changes in China’s economic, trade and technology policy. The U.S. position is not new, it’s been formed over the past two decades under various administrations. As we will discuss later in this article, China has a long history of not allowing a level playing field when it comes to allowing outsiders access to their home market. China has been highly adept at creating creative trade barriers while still maintaining and growing its own exports to other countries such as the U.S. Instead of addressing the concerns that have been expressed by the U.S. and other countries China has threatened retaliation against the U.S. which could include action against U.S. companies operating there. Nothing new here, it has happened before.

History has shown that when major trade issues between two powerful countries are not amicably resolved in a timely manner that often such failure leads to even greater trade conflict between the two countries. Such appears to be happening between the U.S. and China. Although the trade issue is getting 24/7 headline treatment in the U.S. due mainly to the politically charged partisan division that exists there and the fact that the U.S. “midterm” election will be happening shortly. This trade dispute between China and the U.S. is not a new happening nor is it something that only occurred under the current president (Trump). In fact, if you go back in time about 20 years, there was no trade imbalance between the U.S. and China. Unfortunately, that is not true today as the U.S. ended 2017 with a trade deficit with China of $375 billion.

The trade deficit exists because U.S. exports to China were only $130 billion while imports from China were $506 billion. In fact, in 2016 the U.S. only exported eight percent of its total exports to China (this number grew to 10 percent in 2017). The simple truth is that the U.S. consumer has an insatiable appetite for inexpensive China produced electronics, clothing, etc. The other side of the coin is that China has erected strong, impenetrable trade barriers that minimize the ability of U.S. producers to access China’s huge market. The following chart describes the U.S. exports in 2016.

According to import statistics, the U.S. imported from China $77 billion in computers and accessories, $70 billion in cell phones and $54 billion in apparel and footwear. It is possible that some of these imports are from U.S. manufacturers that send raw materials from various countries to China for low labor cost assembly. Once these assembled products are shipped back to the U.S., they are classified as imports from China.

On the other hand, the $130 billion imports from the U.S. in 2017 by China included such items as $16 billion in commercial aircrafts, $12 billion in soybeans and $10 billion in autos.

Looking at a more global perspective China imported $1.841 trillion worth of goods from various countries around the globe in 2017. That dollar amount reflects a -5.6 percent slowdown since 2013 but a 15.9 percent gain from 2016 to 2017. Chinese imports represent approximately 11.5 percent of total global imports which totaled an estimated $16.05 trillion in 2016.

From a strictly regional perspective, 55.9 percent of China’s total imports by value in 2017 were purchased from other Asian countries. European trade partners accounted for 17.7 percent of imported goods bought by China while 10.2 percent worth originated from North America. A smaller percentage of overall Chinese imports came from Latin America excluding Mexico but including the Caribbean (6.2 percent), Australia and other Oceanian sources (5.8 percent) and Africa (4 percent).

Given China’s current population of 1.37 billion people, its $1.84 trillion in 2017 imports translates to roughly $1,350 in yearly product demand from every person in the country.

Who are the largest global importers?

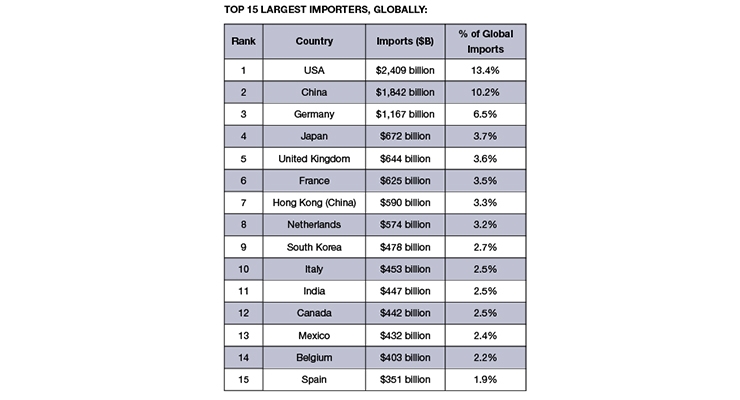

Another way to ask this question is “Which countries can throw their weight around the most with tariffs and retaliatory measures?” It’s those that import the most goods – and the world’s largest importers in 2017, according to recently released data from the World Trade Organization are those shown in the following table.

