Kerry Pianoforte, Editor06.05.17

Industrial coatings encompass a large and varied market. Typically industrial coatings are used to coat high-value assets that need to withstand harsh environmental conditions. Industrial coatings are used in onshore oil and gas, commercial architecture and industrial maintenance applications.

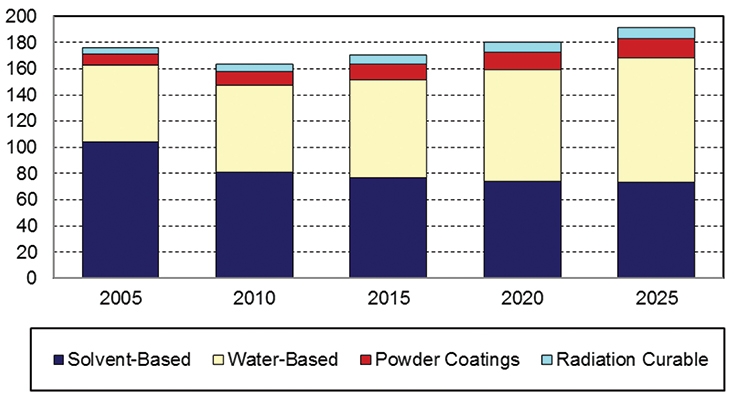

Historically, solvent-based coatings have maintained the largest share of protective and specialty coatings. However, according to a new study from the Freedonia Group, Protective & Specialty Coatings Market in the U.S., solvent-based coatings are projected to be surpassed by water-based coatings by 2020 as regulatory concerns continue to impact the protective and specialty market. Solvents will continue to lose share to other formulations, with trends favoring the use of water-based, high-solids and other coatings, which have lower or no VOC emissions.

According to the study, demand for water-based coatings in the protective and specialty segment is predicted to expand at an annual rate of 2.5 percent to 85 million gallons in 2020, supplanting solventborne coatings as the market leader. Water-based coatings are also gaining a foothold in protective marine coatings as several worldwide treaties and U.S. regulations have put stringent limits on emissions produced by marine coatings. Waterborne coatings provide good adhesion to the market’s primary substrate – metal – and offer solid resistance to weather, chemicals and other harsh conditions in which all varieties of watercraft are exposed.

“Environmental regulations will continue to tighten in the years ahead as governments around the world seek to reduce resource consumption, emissions, and exposure to chemicals of concern,” said Shelley Bausch, PPG vice president, Global Industrial Coatings. “While the VOC tax in China and REACH regulations in Europe receive significant attention, all layers of government, including local communities, are getting involved.”

“For many of our customers, though, regulatory compliance is only part of the equation,” Bausch continued. “They view themselves as good stewards of the environment and take a more holistic approach to sustainability that includes issues like eliminating heavy metals, reducing energy usage and extending the lifespan of their products. Every day, we help customers shift from legacy solventborne coatings to a range of more environmentally-friendly solutions. Depending on the application, the best solution could be a high-solid, low-VOC solvent-based coating, a waterborne coating, a powder coating or electrocwoat. Often, a system approach across layers yields the best outcome. We expect these conversions to continue, if not accelerate, in the year ahead. Legislation around the globe will support this trend, as will increasing focus from investors, NGOs, local communities, end consumers, and our customers themselves.”

“We continue to see environmental legislation affecting the technologies we offer. VOC-driven legislation globally and more chemical restrictions affect how we can formulate industrial coatings,” said David Calabra, General Industrial global product director, Sherwin-Williams Product Finishes. “Clearly VOC reduction has led to powder technology replacing much of the liquid baking enamel coatings. Water-based coatings continue to grow with legislation in China encouraging these products. Water-based acrylics and alkyds are needed, as are water-based urethanes supported by robust water-based epoxy primers. In the end it is important to offer a full line of water-based products as alternatives to solventborne platforms.”

Europe has been a leader in adopting environmental regulations. “There is a trend for many years in Europe to move away from low volume solids products and introducing higher volume solids products as well as waterborne systems,” said Gerard de Vries, business director Protective Coatings North Europe, AkzoNobel. “Depending on the kind of application both technologies can be considered. Alkyds are losing some share in the total product mix although there are still applications where they can and will be used.”

