Arnold Wang, China Correspondent02.11.19

As predicted, many big-time international players – Dow Chemical, BASF, Eastman Chemical and others – were absent from CHINACOAT 2018.

But this most important coatings show in the Asia Pacific region was not short of new faces.

Visitors witnessed a markedly increased presence of domestic companies, although the growth of the whole coatings industry in China is slowing down.

International partnerships, new applications and cool technologies led the trend of product offering from coatings raw material companies in this show, along with oil to water trend which is still popular in China.

Business executives frequently used the word “regulations” and term “trade war” during interviews with Coatings World.

Uncertainty is a common sense in the manufacturing industry, to which coatings is no differeny.

Puhler has four plants in China, two of which are in Guangzhou. The company is focusing on developing waterborne industrial coatings and the automotive coatings market, both of which are enjoying fast growth because of environmental regulation changes in China.

Another important market for Puhler is the billboard market. Thirty percent of Puhler’s sales are generated by its spray ink business unit.

Puhler doesn’t fight market competition alone. It forged a close partnership with Italian company Uptech srl in the development of Morph DHM dry grinding system. Additionally, Puhler partnered with German Leimix Gmbh on developing and producing high-speed dispersion machines.

Puhler recently launched its iMo Smart mill system into the market. With the same driving platform, iMo Smart can be easily designed as four different mill machines, which each fitting specific customer demand.

Innovation and R&D are driving business growth of Puhler worldwide, and with the support and help of its partners, Puhler continuously launches new products to meet new market trends, the company reports.

Another company standing out at the show was Sunin. Hsu F Sheng, managing director, Sunin Machine Co., Ltd, told Coatings World in the company’s booth that China’s coatings industry faces pressures from environmental protection, trade war, labor issues, and more, which contributed to a common perception that the coatings industry has high risks and new investors are unwilling to take on new projects.

Instead of waiting for the situation to get better, Sunin is actively developing a new market segment based on customer demand.

With 40 years of experience in the coatings industry, Sunin focuses on providing the best in class after sales service to their customers. The company recently launched sample painting machines designed specifically for lab use. This series has several models that can meet different customer demands.

Another new product launched by Sunin includes the AFD-5GAL packing machine, which combines several functions into one machine, saving space and requiring less manpower.

Pigment companies were widely seen in Guangzhou. Indian and Chinese pigment companies are catching lots of attention and as a result, European companies are feeling a lot of competition. With their booth stationed in the center of Hall 1, DayGlo, Swada and Radiant had a major presence at the show. Radiant is a leader in the development and production of fluorescent pigments.

This Belgian company has unique products for both the coatings and ink markets.

Jan Van Speybroeck, sales director, Radiant, said that the company’s fluorescent pigments can be used in food contact products – something that differentiates Radiant from its competitors. At CHINACOAT 2018, Radiant showcased an array products that use its fluorescent pigments, including one adidas shoe that contains three pigment applications.

On the show’s opening day – Dec. 4 in Guangzhou – Covestro demonstrated its numerous sustainability-inspired, eco-friendly innovative coating and adhesive solutions for a wide range of industries including automotive, construction, energy, furniture, sports and leisure.

“Sustainability is not only a mega trend for our era but also a key driver for Covestro to keep pushing the boundaries of innovation,” said Zhong Xiaobin, senior vice president of Coatings, Adhesives and Specialties business unit at Covestro Asia Pacific. “In addition to improving the usability of adhesive technologies and low VOC coating technologies including waterborne technology through innovation, we are committed to working closely with partners across the industry value chain to promote sustainable development.”

Covestro organized a wind power coatings press conference in the morning with its downstream partners including PPG, Goldwind and China National Building Materials Co., Ltd.

Ye Qingfeng, technical director, Asia Pacific Region, PPG, said PPG has been testing new coatings systems for wind turbine blades with its partners. As the speed of the tip of the blade is fast and the offshore environment is complicated.

Dr. Jorg Horakh, marketing and product manager, Heubach, told us that the compan’s anti-corrosive coatings business is booming in China and Heubach is currently focusing on growing its business presence in this market segment.

In February 2018, Heubach began operating a new plant for anti-corrosive pigments in Pennsylvania. This new plant increases its global production capacity by about 4,000 tons per year.

In 2018 SAPICI launched several new materials for the waterborne coatings market in China, including Bluecryl, Hydrorene and Bluepur, respectively acrylic dispersions, polyisocyanates for waterborne systems, and PU dispersions. SAPICI entered the Chinese market 12 years ago and it now has a production plant in Zhuhai which has a capacity of 15K tons per year.

The company is increasing its market presence in China by following the government’s Go-to-West policy, according to Marco Meloni, global business manager, SAPICI. The company is also planning to increase its sales in north China, such as the area surrounding Beijing.