The U.S. occupies the number one spot with $2,409 billion of imports in 2017, about 13.4 percent of the global total. It’s worth mentioning that this is $860 billion higher than the country’s exports in 2017 and that the difference between the two numbers is what is leading to the current, hotly-debated trade deficit discussions between the U.S. and it various trading partners.

China and Germany come in the No. 2 and No. 3 spots, respectively, with $1,842 billion (10.2 percent of global total) of imports for China and $1,167 billion (6.5 percent of total) for Europe’s largest economy. After the big three, no other country has a number exceeding five percent of global imports. However, Japan, the United Kingdom, France, Hong Kong (China) and the Netherlands all surpass the three percent mark.

Who are the largest global exporters?

As the environment around trade shifts, it’s worth noting the countries that have the biggest stakes in international trade. Some countries rely on imports to sustain their domestic market while others can only survive based on their exports to other countries. Maintaining a healthy trade balance requires a very delicate balancing act which can impact the value of a country’s currency, it’s employment level, overall gross domestic product growth (GDP), the stability of its workforce, the contentment of its citizens, etc. In essence, “the balance of imports and exports” matter.

The following chart list the world’s biggest exporters. This chart is based on the latest export data from the World Trade Organization for 2017. For simplicity, countries with fewer than $20 billion in exports were not included.

As this chart indicates, China leads the way with $2.26 trillion in exports per year, but the country also has a sizable population of nearly 1.4 billion. This works out to about $1,600 per person in exports. The truth is that China has not grown nor matured its own domestic market and could not survive economically without a huge export market. At the same time, it needs to sustain, nurture and grow its fledging domestic market. Hence, it’s tenacious role as a country with strong trade barriers.

Germany, which is a large exporter of automobiles, sends a whopping $1.45 trillion of goods abroad every year despite only having 83 million people. That amounts to about $18,000 per person in exports.

The U.S. is the world’s second largest exporter in terms of absolute value. However, if you compare it on a per capita basis to a nation like Germany, it’s clear that the U.S. relies less on exports overall. The country exported $1.55 trillion in goods in 2017, about $4,800 per person. The U.S. has a well developed and strong domestic market which could survive with minimal imports if required.

History has shown that it’s important to have a healthy import/export trade balance and that bad economic and social issues can happen when that balance is interrupted. Trade balancing works best in an open and free trade environment (you have something I want, I have something you want so we reach a deal). Unfortunately, although the term free trade is thrown around by political pundits it doesn’t’ adequately define what is happening in our global market.

Simply looking at the export/import data one would think that the global trade market is vibrant and working well. It’s only when you study specifics that it becomes clear that many of the trading partners of the U.S. have installed various levels of trade barriers. However, due to the sheer size of the deficit between the U.S. and China, it is clear why the current U.S. administration has focused on resolving that issue first. In addition, China has made it clear that it intends to remove the U.S. as the leader in international trade.

China has long been a country that has put in place numerous trade barriers that prohibit other countries from having access to its huge domestic market. Nothing new here; it has been this way for many years. Even so, the U.S. continues to pursue vigorous and expanded bilateral and multilateral engagement to increase the benefits that U.S. businesses, workers, farmers, ranchers, service providers and consumers derive from trade and economic ties with China. To remove Chinese barriers blocking or impeding U.S. exports and investment, the U.S. uses outcome-oriented dialogue at all levels of engagement with China, while also taking concrete steps to enforce U.S. rights at the WTO as appropriate. At present, China’s trade policies and practices in several specific areas cause concern for the United States and U.S. stakeholders. The current U.S. administration is asking China to address these concerns and fix the problems and issues associated with each area.

Trade barriers erected by China that concern the U.S.

Trade Secrets

The protection and enforcement of trade secrets in China is a serious problem and has been the subject of high-profile attention and engagement in recent years. Thefts of trade secrets for the benefit of Chinese companies have occurred both within China and outside of China. Offenders in many cases continue to operate with impunity.

Bad Faith Trademark Registration

Of particular and growing concern is the continuing registration of trademarks in bad faith. Although China has taken some steps to address this problem, U.S. companies across industry sectors continue to face Chinese applicants registering their marks and “holding them for ransom” or seeking to establish a business building off of U.S. companies’ global reputations.

Pharmaceuticals

The United States continues to engage China on a range of patent and technology transfer concerns relating to pharmaceuticals. At the December 2013 JCCT meeting, China committed to permitting supplemental data supporting pharmaceutical patent applications. However, to date, it appears that China has only implemented that commitment in part with no further action taken.

