Charles W. Thurston, Latin America Correspondent05.24.23

Latin America is a $5.73 trillion market, led by Brazil, Mexico, Argentina, Chile and Colombia, buoyed by a regional population of 650 million. Within that economy, the paint and coatings market across the region was estimated to be worth $10.2 billion in 2022, according to a recent report by Expert Market Research.

Growth of the industry over the mid term is expected to be fairly strong, as economies in the region continue to recover from the pandemic. “The market is assessed to grow at a compounded average growth rate (CAGR) of 2.8% during [the] 2023-2028 [period] to record a value of $11.9 billion by 2028,” the analysts predict.

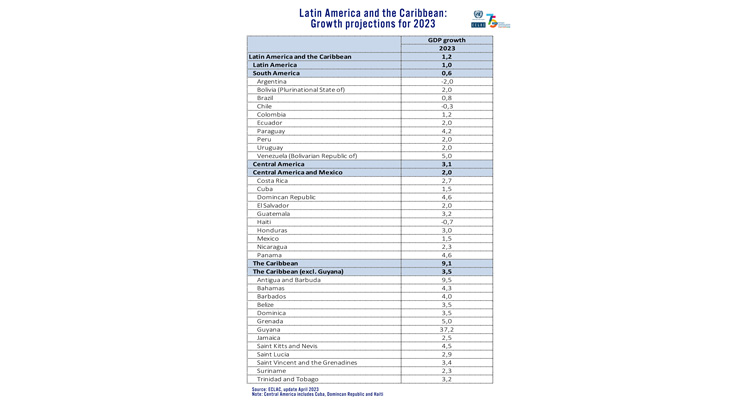

Within the region, the sub-regions of the Caribbean and Central America are seen to be growing faster than the large economies of South America, but not as fast as Mexico.

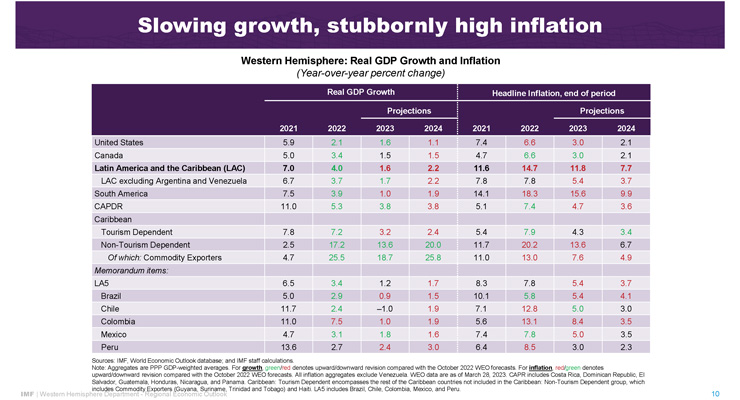

The expected growth rate of Caribbean and Central American nations is expected to double — at least — the growth rate for the United States this year, according to IMF. While U.S. gross domestic product (GDP) is expected to rise 1.6% this year, Central America’s combined GDP rate is expected to hit 3.8%, while the Caribbean combined GDP rate is expected to rise 3.2%.

The difference between U.S. and Latin American GDP growth rates will be even more stark in 2024, when the U.S. rate is predicted to slow to 1.1%, while varying sub-regions and countries in Latin America will either hold or accelerate their GDP growth rates, IMF suggests.

This relatively strong performance in Latin America points to the opportunities for expansion by paints and coatings manufacturers in the high-growth countries. While the average Latin American regional per capita GDP of about $8,300 lags the United States average of some $78,400, Latin America’s expanding middle class typically drives architectural paint consumption at a rate of almost double GDP.

Since more consumers in Latin America are entering the market, different grades of architectural paint are offered than in the United States. The economy, standard and premium paint grades often demonstrate different rates of growth in Latin America, depending on whether the overall economy is doing well, or poorly. Having three grades helps paint vendors balance total revenues more readily. Nonetheless, the trend toward higher quality paint is continuing, especially with the efforts of groups like Associação Brasileira dos Fabricantes de Tintas (Abrafati), the national paint and coatings manufacturers association, based in Sao Paulo.

Similarly, commercial/industrial products should rise as more housing, more commercial buildings and more infrastructure is developed. Direct foreign investment, governmental spending programs and multilateral loans are helping the region recovery and expand.

Mid-sized regional manufacturers like the Caribbean’s Berger, Harris, Lanco, Lee Wind, Penta, and Royal are likely to expand their multi-country footprint, expanding franchise and company store networks. Large manufacturers in the region, like Axalta, Benjamin Moore, PPG’s Mexico-based Comex, and Sherwin Williams are likely to continue to expand distribution networks even more aggressively.

