Terry Knowles, European Correspondent03.22.22

AkzoNobel is the largest paint manufacturer in Europe, where it is challenged by the second-largest paint manufacturer of the USA – and indeed the world: PPG Industries. The two companies compete with each other in most of the main segments, subject to a handful of regional and national variations.

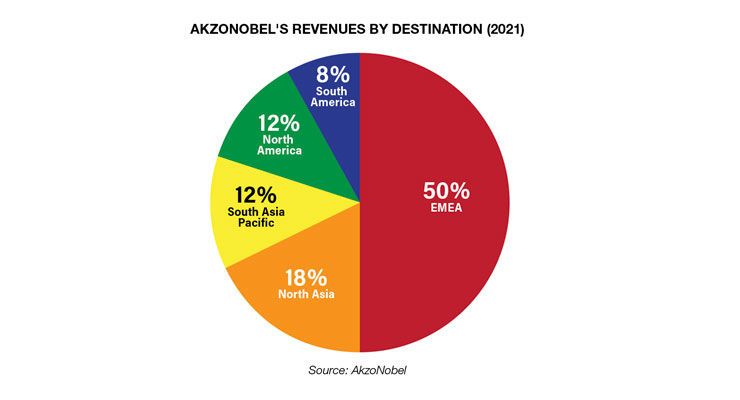

Exactly one-half of AkzoNobel’s turnover is now derived in the EMEA region. After that, Asia accounts for a further 30% and the Americas 20% of the total.

Costs were a crucial factor for many industries in 2021 as a result of diverted raw materials, strange demand patterns and exorbitant shipping costs. At AkzoNobel, raw material and other variable costs increased by €769 million, but in spite of this, operating income rose by 16% across the whole year, from €963 million to €1.118 billion.

Sales through AkzoNobel’s decorative segment participation rose by 6% in volume terms and pricing was raised by 6%, contributing to a 12% growth in decorative coatings revenues. These totalled €3.979 billion in 2021, but the EMEA region emerged with the lowest growth out of the company’s three main regions: South America led the growth at 20%, followed by Asia with 17% growth and the EMEA region on 8%. Nevertheless, the pecking order of the three regions is reversed when revenues are considered, with the EMEA region yielding more than twice the sales of Asia, and more than five times those of South America. Acquisitions, which have been added at a much slower pace in recent times at AkzoNobel, added 2% to decorative sales growth in 2021.

By the end of the year, the company saw a return to some normality in the decorative sector, with sales in the fourth quarter being in line with the previous corresponding period, with lower volumes reflecting a traditionally quieter period for DIY-ers in the sizeable EMEA region. In South America and Asia, revenues in the fourth quarter were up by 8% and 14% respectively.

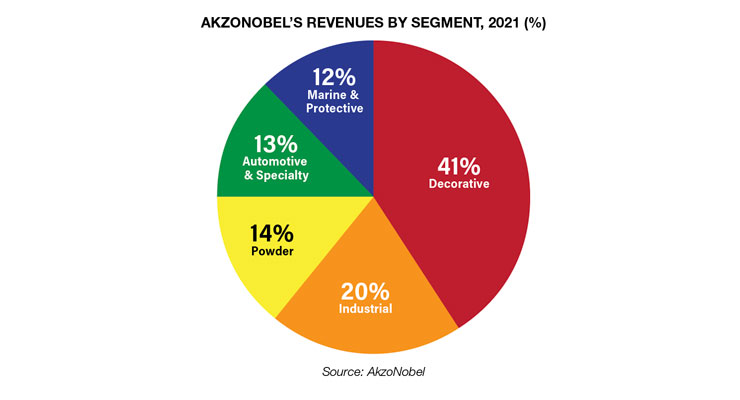

In terms of reporting, AkzoNobel’s Performance Coatings division diffracts into segments rather than regions but the overarching picture is one of good growth in all segments. The two best performers in 2021 were powder coatings (up 17%) and industrial coatings (up 16%) followed by the marine/protective and automotive/specialty combinations, which each turned in 9% growth.

