Kerry Pianoforte, Editor06.12.23

Market research firm Grand View Research has published a report stating that the global industrial coatings market size was valued at $87.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.5% from 2023 to 2030.

Grand View Research identified a number of drivers for this market. The growing usage of refinish coatings for automotive maintenance, repair, and aftermarket painting on account of visual appearance, surface protection, and corrosion resistance is expected to propel the demand for industrial coatings. Good CO2 retention properties to preserve freshness and high flexibility and adhesion of these coatings are boosting their demand in the packaging industry, while increasing construction activities drive product demand in the wood industry.

The global industrial coatings market is showing signs of recovery and growth as we emerge from the effects of the pandemic. There are a number of challenges that still need to be overcome, such as raw material shortages and supply chain issues.

“The global industrial coatings market is still working to overcome some significant hurdles, like raw material shortages, economic headwinds and ongoing supply chain challenges,” said Mike Bourdeau, president of General Industrial Coatings, Sherwin-Williams. “However, we’re beginning to see some of those matters slowly work themselves out and we can once again focus on growth, which is invigorating.”

According to Bourdeau, the industrial coatings market performance varied depending on specific regions and segments. “We see some segments outperforming pre-pandemic levels, while others have slowed due to economic conditions. We have also seen some mega-trends in the industry continue to gain momentum. For example, the interest in powder coatings has grown, which we love to see. As sustainability becomes more of a focus for the industry and manufacturers look for innovative products to support their sustainability goals, I think the pace of progress will quicken.

We’ve seen continued uptake of Powdura ECO, our recent innovation that uses recycled plastic as a raw material to deliver sustainability-advantaged powder coatings without compromising performance. And we’re seeing more and more interest in our liquid-based coatings, which also offer a variety of sustainability advantages. I’m excited to see what other advancements will come to market as customers continue to prioritize sustainability.”

“In the past year, our assessment of the industry was very uneven,” said Kevin Braun, PPG vice president, global Industrial Coatings. “We saw continued strength in sub-segments, such as heavy duty equipment and construction related areas. Alternatively, consumer-driven products took a fairly significant step back from the COVID period highs of late 2020 and 2021. From a regional standpoint, obviously China and Europe were both compromised for different reasons, while our Americas region saw relative strength across the entire general industrial landscape.”

Industrial coatings encompass a variety of market segments: onshore oil and gas, commercial architecture and industrial maintenance. Currently, the heavy equipment and oil and gas segments are offering the most growth opportunities.

“The markets performing the strongest are tied into the industrial world like heavy equipment and energy,” said Bourdeau. “These are markets that have continued to see evolution in their technology, prompting investment in new equipment. They have also seen supporting legislation like the infrastructure bill in the U.S., which set up a strong opportunity for investment over the next five years. We also see strong growth potential in emerging markets like electric vehicle and the many adjacent markets supporting that growth area. That technology is going to continue to develop and grow in all regions of the world over the next few years. We look forward to being a part of that growth.”

“As industrial is a conglomerate of many different segments, it is hard to pinpoint a few that represent the highest opportunities for growth,” said Braun. “However, we believe as a leading coatings supplier, offering our customers high performing products that meet long term sustainability metrics drives coatings growth regardless of application segment. For example, since 2019, PPG has focused on growing its powder coatings capacity and capabilities, making four strategic acquisitions and expanding production and service elements at seven sites across the globe. We see firsthand the market pull for these types of products and we expect this trend to continue well into the future.”

Industrial coatings customers are seeking products that feature extreme durability, efficiency and compliance with environmental regulations.

“In a nutshell, most of our customers are looking for a combination of three primary benefits: faster and more efficient manufacturing processes, longer-lasting durability and protection, and a reduced environmental impact,” said Bourdeau. “Efficiency is a big one for our customers. After dealing with supply chain issues for the last three to four years, our customers are ready for manufacturing processes to flow smoothly again — with supplier and manufacturing partners, as well as internally with their own facilities. Our technical service team has been getting a lot of praise in this area. Their ability to go into a customer facility and spot opportunities to streamline processes is highly valued among our industrial partners, which also contributes to the total cost of ownership, another advantage our customers seek.”