S-W’s Latin America Division operates 307 paint stores in Uruguay, Brazil, Chile, Peru, Mexico and Ecuador. During 2022, The Americas Group opened 72 net new stores, consisting of 89 new stores opened (71 in the United States, 11 in Mexico, 6 in Canada and 1 in South America) and 17 stores closed (2 in the United States, 14 in South America and 1 in Mexico), the report states.

The largest regional manufacturer in Guyana is Harris Paints Guyana, part of the Barbados-based Harris Group with production facilities in six countries and 20 company-owned retail stores across 14 countries in the region. Harris Guyana has a network of about 50 company stores and franchises — including DIY and hardware stores — in the country.

Harris is part of the global Nova Paint Club consortium, a network which helps spread technology and facilitate raw materials acquisition, with a goal of facilitating competion with large multinationals.

Another Guyana paint manufacturer is Torginol Paints, part of the Continental Group of Companies, producing architectural, industrial and wood finishes under the Torga and Arbo brands. The demand for Torginol paints and coatings demand benefits from the client portfolio of HVAC-oriented Continental Group, based in Trinidad & Tobago, encompassing corporate, industrial and governmental customers.

While various multilateral banks are newly supporting Guyana’s economic expansion, one player not often seen in the region is already extending loans. The Islamic Development Bank has signed a $150 million Memorandum of Understanding (MOU) for housing and transportation projects, according to the Guyana Chronicle. A separate loan for $200 million will provide for highway construction, one goal of which is to open up builder access to new residential housing areas.

Paraguay voters recently elected 44-year-old Santiago Peña as president-elect, taking office in mid-August of this year. Peña, who studied at Columbia University, is a former member of the Board of Directors of the Central Bank of Paraguay, and former Minister of Finance.

The U.S. International Trade Administration (ITA) calls Paraguay a top prospect. “Construction equipment and materials are projected to keep rising as the government expands investment in public infrastructure projects to stimulate the economy after COVID-19. As the economy begins to recover from the effects of the pandemic and grow again, so will private sector demand for higher-quality construction materials, currently not locally available,” according to an October 2022 analysis.

Peña was elected on a promise to usher in economic recovery to the country of 7.2 million citizens. Housing is expected to be a major focus of the incoming administration, favoring national manufacturers of architectural paints and coatings, like Pintupar, in the market since 1978.

Pintupar, which manufactures in the capital of Asunción, offers a broad range of architectural and industrial paints and coatings, through a dozen brands. The company lists nearly 50 distributors in the country across a dozen regions.

Other analysts, like the World Bank see even faster growth in Central America this and next year. “The economy is projected to grow at 5.7 percent in 2023 and 5.8 percent in 2024,” the bank predicts. Over $450 million in Panama projects were approved by the World Bank in 2022.

Housing, hotels and other tourism infrastructure in Panama is expected to present substantial demand growth for paints and coatings. “After years of being misunderstood, Panama is perfectly poised for a luxury hospitality and real estate boom,” Forbes suggested in January.

Multinational and national paint manufacturers in Panama that will benefit from new investment in housing and tourism. PPG Industria Panamá manufactures in Panama, while multinationals with a store presence in the country include Axalta, Benjamin Moore, Lanco and Sherwin-Williams,

Among national companies in Panama are: General Paint Intl. Co/Arquitextura, Global Color, and Pinturas AYA. Pinturas AYA, based in Panama City, manufactures there and in Caracas, Venezuela. The company has a broad range of products including architectural, automotive, industrial and maritime products. Apart from stores, the company’s AYA brand products are widely distributed through DIY chains like ConstruMaxima.

Within the Caribbean, St. Vincent and the Grenadines (SVG) will lead growth this year at 6%, up from just over 5% last year, according to the IMF. In 2024, GDP expansion will slow only slightly to 4%, the fund predicts.

“Growth [in SVG] is projected to strengthen further in 2023 as large-scale construction projects get into full swing. External inflation pressures are expected to raise the annual inflation to 5.8% in 2022,” the IMF recently reported. Infrastructure and tourism are both expected to attract growing volumes of supplies.

Tourism will be key to the country’s economic growth. New hotels, like the first Marriott, with 150 rooms, being built in the capital of Kingston, will add to the demand from refurbished tourism facilities across the country’s nine inhabited islands, among the 32 islands and cays comprising the country.

Paints and coatings from many multinational and regional suppliers are available in SVG both through company stores like those of Trinidad-based Penta Paints, and through hardware chains like Ace Hardware.

In February of this year, Lula vowed to restart the federal housing program "Minha Casa, Minha Vida,” or My House, My Life, for lower income people. To begin, the program is expected to help complete a portfolio of 120,000 home projects that were stalled during prior construction and reconstruction. Overall, Brazil’s housing shortage is reported to be between 6 and 7 million units.