Online Piracy

Online piracy continues on a large scale in China, affecting a wide range of industries, including those involved in distributing legitimate music, motion pictures, books and journals, software and video games. While increased enforcement activities have helped stem the flow of online sales of some pirated offerings, much more sustained action and attention are needed to make a more meaningful difference for content creators and rights holders, particularly small and medium-sized enterprises.

Counterfeit Goods

Although rights holders report increased enforcement efforts by Chinese government authorities, counterfeiting in China, affecting a wide range of goods, remains widespread. One area of particular U.S. concern involves medications. Despite sustained engagement by the U.S., China still needs to improve its regulation of the manufacture of active pharmaceutical ingredients to prevent their use in counterfeit and substandard medications.

Export Restraints

China continues to deploy a combination of export restraints, including export quotas, export licensing, minimum export prices, export duties and other restrictions, on a number of raw material inputs where it holds the leverage of being among the world’s leading producers. Through these export restraints, it appears that China is able to provide substantial economic advantages to a wide range of downstream producers in China at the expense of foreign downstream producers while creating pressure on foreign downstream producers to move their operations, technologies and jobs to China.

Subsidies

China has continued to provide substantial subsidies to its domestic industries, causing injury to U.S. industries. Some of these subsidies also appear to be prohibited under WTO rules. The U.S. has addressed these subsidies through countervailing duty proceedings conducted by the Commerce Department, invocation of a trade policy compliance mechanism established by China’s State Council and dispute settlement cases at the WTO. The United States and other WTO members also have continued to press China to notify all of its subsidies to the WTO in accordance with its WTO obligations. Since joining the WTO 15 years ago, China has not yet submitted to the WTO a complete notification of subsidies maintained by the central government, and it did not notify a single sub-central government subsidy until July 2016, when it provided information only on sub-central government subsidies that the United States had challenged as prohibited subsidies in a WTO case.

Excess Capacity

Chinese government actions and financial support in manufacturing industries like steel and aluminum have contributed to massive excess capacity in China, with the resulting over-production distorting global markets and hurting U.S. producers and workers in both the United States and third country markets such as Canada and Mexico, where U.S. exports compete with Chinese exports.

Standards

In the standards area, two principal types of problems harm U.S. companies. First, Chinese government officials in some instances have reportedly pressured foreign companies seeking to participate in the standards-setting process to license their technology or intellectual property on unfavorable terms. Second, China has continued to pursue unique national standards in a number of high technology areas where international standards already exist, such as 3G and 4G telecommunication standards, Wi-Fi standards and information security standards. The U.S. continues to press China to address these specific concerns, but to date, this bilateral engagement has yielded minimal progress.

Investment Restrictions

China seeks to protect many domestic industries through a restrictive investment regime, which adversely affects foreign investors in services sectors, agriculture, extractive industries and manufacturing sectors. In a recent survey, the OECD ranked investment restrictiveness in China at over five times the average of the 58 G20 and OECD members surveyed.

Trade Remedies

China’s regulatory authorities in some instances seem to be pursuing anti-dumping and countervailing duty investigations and imposing duties for the purpose of striking back at trading partners that have exercised their WTO rights against China, even when necessary legal and factual support for the duties is absent. The U.S. response has been the filing and prosecution of three WTO disputes. The decisions reached by the WTO in those three disputes confirm that China failed to abide by WTO disciplines when imposing the duties at issue.

The previously listed areas of trade concern are but a small sample of the trade barriers actually erected by China. A more detailed listing can be found in the 2017 National Trade Estimate Report on Foreign Trade Barriers. The Office of the United States Trade Representative (USTR) is responsible for the preparation of that report.

What appears to be obvious is that China is dependent on a strong, vibrant and expanding export segment and at the same time has made the decision to protect its own domestic market from incursion by outsiders. China wants to be a major, global player in various markets hence its decision to joining the WTO. However, it’s fairly clear that China has not yet decided to abide by the WTO requirements in that area.

Bottom line, it appears that the U.S. is within its right to ask China to remove its barriers, level their trade playing field and abide by WTO standards. It is also the U.S. right to impose tariffs on Chinese imports since China appears unwilling to change its protectionism and refusal to abide by WTO standards.