“At Axalta, we don’t wait for regulators to initiate environmentally sustainable coating developments – we’re inspired by our wide range of customers who want to help preserve and enhance the environment for future generations,” said Michael Cash, SVP and president, Industrial Coatings of Axalta. “Our customers help guide us toward innovations like Alesta powder coatings collection for aluminum extrusions, Hydropon, our innovative waterborne coatings for coil and extrusion applications, and Nap-Gard high temp exterior pipeline coatings, which replace solvent borne liquid products. We usually find that our industrial customers are extremely conscious of the environment, and we work closely with our customers to match our product development strategy with their business needs, as well as our joint obligation to sustainability.”

Environmental legislation has been a key driver in different parts of the world in reducing the usage of solvent-based coatings. “The two most common ways to limit impact is via water-based coatings or the increasing use of higher solids coatings with less solvents,” said Klaus Moeller, group vice president, Group Protective Marketing, Hempel A/S. “The coatings industry is, and has been for a while, heavily investing in R&D to develop new and innovative products with less environmental impact.”

State of the market

According to PPG’s Bausch, global industrial coatings continued a low-single-digit growth trajectory last year, in line with macroeconomic trends. “As you would expect, there was wide variation in performance across segments and geographies. In Asia-Pacific, the automotive, transportation and electronic materials sectors experienced high levels of growth. China’s development continued to drive industrial production in the region while growth rates in India and Southeast Asia were among the fastest in the world.”

“The U.S. and Canadian economies experienced slower construction growth and an overall decline in industrial production. Coatings for building products, as well as automotive builds, were central to regional performance,” Bausch continued. Most segments in Latin America continued to be negatively impacted by Brazil’s economy-wide challenges. A bright spot in the region was the continued growth of automotive production in Mexico. EMEA’s industrial activity showed a modest recovery from recent challenges with particular strength in central and eastern Europe; infrastructure spend in the Middle East remained solid throughout the year.”

The last 12 months have been characterized by challenging market conditions, linked to the price of crude oil. “Although we’ve recently seen prices edge upwards, the industry still faces headwinds and the recovery of the market is still very fragile,” said de Vries. “There is some uncertainty too. There are so many important global events in 2017 important events which could have a considerable impact; such as elections in some key European countries as well the agenda of the newly elected Trump administration. Also, the submission of a Brexit will have its impact in Europe. Overall, demand for coatings solutions continues to be strong given the importance it plays in asset protection and safety. This means investing in maintenance and upkeep to drive operational efficiency.”

“The global industrial coatings market continues to grow,” said Calabra. “Certain regions are soft, but North America, APAC and Europe are still providing opportunity.”

“Over the past year, we have seen low-to-mid-single digit growth rates in the Industrial markets in which we participate,” noted Cash “We have outstanding customers in all parts of the world with whom we have grown, who have served as outstanding references to help us gain additional business, and this has enabled us to grow at rates well above the market rates where we operate. In fact, over the past four years, our industrial business has operated as a united, global team and is currently the second largest worldwide supplier of powder coatings and E-coat to industrial markets, as well as the second largest supplier of high technology coatings to the electrical motor market globally. This past year capitalized on the reputation we built, adding a wide variety of new customers to our family and introducing more than 100 new product innovations.”

“Looking at some of the biggest segments of protective coatings; infrastructure, oil and gas and power generation, performance has been mixed this past year,” said Moeller. “There has been stable growth in infrastructure globally, however in the Middle East economic growth has stagnated due to the low oil price and this has meant less investment in infrastructure. Unsurprisingly there has been slower growth in China due to the country’s slower economic growth. The oil and gas segment continues to be in a prolonged depression, especially in the upstream sector. There have however been recent positive signs of better times in onshore upstream. Finally, the power generation segment continues to grow in Asia, with slower growth in China, and this is the same for all the sub-sectors under power generation.”

Industrial coatings are used for a wide variety of applications from construction to OEM equipment. As such growth varies widely from segment to segment.

“We anticipate cyclical inflection points in key segments over the coming years, shifting the outlook of growth opportunities across the industry,” said Bausch. “After a period of economic challenges, the agricultural and petroleum-related sectors are showing signs of recovery. In these segments, as well as others, we expect regional manufacturers in developing economies to make significant progress with their plans for global expansion.”

“Automotive builds may begin to slow from recent peaks, but there will be regional opportunities as OEMs and their value chain partners continue to shift volume across their global footprint,” Bausch added. We also see opportunities for coatings to be a significant enabler for auto industry transformations in the years ahead in areas such as battery power, autonomous control, user interfaces, and interior design. Construction and infrastructure spend are likely to have modest growth potential in the near-term, while the electronic materials segment continues its high growth trajectory. In addition to the continued transformation of our lives into “smart living” where applications for electronics and displays are accelerating, Auto OEMs will count on functional coatings to deliver an innovative customer experience in future vehicles.”

