Douglas Bohn, Orr & Boss Consulting, Inc.08.30.23

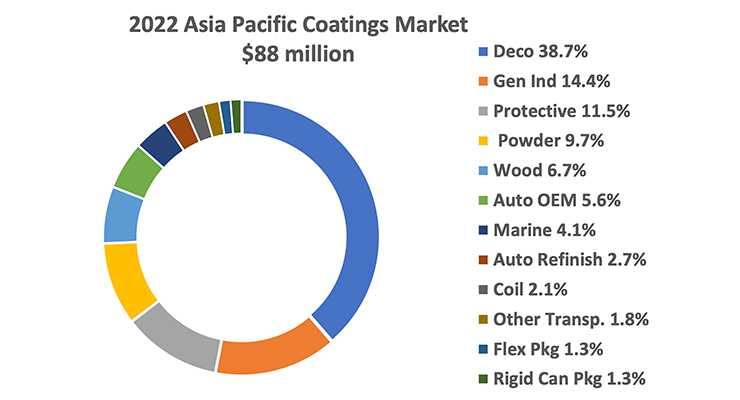

The 2023 Asia Pacific paint and coatings market is estimated to be 27 billion liters and $88 billion. As in other regions of the world, decorative or architectural coatings is the largest segment of the market. Decorative is an estimated 38.7% of the market. The other large segments include General Industrial, Protective, Powder, and Industrial Wood.

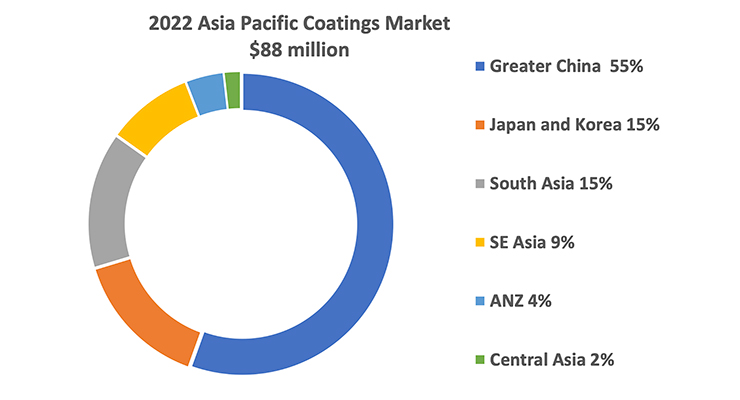

Greater China is the largest geographic sub-region of the Asia Pacific coatings market at 55%. Japan & Korea is the next largest region at 15% (Japan is an estimated 10% of the market and South Korea is 5% of the market). South Asia is also 15% of the market. South Asia includes India, Pakistan, Bangladesh, Nepal, Sri Lanka, Bhutan and the Maldives but is mostly India.

In recent years, this has been the strongest growing region in the world due mainly to strong growth in the India market. In fact, India has surpassed Japan as the second largest paint and coatings market in Asia and continues to be the fastest growing major country market in the world. Within India, both the decorative and industrial coatings segments are growing fast. Southeast Asia is the next largest market in Asia at an estimated 9% of the market. Australia and New Zealand and Central Asia are the smallest regions of the Asia Pacific paint and coatings market.

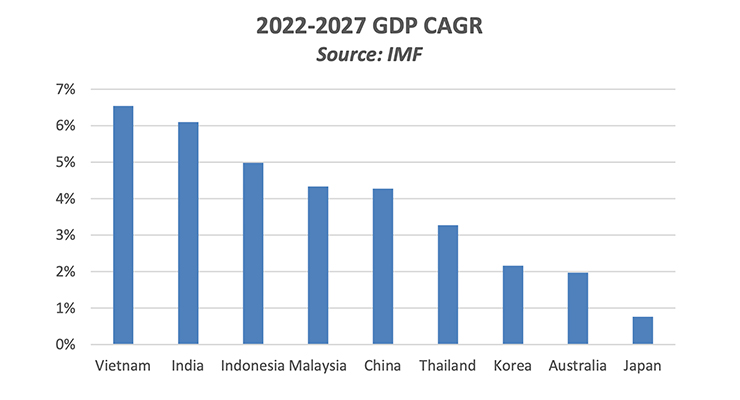

The underlying reason for the relative optimism is that the GDP growth rates are still projected to be much higher than other regions of the world. Figure 3 shows expected GDP growth rates of some of the major Asia Pacific countries from the latest IMF World Economic Outlook publication (published in April, 2023).

