Kerry Pianoforte, Editor10.02.17

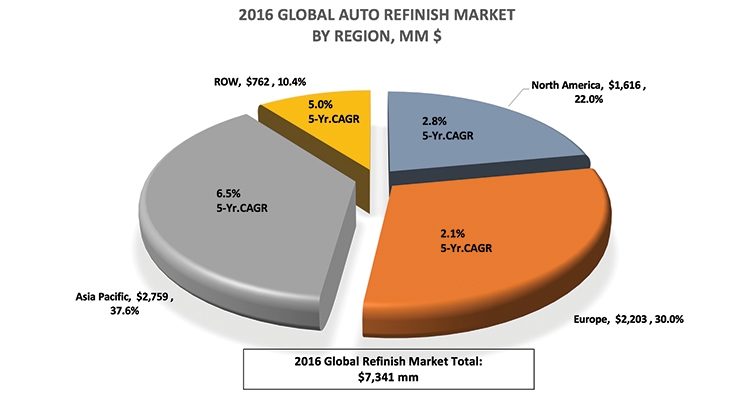

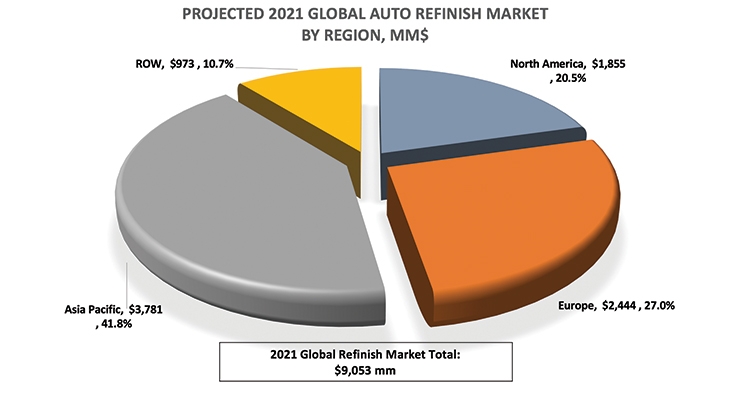

According to Chemark Consulting Group, the global automotive refinish coatings market for 2016 was valued at $7,341 million dollars. Asia Pacific is the largest consumer, comprised of 37.6 percent; Europe is second with 30 percent and North America is third with 22 percent. Chemark predicted that by 2021 the global automotive refinish coatings market will be $9,053 million. Asia Pacific is projected to grow to 41.8 percent of the market, Europe at 27 percent and North America is projected to be 20.5 percent.

“The global coatings market continues to evolve,” said Dirk Bremm, president, Coatings Division at BASF. “We see increasing competitiveness as well as shifting share to the Value-for-Money segment, particularly in Europe and ASEAN, where we are well-positioned with our Baslac and Yinfan brands, respectively. Especially the Chinese region’s rapid growth in car ownership creates increasing demand for refinish coatings. With our recent investment, we are better positioned to support our customers via a well-established distribution network, latest technology and a broad product portfolio.”

“In NAFTA, consolidation and the efficiency of body shops are the key trends we observe in the market,” Bremm continued. “With a complete portfolio of products – from our award-winning Glasurit and R-M lines to our new Norbin Value-for-Money line – we offer customers the right products for the right finish. We continue to develop innovative product and service offerings to match our customers’ individual needs and help them to be more successful.”

According to AkzoNobel, the global vehicle refinishes market is stable, with slight global growth expected. “In the mature North American and European markets, consolidation is taking place across both regions,” said Mark Korsmit, global marketing director of Vehicle Refinishes at AkzoNobel. “Bodyshops are forming network groups to tap into the opportunities, and due to the growing pressure from other key players in the market. Global insurance companies and OEMs are also making more of an effort to impact market conditions in these regions. In South America and Asia, carparks are developing and growing, which is positively impacting the consequent refinish market. These markets are still developing on the maturity curve, and therefore have different market models.”

“The refinish segment globally remains a key end-market for Axalta’s coating products and application technologies,” said Matthew Winokur, vice president, corporate affairs, Axalta Coating Systems. “In the U.S., consolidation is continuing. In Europe, consolidation dynamics have differed. Among distributors, consolidation has led to stocking of multiple paint brands which has had the potential to erode brand loyalty. Whereas body shop consolidation focuses buying power and can advantage individual brands. We’ve seen the latter in the U.S. as well as MSOs continue to gain share. In China, a different dynamic is at play as we seen growing influence of OEMs on the collision repair industry.”

