Vladislav Vorotnikov, Russia Correspondent01.07.19

In order to be eligible for state aid international carmakers in Russia could be obligated to use some share of domestic coatings on their finished vehicle assembly plants in the country.

The Industry and Trade Ministry want all OEMs in the automotive industry to use at least 30 percent of coatings of Russian origin in passenger car production, plus 70 percent in trucks and 80 percent in bus production already from 2020. Though the carmakers may have no choice, none of these targets seem achievable, as Russian production of automotive coatings remains in a dismal state.

The Russian government has been providing substantial state aid to the domestic automotive industry since 2008, according to the common formula “tax breaks in exchange for investments.” Under the agreement with the government, the international OEMs, including Volkswagen, Peugeot-Citroen, Ford, Renault-Nissan, Hyundai-Kia and some others, have been pumping money to increase localization – the share of components of Russian origin used in production.

In exchange, they were allowed to import automotive kits, components and spare parts with the import duty ranging between zero percent and five percent, instead of 20 percent to 25 percent under the common terms, hence saving billions of dollars.

As of early 2018, the share of localization in the industry ranged between 40 percent and 70 percent, and all OEMs were free to choose which parts they wished to source at the Russian market. The current agreements between carmakers and the government are almost expired, and the federal authorities are ready to replace them with the new ones, the so-called special investment contracts.

Now the government wants carmakers to localize certain components, including engines, transmissions, tires and some others. Coatings were also proposed to be in that list.

Backlash

The idea to include coatings into special investment contracts originally was put forward by the Industry and Trade Ministry during a meeting with the carmakers early November 2018.

This proposal prompted a strong resistance from carmakers, Russian newspaper Kommersant reported, citing its own sources. In this case, the problem is not about the rising costs, but about the absence of coatings of Russian origin with technical parameters sufficient to the automotive industry.

In the first half of 2018 Russian production met only 10 percent from the overall demand for the coatings in the automotive industry, Helios Group estimated. Giving this, the import-replacement targets proposed by the government are described by the company as “hardly achievable” in the foreseeable future. Basically, coatings for the automotive industry account for a significant part of industrial coatings sales on the domestic market, according to Helios Group.

Russian consulting agency Technology-Pro estimated sales at the domestic market of industrial coatings at 360,000 tons to 400,000 tons per year or $1 to $1.5 billion per year. The share of automotive coatings in this segment on the market is closer to 20 percent, Technology-Pro said.

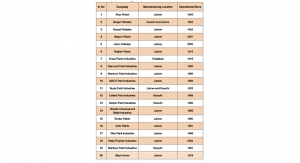

Russia imports coatings for the automotive industry primarily from Eastern Europe and South-East Asia, according to the Russian Federal Customs Service. The biggest importers are PPG, BASF and DuPont.

They jointly supply 90 percent of coatings used in the finished vehicle assembly plants in Russia, and 80 percent of coatings used by repair workshops.

BASF is also manufacturing automotive coatings at its plant in Moscow Oblast, but there is no information about the production volumes.

Question of origin

The idea proposed by the Russian Industry and Trade Ministry is also described as senseless, especially because the targeted localization must be rather deep, which means that in order to be recognized as coatings of Russian origin the products have to be manufactured out of Russian raw materials.

According to Kommersant, at the moment in Russia there are no standards and procedures to confirm that coatings actually could be recognized as a product of Russian origin, and moreover, most coatings in the country are being manufactured out of imported raw materials.

Andrew Kostin, senior analyst of the Russian consulting agency Rupac, commented that there are no entire classes of raw materials and pigments in Russia, in particular for the production of the aliphatic polyurethane paints. Kostin added that these coatings are widely used for painting of white cars as long as they are the only coatings that do not yellow under ultraviolet radiation.

Almost all OEMs have their own approved coatings suppliers on the global market, and it is not easy to change the supply schemes right away, Kostin said. If Russian coatings producers would be really competitive in terms of price and quality, as compared to the importers, they would already establish supplies to the assembly plants in the country, Kostin added.

The Russian government earlier stipulated that the share of raw materials of Russian origin used in the production of coatings should not be lower than 30 percent already in 2018. The target will be raised to 40 percent in 2019 and to 50 percent in 2020. To achieve that goal the government has been subsidizing various projects in the area of raw materials production.

So far, however, there are no official estimations on the actual share of domestic raw materials in the Russian coatings industry, and specifically in the segment of automotive coatings.

Projected growth

Automotive coatings are believed to be the most promising segment of the Russian coatings market. The production in this niche is tightly linked to the overall situation in the automotive industry, where strong growth in production is expected.