Vietnam and India GDP are forecasted to grow at a CAGR above 6%. Indonesia is also expected to grow at a relatively high rate. In a given year, the coatings market growth does not always correlate with GDP growth but over longer periods of time, there is a correlation with growth. In fact, in many of these countries the paint and coatings market will grow faster than GDP due to demographic trends that include a growing population, a younger population and urbanization.

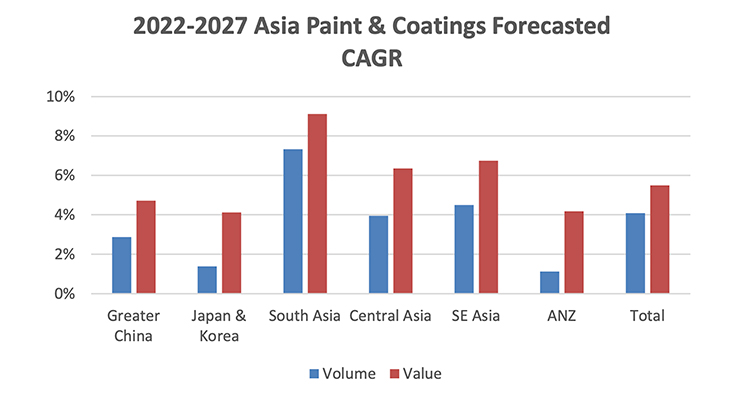

All of these trends are favorable in many of these countries. For these reasons, we do expect the coatings market to continue to perform well in these countries going forward. shows the growth rates in each of these markets. As can be seen, we expect South Asia and Southeast Asia to be the market leaders in the paint and coatings market; this matches up with the GDP growth figures cited earlier.

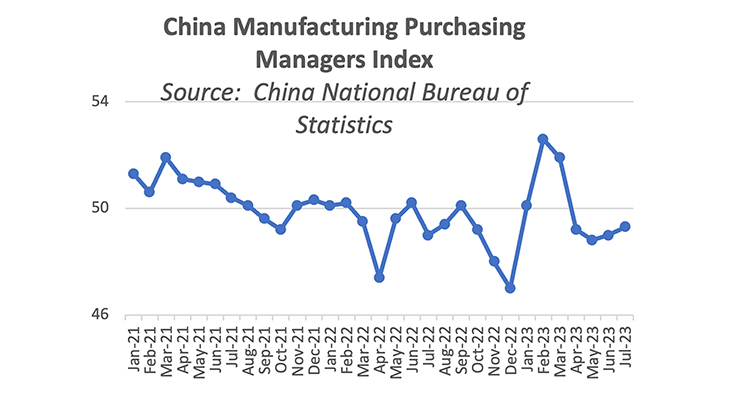

As noted above, one of the short-term challenges is that the Chinese coatings market is not rebounding quite as fast as previously thought. After an initial rebound in Q1 of this year, the Chinese economy has struggled. The real estate market is having trouble. Also, manufacturing is not returning as fast as previously thought. Figure 5 gives the Manufacturing Purchasing Managers Index in China as published by the National Bureau of Statistics. A value of above 50 means industrial activity is expanding with one below 50 indicating contraction. After rebounding in Q1 with three straight readings above 50, the index has been below 50 for the last four months, indicating that manufacturing activity is contracting.

The other major trend impacting all markets globally is the sustainability trend. Consumers and companies alike are looking to become more sustainable and environmentally friendly. This is helping propel growth in powder coatings, radiation cured coatings, and other environmentally friendly paint and coatings products.

Another trend is that infrastructure spending is relatively high across the region. Thus, civil construction projects are growing at relatively high rates. This would include any project related to green energy so coatings for windmills and solar panels are benefitting.