Trends

The collision repair industry is extremely dynamic.

“Consolidation at all levels of the industry is a major trend as well as the pressure on body shops to continuously improve productivity and profitability, as well as their customer satisfaction,” said Marvin Gillfillan, vice president, business management, Automotive Refinish at BASF. “Another critical challenge is talent management and talent recruitment.

Finding qualified technicians, developing them and retaining them is a real industry challenge.”

“Consolidation, of course, is still a trend in this marketplace,” said Rob Mowson, vice president, marketing, Sherwin-WIllimas automotive finishes. “Sherwin-Williams Automotive Finishes continues to build value for Multiple Shop Operators by providing them with the products and tools they need to consistently deliver high-quality repairs, along with the cycle-time reduction desired by vehicle owners and insurance companies. Other factors affecting the collision repair market are new OEM production processes that involve advanced lightweight materials and increasing car connectivity. Concerning the latter, collision centers in the near future will have to prepare their business to handle new connected-car technologies. These technologies will seamlessly connect vehicles and consumers to the manufacturer, dealer and the dealership’s service, parts, and body shop operations.”

“In addition, collision centers will find that they have to be capable of repairing all vehicles to “crashworthy” standards,” he added. “This new repair standard will be required in order to place the vehicle back into service. It requires reconstruction of the damaged vehicle to the OEM specifications, so that it is capable of sustaining a subsequent accident and responding exactly as it was originally designed and engineered to perform. And of course with the advent of technology, comes the potential decline in some repairs needed simply through the onset of new vehicle accident avoidance systems, increased ridesharing services and the advancement of driverless cars. As these influences potentially diminish repair volumes, collision centers must consider alternative sources of revenue to replace those that may decline.”

Innovation and utilizing new technologies is key to growth in the automotive refinish market. “Technology is becoming more important and playing a larger role in industry innovation,” said Korsmit. “Cars are more complex, bringing more complexity for bodyshops to repair cars. Innovative technologies in the short-term are helping to reduce the severity of accidents, resulting in a shift in balance between technical repairs and cosmetic repairs. Looking further out, these technologies are expected to have a positive impact on the accident rate.”

“Technological innovation for cars is moving rapidly,” added Korsmit. “As automobiles become more technologically complex, more repairs will address technology inside the car. The costs of the repairs are not expected to decrease, despite the efforts and wishes of the insurance companies.”

Axalta expects consolidation to continue but said the level at which this will happen will depend on the market. “Plus, the speed of consolidation will depend a lot on the overall economic and market conditions, available and deployed cash for investments and succession strategies and plans,” added Winokur. “Increasingly, customers are focused on innovation and service. For example, in Latin America we’re taking training to body shop technicians with mobile training classes rather than depending on them to come to one of our training centers. In other markets, increasing environmental regulations drives the development of technically advanced high-productivity low-VOC and waterborne coatings.”

Key Issues

Depending on the shop, needs will vary in importance and magnitude. “For many independents and megashops, securing talent is a key concern and managing insurance DRPs is a time-consuming key factor to ensure they get cars to their doors, said Gillfillan. “For MSOs, cycle time and processing vehicles as quickly as possible is a major concern. For dealerships, business management and tracking of KPIs are key challenges.”

For each of these sectors, BASF reported that it has the knowledge, resources and tools to help them succeed, including Business Development Manager (BDM) experts who partner with its customers.

“Our market-leading Advanced Process Solutions lean program, our VisionPLUS Online reports and our Performance Groups support all of these challenges,” said Gillfillan. “BASF prides itself on being able to partner with our customers to work side-by-side with shop owners and managers to improve their business by leveraging our best-in-class tools and services. We’re working to provide solutions for our customers that improve profitability and productivity. We’re also focused on continually improving our products to meet the needs of our customers.”

According to AkzoNobel’s Korsmit, there is a shift in the influence stakeholders have on the market. “Bodyshops used to be in the driver’s seat of the industry, but stakeholders such as insurance and OEM companies are exercising more and more influence,” he stressed. “In addition, we see key challenges and opportunities as the focus of repairs shift from cosmetic and technical to dealing with managing increasingly complex substrates, technologies and electronics.”

In order to compete in these markets, the efficiency of bodyshops is key. Korsmit said AkzoNobel continues to focus on driving bodyshop efficiency, by providing business services to bodyshops, developing cost-effective products, continuously holding an open stakeholder dialogue on the market trends and jointly developing strategies.