Investments in renewable energy – particularly wind power – is a key driver for the industrial coatings market. de Vries noted that this mainly driven by the green agenda of many European governments to meet their set target after the Paris conference.

“Governments have been relatively slow with investment in infrastructure,” he added. “The last quarter we have seen signs of improving conditions in some countries where demand of capital goods has started to pick up.”

“In regard to industrial coatings, the general finishes segment is still one of the largest markets due to the large variety of sub-segments that fall into this category, and it has offered strong growth over the years,” said Calabra.

One of the fastest growing segments, in which Axalta’s Energy Solutions products like Voltatex thrive, is comprised of industrial coatings that are used to insulate and enhance functionality in electrical motors. Protective coatings supplied to the commercial architectural and building construction markets make up another rapidly growing segment for Axalta.

“We are one of few global companies that can offer liquid and powder coatings to enable architects a choice of technology for aluminum extrusions,” said Cash. “As a response to the desire for bright metallic options, we recently launched our Alesta ICONICA powder coatings collection, a selection of 40 new colors designed by trend experts and developed in Alesta SuperDurable quality with the latest in our FX bonding techniques. A third, critical emerging market for industrial coatings includes coatings that can be applied to plastic substrates. At the cutting edge of highly-durable technology in applications to plastic composites, Axalta launched our FlexBase product line earlier this year.”

Meeting customer demands

Keeping industrial coatings customers satisfied is a challenging job. These types of coatings need to withstand punishing elements such as wind, salt, water and UV exposure.

“Our customers continue to expect a lot from their coating suppliers, not only to deliver product performance in the field, but to simplify their operations and strengthen their brand,” said Bausch. “Ultimately, they want coatings to help differentiate their products with end consumers.

Color and surface design play an important role in the product experience. We spend a lot of time with customers developing the right color, texture, gloss and other attributes for their application. Corrosion protection and durability remain a top priority for field performance. Customers across multiple segments are extending warranty periods as a point of differentiation with their products.”

“In several markets, for a variety of reasons, customers continue to shift toward new and complex substrates,” Bausch said. “Coating solutions across mixed-metal alloys, carbon fiber, plastics, and other substrates are becoming increasingly important and can enable weight reduction and performance improvement targets. In addition to performance needs, customers often tell us they want help simplifying their operations. They want robust application windows across a wide range of ambient conditions.

They want to match color and performance across a complex, global supply chain. They want to make things cheaper and faster through more efficient processes.”

“Almost all markets, from agriculture, construction and earth-moving (ACE) to electronics to general finishing, are looking for process efficiency,” said Calabra. “Customers want reduced process time while maintaining or improving associated performance.”

With new standards coming into the market, such as the new ISO 12944 standard, which will add an extra corrosion category with enhanced durability requirements, industrial coatings manufacturers need to develop high performing products. “There is a trend for longer durability as well as a trend for sustainability of products, de Vries said. “A study conducted by CEPE regarding”

Sustainable steel bridge maintenance: the role of paint in an LCA” is showing increasing interest in the market for sustainability and the role coatings can play.”

Sustainability is at the heart of everything AkzoNobel does, de Vries added. “We are committed to making all our products, services and partnerships as sustainable as possible. AkzoNobel will be carbon neutral and use 100 percent renewable energy in its own operations by 2050. Sustainability is critical for the future success of our company, our society and our planet. Planet Possible is how we explain our sustainability strategy on an economic, environmental and social level. It is our commitment to doing more with less: creating more value from fewer resources. It is about developing a more sustainable business and increasing our resource efficiency across the whole value chain.”

Cash noted that Axalta’s customers gravitate towards the latest technologies to introduce to their end-users. This includes increased sustainability, higher quality, and better product consistency. “The latest trend in technology development for liquid coatings involves designing products to ensure the longer life of substrates, such as building and equipment,” he added.

“Customers seek technologies that provide excellent corrosion resistance and withstand high-temperature environments. Powder coatings are an environmentally sustainable alternative that will continue to grow faster than GDP as we see more liquid applications converting to powder coatings. In addition to a low environmental footprint, powder coatings are moving towards lower cure technologies, enabling their usability on a greater variety of substrates like plastics and wood composites. We have been fortunate to gain more than 2,000 customers over the past four years who were looking for a global paint company with a commitment to innovation, a genuine interest in helping customers succeed and meet environmental goals, as well as a reliable technical support team to bring results to life in our customers’ locations.”