Durability is also extremely important. “As technology advances and customers continue to hold on to equipment longer than in years past, finishes are expected to perform and endure for longer periods of time, in all types of extreme conditions,” said Bourdeau. “Customers want bright, consistent color that protects their goods through prolonged exposure to weather, corrosion, UV and more. These needs drive our innovation. Another important element that increasingly comes up in conversation is sustainability. Our customers are being challenged to reduce their environmental impact, and our coatings play a key role in helping them achieve their sustainability goals. We’re working on some very exciting solutions at Sherwin-Williams. In fact, we recently made the switch from using pre-consumer recycled plastic to post-consumer rPET as a raw material in our Powdura ECO line — a change that seems small but that can actually lower total energy consumption and further reduce carbon dioxide emissions.”

“PPG’s brand position that ‘We Protect and Beautify the World’ is ultimately the primary elements our customers are looking for from us,” said Braun. “Protection in the way of durability, corrosion protection and total quality is key. Additionally, we need to offer those performance characteristics in the color and appearance that meets the overall market trends. Beyond these two critical deliverables, we hear exceedingly more about the importance of sustainability, whether it is lower cure products at a customer location, addressing materials of concern, or total life cycle management, all of these are gaining traction in all areas of our business globally.”

As environmental regulations continue to be enacted worldwide, there has been a shift from using solvent-based products to more environmentally-friendly products such as water-based and powder coatings.

“We have certainly seen direct impact from legislation around coatings materials in the last few years, ranging from very specific local impact to entire regions and countries,” said Bourdeau. “The increasing demand for environmental responsibility is occurring across all industries. Entire supply chains are held to higher standards, and as such, we continuously evaluate our environmental footprint, our product blueprint and our social imprint.”

Bourdeau noted that Sherwin-Williams’ strategy is always to concentrate on what it can control. “We continue to focus our research and new product development to proactively support ever-changing requirements. As a global partner, we want to make sure that we deliver the right solutions to customers across the globe, tailored to the specific regulatory concerns of that area.”

“Sustainability is a driving consideration factor across all industrial segments due to changing global regulations and the desire to reduce environmental impact, which is why powder coatings are a key focus for PPG,” said Braun. “Also, we have seen companies in the consumer electronics market leading the way with early adoption of our waterborne coatings due to their sustainability benefits.”

With Sherwin-Williams’ global footprint, reach and scalability, the company seeks to support industrial manufacturers wherever they are based and operate around the world. “We take pride in our ability to provide consistent products, performance and customer service across all locations. This is of the utmost importance and value to our customers,” added Bourdeau.

“As it has for several years, we see Asia leading the way in demand that is driving growth for industrial coatings,” said Braun. “We’re seeing increased opportunities in Greater China, particularly for sustainably advantaged coatings products, including powder and waterborne technologies. Also, in India, growth has been strong and the outlook is very favorable.”

Powdura ECO is an environmentally conscious solution designed to lower carbon dioxide emissions, reduce plastic waste and contribute to a circular economy by giving plastic a second life. Innovations from the lab team permit the formula to do all this while still delivering a balance of mechanical properties, superior flexibility, excellent color retention and solvent resistance.

“Relevant across multiple market segments including appliances, electronic enclosures, heavy equipment and many others, customers use Powdura ECO to achieve exceptional performance and promote sustainable leadership,” said Bourdeau. “We’re continuing to see interest in these breakthrough powder coatings from other customers in a range of markets and regions, so our expectation is that the uptake of Powdura ECO and other sustainability-advantaged products will only continue to grow.”

PPG recently introduced PPG ENVIROCRON Primeron primer powder portfolio in European markets. The product family is designed to provide high corrosion resistance for metal substrates, including steel, hot-dip-galvanized steel, metalized steel and aluminum.

Primeron primer in a multi-layer system offers optimal corrosion protection and is key to extending a product’s lifespan and preserving its structural integrity. PPG Envirocron Primeron primer powder portfolio has been tested according to the corrosivity categories and approved by the QUALISTEELCOAT international quality label for coated steel.

PPG also launched PPG ENVIROCRON LUM coating, which is the industry’s first commercial retroreflective powder coating. The patent-pending coating is engineered to help improve visibility at night and during low-light conditions.

According to the company, until now, retroreflective items like pavement markings, road signs and safety vests were possible with liquid paints, tapes and fabrics. PPG’s advancement combines the safety-enhancing properties of retroreflection with the benefits of a powder coating.

petrochemicals, automotive, pharmaceuticals and composites.