Overall, the performance portfolio (58% of all sales, as seen in the second chart) recorded growth of 13% and 2021 sales topped €5 billion, €5.6 billion to be exact. After a challenging time for most marine and protective coatings suppliers over the last couple of years, the marine and protective sector started into a quarter-on-quarter recovery during in 2021.

At PPG, sales in the company’s Performance Coatings segment rose from $8.48 billion to $10.33 billion throughout 2021 (up by 21%), while income increased from $1.35 billion to $1.49 billion (an increase of 10%). In its Industrial Coatings segment, sales rose from $5.33 billion to $6.46 billion throughout 2021 (another increase of 21%), while income decreased from $750 million to $680 million (down by 9%).

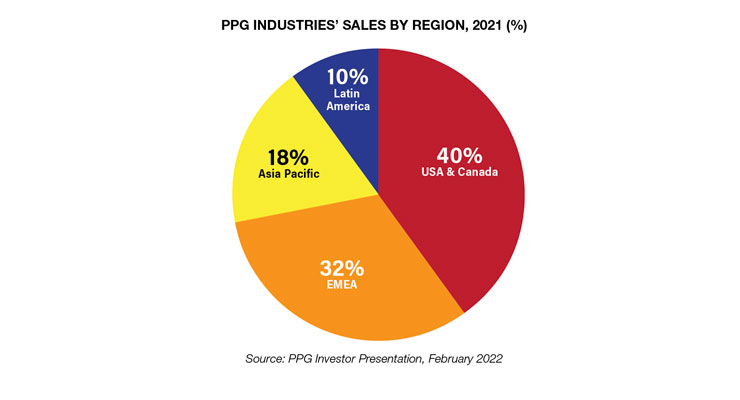

In announcing its annual results, PPG neglected to make much comment on its general performance in the EMEA region (which it usually does include), but highlighted instead that its recent purchases of Wörwag, Cetelon and Tikkurila represented a 6% increase in acquisition-based revenues in the last quarter of the year.

The EMEA region now accounts for 32% of all of PPG’s sales (as seen in the chart), with the Tikkurila takeover adding about $700 million to its annual income. In 2021, PPG had its best year for acquisition-related growth since 2015; since that year it has completed more than 30 acquisitions.

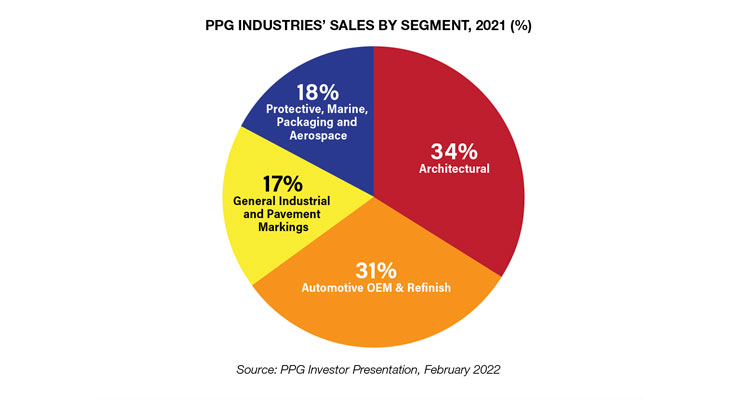

By segment, the latest figures show that architectural coatings now account for 34% of PPG’s annual sales, this figure being shaped most recently by its acquisition of Tikkurila (mostly but not entirely decorative sales) and that of Ennis Flint (all industrial). A better appreciation is gained from the pie chart:

Some useful insights into the breadth of drivers for the coatings markets were revealed in an investor presentation given by PPG in February 2022. These highlighted the attractive growth rates for 2021 to 2024 that are expected by the company, and an array of differing growth factors. These emerged as follows:

• Architectural growing at 3%, driven by rising construction expenditure around the world.

• General industrial coatings rising at 4% and tracking rising world manufacturing output.

• Pavement marking also growing at 4% and mirroring general GDP growth rates.

• Marine and protective coatings demand increasing by 5% as a result of marine newbuilds increasing.

• Packaging coatings growing at 5% through increases in beverage can production.

• Aerospace coatings demand rising by 23% after a disastrous time in the last couple of years, this being spurred on by the building of new commercial aircraft.