“Asset owners and operators are interested in long lasting protection that reduces cost of ownership and operations,” said Moeller. “End users do not wish to have any unexpected surprises that may lead to increased maintenance costs and interruptions to their operations which can be very costly. This means that asset owners look for trusted high performance coating solutions that last as long as possible with a minimal environmental impact.”

“Protective coatings applicators also look for coatings with a limited environmental impact but prefer coatings that are easy to apply, as this increases productivity and saves time and labor costs,” he added. “Finally engineering companies are continually looking for new ways to simplify their projects, be that via reducing specification complexity or minimizing the time and cost impact on project schedules arising from painting activities.”

Historically, solvent-based coatings have maintained the largest share of protective and specialty coatings. However, according to a new study from the Freedonia Group, Protective & Specialty Coatings Market in the U.S., solvent-based coatings are projected to be surpassed by water-based coatings by 2020 as regulatory concerns continue to impact the protective and specialty market. Solvents will continue to lose share to other formulations, with trends favoring the use of water-based, high-solids and other coatings, which have lower or no VOC emissions.

According to the study, demand for water-based coatings in the protective and specialty segment is predicted to expand at an annual rate of 2.5 percent to 85 million gallons in 2020, supplanting solventborne coatings as the market leader. Water-based coatings are also gaining a foothold in protective marine coatings as several worldwide treaties and U.S. regulations have put stringent limits on emissions produced by marine coatings. Waterborne coatings provide good adhesion to the market’s primary substrate – metal – and offer solid resistance to weather, chemicals and other harsh conditions in which all varieties of watercraft are exposed.

“Environmental regulations will continue to tighten in the years ahead as governments around the world seek to reduce resource consumption, emissions, and exposure to chemicals of concern,” said Shelley Bausch, PPG vice president, Global Industrial Coatings. “While the VOC tax in China and REACH regulations in Europe receive significant attention, all layers of government, including local communities, are getting involved.”

“For many of our customers, though, regulatory compliance is only part of the equation,” Bausch continued. “They view themselves as good stewards of the environment and take a more holistic approach to sustainability that includes issues like eliminating heavy metals, reducing energy usage and extending the lifespan of their products. Every day, we help customers shift from legacy solventborne coatings to a range of more environmentally-friendly solutions. Depending on the application, the best solution could be a high-solid, low-VOC solvent-based coating, a waterborne coating, a powder coating or electrocwoat. Often, a system approach across layers yields the best outcome. We expect these conversions to continue, if not accelerate, in the year ahead. Legislation around the globe will support this trend, as will increasing focus from investors, NGOs, local communities, end consumers, and our customers themselves.”

“We continue to see environmental legislation affecting the technologies we offer. VOC-driven legislation globally and more chemical restrictions affect how we can formulate industrial coatings,” said David Calabra, General Industrial global product director, Sherwin-Williams Product Finishes. “Clearly VOC reduction has led to powder technology replacing much of the liquid baking enamel coatings. Water-based coatings continue to grow with legislation in China encouraging these products. Water-based acrylics and alkyds are needed, as are water-based urethanes supported by robust water-based epoxy primers. In the end it is important to offer a full line of water-based products as alternatives to solventborne platforms.”

Europe has been a leader in adopting environmental regulations. “There is a trend for many years in Europe to move away from low volume solids products and introducing higher volume solids products as well as waterborne systems,” said Gerard de Vries, business director Protective Coatings North Europe, AkzoNobel. “Depending on the kind of application both technologies can be considered. Alkyds are losing some share in the total product mix although there are still applications where they can and will be used.”

“At Axalta, we don’t wait for regulators to initiate environmentally sustainable coating developments – we’re inspired by our wide range of customers who want to help preserve and enhance the environment for future generations,” said Michael Cash, SVP and president, Industrial Coatings of Axalta. “Our customers help guide us toward innovations like Alesta powder coatings collection for aluminum extrusions, Hydropon, our innovative waterborne coatings for coil and extrusion applications, and Nap-Gard high temp exterior pipeline coatings, which replace solvent borne liquid products. We usually find that our industrial customers are extremely conscious of the environment, and we work closely with our customers to match our product development strategy with their business needs, as well as our joint obligation to sustainability.”

Environmental legislation has been a key driver in different parts of the world in reducing the usage of solvent-based coatings. “The two most common ways to limit impact is via water-based coatings or the increasing use of higher solids coatings with less solvents,” said Klaus Moeller, group vice president, Group Protective Marketing, Hempel A/S. “The coatings industry is, and has been for a while, heavily investing in R&D to develop new and innovative products with less environmental impact.”

