11.22.17

Axalta (AXTA: Buy, $37 PT)

No “Akzalta” But Nippon Paint Thickens the Plot

• Nippon Paint reportedly enters the fray as Akzo M&A talks are terminated. After the close of trading on Tuesday, Akzo and Axalta confirmed via separate press releases that the companies were unable to agree on terms for a merger of equals (MOE) transaction between the companies. In after-hours action, AXTA shares traded off briefly, then resurged when Reuters reported that Nippon Paint (Japan) made an undisclosed all-cash offer for Axalta that exceeded Axalta’s closing price of $33.54 on 20 November. Our take: we suspect that Nippon Paint made an offer that was sufficiently attractive to Axalta for the company’s board of directors to recommend disengaging with Akzo, at least for the time being.

• We reckon AXTA could be worth $46 in a straight takeout scenario. With potential interest from multiple counterparties, we would expect AXTA shares to respond favorably during Wednesday’s pre-Thanksgiving holiday session, although upside may be tempered somewhat by the 17.0% surge that AXTA shares enjoyed on 27 October when news of MOE talks with Akzo first broke. In our recent upgrade of Axalta (click here), we estimated that AXTA shares could trade as high as $40.53 in an “Akzalta” MOE scenario under certain conditions, including a combined company that was run by Axalta management. However, a straight takeout could...

• Financing is a bit of a mystery. Our preliminary view of the two companies’ portfolios and geographic footprints suggest that a combination between Axalta and Nippon Paint would be quite manageable from an anti-trust perspective. The financial angles are less clear to us though. While we do not cover Nippon Paint, the company’s equity market capitalization is US$10.7bn or only 29% larger than that of Axalta at today’s closing price. While Nippon Paint enjoys a net cash positive balance sheet, a pro forma combined EBITDA base of $2.0bn would suggest debt capacity of perhaps $8bn, or incremental debt capacity of...

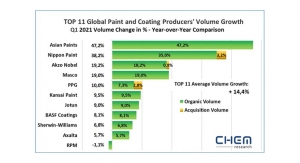

• Coatings industry consolidation: could it be the big four? A tie-up between Axalta and Nippon Paint would clearly confirm the latter’s strategic intention to “go global”. If consummated, the deal would create a top-tier global player with 2017 pro forma sales of $9.3bn and EBITDA of nearly $2bn, making Nippon Paint (assuming that name survives) the fourth largest coatings producer in the world behind Sherwin-Williams, PPG Industries and Akzo as shown in Figure 2. In this “big four” scenario, Sherwin and Nippon would likely be digesting large M&A meals over the next two years, while PPG evaluates options for...

• Nippon Paint has been acquisitive lately with a stated ambition to go global. By way of background, Nippon Paint operates more than 30 manufacturing plants throughout Asia, serving the markets for architectural, automotive, industrial and marine coatings. In March 2017 Nippon Paint acquired Dunn Edwards, a manufacturer of architectural and other coatings in the southwestern US, giving Nippon a foothold in the US market. While the purchase price was undisclosed at the time, a subsequent presentation by Nippon Paint revealed the price to be…

• We recently raised our target to $37 on rising propensity for M&A. Our existing price target, which was probability-weighted for Akzo MOE scenarios, implies total return potential of 9% from current levels (AXTA shares do not currently pay a dividend), but rising probability of a new entrant in Nippon could render that level quite conservative as per our takeout math in Figure 1. Given Axalta’s elevated exposure to autos, pockets of price and volume pressure across the portfolio, and somewhat diminished balance sheet flexibility, we feel that valuation is fair at $29-30 per share absent M&A-related optionality. As a reminder, our base-case valuation of AXTA is predicated upon on an average of two methodologies: DCF analysis and a relative P/E framework. Our DCF analysis suggests a warranted stock price of $30. Using our relative P/E framework wherein we apply a 15% premium to the S&P500 multiple, we calculate warranted value of $27 per AXTA share.

(Please see full report for details)

No “Akzalta” But Nippon Paint Thickens the Plot

• Nippon Paint reportedly enters the fray as Akzo M&A talks are terminated. After the close of trading on Tuesday, Akzo and Axalta confirmed via separate press releases that the companies were unable to agree on terms for a merger of equals (MOE) transaction between the companies. In after-hours action, AXTA shares traded off briefly, then resurged when Reuters reported that Nippon Paint (Japan) made an undisclosed all-cash offer for Axalta that exceeded Axalta’s closing price of $33.54 on 20 November. Our take: we suspect that Nippon Paint made an offer that was sufficiently attractive to Axalta for the company’s board of directors to recommend disengaging with Akzo, at least for the time being.

• We reckon AXTA could be worth $46 in a straight takeout scenario. With potential interest from multiple counterparties, we would expect AXTA shares to respond favorably during Wednesday’s pre-Thanksgiving holiday session, although upside may be tempered somewhat by the 17.0% surge that AXTA shares enjoyed on 27 October when news of MOE talks with Akzo first broke. In our recent upgrade of Axalta (click here), we estimated that AXTA shares could trade as high as $40.53 in an “Akzalta” MOE scenario under certain conditions, including a combined company that was run by Axalta management. However, a straight takeout could...

• Financing is a bit of a mystery. Our preliminary view of the two companies’ portfolios and geographic footprints suggest that a combination between Axalta and Nippon Paint would be quite manageable from an anti-trust perspective. The financial angles are less clear to us though. While we do not cover Nippon Paint, the company’s equity market capitalization is US$10.7bn or only 29% larger than that of Axalta at today’s closing price. While Nippon Paint enjoys a net cash positive balance sheet, a pro forma combined EBITDA base of $2.0bn would suggest debt capacity of perhaps $8bn, or incremental debt capacity of...

• Coatings industry consolidation: could it be the big four? A tie-up between Axalta and Nippon Paint would clearly confirm the latter’s strategic intention to “go global”. If consummated, the deal would create a top-tier global player with 2017 pro forma sales of $9.3bn and EBITDA of nearly $2bn, making Nippon Paint (assuming that name survives) the fourth largest coatings producer in the world behind Sherwin-Williams, PPG Industries and Akzo as shown in Figure 2. In this “big four” scenario, Sherwin and Nippon would likely be digesting large M&A meals over the next two years, while PPG evaluates options for...

• Nippon Paint has been acquisitive lately with a stated ambition to go global. By way of background, Nippon Paint operates more than 30 manufacturing plants throughout Asia, serving the markets for architectural, automotive, industrial and marine coatings. In March 2017 Nippon Paint acquired Dunn Edwards, a manufacturer of architectural and other coatings in the southwestern US, giving Nippon a foothold in the US market. While the purchase price was undisclosed at the time, a subsequent presentation by Nippon Paint revealed the price to be…

• We recently raised our target to $37 on rising propensity for M&A. Our existing price target, which was probability-weighted for Akzo MOE scenarios, implies total return potential of 9% from current levels (AXTA shares do not currently pay a dividend), but rising probability of a new entrant in Nippon could render that level quite conservative as per our takeout math in Figure 1. Given Axalta’s elevated exposure to autos, pockets of price and volume pressure across the portfolio, and somewhat diminished balance sheet flexibility, we feel that valuation is fair at $29-30 per share absent M&A-related optionality. As a reminder, our base-case valuation of AXTA is predicated upon on an average of two methodologies: DCF analysis and a relative P/E framework. Our DCF analysis suggests a warranted stock price of $30. Using our relative P/E framework wherein we apply a 15% premium to the S&P500 multiple, we calculate warranted value of $27 per AXTA share.

(Please see full report for details)