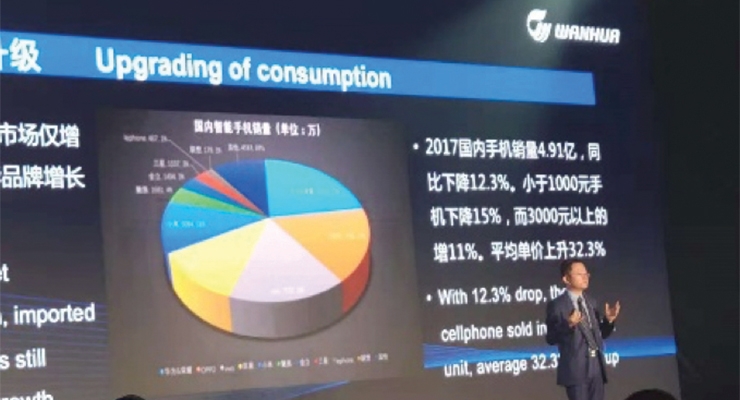

Wanhua Chemical has been partnering with SAPICI in developing the markets. With a great year for Wanhua’s MDI business, Wanhua had the largest island in Guangzhou and held a splendid welcome dinner for its customers right before the show. As Wanhua disclosed, the labor cost in China is increasing quickly, and right now it is higher than those in Southeast Asia and Latin America, leading to value transfer and repositioning on industry chain. And upgrading of consumption offers new opportunities. For example, although the car market is slowing down, luxurious brands enjoy fast growth.

Pilot highlighted diphenyl oxide disulfonates, especially Califax16L-45 and Califax 6LA-70, in their booth.

Jan Zeinstra, GM, EMEA and Asia, Pilot Chemical Company, said that Pilot is offering unique surfactant chemicals in China to target coatings emulsion companies.

Several architecture emulsion companies have been partnering with Pilot already and as China’s demand for high-quality coatings is growing Pilot is trying to expand its market share through their distribution system in China.

Orion specializes in developing and manufacturing carbon black.

In Guangzhou, Orion introduced its new Colour Black OE 430 W.

David Deters, senior vice president and chief technology officer, said that compared with traditional carbon black, OE 430W is very easy to be dispersed in the water and very suitable for automotive OEM coatings as well as other applications with a need for high-quality black color. With Colour Black OE 430, one does not need to add dispersant agents, saving cost, per Deters.

Marcus Mahn, global marketing director for Coatings, said that with 14 plants worldwide, Orion can easily move capacity and control inventories so as to address the impact from a trade war.

The company is also considering market expansion in Asia, especially in China.

Although the growth of China’s coatings market is slowing down, both domestic and international companies are not losing faith in the local market.

Waterborne coatings are growing at two digits still, and UV and powder coatings are both growing fast.

China is upgrading its coatings an ink industries, which offer new opportunities to every company who can offer differentiated products and technologies at competitive prices.

But this most important coatings show in the Asia Pacific region was not short of new faces.

Visitors witnessed a markedly increased presence of domestic companies, although the growth of the whole coatings industry in China is slowing down.

International partnerships, new applications and cool technologies led the trend of product offering from coatings raw material companies in this show, along with oil to water trend which is still popular in China.

Business executives frequently used the word “regulations” and term “trade war” during interviews with Coatings World.

Uncertainty is a common sense in the manufacturing industry, to which coatings is no differeny.

Puhler has four plants in China, two of which are in Guangzhou. The company is focusing on developing waterborne industrial coatings and the automotive coatings market, both of which are enjoying fast growth because of environmental regulation changes in China.

Another important market for Puhler is the billboard market. Thirty percent of Puhler’s sales are generated by its spray ink business unit.

Puhler doesn’t fight market competition alone. It forged a close partnership with Italian company Uptech srl in the development of Morph DHM dry grinding system. Additionally, Puhler partnered with German Leimix Gmbh on developing and producing high-speed dispersion machines.

Puhler recently launched its iMo Smart mill system into the market. With the same driving platform, iMo Smart can be easily designed as four different mill machines, which each fitting specific customer demand.

Innovation and R&D are driving business growth of Puhler worldwide, and with the support and help of its partners, Puhler continuously launches new products to meet new market trends, the company reports.

Another company standing out at the show was Sunin. Hsu F Sheng, managing director, Sunin Machine Co., Ltd, told Coatings World in the company’s booth that China’s coatings industry faces pressures from environmental protection, trade war, labor issues, and more, which contributed to a common perception that the coatings industry has high risks and new investors are unwilling to take on new projects.

Instead of waiting for the situation to get better, Sunin is actively developing a new market segment based on customer demand.