State of the market

According to PPG’s Bausch, global industrial coatings continued a low-single-digit growth trajectory last year, in line with macroeconomic trends. “As you would expect, there was wide variation in performance across segments and geographies. In Asia-Pacific, the automotive, transportation and electronic materials sectors experienced high levels of growth. China’s development continued to drive industrial production in the region while growth rates in India and Southeast Asia were among the fastest in the world.”

“The U.S. and Canadian economies experienced slower construction growth and an overall decline in industrial production. Coatings for building products, as well as automotive builds, were central to regional performance,” Bausch continued. Most segments in Latin America continued to be negatively impacted by Brazil’s economy-wide challenges. A bright spot in the region was the continued growth of automotive production in Mexico. EMEA’s industrial activity showed a modest recovery from recent challenges with particular strength in central and eastern Europe; infrastructure spend in the Middle East remained solid throughout the year.”

The last 12 months have been characterized by challenging market conditions, linked to the price of crude oil. “Although we’ve recently seen prices edge upwards, the industry still faces headwinds and the recovery of the market is still very fragile,” said de Vries. “There is some uncertainty too. There are so many important global events in 2017 important events which could have a considerable impact; such as elections in some key European countries as well the agenda of the newly elected Trump administration. Also, the submission of a Brexit will have its impact in Europe. Overall, demand for coatings solutions continues to be strong given the importance it plays in asset protection and safety. This means investing in maintenance and upkeep to drive operational efficiency.”

“The global industrial coatings market continues to grow,” said Calabra. “Certain regions are soft, but North America, APAC and Europe are still providing opportunity.”

“Over the past year, we have seen low-to-mid-single digit growth rates in the Industrial markets in which we participate,” noted Cash “We have outstanding customers in all parts of the world with whom we have grown, who have served as outstanding references to help us gain additional business, and this has enabled us to grow at rates well above the market rates where we operate. In fact, over the past four years, our industrial business has operated as a united, global team and is currently the second largest worldwide supplier of powder coatings and E-coat to industrial markets, as well as the second largest supplier of high technology coatings to the electrical motor market globally. This past year capitalized on the reputation we built, adding a wide variety of new customers to our family and introducing more than 100 new product innovations.”

“Looking at some of the biggest segments of protective coatings; infrastructure, oil and gas and power generation, performance has been mixed this past year,” said Moeller. “There has been stable growth in infrastructure globally, however in the Middle East economic growth has stagnated due to the low oil price and this has meant less investment in infrastructure. Unsurprisingly there has been slower growth in China due to the country’s slower economic growth. The oil and gas segment continues to be in a prolonged depression, especially in the upstream sector. There have however been recent positive signs of better times in onshore upstream. Finally, the power generation segment continues to grow in Asia, with slower growth in China, and this is the same for all the sub-sectors under power generation.”

Industrial coatings are used for a wide variety of applications from construction to OEM equipment. As such growth varies widely from segment to segment.

“We anticipate cyclical inflection points in key segments over the coming years, shifting the outlook of growth opportunities across the industry,” said Bausch. “After a period of economic challenges, the agricultural and petroleum-related sectors are showing signs of recovery. In these segments, as well as others, we expect regional manufacturers in developing economies to make significant progress with their plans for global expansion.”

“Automotive builds may begin to slow from recent peaks, but there will be regional opportunities as OEMs and their value chain partners continue to shift volume across their global footprint,” Bausch added. We also see opportunities for coatings to be a significant enabler for auto industry transformations in the years ahead in areas such as battery power, autonomous control, user interfaces, and interior design. Construction and infrastructure spend are likely to have modest growth potential in the near-term, while the electronic materials segment continues its high growth trajectory. In addition to the continued transformation of our lives into “smart living” where applications for electronics and displays are accelerating, Auto OEMs will count on functional coatings to deliver an innovative customer experience in future vehicles.”

Investments in renewable energy – particularly wind power – is a key driver for the industrial coatings market. de Vries noted that this mainly driven by the green agenda of many European governments to meet their set target after the Paris conference.

“Governments have been relatively slow with investment in infrastructure,” he added. “The last quarter we have seen signs of improving conditions in some countries where demand of capital goods has started to pick up.”

“In regard to industrial coatings, the general finishes segment is still one of the largest markets due to the large variety of sub-segments that fall into this category, and it has offered strong growth over the years,” said Calabra.