In 2017, Russia produced 1.8 million finished vehicles, 20 percent up as compared to the previous year, the Russian State Statistical Service estimated. The average capacity utilization factor of the Russian assembly plants is still below 50 percent, and this means there are huge growth prospects. In addition, in the coming few years new finished vehicle plants should be built in Russia by Mercedes and BMW, according to the Industry and Trade Ministry.

In 2013, the federal government forecasted that the actual sales of finished vehicles in the country could reach 3.6 million units in the early 2020s. This would make Russia the biggest automotive market in Europe.

It seems that those plans are not destined to come true, as it was originally projected, since domestic sales slumped in Russia when the first international sanctions were introduced against the country in 2014, driving down the production as well.

Nevertheless, all forecasts say that the finished vehicle production in Russia will be growing in the coming years, so the local assembly plants could gradually increase their occupancy in the next decade. The Industry and Trade Ministry expects that this factor would push the demand for all components and parts in the industry respectively.

New trends

Over the past several years, sales of automotive coatings in Russia have been seen shrinking, according to the Russian informational agency Avtoindustriya. The production was mainly following the ups and downs in the automotive industry.

Although, the negative economic situation in the country over these years has not changed the preferences of the assembly plants, in the repair segment there was a big shift towards cheap coatings with poor quality.

Under current market conditions it is impossible to establish a full-cycle production of coatings in Russia, Avtoindustriya said. The local companies have no ability to attract investments necessary to establish new production capacities.

In this situation, some producers shift to produce automotive coatings in the economy segment. Alexey Kozyrev, senior manager of Spectral, commented that the market is still rather depressed. Kozyrev explained that the main problem is that the market is oversaturated with cheap, unknown coatings with unclear quality.

The state insurance system in the automotive industry pushes the car owners to spare some money on repair, in the first place on coatings, Kozyrev said. As a result, in many cases the actual repair of a car after the accident is taking place not in the respectable workshops, but in “garages,” Kozyrev added.

Basically, it is believed that these garages are the main customers of the poor quality coatings suppliers, Kozyrev said. As the rule, the garage workshops use cheap coatings, as well as “garage coatings.”

The “garage coatings” are an illegal segment of the coatings industry that still exists in most countries of the post-Soviet space. It is referred to in this way because most manufacturers here are small-scale private businesspeople who don’t have production facilities and are simply mixing up some components to produce the cheapest possible coatings in their own garages.

There is no official information about the share of these “garage coatings” on the market, but in general; it is believed that it significantly increased since 2014.

The Industry and Trade Ministry want all OEMs in the automotive industry to use at least 30 percent of coatings of Russian origin in passenger car production, plus 70 percent in trucks and 80 percent in bus production already from 2020. Though the carmakers may have no choice, none of these targets seem achievable, as Russian production of automotive coatings remains in a dismal state.

The Russian government has been providing substantial state aid to the domestic automotive industry since 2008, according to the common formula “tax breaks in exchange for investments.” Under the agreement with the government, the international OEMs, including Volkswagen, Peugeot-Citroen, Ford, Renault-Nissan, Hyundai-Kia and some others, have been pumping money to increase localization – the share of components of Russian origin used in production.

In exchange, they were allowed to import automotive kits, components and spare parts with the import duty ranging between zero percent and five percent, instead of 20 percent to 25 percent under the common terms, hence saving billions of dollars.

As of early 2018, the share of localization in the industry ranged between 40 percent and 70 percent, and all OEMs were free to choose which parts they wished to source at the Russian market. The current agreements between carmakers and the government are almost expired, and the federal authorities are ready to replace them with the new ones, the so-called special investment contracts.

Now the government wants carmakers to localize certain components, including engines, transmissions, tires and some others. Coatings were also proposed to be in that list.

Backlash

The idea to include coatings into special investment contracts originally was put forward by the Industry and Trade Ministry during a meeting with the carmakers early November 2018.

This proposal prompted a strong resistance from carmakers, Russian newspaper Kommersant reported, citing its own sources. In this case, the problem is not about the rising costs, but about the absence of coatings of Russian origin with technical parameters sufficient to the automotive industry.

In the first half of 2018 Russian production met only 10 percent from the overall demand for the coatings in the automotive industry, Helios Group estimated. Giving this, the import-replacement targets proposed by the government are described by the company as “hardly achievable” in the foreseeable future. Basically, coatings for the automotive industry account for a significant part of industrial coatings sales on the domestic market, according to Helios Group.

Russian consulting agency Technology-Pro estimated sales at the domestic market of industrial coatings at 360,000 tons to 400,000 tons per year or $1 to $1.5 billion per year. The share of automotive coatings in this segment on the market is closer to 20 percent, Technology-Pro said.