As the approaching trade war escalates between the U.S. and China, who is likely to win and who will lose?

Most economic pundits feel that China has more to lose economically in an all-out trade war with the U.S. The Chinese economy is heavily dependent on exports, and nearly 20 percent of its exports go to the U.S. It sold $506 billion in stuff and services to the U.S. last year. In contrast, the U.S. only sold $130 billion to the Chinese.

The opinion that China has more to lose might be true if all things were equal but of course, that’s not the way things happen. This isn’t just an economic fight, it’s also political, and there’s a strong case that the current U.S. administration would be less able to sustain a protracted conflict than the Chinese especially with the 2018 midterm elections coming up and the strong partisan divide that exists within the U.S.

On the other side, Chinese President Xi Jinping runs a communist country that has just granted him the ability to rule for life. He controls the media in his country (something President Trump cannot do) and is also sitting on top of about $3 trillion in surplus cash (something President Trump does not have).

Bottom line, all of this means Xi can react quickly to whatever measures the U.S. chose to take in this trade war. He can even aid Chinese companies that get hurt in the coming months and subsidize soybean prices, so Chinese consumers don’t face massive sticker shock at the store. The Chinese used similar tactics during the global financial crisis of 2008 and 2009, spending heavily from their surplus reserves to stimulate their economy and insulate their people from pain. The Chinese cash reserves are not as large now, but they still have more than the U.S. In addition, and perhaps the strongest hand for Xi to play is the fact that he (unlike President Trump) is not constrained by the rule of law or a representative democracy. Xi is not contending with a divided government.

It’s merely speculation at this point to project a probable outcome of this particular Trade War. In truth, both sides have a lot to lose and little to gain by a long-term, protracted trade war. Xi is counting on political pressure in the U.S. to end the tariffs that have been and will be imposed on China. Politically speaking, Xi cannot simply agree to erase all of China’s trade barriers, at least in the short term. Trump, on the other hand, cannot sustain a long-term dispute with China as it will start to impact on an area that he feels he has created (a vibrant and growing U.S. job market).

Unfortunately, Trump cannot just walk away from this conflict. He has invested a great deal of political capital into this matter. The only way this is going to end is with both sides looking at areas of compromise with an understanding that China has to enter the Global market with a level domestic playing field similar to its trading partners and adhere to WTO standards.

The good news is that it has been reported that Chinese Premier Li Keqiang has indicated that China is prepared to ease market access for U.S. companies and stop forcing foreign companies to transfer technology. This would be a small concession and one that will not erase the current U.S. trade deficit with China, but it might be the foot in the door that allows both sides to seek a more amicable settlement of their grievances. Neither side has anything to gain by allowing this situation to continue.

These impending actions would sharply escalate the developing trade war with Beijing over the U.S. demand for major changes in China’s economic, trade and technology policy. The U.S. position is not new, it’s been formed over the past two decades under various administrations. As we will discuss later in this article, China has a long history of not allowing a level playing field when it comes to allowing outsiders access to their home market. China has been highly adept at creating creative trade barriers while still maintaining and growing its own exports to other countries such as the U.S. Instead of addressing the concerns that have been expressed by the U.S. and other countries China has threatened retaliation against the U.S. which could include action against U.S. companies operating there. Nothing new here, it has happened before.

History has shown that when major trade issues between two powerful countries are not amicably resolved in a timely manner that often such failure leads to even greater trade conflict between the two countries. Such appears to be happening between the U.S. and China. Although the trade issue is getting 24/7 headline treatment in the U.S. due mainly to the politically charged partisan division that exists there and the fact that the U.S. “midterm” election will be happening shortly. This trade dispute between China and the U.S. is not a new happening nor is it something that only occurred under the current president (Trump). In fact, if you go back in time about 20 years, there was no trade imbalance between the U.S. and China. Unfortunately, that is not true today as the U.S. ended 2017 with a trade deficit with China of $375 billion.

The trade deficit exists because U.S. exports to China were only $130 billion while imports from China were $506 billion. In fact, in 2016 the U.S. only exported eight percent of its total exports to China (this number grew to 10 percent in 2017). The simple truth is that the U.S. consumer has an insatiable appetite for inexpensive China produced electronics, clothing, etc. The other side of the coin is that China has erected strong, impenetrable trade barriers that minimize the ability of U.S. producers to access China’s huge market. The following chart describes the U.S. exports in 2016.