With 40 years of experience in the coatings industry, Sunin focuses on providing the best in class after sales service to their customers. The company recently launched sample painting machines designed specifically for lab use. This series has several models that can meet different customer demands.

Another new product launched by Sunin includes the AFD-5GAL packing machine, which combines several functions into one machine, saving space and requiring less manpower.

Pigment companies were widely seen in Guangzhou. Indian and Chinese pigment companies are catching lots of attention and as a result, European companies are feeling a lot of competition. With their booth stationed in the center of Hall 1, DayGlo, Swada and Radiant had a major presence at the show. Radiant is a leader in the development and production of fluorescent pigments.

This Belgian company has unique products for both the coatings and ink markets.

Jan Van Speybroeck, sales director, Radiant, said that the company’s fluorescent pigments can be used in food contact products – something that differentiates Radiant from its competitors. At CHINACOAT 2018, Radiant showcased an array products that use its fluorescent pigments, including one adidas shoe that contains three pigment applications.

On the show’s opening day – Dec. 4 in Guangzhou – Covestro demonstrated its numerous sustainability-inspired, eco-friendly innovative coating and adhesive solutions for a wide range of industries including automotive, construction, energy, furniture, sports and leisure.

“Sustainability is not only a mega trend for our era but also a key driver for Covestro to keep pushing the boundaries of innovation,” said Zhong Xiaobin, senior vice president of Coatings, Adhesives and Specialties business unit at Covestro Asia Pacific. “In addition to improving the usability of adhesive technologies and low VOC coating technologies including waterborne technology through innovation, we are committed to working closely with partners across the industry value chain to promote sustainable development.”

Covestro organized a wind power coatings press conference in the morning with its downstream partners including PPG, Goldwind and China National Building Materials Co., Ltd.

Ye Qingfeng, technical director, Asia Pacific Region, PPG, said PPG has been testing new coatings systems for wind turbine blades with its partners. As the speed of the tip of the blade is fast and the offshore environment is complicated.

Dr. Jorg Horakh, marketing and product manager, Heubach, told us that the compan’s anti-corrosive coatings business is booming in China and Heubach is currently focusing on growing its business presence in this market segment.

In February 2018, Heubach began operating a new plant for anti-corrosive pigments in Pennsylvania. This new plant increases its global production capacity by about 4,000 tons per year.

In 2018 SAPICI launched several new materials for the waterborne coatings market in China, including Bluecryl, Hydrorene and Bluepur, respectively acrylic dispersions, polyisocyanates for waterborne systems, and PU dispersions. SAPICI entered the Chinese market 12 years ago and it now has a production plant in Zhuhai which has a capacity of 15K tons per year.

The company is increasing its market presence in China by following the government’s Go-to-West policy, according to Marco Meloni, global business manager, SAPICI. The company is also planning to increase its sales in north China, such as the area surrounding Beijing.

Wanhua Chemical has been partnering with SAPICI in developing the markets. With a great year for Wanhua’s MDI business, Wanhua had the largest island in Guangzhou and held a splendid welcome dinner for its customers right before the show. As Wanhua disclosed, the labor cost in China is increasing quickly, and right now it is higher than those in Southeast Asia and Latin America, leading to value transfer and repositioning on industry chain. And upgrading of consumption offers new opportunities. For example, although the car market is slowing down, luxurious brands enjoy fast growth.

Pilot highlighted diphenyl oxide disulfonates, especially Califax16L-45 and Califax 6LA-70, in their booth.

Jan Zeinstra, GM, EMEA and Asia, Pilot Chemical Company, said that Pilot is offering unique surfactant chemicals in China to target coatings emulsion companies.

Several architecture emulsion companies have been partnering with Pilot already and as China’s demand for high-quality coatings is growing Pilot is trying to expand its market share through their distribution system in China.

Orion specializes in developing and manufacturing carbon black.

In Guangzhou, Orion introduced its new Colour Black OE 430 W.

David Deters, senior vice president and chief technology officer, said that compared with traditional carbon black, OE 430W is very easy to be dispersed in the water and very suitable for automotive OEM coatings as well as other applications with a need for high-quality black color. With Colour Black OE 430, one does not need to add dispersant agents, saving cost, per Deters.

Marcus Mahn, global marketing director for Coatings, said that with 14 plants worldwide, Orion can easily move capacity and control inventories so as to address the impact from a trade war.

The company is also considering market expansion in Asia, especially in China.

Although the growth of China’s coatings market is slowing down, both domestic and international companies are not losing faith in the local market.

Waterborne coatings are growing at two digits still, and UV and powder coatings are both growing fast.

China is upgrading its coatings an ink industries, which offer new opportunities to every company who can offer differentiated products and technologies at competitive prices.