Finally, there is a trend towards on-shoring and near-shoring. The Covid pandemic exposed the fragility of the global supply chain. Manufacturing companies are moving production to various countries to avoid being reliant on one country. Within Asia, India and Vietnam are benefitting from this trend. Outside of Asia, Mexico is also benefitting from this trend.

Greater China is the largest geographic sub-region of the Asia Pacific coatings market at 55%. Japan & Korea is the next largest region at 15% (Japan is an estimated 10% of the market and South Korea is 5% of the market). South Asia is also 15% of the market. South Asia includes India, Pakistan, Bangladesh, Nepal, Sri Lanka, Bhutan and the Maldives but is mostly India.

In recent years, this has been the strongest growing region in the world due mainly to strong growth in the India market. In fact, India has surpassed Japan as the second largest paint and coatings market in Asia and continues to be the fastest growing major country market in the world. Within India, both the decorative and industrial coatings segments are growing fast. Southeast Asia is the next largest market in Asia at an estimated 9% of the market. Australia and New Zealand and Central Asia are the smallest regions of the Asia Pacific paint and coatings market.

Growth Rate

Going forward, we expect the Asia Pacific paint and coatings market to grow at above the global average rates. There are some near-term headwinds occurring in Asia that will limit that growth this year and possibly next year. These headwinds include a slowing economy in China as well as continued high inflation and high interest rates, which is suppressing building and construction activity and thus demand for paint and coatings. Despite these near-term headwinds we remain relatively optimistic about the future of the paint and coatings industry in Asia Pacific.The underlying reason for the relative optimism is that the GDP growth rates are still projected to be much higher than other regions of the world. Figure 3 shows expected GDP growth rates of some of the major Asia Pacific countries from the latest IMF World Economic Outlook publication (published in April, 2023).

Vietnam and India GDP are forecasted to grow at a CAGR above 6%. Indonesia is also expected to grow at a relatively high rate. In a given year, the coatings market growth does not always correlate with GDP growth but over longer periods of time, there is a correlation with growth. In fact, in many of these countries the paint and coatings market will grow faster than GDP due to demographic trends that include a growing population, a younger population and urbanization.

All of these trends are favorable in many of these countries. For these reasons, we do expect the coatings market to continue to perform well in these countries going forward. shows the growth rates in each of these markets. As can be seen, we expect South Asia and Southeast Asia to be the market leaders in the paint and coatings market; this matches up with the GDP growth figures cited earlier.

As noted above, one of the short-term challenges is that the Chinese coatings market is not rebounding quite as fast as previously thought. After an initial rebound in Q1 of this year, the Chinese economy has struggled. The real estate market is having trouble. Also, manufacturing is not returning as fast as previously thought. Figure 5 gives the Manufacturing Purchasing Managers Index in China as published by the National Bureau of Statistics. A value of above 50 means industrial activity is expanding with one below 50 indicating contraction. After rebounding in Q1 with three straight readings above 50, the index has been below 50 for the last four months, indicating that manufacturing activity is contracting.

Trends

Many of the trends impacting the Asian paint and coatings markets are similar to those impacting other geographic markets around the world. First, continued inflation and relatively high interest rates have led to decreased building and construction activity in many countries of Asia. A decrease in building and construction activity results in lower demand for decorative as well as coil, wood and even some general industrial and powder sub-segments.The other major trend impacting all markets globally is the sustainability trend. Consumers and companies alike are looking to become more sustainable and environmentally friendly. This is helping propel growth in powder coatings, radiation cured coatings, and other environmentally friendly paint and coatings products.

Another trend is that infrastructure spending is relatively high across the region. Thus, civil construction projects are growing at relatively high rates. This would include any project related to green energy so coatings for windmills and solar panels are benefitting.

Finally, there is a trend towards on-shoring and near-shoring. The Covid pandemic exposed the fragility of the global supply chain. Manufacturing companies are moving production to various countries to avoid being reliant on one country. Within Asia, India and Vietnam are benefitting from this trend. Outside of Asia, Mexico is also benefitting from this trend.