According to import statistics, the U.S. imported from China $77 billion in computers and accessories, $70 billion in cell phones and $54 billion in apparel and footwear. It is possible that some of these imports are from U.S. manufacturers that send raw materials from various countries to China for low labor cost assembly. Once these assembled products are shipped back to the U.S., they are classified as imports from China.

On the other hand, the $130 billion imports from the U.S. in 2017 by China included such items as $16 billion in commercial aircrafts, $12 billion in soybeans and $10 billion in autos.

Looking at a more global perspective China imported $1.841 trillion worth of goods from various countries around the globe in 2017. That dollar amount reflects a -5.6 percent slowdown since 2013 but a 15.9 percent gain from 2016 to 2017. Chinese imports represent approximately 11.5 percent of total global imports which totaled an estimated $16.05 trillion in 2016.

From a strictly regional perspective, 55.9 percent of China’s total imports by value in 2017 were purchased from other Asian countries. European trade partners accounted for 17.7 percent of imported goods bought by China while 10.2 percent worth originated from North America. A smaller percentage of overall Chinese imports came from Latin America excluding Mexico but including the Caribbean (6.2 percent), Australia and other Oceanian sources (5.8 percent) and Africa (4 percent).

Given China’s current population of 1.37 billion people, its $1.84 trillion in 2017 imports translates to roughly $1,350 in yearly product demand from every person in the country.

Who are the largest global importers?

Another way to ask this question is “Which countries can throw their weight around the most with tariffs and retaliatory measures?” It’s those that import the most goods – and the world’s largest importers in 2017, according to recently released data from the World Trade Organization are those shown in the following table.

The U.S. occupies the number one spot with $2,409 billion of imports in 2017, about 13.4 percent of the global total. It’s worth mentioning that this is $860 billion higher than the country’s exports in 2017 and that the difference between the two numbers is what is leading to the current, hotly-debated trade deficit discussions between the U.S. and it various trading partners.

China and Germany come in the No. 2 and No. 3 spots, respectively, with $1,842 billion (10.2 percent of global total) of imports for China and $1,167 billion (6.5 percent of total) for Europe’s largest economy. After the big three, no other country has a number exceeding five percent of global imports. However, Japan, the United Kingdom, France, Hong Kong (China) and the Netherlands all surpass the three percent mark.

Who are the largest global exporters?

As the environment around trade shifts, it’s worth noting the countries that have the biggest stakes in international trade. Some countries rely on imports to sustain their domestic market while others can only survive based on their exports to other countries. Maintaining a healthy trade balance requires a very delicate balancing act which can impact the value of a country’s currency, it’s employment level, overall gross domestic product growth (GDP), the stability of its workforce, the contentment of its citizens, etc. In essence, “the balance of imports and exports” matter.

The following chart list the world’s biggest exporters. This chart is based on the latest export data from the World Trade Organization for 2017. For simplicity, countries with fewer than $20 billion in exports were not included.

As this chart indicates, China leads the way with $2.26 trillion in exports per year, but the country also has a sizable population of nearly 1.4 billion. This works out to about $1,600 per person in exports. The truth is that China has not grown nor matured its own domestic market and could not survive economically without a huge export market. At the same time, it needs to sustain, nurture and grow its fledging domestic market. Hence, it’s tenacious role as a country with strong trade barriers.

Germany, which is a large exporter of automobiles, sends a whopping $1.45 trillion of goods abroad every year despite only having 83 million people. That amounts to about $18,000 per person in exports.

The U.S. is the world’s second largest exporter in terms of absolute value. However, if you compare it on a per capita basis to a nation like Germany, it’s clear that the U.S. relies less on exports overall. The country exported $1.55 trillion in goods in 2017, about $4,800 per person. The U.S. has a well developed and strong domestic market which could survive with minimal imports if required.

History has shown that it’s important to have a healthy import/export trade balance and that bad economic and social issues can happen when that balance is interrupted. Trade balancing works best in an open and free trade environment (you have something I want, I have something you want so we reach a deal). Unfortunately, although the term free trade is thrown around by political pundits it doesn’t’ adequately define what is happening in our global market.

Simply looking at the export/import data one would think that the global trade market is vibrant and working well. It’s only when you study specifics that it becomes clear that many of the trading partners of the U.S. have installed various levels of trade barriers. However, due to the sheer size of the deficit between the U.S. and China, it is clear why the current U.S. administration has focused on resolving that issue first. In addition, China has made it clear that it intends to remove the U.S. as the leader in international trade.

