09.07.16

Valspar has released its fiscal third quarter 2016 results. Highlights of the report include:

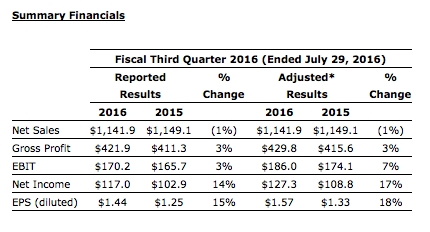

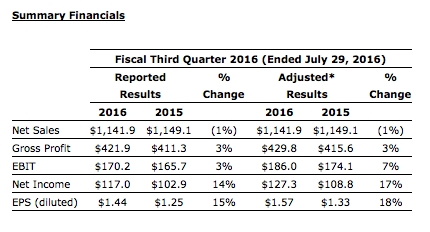

Notes on Net Sales and Volume: Acquisitions added 2% to net sales and 1% to volume for fiscal Q3 2016 (2% and 2% respectively for fiscal Q3 2015). Foreign currency translation negatively impacted net sales by 2% for fiscal Q3 2016 (5% for fiscal Q3 2015).

* Adjusted Results exclude certain items which are detailed in the “Reconciliation of Non-GAAP Financial Measures” included in this release. In addition to restructuring and other charges, the excluded items in fiscal Q3 2016 include $5 million of pre-tax costs incurred in connection with the proposed merger with The Sherwin-Williams Company.

“In the third quarter, adjusted EBIT increased 7 percent and adjusted EPS grew 18 percent. These results were highlighted by volume growth, new business wins across the portfolio and effective cost management. Coatings segment performance was led by strong volume growth in the Coil and Wood product lines. In the Paints segment, volumes grew 3 percent led by each of our International regions, and EBIT increased 28 percent,” said Gary E. Hendrickson, chairman and chief executive officer.

Fiscal third quarter 2016 net sales in the Coatings segment decreased 1 percent to $631 million. This includes the effects of foreign currency translation that negatively impacted net sales by 3 percent. Acquisitions added 1 percent to net sales in the quarter. Volumes increased 1 percent in the fiscal third quarter of 2016. Acquisitions added 1 percent to volume in the quarter. Coatings segment EBIT of $126 million increased 8 percent. Adjusted EBIT of $127 million increased 6 percent, primarily driven by benefits from productivity initiatives. Adjusted EBIT as a percent of net sales increased to 20.1% from 18.7% in the prior year.

Fiscal third quarter 2016 net sales of $445 million in the Paints segment increased slightly compared to the prior year. This includes the effects of foreign currency translation that negatively impacted net sales by 2 percent. Acquisitions added 4 percent to net sales in the quarter. Volume increased 3 percent in the fiscal third quarter of 2016. Acquisitions added 2 percent to volume in the quarter. Paints segment EBIT of $59 million increased 28 percent. Paints segment adjusted EBIT of $68 million increased 30 percent, driven by the benefits from productivity initiatives and the impact of the Quest acquisition. Adjusted EBIT as a percent of net sales increased to 15.2% from 11.7% in the prior year.

During the quarter, the company paid a quarterly dividend of $0.33 per common share outstanding, or $26 million. Valspar is a member of the S&P High Yield Dividend Aristocrats, which is comprised of companies increasing dividends every year for at least 20 consecutive years.

- Reported diluted EPS of $1.44 (includes pre-tax merger related costs of $5 million)

- Adjusted diluted EPS increased 18% to $1.57

- Total volumes increased 2%, Paints segment volume up 3%, Coatings segment up 1%

- Net sales declined 1% (includes a negative 2% impact from F/X translation)

- Reported earnings before interest and taxes (EBIT) increased 3%

- Adjusted EBIT increased 7% (Adjusted EBIT margin rate up 114 bps)

* Adjusted Results exclude certain items which are detailed in the “Reconciliation of Non-GAAP Financial Measures” included in this release. In addition to restructuring and other charges, the excluded items in fiscal Q3 2016 include $5 million of pre-tax costs incurred in connection with the proposed merger with The Sherwin-Williams Company.

“In the third quarter, adjusted EBIT increased 7 percent and adjusted EPS grew 18 percent. These results were highlighted by volume growth, new business wins across the portfolio and effective cost management. Coatings segment performance was led by strong volume growth in the Coil and Wood product lines. In the Paints segment, volumes grew 3 percent led by each of our International regions, and EBIT increased 28 percent,” said Gary E. Hendrickson, chairman and chief executive officer.

Fiscal third quarter 2016 net sales in the Coatings segment decreased 1 percent to $631 million. This includes the effects of foreign currency translation that negatively impacted net sales by 3 percent. Acquisitions added 1 percent to net sales in the quarter. Volumes increased 1 percent in the fiscal third quarter of 2016. Acquisitions added 1 percent to volume in the quarter. Coatings segment EBIT of $126 million increased 8 percent. Adjusted EBIT of $127 million increased 6 percent, primarily driven by benefits from productivity initiatives. Adjusted EBIT as a percent of net sales increased to 20.1% from 18.7% in the prior year.

Fiscal third quarter 2016 net sales of $445 million in the Paints segment increased slightly compared to the prior year. This includes the effects of foreign currency translation that negatively impacted net sales by 2 percent. Acquisitions added 4 percent to net sales in the quarter. Volume increased 3 percent in the fiscal third quarter of 2016. Acquisitions added 2 percent to volume in the quarter. Paints segment EBIT of $59 million increased 28 percent. Paints segment adjusted EBIT of $68 million increased 30 percent, driven by the benefits from productivity initiatives and the impact of the Quest acquisition. Adjusted EBIT as a percent of net sales increased to 15.2% from 11.7% in the prior year.

During the quarter, the company paid a quarterly dividend of $0.33 per common share outstanding, or $26 million. Valspar is a member of the S&P High Yield Dividend Aristocrats, which is comprised of companies increasing dividends every year for at least 20 consecutive years.