According to Mowson, providing premium products and systems is another key issue. He cited Sherwin-William’s ULTRA refinish system, HP Process and AWX Performance Plus waterborne technology. “They are obviously key to meeting their needs from a paint product standpoint. It’s also about being a Solutions Provider to our customers: We feel and have seen the effects of providing our independent, MSO and dealership collision repair facilities more than just good paint. We think it’s imperative to help provide them solutions to increase their business’ productivity and profitability through better cycle times, lean practices and recognizing other shop efficiencies.”

Sherwin-Williams collaborates with its customers to develop custom solutions based on their specific growth opportunities. “We employ the industry’s largest team of technical service specialists in addition to highly-trained field personnel and industry leading consultants to deliver the on-site service, extensive training and whatever support is necessary to help them achieve sustainable efficiency,” said Mowson.

Newest Technologies

According to Gillfillan, BASF is the number one chemical supplier to the automotive industry. “Having this broad experience and know-how enables BASF to be a market-leading coatings supplier,” he stated. “BASF provides our customers with the best-in-class refinish products and the most OEM approvals of refinish paint providers, combined with the best-in-class services and solutions to support the collision repair industry. We will continue to bring innovation to the automotive industry, including the right finishes as vehicle technology changes (e.g. new substrates and processes). Not only does BASF have the most OEM approvals in the Refinish industry, but our partnership goes much further to shape the mobility of the future. In addition, we have breadth within the industry by being vertically integrated. BASF spends 1.9 billion Euros on R&D globally each year, over 200 million of which is spent in the automotive industry alone. This enables BASF to continue to bring market leading, innovative products and solutions to our customers.”

AkzoNobel has stated that it is the frontrunner in the industry when it comes to innovative and sustainable products, as well as digital solutions. “Sustainability is at the heart of everything we do,” said Korsmit. “We continuously look into products and processes to reduce the impact of our operations and products on the environment while simultaneously delivering business value to our customers. This includes our range of UV-curing products. The benefits of such products include the ability to drastically speed up repair times, eliminate material waste and reduce energy consumption for curing. A true win-win proposition.”

The automotive refinish technology continues to evolve to address market needs. “Nano-dispersed pigments are used to recreate very high chromo colors recently introduced by several OEMs,” said Robert K. Roop, vice president, global refinish technology at Axalta. “Special clearcoat additives have been developed to recreate unique appearances such as “matte” finishes. And proprietary polymer technology is used to drive highly productive coating systems, including undercoats, basecoats, and clearcoats. Going forward, Refinish technology will use a variety of pigment, additives, and polymer technologies to recreate future OEM finishes.”

New Products

Collision shops today are continually challenged to drive efficiencies and profits, and meet stringent OEM requirements.

“BASF wants to be that partner so we will continue to advance products and services that deliver increases in shop efficiency and drive growth and profitability,” said Gillfillan. “The newest technologies we recently launched are focused around reducing cycle time including fast drying clears for Glasurit and R-M and UV primers. The new Glasurit UV Primer offers exceptional holdout and gloss retention on repair areas, can be cured in seconds using advanced UV curing equipment or cured in the sunlight, all increasing through put inside the shop.”

AkzoNobel is leading the digitizing of color retrieval, according to Korsmit. “Our COLORVATION program builds on the leading color matching tools, such as Automatchic vision and MIXIT. It is our commitment to continuously push technological boundaries, and COLORVATION is designed to deliver the highest first time right hit rate in obtaining the perfect color match, enabling bodyshops to enhance their efficiency by making the transition to 100 percent digital color matching.”

“Our MIXIT mobile app offers bodyshops, technicians and painters across the globe instant access to the latest color formulas. Through the cloud-based software, users have immediate access to its vast database which hosts more than two million colors and variants – with more being added every day. We are also very excited about this year’s SEMA event in Las Vegas. At the show, we will introduce a new custom color line of automotive paints through our Sikkens brand. The new colors are being developed in partnership with Dave Kindig, automotive artist and host of the popular cable show Bitchin’ Rides on the Velocity Channel. Dave is known by auto enthusiasts for his commitment to quality and excellence, and that commitment will be evident in this new line of paints.”