China has long been a country that has put in place numerous trade barriers that prohibit other countries from having access to its huge domestic market. Nothing new here; it has been this way for many years. Even so, the U.S. continues to pursue vigorous and expanded bilateral and multilateral engagement to increase the benefits that U.S. businesses, workers, farmers, ranchers, service providers and consumers derive from trade and economic ties with China. To remove Chinese barriers blocking or impeding U.S. exports and investment, the U.S. uses outcome-oriented dialogue at all levels of engagement with China, while also taking concrete steps to enforce U.S. rights at the WTO as appropriate. At present, China’s trade policies and practices in several specific areas cause concern for the United States and U.S. stakeholders. The current U.S. administration is asking China to address these concerns and fix the problems and issues associated with each area.

Trade barriers erected by China that concern the U.S.

Trade Secrets

The protection and enforcement of trade secrets in China is a serious problem and has been the subject of high-profile attention and engagement in recent years. Thefts of trade secrets for the benefit of Chinese companies have occurred both within China and outside of China. Offenders in many cases continue to operate with impunity.

Bad Faith Trademark Registration

Of particular and growing concern is the continuing registration of trademarks in bad faith. Although China has taken some steps to address this problem, U.S. companies across industry sectors continue to face Chinese applicants registering their marks and “holding them for ransom” or seeking to establish a business building off of U.S. companies’ global reputations.

Pharmaceuticals

The United States continues to engage China on a range of patent and technology transfer concerns relating to pharmaceuticals. At the December 2013 JCCT meeting, China committed to permitting supplemental data supporting pharmaceutical patent applications. However, to date, it appears that China has only implemented that commitment in part with no further action taken.

Online Piracy

Online piracy continues on a large scale in China, affecting a wide range of industries, including those involved in distributing legitimate music, motion pictures, books and journals, software and video games. While increased enforcement activities have helped stem the flow of online sales of some pirated offerings, much more sustained action and attention are needed to make a more meaningful difference for content creators and rights holders, particularly small and medium-sized enterprises.

Counterfeit Goods

Although rights holders report increased enforcement efforts by Chinese government authorities, counterfeiting in China, affecting a wide range of goods, remains widespread. One area of particular U.S. concern involves medications. Despite sustained engagement by the U.S., China still needs to improve its regulation of the manufacture of active pharmaceutical ingredients to prevent their use in counterfeit and substandard medications.

Export Restraints

China continues to deploy a combination of export restraints, including export quotas, export licensing, minimum export prices, export duties and other restrictions, on a number of raw material inputs where it holds the leverage of being among the world’s leading producers. Through these export restraints, it appears that China is able to provide substantial economic advantages to a wide range of downstream producers in China at the expense of foreign downstream producers while creating pressure on foreign downstream producers to move their operations, technologies and jobs to China.

Subsidies

China has continued to provide substantial subsidies to its domestic industries, causing injury to U.S. industries. Some of these subsidies also appear to be prohibited under WTO rules. The U.S. has addressed these subsidies through countervailing duty proceedings conducted by the Commerce Department, invocation of a trade policy compliance mechanism established by China’s State Council and dispute settlement cases at the WTO. The United States and other WTO members also have continued to press China to notify all of its subsidies to the WTO in accordance with its WTO obligations. Since joining the WTO 15 years ago, China has not yet submitted to the WTO a complete notification of subsidies maintained by the central government, and it did not notify a single sub-central government subsidy until July 2016, when it provided information only on sub-central government subsidies that the United States had challenged as prohibited subsidies in a WTO case.

Excess Capacity

Chinese government actions and financial support in manufacturing industries like steel and aluminum have contributed to massive excess capacity in China, with the resulting over-production distorting global markets and hurting U.S. producers and workers in both the United States and third country markets such as Canada and Mexico, where U.S. exports compete with Chinese exports.

Standards

In the standards area, two principal types of problems harm U.S. companies. First, Chinese government officials in some instances have reportedly pressured foreign companies seeking to participate in the standards-setting process to license their technology or intellectual property on unfavorable terms. Second, China has continued to pursue unique national standards in a number of high technology areas where international standards already exist, such as 3G and 4G telecommunication standards, Wi-Fi standards and information security standards. The U.S. continues to press China to address these specific concerns, but to date, this bilateral engagement has yielded minimal progress.

