Yogender Singh, India, Asia-Pacific Correspondent06.12.23

China, the factory of the world, is the largest automotive producer in the world by a large distance. China’s emergence as the largest automotive producer has benefited the country’s automotive coating industry in a major way. Coatings World presents an overview of China’s automotive coating industry in this feature through an interaction with three senior executives at BASF and PPG.

China has been the largest global automotive maker and market since 2009, when the country surpassed the U.S. as the largest producer of automobiles. The country sold more than 13.5 million vehicles in 2009, as compared with 10.4 million cars and light trucks sold in the U.S.

It has been 13 years since China ascended to the pole position of the global automotive industry. In the intervening years, Chinese automotive producers have further widened the difference between the automotive produced and sold in the country as compared to second-placed U.S.

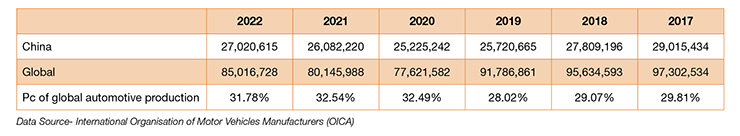

Chinese carmakers produced 27.02 million units in 2022, up by 3.4% year on year, while sales rose by 2.1% to 26.86 million units, according to data from the China Association of Automobile Manufacturers (CAAM).

The production figures look remarkable considering the fact that Chinese automotive industry faced multiple headwinds, including the resurgence of COVID-19 in the country, one of the leanest years in terms of economic growth, a shortage of semiconductor chips and an unstable geopolitical situation.

On the negative side, Chinese automotive production in 2022 is still 6.87% lower than the historic highs of nearly 29 million vehicles produced in 2017.

Paint and coating producers catering to the automotive segment in China have reaped rich dividends from the explosive growth in the automotive industry in the country. Emergence of China as the largest global automotive production base has also propelled the automotive paints and coating industry in the country to become the largest on the global scale.

Barring three years (2018, 2019 and 2020), China’s automotive coating market has registered growth of more than 5% in each of the last ten years.

Though demand of automotive coatings has remained steady in China during the last two years, automotive coating producers are expecting a set of challenges in the short and medium-term. The structure of the industry is set to undergo a transformation as electric vehicles (EVs) become the norm. Though like any other vehicle, EVs require coatings, this segment will also generate demand for new coatings, such as those used for batteries.

Vincent Robin: PPG is one of the few global chemical companies that first invested in China in the 1980s, and today PPG China is a fully-owned subsidiary of PPG. Our 4,000 employees and 25 manufacturing and technical sites throughout China enable PPG to cover multiple market needs and lead in most of the markets we participate in. Specifically for Automotive OEM Coatings, we invested in five main manufacturing sites (Tianjin, Shenyang, Wuhu, Jiading and Zhangjiagang) and will open this year our new R&D center in Tianjin to increase our capability to develop “in China for China.”

In the first quarter of 2023, automotive industry OEM production was similar to the prior year’s first quarter. However, dealer inventory continues to be less than 50% of typical levels of the past decade. Most PPG customers are making massive investments in the development of battery electric vehicles (BEVs) and the BEV segment sustained an annualized growth rate greater than 25% in the first quarter. PPG is responding to this shift by offering the most comprehensive product lineup to our automotive customers and helping them to make the right choices for new coatings technologies in their path towards increased sustainability and productivity.

PPG will inaugurate a battery pack application center (BPAC) in Tianjin, China at the end of May 2023. The $30 million facility features a full range of capabilities to test the application of PPG technologies, materials, and systems for EV battery packs, allowing customers to accelerate the development of new EV technologies. The BPAC will test PPG technologies including powder coatings, fire protection, dielectric coatings, adhesives and sealants, surface pre-treatment, and e-coat. Its modular design will allow for independent projects to be carried out concurrently in each of the application areas. This flexibility will enable development of material and process solutions across the range of current and potential customers.

Additionally, China is well-positioned for growth as it relaxes COVID-19 restrictions. The adoption of BEVs in China is progressing at a faster pace than any other region in the world and PPG is growing with the largest BEV producer in the region.

CW: What is the approximate share of PPG in the overall automotive coating market in China?

Robin: There are several different facets to calculating market share for the growing automotive coating market in China. However, we do not share those datapoints externally. What we can share is that customers look to us to drive product performance through innovation, service and industry-leading knowledge that creates mutual value. PPG automotive coatings experts are deployed in more than 75 automotive manufacturing facilities in China to ensure the successful application of our paints, coatings and adhesives and sealants on the production line. This enables us to deliver a comprehensive and consistent value package designed to help OEMs reduce costs, increase productivity, and meet increasing quality and performance targets. It also allows us to introduce new coatings solutions and expands customer access to innovative technologies.

CW: What is the approximate size of China’s automotive coatings market in volume or value terms?

Robin: While PPG does not disclose market size by region, we can share that PPG continues to grow in the China region with multiple customers. Industry datapoints suggest China vehicle production accounts for more than 32% of worldwide production.

CW: What are some of the key challenges facing automotive coatings producers?