Axalta has launched a wide range of new products to address the needs of the Refinish marketplace. “Our newest Spies Hecker ultra-productive primer, HS Speed Surfacer, was recently launched in Europe and cures in less than 15 minutes,” said Roop. “Our new waterborne basecoat system, Syrox, was recently launched in China, Europe, and Australia provides easy application for our body shop painters. And our low energy, ultra-productive clearcoats including Standox VOC-Xtreme, Spies Hecker HS Speed, and Cromax Ultra Performance Energy provide excellent appearance and extremely fast cure times. These products, combined with global launch of the Acquire™ Quantum EFX, our newest state-of-the-art spectrophotometer, provide body shops all the tools needed to quickly to recreate any OEM finish.”

Mowson said that he feels Sherwin-Williams is changing the game by making a premium finish possible in half the time of typical glamour clearcoats. “Our latest CC200 Dynamic Clearcoat features significantly shorter bake times, at lower temperatures, to allow shops to significantly increase daily throughput without compromising on appearance. It’s optimized for any level painter, application and repair environment, so CC200 effectively replaces several clearcoats with one workhorse to simplify the shop owner, as well as the painter’s, world.”

Sherwin-Williams has also introduced FASTLINE professional series of associated products designed for the collision repair, OEM and fleet refinishing markets. Now sold through Sherwin-Williams Automotive Finishes stores, this extensive collection of premium PBE products allows customers access to body fillers, masking products and abrasives at competitive prices. “Our customers find it convenient to buy these products from the same company that manufactures and delivers their premium refinish coatings,” Mowson concluded.

“The global coatings market continues to evolve,” said Dirk Bremm, president, Coatings Division at BASF. “We see increasing competitiveness as well as shifting share to the Value-for-Money segment, particularly in Europe and ASEAN, where we are well-positioned with our Baslac and Yinfan brands, respectively. Especially the Chinese region’s rapid growth in car ownership creates increasing demand for refinish coatings. With our recent investment, we are better positioned to support our customers via a well-established distribution network, latest technology and a broad product portfolio.”

“In NAFTA, consolidation and the efficiency of body shops are the key trends we observe in the market,” Bremm continued. “With a complete portfolio of products – from our award-winning Glasurit and R-M lines to our new Norbin Value-for-Money line – we offer customers the right products for the right finish. We continue to develop innovative product and service offerings to match our customers’ individual needs and help them to be more successful.”

According to AkzoNobel, the global vehicle refinishes market is stable, with slight global growth expected. “In the mature North American and European markets, consolidation is taking place across both regions,” said Mark Korsmit, global marketing director of Vehicle Refinishes at AkzoNobel. “Bodyshops are forming network groups to tap into the opportunities, and due to the growing pressure from other key players in the market. Global insurance companies and OEMs are also making more of an effort to impact market conditions in these regions. In South America and Asia, carparks are developing and growing, which is positively impacting the consequent refinish market. These markets are still developing on the maturity curve, and therefore have different market models.”

“The refinish segment globally remains a key end-market for Axalta’s coating products and application technologies,” said Matthew Winokur, vice president, corporate affairs, Axalta Coating Systems. “In the U.S., consolidation is continuing. In Europe, consolidation dynamics have differed. Among distributors, consolidation has led to stocking of multiple paint brands which has had the potential to erode brand loyalty. Whereas body shop consolidation focuses buying power and can advantage individual brands. We’ve seen the latter in the U.S. as well as MSOs continue to gain share. In China, a different dynamic is at play as we seen growing influence of OEMs on the collision repair industry.”

Trends

The collision repair industry is extremely dynamic.

“Consolidation at all levels of the industry is a major trend as well as the pressure on body shops to continuously improve productivity and profitability, as well as their customer satisfaction,” said Marvin Gillfillan, vice president, business management, Automotive Refinish at BASF. “Another critical challenge is talent management and talent recruitment.

Finding qualified technicians, developing them and retaining them is a real industry challenge.”

“Consolidation, of course, is still a trend in this marketplace,” said Rob Mowson, vice president, marketing, Sherwin-WIllimas automotive finishes. “Sherwin-Williams Automotive Finishes continues to build value for Multiple Shop Operators by providing them with the products and tools they need to consistently deliver high-quality repairs, along with the cycle-time reduction desired by vehicle owners and insurance companies. Other factors affecting the collision repair market are new OEM production processes that involve advanced lightweight materials and increasing car connectivity. Concerning the latter, collision centers in the near future will have to prepare their business to handle new connected-car technologies. These technologies will seamlessly connect vehicles and consumers to the manufacturer, dealer and the dealership’s service, parts, and body shop operations.”