The Minha Casa program financed some 14.7 million home purchases during its first operational period between 2009 and 2018, according to statistics from Caixa Econômica Federal, the state-owned Brazilian financial services giant headquartered in Brasília (See CW 11/9/22).

The social program will help drive the demand for architectural products, which could help return growth to the segment. Brazil’s paint and coatings industry produced 1,647 billion liters of product in 2022, down 4% from the total of 1,715 billion liters in 2021, the industry’s peak year of production to date, according to recent statistics from Abrafati (See CW 3/1/23).

Prior to the pandemic, Abrafati estimated domestic production of paint and coatings at more than 1.5 billion liters per year, with an industry sales total close to $8 billion, reflecting an average per capita consumption of about seven liters (see CW 2/16/22).

An overwhelming 82.5% of the annual Brazilian production goes into architectural paints and coatings, followed by 11.2% for industrial paints and coatings, including white goods, transportation and auto parts. A total of 4.3% of the 2022 production was for after-market automotive painting, and 2.0% was for the OEM automotive industry, according to Abrafati.

Brazil’s automotive industry is the kingpin for South American car sales. Exports to the Southern Cone area are particularly strong. Among automotive paint manufacturers in Brazil is WEG Tintas, based in Guaramirim, Brazil, which produces some 1.7 million liters of coatings per month, including 2,300 tons of powder coatings monthly (See CW 7/29/22).

Overall, Mexico’s GDP is valued at $1.41 trillion, according to Statista, based on 2022 data. That translates into a per capita GDP of $9,926, the agency reports. The population of Mexico is now nearly 133 million, according to United Nations statistics.

Mexico’s Asociacion Nacional de Fabricantes de Pinturas y Tintas (Anafapyt), the national paint and coatings association, includes 80 member companies, from multinationals, to regionals, to national manufacturers and suppliers.

Within the automotive and industrial paint and coatings segment, growth is expected to be robust, according to market analysts MarkNTel. These segments together are expected to grow at a CAGR of close to 19% during the forecast period 2022 to 2027.

“The market growth ascribes primarily to massive investments in manufacturing vehicles and their components that have established new industrial facilities across Mexico and, in turn, has propelled the demand for industrial coatings in the country,” the MarkNTel analysts say.

This growth is being encouraged by the new nearshoring trend, MarkNTel notes. “Additionally, Mexico's Free Trade Agreements (FTAs) with the USA, Canada, and the European Union are encouraging several global players to set up their manufacturing units across the country a crucial aspect driving the market,” they say.

Nearshoring investments in Mexico are set to boom, many analysts predict. “Nearshoring will generate approximately $30 billion in Mexico by the end of 2022,” according to a recent statement by Sergio Arguelles, the president of Asociación Mexicana de Parques Industriales Privados (AMPIP), the Mexican association of private industrial parks.

Others agree. “Mexico has a golden opportunity in the form of nearshoring, as it could drive investments, exports, and overall economic growth, especially in the manufacturing sector,” according to a recent report by market analysts at Deloitte (See CW 12/21/22).

Some U.S.-Mexico analysts believe nearshoring will bring far more to Mexico over the long run: “According to financial analysts, over the next decade, between $60 billion and $150 billion could flow into Mexico as part of the efforts to move production closer to consumption centers,” Lourdes Melgar, a research affiliate for the Center for Collective Intelligence at MIT, writing for the Brookings Institute (see CW 4/11/23).

As evidence, Mexico became the world’s largest exporter of vehicles to the United States for the first time, in 2022, with exports to the United States worth about $35 billion, according to Mexico News Daily.

OEM demand for paint and coatings is the fastest growing segment of the Mexico market overall. “Mexico’s automobile production increased 2.38% in the month of January to 280,315 units, according to the Administrative Registry of the Light Vehicle Automotive Industry (RAIAVL),” reported Mexico News Daily in February.

“Light trucks represented 76.9% of that number, with the rest represented by passenger vehicles. Meanwhile, production of heavy vehicles (including tractor-trailer trucks and buses) grew 26% in January. The nation’s statistics agency INEGI reported that it was the highest figure in the first month of any year for that segment of Mexico’s automotive industry,” Mexico News Daily reported.

Apart from the massive demand from OEMs in Mexico, the refinish market is also strong. Axalta Mexico recently launched its next generation base coat technology Cromax Gen, which will be manufactured at Axalta’s Tlalnepantla, in the state of Mexico north of Mexico City, and at Ocoyoacac, which borders Mexico City.

The Argentina architectural coatings market size is projected to reach a value of $649 million by the end of 2027 after growing at a compound annual growth rate (CAGR) of around 4.5% during the five-year period between 2022 and 2027, according to a new study by IndustryARC.

