Terry Knowles, European Correspondent09.06.22

Europe is arguably the most troubled regional market at the moment given the unfortunate collection of battles the industry is facing on different fronts (raw material prices and supplies, haulage, Brexit, fuel prices and the close proximity to the Ukraine/Russia conflict). In addition, the sizeable DIY decorative markets that have experienced the “artificial” boost that lockdowns created in 2020-21 have short-circuited the natural cycle of domestic interior renewals.

In this article, the contrasting performance of three major participants in Europe that have each had different experiences in 2022 is highlighted.

Significant pricing initiatives and ongoing strong demand from the professional segment were tempered by lower sales volumes in the European DIY sector, although some recovery in the European DIY sector seemed to have taken hold in the later weeks of the second half. Sales for Decorative Paints in the EMEA region actually fell by 6% in the second quarter from €720 million to €673 million. This was the only regional fall in sales.

The company’s new Decorative Paints Latin America arm (previously Decorative Paints South America but now with Grupo Orbis added in, and with the benefit of store expansions and new product introductions), saw a 78% jump in sales in constant currencies (acquisition effect) while Decorative Paints’ sales in Asia rose by a steady 7%, also on a constant currency basis. On a half-yearly basis and following the same respective pattern (q.v.) the decrease was 3% (EMEA) followed by increases of 49% (Latin America) and 11% (Asia). From 2023, once it has been completed, AkzoNobel’s acquisition of Kansai Paint’s African paint and coatings operations will transfer another €280 million to EMEA sales.

Concerning Russia and Ukraine, AkzoNobel stated that the business in these two countries represented about 2% of its revenues, with the majority of that originating in Russia. In the first quarter, AkzoNobel’s activities in Ukraine had come to a halt, while in Russia, the company’s Aerospace Coatings activities and new investments and marketing activities were suspended.

In the second quarter, following EU sanctions, the majority of AkzoNobel’s coatings business in Russia was suspended with the residual Russian business being locally operated.

By contrast, PPG’s Industrial Coating arm flourished on the back of its recent German and Finnish acquisitions providing bolt-on growth, in spite of Chinese lockdowns and a softening of European demand from the industrial sector. Sales for the six months to June 30 in Performance Coatings rose from $5.07 billion to $5.50 billion and in Industrial Coatings from $3.17 billion to $3.50 billion. Net profits, however, fared less well in the current climate, and decreasing from $840 million to $765 million in Performance Coatings and from $435 million to $296 million in Industrial Coatings.

Michael McGarry, PPG’s chairman and CEO, shared an interesting outlook on the global markets for the near future, saying, “Looking ahead, in most major regions and end-use markets, underlying demand for PPG products is expected to remain solid. We anticipate strong sequential growth in Asia due to higher industrial production compared to the second quarter. Positive growth trends are generally expected to continue in North America. In Europe, we expect economic conditions to remain soft, including normal seasonal demand trends. We have already begun to implement cost mitigation actions in Europe and have contingency plans ready to deploy in the event of a broader economic slowdown. In the second half of the year, we expect several of our larger businesses, including automotive original equipment manufacturer (OEM) and aerospace coatings, to deliver strong growth due to large current supply deficits and low inventories in these end-use markets. Importantly, we expect that our sequential quarterly momentum on operating margin improvement will continue in the third quarter as we work back to our historical margins, and our adjusted earnings will increase on a year-over-year basis.”

This is primarily due to the acquisition on Jan. 20, 2022 of European paint manufacturer Cromology Holding SAS and the acquisition on May 31, 2022 of European paint manufacturer DB JUB delniška družba pooblaščenka d.d. (JUB) by NPHD, as subsidiaries. These European subsidiaries have been integrated into the company under the DuluxGroup operations, reflecting some of the close market approximations between Australia and New Zealand and the West.

Direct comparison of the DuluxGroup results between the first half of 2021 and the first half of 2022, counting also the incorporation of the new European operations, showed that DuluxGroup turnover more than doubled across the comparable periods. Sales of decorative paints in the first half of 2021 amounted to more than ¥43 billion, but in the first half of 2022 they totalled nearly ¥96 billion. In industrial coatings the change is less marked.

Although acquisitions such as this – in combination with higher selling prices – yielded an improvement in sales figures, consolidated operating profits at Nippon Paint Holdings decreased by 9.7% to ¥44,202 million, mainly due to spiraling raw material prices around the world.

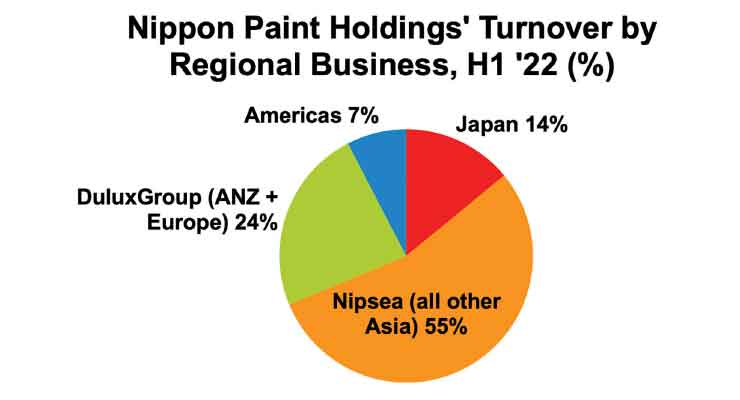

The combined business of the Europe and ANZ, reflected in Nippon Paint’s results as DuluxGroup, now makes it the second-largest of the company’s businesses after some minor rearrangement of reporting, as seen in the pie chart. Nippon Paint reports that Europe is reported as the world’s second-largest paint market after China. This might seem like something of a fudge-factor but with due consideration given to the pitchfork effect from the company’s prominent positions in France and Italy, it’s not as unreasonable a comparison as it might first appear.