“In addition, collision centers will find that they have to be capable of repairing all vehicles to “crashworthy” standards,” he added. “This new repair standard will be required in order to place the vehicle back into service. It requires reconstruction of the damaged vehicle to the OEM specifications, so that it is capable of sustaining a subsequent accident and responding exactly as it was originally designed and engineered to perform. And of course with the advent of technology, comes the potential decline in some repairs needed simply through the onset of new vehicle accident avoidance systems, increased ridesharing services and the advancement of driverless cars. As these influences potentially diminish repair volumes, collision centers must consider alternative sources of revenue to replace those that may decline.”

Innovation and utilizing new technologies is key to growth in the automotive refinish market. “Technology is becoming more important and playing a larger role in industry innovation,” said Korsmit. “Cars are more complex, bringing more complexity for bodyshops to repair cars. Innovative technologies in the short-term are helping to reduce the severity of accidents, resulting in a shift in balance between technical repairs and cosmetic repairs. Looking further out, these technologies are expected to have a positive impact on the accident rate.”

“Technological innovation for cars is moving rapidly,” added Korsmit. “As automobiles become more technologically complex, more repairs will address technology inside the car. The costs of the repairs are not expected to decrease, despite the efforts and wishes of the insurance companies.”

Axalta expects consolidation to continue but said the level at which this will happen will depend on the market. “Plus, the speed of consolidation will depend a lot on the overall economic and market conditions, available and deployed cash for investments and succession strategies and plans,” added Winokur. “Increasingly, customers are focused on innovation and service. For example, in Latin America we’re taking training to body shop technicians with mobile training classes rather than depending on them to come to one of our training centers. In other markets, increasing environmental regulations drives the development of technically advanced high-productivity low-VOC and waterborne coatings.”

Key Issues

Depending on the shop, needs will vary in importance and magnitude. “For many independents and megashops, securing talent is a key concern and managing insurance DRPs is a time-consuming key factor to ensure they get cars to their doors, said Gillfillan. “For MSOs, cycle time and processing vehicles as quickly as possible is a major concern. For dealerships, business management and tracking of KPIs are key challenges.”

For each of these sectors, BASF reported that it has the knowledge, resources and tools to help them succeed, including Business Development Manager (BDM) experts who partner with its customers.

“Our market-leading Advanced Process Solutions lean program, our VisionPLUS Online reports and our Performance Groups support all of these challenges,” said Gillfillan. “BASF prides itself on being able to partner with our customers to work side-by-side with shop owners and managers to improve their business by leveraging our best-in-class tools and services. We’re working to provide solutions for our customers that improve profitability and productivity. We’re also focused on continually improving our products to meet the needs of our customers.”

According to AkzoNobel’s Korsmit, there is a shift in the influence stakeholders have on the market. “Bodyshops used to be in the driver’s seat of the industry, but stakeholders such as insurance and OEM companies are exercising more and more influence,” he stressed. “In addition, we see key challenges and opportunities as the focus of repairs shift from cosmetic and technical to dealing with managing increasingly complex substrates, technologies and electronics.”

In order to compete in these markets, the efficiency of bodyshops is key. Korsmit said AkzoNobel continues to focus on driving bodyshop efficiency, by providing business services to bodyshops, developing cost-effective products, continuously holding an open stakeholder dialogue on the market trends and jointly developing strategies.

According to Mowson, providing premium products and systems is another key issue. He cited Sherwin-William’s ULTRA refinish system, HP Process and AWX Performance Plus waterborne technology. “They are obviously key to meeting their needs from a paint product standpoint. It’s also about being a Solutions Provider to our customers: We feel and have seen the effects of providing our independent, MSO and dealership collision repair facilities more than just good paint. We think it’s imperative to help provide them solutions to increase their business’ productivity and profitability through better cycle times, lean practices and recognizing other shop efficiencies.”

Sherwin-Williams collaborates with its customers to develop custom solutions based on their specific growth opportunities. “We employ the industry’s largest team of technical service specialists in addition to highly-trained field personnel and industry leading consultants to deliver the on-site service, extensive training and whatever support is necessary to help them achieve sustainable efficiency,” said Mowson.

Newest Technologies

According to Gillfillan, BASF is the number one chemical supplier to the automotive industry. “Having this broad experience and know-how enables BASF to be a market-leading coatings supplier,” he stated. “BASF provides our customers with the best-in-class refinish products and the most OEM approvals of refinish paint providers, combined with the best-in-class services and solutions to support the collision repair industry. We will continue to bring innovation to the automotive industry, including the right finishes as vehicle technology changes (e.g. new substrates and processes). Not only does BASF have the most OEM approvals in the Refinish industry, but our partnership goes much further to shape the mobility of the future. In addition, we have breadth within the industry by being vertically integrated. BASF spends 1.9 billion Euros on R&D globally each year, over 200 million of which is spent in the automotive industry alone. This enables BASF to continue to bring market leading, innovative products and solutions to our customers.”