Russia imports coatings for the automotive industry primarily from Eastern Europe and South-East Asia, according to the Russian Federal Customs Service. The biggest importers are PPG, BASF and DuPont.

They jointly supply 90 percent of coatings used in the finished vehicle assembly plants in Russia, and 80 percent of coatings used by repair workshops.

BASF is also manufacturing automotive coatings at its plant in Moscow Oblast, but there is no information about the production volumes.

Question of origin

The idea proposed by the Russian Industry and Trade Ministry is also described as senseless, especially because the targeted localization must be rather deep, which means that in order to be recognized as coatings of Russian origin the products have to be manufactured out of Russian raw materials.

According to Kommersant, at the moment in Russia there are no standards and procedures to confirm that coatings actually could be recognized as a product of Russian origin, and moreover, most coatings in the country are being manufactured out of imported raw materials.

Andrew Kostin, senior analyst of the Russian consulting agency Rupac, commented that there are no entire classes of raw materials and pigments in Russia, in particular for the production of the aliphatic polyurethane paints. Kostin added that these coatings are widely used for painting of white cars as long as they are the only coatings that do not yellow under ultraviolet radiation.

Almost all OEMs have their own approved coatings suppliers on the global market, and it is not easy to change the supply schemes right away, Kostin said. If Russian coatings producers would be really competitive in terms of price and quality, as compared to the importers, they would already establish supplies to the assembly plants in the country, Kostin added.

The Russian government earlier stipulated that the share of raw materials of Russian origin used in the production of coatings should not be lower than 30 percent already in 2018. The target will be raised to 40 percent in 2019 and to 50 percent in 2020. To achieve that goal the government has been subsidizing various projects in the area of raw materials production.

So far, however, there are no official estimations on the actual share of domestic raw materials in the Russian coatings industry, and specifically in the segment of automotive coatings.

Projected growth

Automotive coatings are believed to be the most promising segment of the Russian coatings market. The production in this niche is tightly linked to the overall situation in the automotive industry, where strong growth in production is expected.

In 2017, Russia produced 1.8 million finished vehicles, 20 percent up as compared to the previous year, the Russian State Statistical Service estimated. The average capacity utilization factor of the Russian assembly plants is still below 50 percent, and this means there are huge growth prospects. In addition, in the coming few years new finished vehicle plants should be built in Russia by Mercedes and BMW, according to the Industry and Trade Ministry.

In 2013, the federal government forecasted that the actual sales of finished vehicles in the country could reach 3.6 million units in the early 2020s. This would make Russia the biggest automotive market in Europe.

It seems that those plans are not destined to come true, as it was originally projected, since domestic sales slumped in Russia when the first international sanctions were introduced against the country in 2014, driving down the production as well.

Nevertheless, all forecasts say that the finished vehicle production in Russia will be growing in the coming years, so the local assembly plants could gradually increase their occupancy in the next decade. The Industry and Trade Ministry expects that this factor would push the demand for all components and parts in the industry respectively.

New trends

Over the past several years, sales of automotive coatings in Russia have been seen shrinking, according to the Russian informational agency Avtoindustriya. The production was mainly following the ups and downs in the automotive industry.

Although, the negative economic situation in the country over these years has not changed the preferences of the assembly plants, in the repair segment there was a big shift towards cheap coatings with poor quality.

Under current market conditions it is impossible to establish a full-cycle production of coatings in Russia, Avtoindustriya said. The local companies have no ability to attract investments necessary to establish new production capacities.

In this situation, some producers shift to produce automotive coatings in the economy segment. Alexey Kozyrev, senior manager of Spectral, commented that the market is still rather depressed. Kozyrev explained that the main problem is that the market is oversaturated with cheap, unknown coatings with unclear quality.

The state insurance system in the automotive industry pushes the car owners to spare some money on repair, in the first place on coatings, Kozyrev said. As a result, in many cases the actual repair of a car after the accident is taking place not in the respectable workshops, but in “garages,” Kozyrev added.

Basically, it is believed that these garages are the main customers of the poor quality coatings suppliers, Kozyrev said. As the rule, the garage workshops use cheap coatings, as well as “garage coatings.”

The “garage coatings” are an illegal segment of the coatings industry that still exists in most countries of the post-Soviet space. It is referred to in this way because most manufacturers here are small-scale private businesspeople who don’t have production facilities and are simply mixing up some components to produce the cheapest possible coatings in their own garages.

There is no official information about the share of these “garage coatings” on the market, but in general; it is believed that it significantly increased since 2014.