Robin: Since the start of 2023 the automotive market has experienced some easing of supply chain issues, which should lead to an increase in vehicle production, especially in the second half of the year. The flow of materials is improving through our customers’ production facilities, and we see volume increasing, so dealers can improve their inventory positions and fleets can replenish their supply. There are, however, still challenges that could disrupt this going forward. Recent rises in COVID-19 cases in China are impacting automotive supply chains and are resulting in automotive plants suspending production due to parts shortages. The automotive industry, as a key pillar of the economy, has also been rolling out buyer subsidies to

drive demand.

Jack Zou: BASF has a comprehensive range of automotive coatings products manufactured locally in China, including pre-treatment, automotive OEM and refinish coatings, and applied surface treatments for both metal and plastic substrates. Our global collaborative network enables us to create advanced performance solutions and drive innovation in design and new applications, ensuring that we meet the unique needs of our customers.

CW: What is the approximate size of China’s automotive coatings market in volume or value terms?

Zou: With around 26 million light vehicles locally produced in China in 2022, BASF estimates that approximately 400,000 tons of automotive coatings products, including e-coat, primer, basecoat, clearcoat and hardener, are associated with this production.

CW: What are some of the key challenges facing automotive coatings producers?

Zou: BASF Coatings faces two significant challenges in the automotive coatings sector in China, namely supply chain disruption and raw material cost inflation. To address these challenges, we closely monitor further developments in the market with the help of our global supply chain network, and regularly evaluate the likely consequences for our product supply. We are also partnering with leading suppliers in the automotive value chain, expanding our local production and supply, and investing in local innovation. We are working closely with our customers to ensure a stable and sustainable ecosystem, and to ensure that we can provide uninterrupted supply.

Nevertheless, taking a broader view, we also see acute environmental challenges faced by all industries in China and abroad – from water scarcity and climate change to limited access to resources. BASF Coatings has taken various measures to tackle these challenges. For instance, the solar power facilities at our Caojing, Minhang and Pudong sites in Shanghai have been enabling us to generate electricity from renewable resources. The MEK recycling units at our resin plant in Caojing can help us recycle the resources that were once incinerated or discarded.

Furthermore, BASF also launched our first biomass balance automotive coatings in China last year, which was already applied to the car bodies of Chinese OEMs.

Dr. Mirko Arnold: In 2016, BASF established its first production and R&D site for automotive refinish coatings of Asia Pacific in Jiangmen. Since then, we have consistently expanded our production capacity, with a 30% increase in 2022 alone. In February 2023, our new Application and Technical Centre for refinish coatings at our Jiangmen site completed civil work construction and will go live in early 2024.

China has been the largest global automotive maker and market since 2009, when the country surpassed the U.S. as the largest producer of automobiles. The country sold more than 13.5 million vehicles in 2009, as compared with 10.4 million cars and light trucks sold in the U.S.

It has been 13 years since China ascended to the pole position of the global automotive industry. In the intervening years, Chinese automotive producers have further widened the difference between the automotive produced and sold in the country as compared to second-placed U.S.

Chinese carmakers produced 27.02 million units in 2022, up by 3.4% year on year, while sales rose by 2.1% to 26.86 million units, according to data from the China Association of Automobile Manufacturers (CAAM).

The production figures look remarkable considering the fact that Chinese automotive industry faced multiple headwinds, including the resurgence of COVID-19 in the country, one of the leanest years in terms of economic growth, a shortage of semiconductor chips and an unstable geopolitical situation.

On the negative side, Chinese automotive production in 2022 is still 6.87% lower than the historic highs of nearly 29 million vehicles produced in 2017.

Paint and coating producers catering to the automotive segment in China have reaped rich dividends from the explosive growth in the automotive industry in the country. Emergence of China as the largest global automotive production base has also propelled the automotive paints and coating industry in the country to become the largest on the global scale.

Barring three years (2018, 2019 and 2020), China’s automotive coating market has registered growth of more than 5% in each of the last ten years.

Though demand of automotive coatings has remained steady in China during the last two years, automotive coating producers are expecting a set of challenges in the short and medium-term. The structure of the industry is set to undergo a transformation as electric vehicles (EVs) become the norm. Though like any other vehicle, EVs require coatings, this segment will also generate demand for new coatings, such as those used for batteries.

Vincent Robin, VP, Global Automotive Coatings, PPG

Coatings World: What is the scale and scope of PPG’s automotive coating products in China?Vincent Robin: PPG is one of the few global chemical companies that first invested in China in the 1980s, and today PPG China is a fully-owned subsidiary of PPG. Our 4,000 employees and 25 manufacturing and technical sites throughout China enable PPG to cover multiple market needs and lead in most of the markets we participate in. Specifically for Automotive OEM Coatings, we invested in five main manufacturing sites (Tianjin, Shenyang, Wuhu, Jiading and Zhangjiagang) and will open this year our new R&D center in Tianjin to increase our capability to develop “in China for China.”