The company designs and supplies integrated powder paint production lines including feeding equipment, extruders, cooling and flaking systems, and downstream

handling solutions.

Twin screw extruders are available with capacities from 60-2500 kg/h. Each model is designed for energy-efficient operation with easy cleaning and rapid switchover between products with minimal waste. IPCO’s extruders feature precise temperature control and adjustable screw speeds to ensure optimum product quality. A split design delivers quick access to the upper and lower parts of the barrel, enabling faster colour changes and efficient maintenance and cleaning operations.

IPCO’s cooling conveyors are based on stainless steel belts and a closed loop system of chilled water. The cooling water is sprayed against the underside of the cooler belt and then returned to the chiller. Chill rolls use plastic belts and offer an efficient solution for installations where space is limited or quick cooling time is necessary.

All ranges are backed up by a comprehensive global service offering including spare parts and maintenance. The company also provides service and refurbishment of equipment from the ranges of most other leading OEMs, and performance optimization consulting.

The company’s manufacturing base for extruder and cooling ranges is in Milan, Italy and the facility is also home to a Productivity Center dedicated to powder paint production technologies. Equipped with 100 kg/h and 1000 kg/h extruder lines and associated cooling equipment, the center is available for customer product trials, batch production and feasibility/quality tests.

IPCO systems are used by many of the world’s leading manufacturers and suppliers of powder paint, as well as by companies with their own in-house paint production facilities www.ipco.com/applications/powder-paint/

Grand View Research identified a number of drivers for this market. The growing usage of refinish coatings for automotive maintenance, repair, and aftermarket painting on account of visual appearance, surface protection, and corrosion resistance is expected to propel the demand for industrial coatings. Good CO2 retention properties to preserve freshness and high flexibility and adhesion of these coatings are boosting their demand in the packaging industry, while increasing construction activities drive product demand in the wood industry.

The global industrial coatings market is showing signs of recovery and growth as we emerge from the effects of the pandemic. There are a number of challenges that still need to be overcome, such as raw material shortages and supply chain issues.

“The global industrial coatings market is still working to overcome some significant hurdles, like raw material shortages, economic headwinds and ongoing supply chain challenges,” said Mike Bourdeau, president of General Industrial Coatings, Sherwin-Williams. “However, we’re beginning to see some of those matters slowly work themselves out and we can once again focus on growth, which is invigorating.”

According to Bourdeau, the industrial coatings market performance varied depending on specific regions and segments. “We see some segments outperforming pre-pandemic levels, while others have slowed due to economic conditions. We have also seen some mega-trends in the industry continue to gain momentum. For example, the interest in powder coatings has grown, which we love to see. As sustainability becomes more of a focus for the industry and manufacturers look for innovative products to support their sustainability goals, I think the pace of progress will quicken.

We’ve seen continued uptake of Powdura ECO, our recent innovation that uses recycled plastic as a raw material to deliver sustainability-advantaged powder coatings without compromising performance. And we’re seeing more and more interest in our liquid-based coatings, which also offer a variety of sustainability advantages. I’m excited to see what other advancements will come to market as customers continue to prioritize sustainability.”

“In the past year, our assessment of the industry was very uneven,” said Kevin Braun, PPG vice president, global Industrial Coatings. “We saw continued strength in sub-segments, such as heavy duty equipment and construction related areas. Alternatively, consumer-driven products took a fairly significant step back from the COVID period highs of late 2020 and 2021. From a regional standpoint, obviously China and Europe were both compromised for different reasons, while our Americas region saw relative strength across the entire general industrial landscape.”

Industrial coatings encompass a variety of market segments: onshore oil and gas, commercial architecture and industrial maintenance. Currently, the heavy equipment and oil and gas segments are offering the most growth opportunities.

“The markets performing the strongest are tied into the industrial world like heavy equipment and energy,” said Bourdeau. “These are markets that have continued to see evolution in their technology, prompting investment in new equipment. They have also seen supporting legislation like the infrastructure bill in the U.S., which set up a strong opportunity for investment over the next five years. We also see strong growth potential in emerging markets like electric vehicle and the many adjacent markets supporting that growth area. That technology is going to continue to develop and grow in all regions of the world over the next few years. We look forward to being a part of that growth.”