Within the Argentine architectural market, AkzoNobel expects to grow at twice the general economy rate. “The expectation is that the market will remain tough for the next few years in terms of macro-economic drivers, but with the plans that we have to grow the category and our brands, we expect to do better than GDP by 2% to 4% in terms of volume,” says Fernando Domingues, the general business director for AkzoNobel Decorative Paints South Cone countries (see CW 4/26/23).

Similarly, market analyst GlobalData “expects Argentina’s construction industry to grow by 2.3% in real terms in 2023, following a growth of 3.2% in 2022, supported by the execution of major infrastructure projects.”

While the architectural segment is the largest in the country, and infrastructure projects will drive the industrial segment demand, automotive denabd is also predicted to expand over the near future.

“There is a growth projection in car production in Argentina for the next few years, according to IHS figures. This is primarily for Toyota, which is Axalta's main customer in the country and with which there is a contract to gain greater business volume,” says Jessica McDuell, director of external communications for Axalta.

“Following an agreement between Toyota Argentina and Axalta, we plan to have a small operations facility in Argentina to be able to supply Toyota locally,” says McDuell. “Due to the current challenging economic scenario in Argentina and some schedule delay to introduce new Axalta products, we don’t have an estimated date for this project at this moment,” she says.

However, “Axalta is currently running the approval process on two Toyota big runners colors (1G3 and 1L0) which should be launched by the end of 2023 or beginning 2024,” says McDuell.

Chile’s government hopes to keep growth positive this year. New investments in Chile include those of San Lorenzo, Puerto Rico-based Lanco Paint, which announced plans for a new manufacturing facility in the country two years ago. Today, Lanco has six distributors nationwide in Chile, including the Sodimac and Homecenter DIY chains.

Among multinational manufacturers in Chile are AkzoNobel, Huber, PPG and Sherwin-Williams. National manufacturers include Coatings Renner (a subsidiary of the Brazilian parent), Epothan, Fabrica de Cera Nativa, Novocolor, Pinturas Alemanas, Pinturas Color Chile, Pinturas Panoramica, and Prisma, according to Internet listings.

Colombia’s new socialist-oriented administration led by President Gustavo Petrois focusing on housing as a key goal. Over the next two years Colombia expects to see 500,000 new housing starts, a double-digit increase over prior years, the Camacol La Cámara Colombiana de la Construcción (Camacol), the national construction association, said in 2022.

“The main challenge in housing is to overcome the housing deficit and provide formal housing for the 1.6 million new households that will be formed in the years 2022-2026,” Camacol said. Over the first three months of this year, the construction industry expanded by nearly 3%, the association reported.

For others, the Colombian construction industry is predicted to grow much more substantially this year. In a February release, Research And Markets predicted that the sector will grow by 8.3% in 2023.

Supporting the demand for architectural paints and coatings in Colombia are multinational manufacturers AkzoNobel, Axalta and PPG. Among national manufacturers are Pinturas Ferro, Piinpol Static and Roha.

Akzo Nobel acquired Grupo Orbis, with consolidated revenue of around €360 million, in April 2022. The deal included Pintuco paints and coatings, Andercol and Poliquim, manufacturers of resins, emulsions, adhesives and specialty chemicals, along with the Mundial distribution business and the Centro de Servicios Mundial shared services center, according to AkzoNobel.

Pintuco is the Grupo Orbis flagship, operating in several Latin American regions including country operations in: Colombia; Ecuador; Venezuela; Curaçao; Aruba; Costa Rica; Panama; Honduras; El Salvador; Guatemala and Nicaragua, the company website indicates. Pintuco brands include Vinyltex, Koraza, Terinsa, ICO, Protecto, Fiesta, and Pintulux. The Pintuco portfolio consists of 75% decorative paints and 25% coatings.

Brazil now holds the rotating presidency of LatinPin, and Argentina and Mexico hold the vice presidency positions.

Among LatinPin’s primary campaigns is advocacy for legal limitations of lead content in paint. While many countries in the region have laws in place for some form of lead limits, others have dated legislation in place that is not stringent enough.

Another LatinPin project is a regional statistical database that could help member countries compare their environmental, production, quality, sales and other metrics.

Growth of the industry over the mid term is expected to be fairly strong, as economies in the region continue to recover from the pandemic. “The market is assessed to grow at a compounded average growth rate (CAGR) of 2.8% during [the] 2023-2028 [period] to record a value of $11.9 billion by 2028,” the analysts predict.

Stable Growth Across the Region

Latin America as a whole is expected to grow at a rate of 1.6% this year — equal to U.S. growth — following a 4.0% performance in 2022, according to a recent analysis by the International Monetary Fund (IMF).Within the region, the sub-regions of the Caribbean and Central America are seen to be growing faster than the large economies of South America, but not as fast as Mexico.