Investment Restrictions

China seeks to protect many domestic industries through a restrictive investment regime, which adversely affects foreign investors in services sectors, agriculture, extractive industries and manufacturing sectors. In a recent survey, the OECD ranked investment restrictiveness in China at over five times the average of the 58 G20 and OECD members surveyed.

Trade Remedies

China’s regulatory authorities in some instances seem to be pursuing anti-dumping and countervailing duty investigations and imposing duties for the purpose of striking back at trading partners that have exercised their WTO rights against China, even when necessary legal and factual support for the duties is absent. The U.S. response has been the filing and prosecution of three WTO disputes. The decisions reached by the WTO in those three disputes confirm that China failed to abide by WTO disciplines when imposing the duties at issue.

The previously listed areas of trade concern are but a small sample of the trade barriers actually erected by China. A more detailed listing can be found in the 2017 National Trade Estimate Report on Foreign Trade Barriers. The Office of the United States Trade Representative (USTR) is responsible for the preparation of that report.

What appears to be obvious is that China is dependent on a strong, vibrant and expanding export segment and at the same time has made the decision to protect its own domestic market from incursion by outsiders. China wants to be a major, global player in various markets hence its decision to joining the WTO. However, it’s fairly clear that China has not yet decided to abide by the WTO requirements in that area.

Bottom line, it appears that the U.S. is within its right to ask China to remove its barriers, level their trade playing field and abide by WTO standards. It is also the U.S. right to impose tariffs on Chinese imports since China appears unwilling to change its protectionism and refusal to abide by WTO standards.

As the approaching trade war escalates between the U.S. and China, who is likely to win and who will lose?

Most economic pundits feel that China has more to lose economically in an all-out trade war with the U.S. The Chinese economy is heavily dependent on exports, and nearly 20 percent of its exports go to the U.S. It sold $506 billion in stuff and services to the U.S. last year. In contrast, the U.S. only sold $130 billion to the Chinese.

The opinion that China has more to lose might be true if all things were equal but of course, that’s not the way things happen. This isn’t just an economic fight, it’s also political, and there’s a strong case that the current U.S. administration would be less able to sustain a protracted conflict than the Chinese especially with the 2018 midterm elections coming up and the strong partisan divide that exists within the U.S.

On the other side, Chinese President Xi Jinping runs a communist country that has just granted him the ability to rule for life. He controls the media in his country (something President Trump cannot do) and is also sitting on top of about $3 trillion in surplus cash (something President Trump does not have).

Bottom line, all of this means Xi can react quickly to whatever measures the U.S. chose to take in this trade war. He can even aid Chinese companies that get hurt in the coming months and subsidize soybean prices, so Chinese consumers don’t face massive sticker shock at the store. The Chinese used similar tactics during the global financial crisis of 2008 and 2009, spending heavily from their surplus reserves to stimulate their economy and insulate their people from pain. The Chinese cash reserves are not as large now, but they still have more than the U.S. In addition, and perhaps the strongest hand for Xi to play is the fact that he (unlike President Trump) is not constrained by the rule of law or a representative democracy. Xi is not contending with a divided government.

It’s merely speculation at this point to project a probable outcome of this particular Trade War. In truth, both sides have a lot to lose and little to gain by a long-term, protracted trade war. Xi is counting on political pressure in the U.S. to end the tariffs that have been and will be imposed on China. Politically speaking, Xi cannot simply agree to erase all of China’s trade barriers, at least in the short term. Trump, on the other hand, cannot sustain a long-term dispute with China as it will start to impact on an area that he feels he has created (a vibrant and growing U.S. job market).

Unfortunately, Trump cannot just walk away from this conflict. He has invested a great deal of political capital into this matter. The only way this is going to end is with both sides looking at areas of compromise with an understanding that China has to enter the Global market with a level domestic playing field similar to its trading partners and adhere to WTO standards.

The good news is that it has been reported that Chinese Premier Li Keqiang has indicated that China is prepared to ease market access for U.S. companies and stop forcing foreign companies to transfer technology. This would be a small concession and one that will not erase the current U.S. trade deficit with China, but it might be the foot in the door that allows both sides to seek a more amicable settlement of their grievances. Neither side has anything to gain by allowing this situation to continue.