“As industrial is a conglomerate of many different segments, it is hard to pinpoint a few that represent the highest opportunities for growth,” said Braun. “However, we believe as a leading coatings supplier, offering our customers high performing products that meet long term sustainability metrics drives coatings growth regardless of application segment. For example, since 2019, PPG has focused on growing its powder coatings capacity and capabilities, making four strategic acquisitions and expanding production and service elements at seven sites across the globe. We see firsthand the market pull for these types of products and we expect this trend to continue well into the future.”

Industrial coatings customers are seeking products that feature extreme durability, efficiency and compliance with environmental regulations.

“In a nutshell, most of our customers are looking for a combination of three primary benefits: faster and more efficient manufacturing processes, longer-lasting durability and protection, and a reduced environmental impact,” said Bourdeau. “Efficiency is a big one for our customers. After dealing with supply chain issues for the last three to four years, our customers are ready for manufacturing processes to flow smoothly again — with supplier and manufacturing partners, as well as internally with their own facilities. Our technical service team has been getting a lot of praise in this area. Their ability to go into a customer facility and spot opportunities to streamline processes is highly valued among our industrial partners, which also contributes to the total cost of ownership, another advantage our customers seek.”

Durability is also extremely important. “As technology advances and customers continue to hold on to equipment longer than in years past, finishes are expected to perform and endure for longer periods of time, in all types of extreme conditions,” said Bourdeau. “Customers want bright, consistent color that protects their goods through prolonged exposure to weather, corrosion, UV and more. These needs drive our innovation. Another important element that increasingly comes up in conversation is sustainability. Our customers are being challenged to reduce their environmental impact, and our coatings play a key role in helping them achieve their sustainability goals. We’re working on some very exciting solutions at Sherwin-Williams. In fact, we recently made the switch from using pre-consumer recycled plastic to post-consumer rPET as a raw material in our Powdura ECO line — a change that seems small but that can actually lower total energy consumption and further reduce carbon dioxide emissions.”

“PPG’s brand position that ‘We Protect and Beautify the World’ is ultimately the primary elements our customers are looking for from us,” said Braun. “Protection in the way of durability, corrosion protection and total quality is key. Additionally, we need to offer those performance characteristics in the color and appearance that meets the overall market trends. Beyond these two critical deliverables, we hear exceedingly more about the importance of sustainability, whether it is lower cure products at a customer location, addressing materials of concern, or total life cycle management, all of these are gaining traction in all areas of our business globally.”

As environmental regulations continue to be enacted worldwide, there has been a shift from using solvent-based products to more environmentally-friendly products such as water-based and powder coatings.

“We have certainly seen direct impact from legislation around coatings materials in the last few years, ranging from very specific local impact to entire regions and countries,” said Bourdeau. “The increasing demand for environmental responsibility is occurring across all industries. Entire supply chains are held to higher standards, and as such, we continuously evaluate our environmental footprint, our product blueprint and our social imprint.”

Bourdeau noted that Sherwin-Williams’ strategy is always to concentrate on what it can control. “We continue to focus our research and new product development to proactively support ever-changing requirements. As a global partner, we want to make sure that we deliver the right solutions to customers across the globe, tailored to the specific regulatory concerns of that area.”

“Sustainability is a driving consideration factor across all industrial segments due to changing global regulations and the desire to reduce environmental impact, which is why powder coatings are a key focus for PPG,” said Braun. “Also, we have seen companies in the consumer electronics market leading the way with early adoption of our waterborne coatings due to their sustainability benefits.”

Regions

“In today’s market, growth is really a function of specific markets in specific regions,” said Bourdeau. “Every region has markets that are down, and every region has markets that are outperforming previous years’ performance. For us, it is about focusing on the right markets in the right regions to accelerate our growth targets. “With Sherwin-Williams’ global footprint, reach and scalability, the company seeks to support industrial manufacturers wherever they are based and operate around the world. “We take pride in our ability to provide consistent products, performance and customer service across all locations. This is of the utmost importance and value to our customers,” added Bourdeau.

“As it has for several years, we see Asia leading the way in demand that is driving growth for industrial coatings,” said Braun. “We’re seeing increased opportunities in Greater China, particularly for sustainably advantaged coatings products, including powder and waterborne technologies. Also, in India, growth has been strong and the outlook is very favorable.”