The expected growth rate of Caribbean and Central American nations is expected to double — at least — the growth rate for the United States this year, according to IMF. While U.S. gross domestic product (GDP) is expected to rise 1.6% this year, Central America’s combined GDP rate is expected to hit 3.8%, while the Caribbean combined GDP rate is expected to rise 3.2%.

The difference between U.S. and Latin American GDP growth rates will be even more stark in 2024, when the U.S. rate is predicted to slow to 1.1%, while varying sub-regions and countries in Latin America will either hold or accelerate their GDP growth rates, IMF suggests.

This relatively strong performance in Latin America points to the opportunities for expansion by paints and coatings manufacturers in the high-growth countries. While the average Latin American regional per capita GDP of about $8,300 lags the United States average of some $78,400, Latin America’s expanding middle class typically drives architectural paint consumption at a rate of almost double GDP.

Since more consumers in Latin America are entering the market, different grades of architectural paint are offered than in the United States. The economy, standard and premium paint grades often demonstrate different rates of growth in Latin America, depending on whether the overall economy is doing well, or poorly. Having three grades helps paint vendors balance total revenues more readily. Nonetheless, the trend toward higher quality paint is continuing, especially with the efforts of groups like Associação Brasileira dos Fabricantes de Tintas (Abrafati), the national paint and coatings manufacturers association, based in Sao Paulo.

Similarly, commercial/industrial products should rise as more housing, more commercial buildings and more infrastructure is developed. Direct foreign investment, governmental spending programs and multilateral loans are helping the region recovery and expand.

Mid-sized regional manufacturers like the Caribbean’s Berger, Harris, Lanco, Lee Wind, Penta, and Royal are likely to expand their multi-country footprint, expanding franchise and company store networks. Large manufacturers in the region, like Axalta, Benjamin Moore, PPG’s Mexico-based Comex, and Sherwin Williams are likely to continue to expand distribution networks even more aggressively.

Franchise and Company Store Count Rises

Sherwin-Williams (S-W) has one of the largest store networks in Latin America. The company’s Southeastern Division operates 1,171 paint stores principally covering the lower U.S. east and gulf coast states, along with Caribbean locations in Puerto Rico, Virgin Islands, Grenada, Trinidad and Tobago, St. Maarten, Jamaica, Curacao, Aruba, St. Lucia and Barbados, according to S-W’s 2022 annual report.S-W’s Latin America Division operates 307 paint stores in Uruguay, Brazil, Chile, Peru, Mexico and Ecuador. During 2022, The Americas Group opened 72 net new stores, consisting of 89 new stores opened (71 in the United States, 11 in Mexico, 6 in Canada and 1 in South America) and 17 stores closed (2 in the United States, 14 in South America and 1 in Mexico), the report states.

Runaway Growth in Guyana

The hot spot among all Latin American GDP rates is overwhelmingly Guyana, which, thanks to newly found and exploited oil and gas reserves, is expected to grow by over 37% this year, following an unheard-of 62% expansion performance in 2022. In 2024, Guyana is predicted to regain its GPD expansion pace, growing at over 45%, the IMF reckons.The largest regional manufacturer in Guyana is Harris Paints Guyana, part of the Barbados-based Harris Group with production facilities in six countries and 20 company-owned retail stores across 14 countries in the region. Harris Guyana has a network of about 50 company stores and franchises — including DIY and hardware stores — in the country.

Harris is part of the global Nova Paint Club consortium, a network which helps spread technology and facilitate raw materials acquisition, with a goal of facilitating competion with large multinationals.

Another Guyana paint manufacturer is Torginol Paints, part of the Continental Group of Companies, producing architectural, industrial and wood finishes under the Torga and Arbo brands. The demand for Torginol paints and coatings demand benefits from the client portfolio of HVAC-oriented Continental Group, based in Trinidad & Tobago, encompassing corporate, industrial and governmental customers.

While various multilateral banks are newly supporting Guyana’s economic expansion, one player not often seen in the region is already extending loans. The Islamic Development Bank has signed a $150 million Memorandum of Understanding (MOU) for housing and transportation projects, according to the Guyana Chronicle. A separate loan for $200 million will provide for highway construction, one goal of which is to open up builder access to new residential housing areas.

Paraguay to Lead South American Growth

Among the 10 South American countries, Paraguay will lead sub-regional growth this year with a 4.5% GDP expansion followed by 3.5% growth next year, according to the IMF. The sub-region as a whole will have a combined 1% growth rate in 2023, and a 1.9% growth rate in 2024, the fund predicts.Paraguay voters recently elected 44-year-old Santiago Peña as president-elect, taking office in mid-August of this year. Peña, who studied at Columbia University, is a former member of the Board of Directors of the Central Bank of Paraguay, and former Minister of Finance.