In the first quarter of 2023, automotive industry OEM production was similar to the prior year’s first quarter. However, dealer inventory continues to be less than 50% of typical levels of the past decade. Most PPG customers are making massive investments in the development of battery electric vehicles (BEVs) and the BEV segment sustained an annualized growth rate greater than 25% in the first quarter. PPG is responding to this shift by offering the most comprehensive product lineup to our automotive customers and helping them to make the right choices for new coatings technologies in their path towards increased sustainability and productivity.

PPG will inaugurate a battery pack application center (BPAC) in Tianjin, China at the end of May 2023. The $30 million facility features a full range of capabilities to test the application of PPG technologies, materials, and systems for EV battery packs, allowing customers to accelerate the development of new EV technologies. The BPAC will test PPG technologies including powder coatings, fire protection, dielectric coatings, adhesives and sealants, surface pre-treatment, and e-coat. Its modular design will allow for independent projects to be carried out concurrently in each of the application areas. This flexibility will enable development of material and process solutions across the range of current and potential customers.

Additionally, China is well-positioned for growth as it relaxes COVID-19 restrictions. The adoption of BEVs in China is progressing at a faster pace than any other region in the world and PPG is growing with the largest BEV producer in the region.

CW: What is the approximate share of PPG in the overall automotive coating market in China?

Robin: There are several different facets to calculating market share for the growing automotive coating market in China. However, we do not share those datapoints externally. What we can share is that customers look to us to drive product performance through innovation, service and industry-leading knowledge that creates mutual value. PPG automotive coatings experts are deployed in more than 75 automotive manufacturing facilities in China to ensure the successful application of our paints, coatings and adhesives and sealants on the production line. This enables us to deliver a comprehensive and consistent value package designed to help OEMs reduce costs, increase productivity, and meet increasing quality and performance targets. It also allows us to introduce new coatings solutions and expands customer access to innovative technologies.

CW: What is the approximate size of China’s automotive coatings market in volume or value terms?

Robin: While PPG does not disclose market size by region, we can share that PPG continues to grow in the China region with multiple customers. Industry datapoints suggest China vehicle production accounts for more than 32% of worldwide production.

CW: What are some of the key challenges facing automotive coatings producers?

Robin: Since the start of 2023 the automotive market has experienced some easing of supply chain issues, which should lead to an increase in vehicle production, especially in the second half of the year. The flow of materials is improving through our customers’ production facilities, and we see volume increasing, so dealers can improve their inventory positions and fleets can replenish their supply. There are, however, still challenges that could disrupt this going forward. Recent rises in COVID-19 cases in China are impacting automotive supply chains and are resulting in automotive plants suspending production due to parts shortages. The automotive industry, as a key pillar of the economy, has also been rolling out buyer subsidies to

drive demand.

Jack Zou, VP, Automotive OEM Coatings Solutions Asia Pacific, BASF

CW: What is the scale and scope of BASF’s automotive coating products in China?Jack Zou: BASF has a comprehensive range of automotive coatings products manufactured locally in China, including pre-treatment, automotive OEM and refinish coatings, and applied surface treatments for both metal and plastic substrates. Our global collaborative network enables us to create advanced performance solutions and drive innovation in design and new applications, ensuring that we meet the unique needs of our customers.

CW: What is the approximate size of China’s automotive coatings market in volume or value terms?

Zou: With around 26 million light vehicles locally produced in China in 2022, BASF estimates that approximately 400,000 tons of automotive coatings products, including e-coat, primer, basecoat, clearcoat and hardener, are associated with this production.

CW: What are some of the key challenges facing automotive coatings producers?

Zou: BASF Coatings faces two significant challenges in the automotive coatings sector in China, namely supply chain disruption and raw material cost inflation. To address these challenges, we closely monitor further developments in the market with the help of our global supply chain network, and regularly evaluate the likely consequences for our product supply. We are also partnering with leading suppliers in the automotive value chain, expanding our local production and supply, and investing in local innovation. We are working closely with our customers to ensure a stable and sustainable ecosystem, and to ensure that we can provide uninterrupted supply.

Nevertheless, taking a broader view, we also see acute environmental challenges faced by all industries in China and abroad – from water scarcity and climate change to limited access to resources. BASF Coatings has taken various measures to tackle these challenges. For instance, the solar power facilities at our Caojing, Minhang and Pudong sites in Shanghai have been enabling us to generate electricity from renewable resources. The MEK recycling units at our resin plant in Caojing can help us recycle the resources that were once incinerated or discarded.

Furthermore, BASF also launched our first biomass balance automotive coatings in China last year, which was already applied to the car bodies of Chinese OEMs.

Dr. Mirko Arnold, VP - Global Technology, Automotive Refinish Coatings Solutions, BASF

CW: BASF has recently (July 2022) expanded automotive refinish coating capacity in Jiangmen. Has the facility with expanded capacity commenced commercial operations?Dr. Mirko Arnold: In 2016, BASF established its first production and R&D site for automotive refinish coatings of Asia Pacific in Jiangmen. Since then, we have consistently expanded our production capacity, with a 30% increase in 2022 alone. In February 2023, our new Application and Technical Centre for refinish coatings at our Jiangmen site completed civil work construction and will go live in early 2024.