One of the fastest growing segments, in which Axalta’s Energy Solutions products like Voltatex thrive, is comprised of industrial coatings that are used to insulate and enhance functionality in electrical motors. Protective coatings supplied to the commercial architectural and building construction markets make up another rapidly growing segment for Axalta.

“We are one of few global companies that can offer liquid and powder coatings to enable architects a choice of technology for aluminum extrusions,” said Cash. “As a response to the desire for bright metallic options, we recently launched our Alesta ICONICA powder coatings collection, a selection of 40 new colors designed by trend experts and developed in Alesta SuperDurable quality with the latest in our FX bonding techniques. A third, critical emerging market for industrial coatings includes coatings that can be applied to plastic substrates. At the cutting edge of highly-durable technology in applications to plastic composites, Axalta launched our FlexBase product line earlier this year.”

Meeting customer demands

Keeping industrial coatings customers satisfied is a challenging job. These types of coatings need to withstand punishing elements such as wind, salt, water and UV exposure.

“Our customers continue to expect a lot from their coating suppliers, not only to deliver product performance in the field, but to simplify their operations and strengthen their brand,” said Bausch. “Ultimately, they want coatings to help differentiate their products with end consumers.

Color and surface design play an important role in the product experience. We spend a lot of time with customers developing the right color, texture, gloss and other attributes for their application. Corrosion protection and durability remain a top priority for field performance. Customers across multiple segments are extending warranty periods as a point of differentiation with their products.”

“In several markets, for a variety of reasons, customers continue to shift toward new and complex substrates,” Bausch said. “Coating solutions across mixed-metal alloys, carbon fiber, plastics, and other substrates are becoming increasingly important and can enable weight reduction and performance improvement targets. In addition to performance needs, customers often tell us they want help simplifying their operations. They want robust application windows across a wide range of ambient conditions.

They want to match color and performance across a complex, global supply chain. They want to make things cheaper and faster through more efficient processes.”

“Almost all markets, from agriculture, construction and earth-moving (ACE) to electronics to general finishing, are looking for process efficiency,” said Calabra. “Customers want reduced process time while maintaining or improving associated performance.”

With new standards coming into the market, such as the new ISO 12944 standard, which will add an extra corrosion category with enhanced durability requirements, industrial coatings manufacturers need to develop high performing products. “There is a trend for longer durability as well as a trend for sustainability of products, de Vries said. “A study conducted by CEPE regarding”

Sustainable steel bridge maintenance: the role of paint in an LCA” is showing increasing interest in the market for sustainability and the role coatings can play.”

Sustainability is at the heart of everything AkzoNobel does, de Vries added. “We are committed to making all our products, services and partnerships as sustainable as possible. AkzoNobel will be carbon neutral and use 100 percent renewable energy in its own operations by 2050. Sustainability is critical for the future success of our company, our society and our planet. Planet Possible is how we explain our sustainability strategy on an economic, environmental and social level. It is our commitment to doing more with less: creating more value from fewer resources. It is about developing a more sustainable business and increasing our resource efficiency across the whole value chain.”

Cash noted that Axalta’s customers gravitate towards the latest technologies to introduce to their end-users. This includes increased sustainability, higher quality, and better product consistency. “The latest trend in technology development for liquid coatings involves designing products to ensure the longer life of substrates, such as building and equipment,” he added.

“Customers seek technologies that provide excellent corrosion resistance and withstand high-temperature environments. Powder coatings are an environmentally sustainable alternative that will continue to grow faster than GDP as we see more liquid applications converting to powder coatings. In addition to a low environmental footprint, powder coatings are moving towards lower cure technologies, enabling their usability on a greater variety of substrates like plastics and wood composites. We have been fortunate to gain more than 2,000 customers over the past four years who were looking for a global paint company with a commitment to innovation, a genuine interest in helping customers succeed and meet environmental goals, as well as a reliable technical support team to bring results to life in our customers’ locations.”

“Asset owners and operators are interested in long lasting protection that reduces cost of ownership and operations,” said Moeller. “End users do not wish to have any unexpected surprises that may lead to increased maintenance costs and interruptions to their operations which can be very costly. This means that asset owners look for trusted high performance coating solutions that last as long as possible with a minimal environmental impact.”

“Protective coatings applicators also look for coatings with a limited environmental impact but prefer coatings that are easy to apply, as this increases productivity and saves time and labor costs,” he added. “Finally engineering companies are continually looking for new ways to simplify their projects, be that via reducing specification complexity or minimizing the time and cost impact on project schedules arising from painting activities.”