The U.S. International Trade Administration (ITA) calls Paraguay a top prospect. “Construction equipment and materials are projected to keep rising as the government expands investment in public infrastructure projects to stimulate the economy after COVID-19. As the economy begins to recover from the effects of the pandemic and grow again, so will private sector demand for higher-quality construction materials, currently not locally available,” according to an October 2022 analysis.

Peña was elected on a promise to usher in economic recovery to the country of 7.2 million citizens. Housing is expected to be a major focus of the incoming administration, favoring national manufacturers of architectural paints and coatings, like Pintupar, in the market since 1978.

Pintupar, which manufactures in the capital of Asunción, offers a broad range of architectural and industrial paints and coatings, through a dozen brands. The company lists nearly 50 distributors in the country across a dozen regions.

Panama Leads Central American Growth

Among the six Central American countries, Panama is expected to have the highest GDP rise this year at 5.0%, followed by 4% in 2024, according to the IMF. These rates contrast with the 10% acceleration in 2022, and 15% growth in 2021, the fund notes.Other analysts, like the World Bank see even faster growth in Central America this and next year. “The economy is projected to grow at 5.7 percent in 2023 and 5.8 percent in 2024,” the bank predicts. Over $450 million in Panama projects were approved by the World Bank in 2022.

Housing, hotels and other tourism infrastructure in Panama is expected to present substantial demand growth for paints and coatings. “After years of being misunderstood, Panama is perfectly poised for a luxury hospitality and real estate boom,” Forbes suggested in January.

Multinational and national paint manufacturers in Panama that will benefit from new investment in housing and tourism. PPG Industria Panamá manufactures in Panama, while multinationals with a store presence in the country include Axalta, Benjamin Moore, Lanco and Sherwin-Williams,

Among national companies in Panama are: General Paint Intl. Co/Arquitextura, Global Color, and Pinturas AYA. Pinturas AYA, based in Panama City, manufactures there and in Caracas, Venezuela. The company has a broad range of products including architectural, automotive, industrial and maritime products. Apart from stores, the company’s AYA brand products are widely distributed through DIY chains like ConstruMaxima.

St. Vincent and the Grenadines Lead Caribbean Growth

Within the Caribbean, St. Vincent and the Grenadines (SVG) will lead growth this year at 6%, up from just over 5% last year, according to the IMF. In 2024, GDP expansion will slow only slightly to 4%, the fund predicts.

“Growth [in SVG] is projected to strengthen further in 2023 as large-scale construction projects get into full swing. External inflation pressures are expected to raise the annual inflation to 5.8% in 2022,” the IMF recently reported. Infrastructure and tourism are both expected to attract growing volumes of supplies.

Tourism will be key to the country’s economic growth. New hotels, like the first Marriott, with 150 rooms, being built in the capital of Kingston, will add to the demand from refurbished tourism facilities across the country’s nine inhabited islands, among the 32 islands and cays comprising the country.

Paints and coatings from many multinational and regional suppliers are available in SVG both through company stores like those of Trinidad-based Penta Paints, and through hardware chains like Ace Hardware.

Major Economies Demonstrate Slow Growth

The major economies of Latin America as a whole are not expected to show growth expansion beyond 1% in South America, and 1.8% in Mexico this year, the IMF suggests. A synopsis of the growth among the top five follow, listed by total market size:Brazil Renews Housing Commitment

Brazil is the largest economy in Latin America, and the cornerstone of trade among the Southern Cone sub-region, comprising Brazil, Argentina, Chile and Uruguay. Brazil’s new left-leaning president Luis da Silva, also known as Lula, was re-elected this year after a long hiatus, and his goals include the continuation and expansion of social infrastructure under programs he began in 2009 during his first term.In February of this year, Lula vowed to restart the federal housing program "Minha Casa, Minha Vida,” or My House, My Life, for lower income people. To begin, the program is expected to help complete a portfolio of 120,000 home projects that were stalled during prior construction and reconstruction. Overall, Brazil’s housing shortage is reported to be between 6 and 7 million units.

The Minha Casa program financed some 14.7 million home purchases during its first operational period between 2009 and 2018, according to statistics from Caixa Econômica Federal, the state-owned Brazilian financial services giant headquartered in Brasília (See CW 11/9/22).

The social program will help drive the demand for architectural products, which could help return growth to the segment. Brazil’s paint and coatings industry produced 1,647 billion liters of product in 2022, down 4% from the total of 1,715 billion liters in 2021, the industry’s peak year of production to date, according to recent statistics from Abrafati (See CW 3/1/23).

Prior to the pandemic, Abrafati estimated domestic production of paint and coatings at more than 1.5 billion liters per year, with an industry sales total close to $8 billion, reflecting an average per capita consumption of about seven liters (see CW 2/16/22).