In this article, the contrasting performance of three major participants in Europe that have each had different experiences in 2022 is highlighted.

AkzoNobel: A Drier Spell for DIY

Reporting on the company’s second-quarter and first-half results for the Decorative Paints business, AkzoNobel said that its revenues were 7% lower and 6% lower in constant currencies.Significant pricing initiatives and ongoing strong demand from the professional segment were tempered by lower sales volumes in the European DIY sector, although some recovery in the European DIY sector seemed to have taken hold in the later weeks of the second half. Sales for Decorative Paints in the EMEA region actually fell by 6% in the second quarter from €720 million to €673 million. This was the only regional fall in sales.

The company’s new Decorative Paints Latin America arm (previously Decorative Paints South America but now with Grupo Orbis added in, and with the benefit of store expansions and new product introductions), saw a 78% jump in sales in constant currencies (acquisition effect) while Decorative Paints’ sales in Asia rose by a steady 7%, also on a constant currency basis. On a half-yearly basis and following the same respective pattern (q.v.) the decrease was 3% (EMEA) followed by increases of 49% (Latin America) and 11% (Asia). From 2023, once it has been completed, AkzoNobel’s acquisition of Kansai Paint’s African paint and coatings operations will transfer another €280 million to EMEA sales.

Concerning Russia and Ukraine, AkzoNobel stated that the business in these two countries represented about 2% of its revenues, with the majority of that originating in Russia. In the first quarter, AkzoNobel’s activities in Ukraine had come to a halt, while in Russia, the company’s Aerospace Coatings activities and new investments and marketing activities were suspended.

In the second quarter, following EU sanctions, the majority of AkzoNobel’s coatings business in Russia was suspended with the residual Russian business being locally operated.

Europe Softens At PPG Industries

Like AkzoNobel, PPG also referred to some softening in Europe when releasing its first-half results. Although avoiding a regional sales breakdown, PPG’s press announcement said that demand for do-it-yourself coatings in the architectural coatings EMEA business softened due to lower consumer confidence and weaker demand related to the current geopolitical issues as part of the Performance Coatings operations.By contrast, PPG’s Industrial Coating arm flourished on the back of its recent German and Finnish acquisitions providing bolt-on growth, in spite of Chinese lockdowns and a softening of European demand from the industrial sector. Sales for the six months to June 30 in Performance Coatings rose from $5.07 billion to $5.50 billion and in Industrial Coatings from $3.17 billion to $3.50 billion. Net profits, however, fared less well in the current climate, and decreasing from $840 million to $765 million in Performance Coatings and from $435 million to $296 million in Industrial Coatings.

Michael McGarry, PPG’s chairman and CEO, shared an interesting outlook on the global markets for the near future, saying, “Looking ahead, in most major regions and end-use markets, underlying demand for PPG products is expected to remain solid. We anticipate strong sequential growth in Asia due to higher industrial production compared to the second quarter. Positive growth trends are generally expected to continue in North America. In Europe, we expect economic conditions to remain soft, including normal seasonal demand trends. We have already begun to implement cost mitigation actions in Europe and have contingency plans ready to deploy in the event of a broader economic slowdown. In the second half of the year, we expect several of our larger businesses, including automotive original equipment manufacturer (OEM) and aerospace coatings, to deliver strong growth due to large current supply deficits and low inventories in these end-use markets. Importantly, we expect that our sequential quarterly momentum on operating margin improvement will continue in the third quarter as we work back to our historical margins, and our adjusted earnings will increase on a year-over-year basis.”

Cromology Buy Pitchforks Nippon Paint

The continued rise of Nippon Paint in Europe is one that can no longer be overlooked when making comparisons. Reporting its first-half results for 2022 in mid-August, for the six months ended June 30, 2022, consolidated revenue at Nippon Paint Holdings increased by 29.1% from the corresponding period of the previous year to ¥622,049 million (€4.52 billion).This is primarily due to the acquisition on Jan. 20, 2022 of European paint manufacturer Cromology Holding SAS and the acquisition on May 31, 2022 of European paint manufacturer DB JUB delniška družba pooblaščenka d.d. (JUB) by NPHD, as subsidiaries. These European subsidiaries have been integrated into the company under the DuluxGroup operations, reflecting some of the close market approximations between Australia and New Zealand and the West.

Direct comparison of the DuluxGroup results between the first half of 2021 and the first half of 2022, counting also the incorporation of the new European operations, showed that DuluxGroup turnover more than doubled across the comparable periods. Sales of decorative paints in the first half of 2021 amounted to more than ¥43 billion, but in the first half of 2022 they totalled nearly ¥96 billion. In industrial coatings the change is less marked.

Although acquisitions such as this – in combination with higher selling prices – yielded an improvement in sales figures, consolidated operating profits at Nippon Paint Holdings decreased by 9.7% to ¥44,202 million, mainly due to spiraling raw material prices around the world.

The combined business of the Europe and ANZ, reflected in Nippon Paint’s results as DuluxGroup, now makes it the second-largest of the company’s businesses after some minor rearrangement of reporting, as seen in the pie chart. Nippon Paint reports that Europe is reported as the world’s second-largest paint market after China. This might seem like something of a fudge-factor but with due consideration given to the pitchfork effect from the company’s prominent positions in France and Italy, it’s not as unreasonable a comparison as it might first appear.