AkzoNobel has stated that it is the frontrunner in the industry when it comes to innovative and sustainable products, as well as digital solutions. “Sustainability is at the heart of everything we do,” said Korsmit. “We continuously look into products and processes to reduce the impact of our operations and products on the environment while simultaneously delivering business value to our customers. This includes our range of UV-curing products. The benefits of such products include the ability to drastically speed up repair times, eliminate material waste and reduce energy consumption for curing. A true win-win proposition.”

The automotive refinish technology continues to evolve to address market needs. “Nano-dispersed pigments are used to recreate very high chromo colors recently introduced by several OEMs,” said Robert K. Roop, vice president, global refinish technology at Axalta. “Special clearcoat additives have been developed to recreate unique appearances such as “matte” finishes. And proprietary polymer technology is used to drive highly productive coating systems, including undercoats, basecoats, and clearcoats. Going forward, Refinish technology will use a variety of pigment, additives, and polymer technologies to recreate future OEM finishes.”

New Products

Collision shops today are continually challenged to drive efficiencies and profits, and meet stringent OEM requirements.

“BASF wants to be that partner so we will continue to advance products and services that deliver increases in shop efficiency and drive growth and profitability,” said Gillfillan. “The newest technologies we recently launched are focused around reducing cycle time including fast drying clears for Glasurit and R-M and UV primers. The new Glasurit UV Primer offers exceptional holdout and gloss retention on repair areas, can be cured in seconds using advanced UV curing equipment or cured in the sunlight, all increasing through put inside the shop.”

AkzoNobel is leading the digitizing of color retrieval, according to Korsmit. “Our COLORVATION program builds on the leading color matching tools, such as Automatchic vision and MIXIT. It is our commitment to continuously push technological boundaries, and COLORVATION is designed to deliver the highest first time right hit rate in obtaining the perfect color match, enabling bodyshops to enhance their efficiency by making the transition to 100 percent digital color matching.”

“Our MIXIT mobile app offers bodyshops, technicians and painters across the globe instant access to the latest color formulas. Through the cloud-based software, users have immediate access to its vast database which hosts more than two million colors and variants – with more being added every day. We are also very excited about this year’s SEMA event in Las Vegas. At the show, we will introduce a new custom color line of automotive paints through our Sikkens brand. The new colors are being developed in partnership with Dave Kindig, automotive artist and host of the popular cable show Bitchin’ Rides on the Velocity Channel. Dave is known by auto enthusiasts for his commitment to quality and excellence, and that commitment will be evident in this new line of paints.”

Axalta has launched a wide range of new products to address the needs of the Refinish marketplace. “Our newest Spies Hecker ultra-productive primer, HS Speed Surfacer, was recently launched in Europe and cures in less than 15 minutes,” said Roop. “Our new waterborne basecoat system, Syrox, was recently launched in China, Europe, and Australia provides easy application for our body shop painters. And our low energy, ultra-productive clearcoats including Standox VOC-Xtreme, Spies Hecker HS Speed, and Cromax Ultra Performance Energy provide excellent appearance and extremely fast cure times. These products, combined with global launch of the Acquire™ Quantum EFX, our newest state-of-the-art spectrophotometer, provide body shops all the tools needed to quickly to recreate any OEM finish.”

Mowson said that he feels Sherwin-Williams is changing the game by making a premium finish possible in half the time of typical glamour clearcoats. “Our latest CC200 Dynamic Clearcoat features significantly shorter bake times, at lower temperatures, to allow shops to significantly increase daily throughput without compromising on appearance. It’s optimized for any level painter, application and repair environment, so CC200 effectively replaces several clearcoats with one workhorse to simplify the shop owner, as well as the painter’s, world.”

Sherwin-Williams has also introduced FASTLINE professional series of associated products designed for the collision repair, OEM and fleet refinishing markets. Now sold through Sherwin-Williams Automotive Finishes stores, this extensive collection of premium PBE products allows customers access to body fillers, masking products and abrasives at competitive prices. “Our customers find it convenient to buy these products from the same company that manufactures and delivers their premium refinish coatings,” Mowson concluded.