An overwhelming 82.5% of the annual Brazilian production goes into architectural paints and coatings, followed by 11.2% for industrial paints and coatings, including white goods, transportation and auto parts. A total of 4.3% of the 2022 production was for after-market automotive painting, and 2.0% was for the OEM automotive industry, according to Abrafati.

Brazil’s automotive industry is the kingpin for South American car sales. Exports to the Southern Cone area are particularly strong. Among automotive paint manufacturers in Brazil is WEG Tintas, based in Guaramirim, Brazil, which produces some 1.7 million liters of coatings per month, including 2,300 tons of powder coatings monthly (See CW 7/29/22).

Mexico Grows on Good U.S. Neighbor Status

Mexico continues to be the most important economy in Latin America from the U.S. perspective. The economy is expected to grow by 1.8% this year, following a 3.1% performance last year, according to IMF statistics. Growth in 2024 will slow only slightly to 1.6%, the fund says.Overall, Mexico’s GDP is valued at $1.41 trillion, according to Statista, based on 2022 data. That translates into a per capita GDP of $9,926, the agency reports. The population of Mexico is now nearly 133 million, according to United Nations statistics.

Mexico’s Asociacion Nacional de Fabricantes de Pinturas y Tintas (Anafapyt), the national paint and coatings association, includes 80 member companies, from multinationals, to regionals, to national manufacturers and suppliers.

Within the automotive and industrial paint and coatings segment, growth is expected to be robust, according to market analysts MarkNTel. These segments together are expected to grow at a CAGR of close to 19% during the forecast period 2022 to 2027.

“The market growth ascribes primarily to massive investments in manufacturing vehicles and their components that have established new industrial facilities across Mexico and, in turn, has propelled the demand for industrial coatings in the country,” the MarkNTel analysts say.

This growth is being encouraged by the new nearshoring trend, MarkNTel notes. “Additionally, Mexico's Free Trade Agreements (FTAs) with the USA, Canada, and the European Union are encouraging several global players to set up their manufacturing units across the country a crucial aspect driving the market,” they say.

Nearshoring investments in Mexico are set to boom, many analysts predict. “Nearshoring will generate approximately $30 billion in Mexico by the end of 2022,” according to a recent statement by Sergio Arguelles, the president of Asociación Mexicana de Parques Industriales Privados (AMPIP), the Mexican association of private industrial parks.

Others agree. “Mexico has a golden opportunity in the form of nearshoring, as it could drive investments, exports, and overall economic growth, especially in the manufacturing sector,” according to a recent report by market analysts at Deloitte (See CW 12/21/22).

Some U.S.-Mexico analysts believe nearshoring will bring far more to Mexico over the long run: “According to financial analysts, over the next decade, between $60 billion and $150 billion could flow into Mexico as part of the efforts to move production closer to consumption centers,” Lourdes Melgar, a research affiliate for the Center for Collective Intelligence at MIT, writing for the Brookings Institute (see CW 4/11/23).

As evidence, Mexico became the world’s largest exporter of vehicles to the United States for the first time, in 2022, with exports to the United States worth about $35 billion, according to Mexico News Daily.

OEM demand for paint and coatings is the fastest growing segment of the Mexico market overall. “Mexico’s automobile production increased 2.38% in the month of January to 280,315 units, according to the Administrative Registry of the Light Vehicle Automotive Industry (RAIAVL),” reported Mexico News Daily in February.

“Light trucks represented 76.9% of that number, with the rest represented by passenger vehicles. Meanwhile, production of heavy vehicles (including tractor-trailer trucks and buses) grew 26% in January. The nation’s statistics agency INEGI reported that it was the highest figure in the first month of any year for that segment of Mexico’s automotive industry,” Mexico News Daily reported.

Apart from the massive demand from OEMs in Mexico, the refinish market is also strong. Axalta Mexico recently launched its next generation base coat technology Cromax Gen, which will be manufactured at Axalta’s Tlalnepantla, in the state of Mexico north of Mexico City, and at Ocoyoacac, which borders Mexico City.

Argentina Bears Inflationary Weight

Despite the crushing 100%-plus inflation rate in Argentina, major manufacturers are moving forward with plans for both the short and mid terms.The Argentina architectural coatings market size is projected to reach a value of $649 million by the end of 2027 after growing at a compound annual growth rate (CAGR) of around 4.5% during the five-year period between 2022 and 2027, according to a new study by IndustryARC.

Within the Argentine architectural market, AkzoNobel expects to grow at twice the general economy rate. “The expectation is that the market will remain tough for the next few years in terms of macro-economic drivers, but with the plans that we have to grow the category and our brands, we expect to do better than GDP by 2% to 4% in terms of volume,” says Fernando Domingues, the general business director for AkzoNobel Decorative Paints South Cone countries (see CW 4/26/23).