New Products

As a company, Sherwin-Williams is committed to driving sustainability across its products and processes. Powdura ECO is its newest line of powder coatings, formulated with resins created from post-consumer recycled plastics, or rPETs.Powdura ECO is an environmentally conscious solution designed to lower carbon dioxide emissions, reduce plastic waste and contribute to a circular economy by giving plastic a second life. Innovations from the lab team permit the formula to do all this while still delivering a balance of mechanical properties, superior flexibility, excellent color retention and solvent resistance.

“Relevant across multiple market segments including appliances, electronic enclosures, heavy equipment and many others, customers use Powdura ECO to achieve exceptional performance and promote sustainable leadership,” said Bourdeau. “We’re continuing to see interest in these breakthrough powder coatings from other customers in a range of markets and regions, so our expectation is that the uptake of Powdura ECO and other sustainability-advantaged products will only continue to grow.”

PPG recently introduced PPG ENVIROCRON Primeron primer powder portfolio in European markets. The product family is designed to provide high corrosion resistance for metal substrates, including steel, hot-dip-galvanized steel, metalized steel and aluminum.

Primeron primer in a multi-layer system offers optimal corrosion protection and is key to extending a product’s lifespan and preserving its structural integrity. PPG Envirocron Primeron primer powder portfolio has been tested according to the corrosivity categories and approved by the QUALISTEELCOAT international quality label for coated steel.

PPG also launched PPG ENVIROCRON LUM coating, which is the industry’s first commercial retroreflective powder coating. The patent-pending coating is engineered to help improve visibility at night and during low-light conditions.

According to the company, until now, retroreflective items like pavement markings, road signs and safety vests were possible with liquid paints, tapes and fabrics. PPG’s advancement combines the safety-enhancing properties of retroreflection with the benefits of a powder coating.

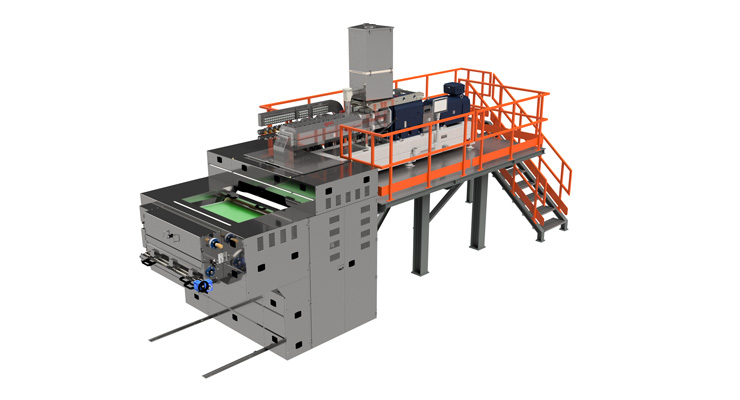

IPCO – Extrusion and cooling systems

IPCO is a world-leading manufacturer of steel belts and industrial processing technologies, with customers in markets as diverse aspetrochemicals, automotive, pharmaceuticals and composites.

The company designs and supplies integrated powder paint production lines including feeding equipment, extruders, cooling and flaking systems, and downstream

handling solutions.

Twin screw extruders are available with capacities from 60-2500 kg/h. Each model is designed for energy-efficient operation with easy cleaning and rapid switchover between products with minimal waste. IPCO’s extruders feature precise temperature control and adjustable screw speeds to ensure optimum product quality. A split design delivers quick access to the upper and lower parts of the barrel, enabling faster colour changes and efficient maintenance and cleaning operations.

IPCO’s cooling conveyors are based on stainless steel belts and a closed loop system of chilled water. The cooling water is sprayed against the underside of the cooler belt and then returned to the chiller. Chill rolls use plastic belts and offer an efficient solution for installations where space is limited or quick cooling time is necessary.

All ranges are backed up by a comprehensive global service offering including spare parts and maintenance. The company also provides service and refurbishment of equipment from the ranges of most other leading OEMs, and performance optimization consulting.

The company’s manufacturing base for extruder and cooling ranges is in Milan, Italy and the facility is also home to a Productivity Center dedicated to powder paint production technologies. Equipped with 100 kg/h and 1000 kg/h extruder lines and associated cooling equipment, the center is available for customer product trials, batch production and feasibility/quality tests.

IPCO systems are used by many of the world’s leading manufacturers and suppliers of powder paint, as well as by companies with their own in-house paint production facilities www.ipco.com/applications/powder-paint/