• Automotive OEM growing at 8% driven by light vehicle production.

• Automotive refinish increasing at 9% being driven by the global market for automotive aftermarket components.

Exactly one-half of AkzoNobel’s turnover is now derived in the EMEA region. After that, Asia accounts for a further 30% and the Americas 20% of the total.

Costs were a crucial factor for many industries in 2021 as a result of diverted raw materials, strange demand patterns and exorbitant shipping costs. At AkzoNobel, raw material and other variable costs increased by €769 million, but in spite of this, operating income rose by 16% across the whole year, from €963 million to €1.118 billion.

Sales through AkzoNobel’s decorative segment participation rose by 6% in volume terms and pricing was raised by 6%, contributing to a 12% growth in decorative coatings revenues. These totalled €3.979 billion in 2021, but the EMEA region emerged with the lowest growth out of the company’s three main regions: South America led the growth at 20%, followed by Asia with 17% growth and the EMEA region on 8%. Nevertheless, the pecking order of the three regions is reversed when revenues are considered, with the EMEA region yielding more than twice the sales of Asia, and more than five times those of South America. Acquisitions, which have been added at a much slower pace in recent times at AkzoNobel, added 2% to decorative sales growth in 2021.

By the end of the year, the company saw a return to some normality in the decorative sector, with sales in the fourth quarter being in line with the previous corresponding period, with lower volumes reflecting a traditionally quieter period for DIY-ers in the sizeable EMEA region. In South America and Asia, revenues in the fourth quarter were up by 8% and 14% respectively.

In terms of reporting, AkzoNobel’s Performance Coatings division diffracts into segments rather than regions but the overarching picture is one of good growth in all segments. The two best performers in 2021 were powder coatings (up 17%) and industrial coatings (up 16%) followed by the marine/protective and automotive/specialty combinations, which each turned in 9% growth.

Overall, the performance portfolio (58% of all sales, as seen in the second chart) recorded growth of 13% and 2021 sales topped €5 billion, €5.6 billion to be exact. After a challenging time for most marine and protective coatings suppliers over the last couple of years, the marine and protective sector started into a quarter-on-quarter recovery during in 2021.

At PPG, sales in the company’s Performance Coatings segment rose from $8.48 billion to $10.33 billion throughout 2021 (up by 21%), while income increased from $1.35 billion to $1.49 billion (an increase of 10%). In its Industrial Coatings segment, sales rose from $5.33 billion to $6.46 billion throughout 2021 (another increase of 21%), while income decreased from $750 million to $680 million (down by 9%).

In announcing its annual results, PPG neglected to make much comment on its general performance in the EMEA region (which it usually does include), but highlighted instead that its recent purchases of Wörwag, Cetelon and Tikkurila represented a 6% increase in acquisition-based revenues in the last quarter of the year.

The EMEA region now accounts for 32% of all of PPG’s sales (as seen in the chart), with the Tikkurila takeover adding about $700 million to its annual income. In 2021, PPG had its best year for acquisition-related growth since 2015; since that year it has completed more than 30 acquisitions.

By segment, the latest figures show that architectural coatings now account for 34% of PPG’s annual sales, this figure being shaped most recently by its acquisition of Tikkurila (mostly but not entirely decorative sales) and that of Ennis Flint (all industrial). A better appreciation is gained from the pie chart:

Some useful insights into the breadth of drivers for the coatings markets were revealed in an investor presentation given by PPG in February 2022. These highlighted the attractive growth rates for 2021 to 2024 that are expected by the company, and an array of differing growth factors. These emerged as follows:

• Architectural growing at 3%, driven by rising construction expenditure around the world.

• General industrial coatings rising at 4% and tracking rising world manufacturing output.

• Pavement marking also growing at 4% and mirroring general GDP growth rates.

• Marine and protective coatings demand increasing by 5% as a result of marine newbuilds increasing.

• Packaging coatings growing at 5% through increases in beverage can production.

• Aerospace coatings demand rising by 23% after a disastrous time in the last couple of years, this being spurred on by the building of new commercial aircraft.

• Automotive OEM growing at 8% driven by light vehicle production.

• Automotive refinish increasing at 9% being driven by the global market for automotive aftermarket components.