Similarly, market analyst GlobalData “expects Argentina’s construction industry to grow by 2.3% in real terms in 2023, following a growth of 3.2% in 2022, supported by the execution of major infrastructure projects.”

While the architectural segment is the largest in the country, and infrastructure projects will drive the industrial segment demand, automotive denabd is also predicted to expand over the near future.

“There is a growth projection in car production in Argentina for the next few years, according to IHS figures. This is primarily for Toyota, which is Axalta's main customer in the country and with which there is a contract to gain greater business volume,” says Jessica McDuell, director of external communications for Axalta.

“Following an agreement between Toyota Argentina and Axalta, we plan to have a small operations facility in Argentina to be able to supply Toyota locally,” says McDuell. “Due to the current challenging economic scenario in Argentina and some schedule delay to introduce new Axalta products, we don’t have an estimated date for this project at this moment,” she says.

However, “Axalta is currently running the approval process on two Toyota big runners colors (1G3 and 1L0) which should be launched by the end of 2023 or beginning 2024,” says McDuell.

Chile

As the third largest economy in Latin America, Chile’s paint and coatings industry is expanding despite the slowing GDP pace. This year, Chile’s economy is expected to contract by 1%, following a 2.4% expansion last year, according the the IMF. Next year, however, GDP is predicted to recover to a 1.9% growth rate, the institution suggests.Chile’s government hopes to keep growth positive this year. New investments in Chile include those of San Lorenzo, Puerto Rico-based Lanco Paint, which announced plans for a new manufacturing facility in the country two years ago. Today, Lanco has six distributors nationwide in Chile, including the Sodimac and Homecenter DIY chains.

Among multinational manufacturers in Chile are AkzoNobel, Huber, PPG and Sherwin-Williams. National manufacturers include Coatings Renner (a subsidiary of the Brazilian parent), Epothan, Fabrica de Cera Nativa, Novocolor, Pinturas Alemanas, Pinturas Color Chile, Pinturas Panoramica, and Prisma, according to Internet listings.

Colombia

Colombia’s economy, the fifth-largest in Latin America, has slowed to an expected 1% this year, following a strong 7.5% GDP advance in 2022 as the country recovered from the pandemic. GDP in Colombia should accelerate in 2024 to 1.9%, the IMF predicts.Colombia’s new socialist-oriented administration led by President Gustavo Petrois focusing on housing as a key goal. Over the next two years Colombia expects to see 500,000 new housing starts, a double-digit increase over prior years, the Camacol La Cámara Colombiana de la Construcción (Camacol), the national construction association, said in 2022.

“The main challenge in housing is to overcome the housing deficit and provide formal housing for the 1.6 million new households that will be formed in the years 2022-2026,” Camacol said. Over the first three months of this year, the construction industry expanded by nearly 3%, the association reported.

For others, the Colombian construction industry is predicted to grow much more substantially this year. In a February release, Research And Markets predicted that the sector will grow by 8.3% in 2023.

Supporting the demand for architectural paints and coatings in Colombia are multinational manufacturers AkzoNobel, Axalta and PPG. Among national manufacturers are Pinturas Ferro, Piinpol Static and Roha.

Akzo Nobel acquired Grupo Orbis, with consolidated revenue of around €360 million, in April 2022. The deal included Pintuco paints and coatings, Andercol and Poliquim, manufacturers of resins, emulsions, adhesives and specialty chemicals, along with the Mundial distribution business and the Centro de Servicios Mundial shared services center, according to AkzoNobel.

Pintuco is the Grupo Orbis flagship, operating in several Latin American regions including country operations in: Colombia; Ecuador; Venezuela; Curaçao; Aruba; Costa Rica; Panama; Honduras; El Salvador; Guatemala and Nicaragua, the company website indicates. Pintuco brands include Vinyltex, Koraza, Terinsa, ICO, Protecto, Fiesta, and Pintulux. The Pintuco portfolio consists of 75% decorative paints and 25% coatings.

LatinPin Unites Regional Paint Associations

The regional federation of paint and coatings manufacturers, La Federación Latinoamericana de Asociaciones de Técnicos y Fabricantes de Pinturas y Tintas (LatinPin), currently includes national associations from Argentina, Bolivia, Brasil, Colombia, Ecuador, México and Uruguay.Brazil now holds the rotating presidency of LatinPin, and Argentina and Mexico hold the vice presidency positions.

Among LatinPin’s primary campaigns is advocacy for legal limitations of lead content in paint. While many countries in the region have laws in place for some form of lead limits, others have dated legislation in place that is not stringent enough.

Another LatinPin project is a regional statistical database that could help member countries compare their environmental, production, quality, sales and other metrics.