Doug Bohn, Consultant Orr and Boss08.10.18

Over the last several years, the Asian paint and coatings market has undergone several changes. The growth has slightly decreased, there has been stricter enforcement of environmental regulations and countries like India and Indonesia have begun to grow faster than the historical growth leader of China. Will these trends continue into the second half of 2018 and beyond? The short answer is yes. Orr & Boss expects many of the trends that have been impacting the Asian paint and coatings market to continue with growth gradually slowing, stricter environmental regulations continuing to take hold and countries like India and Indonesia continuing to grow at strong rates. The rest of this article provides our views of the Asian coatings market.

Global and Asian Coatings Markets

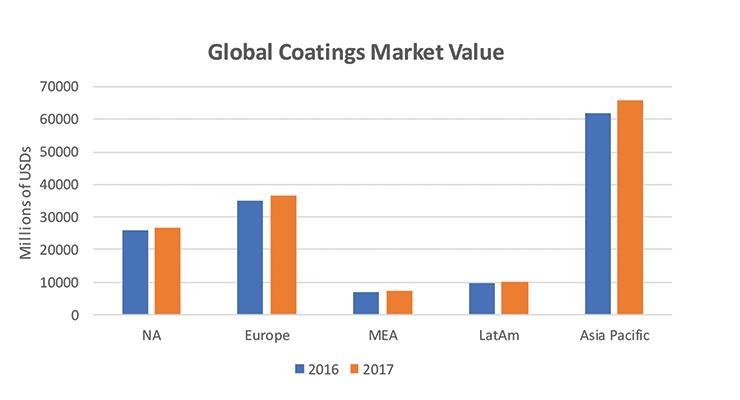

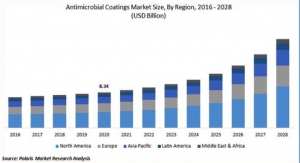

Before discussing, the Asian paint and coatings market, we would like to summarize the global paint and coatings market. Orr & Boss estimates the 2017 global coating market to be $147 billion and 41.8 billion liters. The value of the global market grew at 5.2 percent and volume grew at a rate of 4.3 percent from 2016 to 2017. The largest and most dynamic region of the global coatings industry is Asia-Pacific. Orr & Boss estimates the Asia-Pacific paint and coatings market to be $66 billion and 22.2 billion liters. The value of the Asian-Pacific coatings market grew at a rate of 6.5 percent and volume grew at a rate of 5.9 percent in 2017.

The chart below summarizes the 2016 and 2017 value of the global coatings market by region.

Segments of the Asia-Pacific Coatings Market

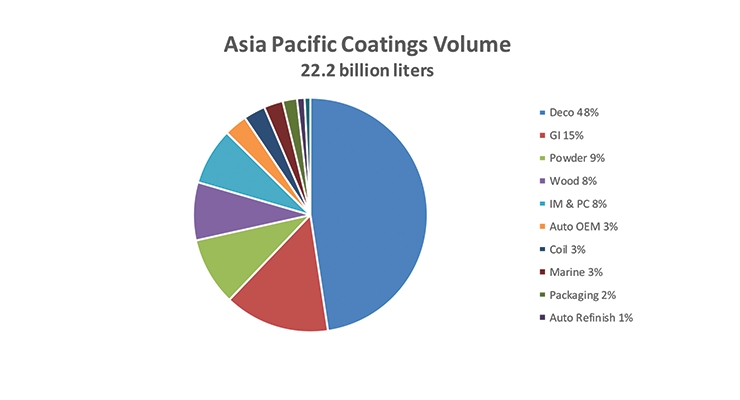

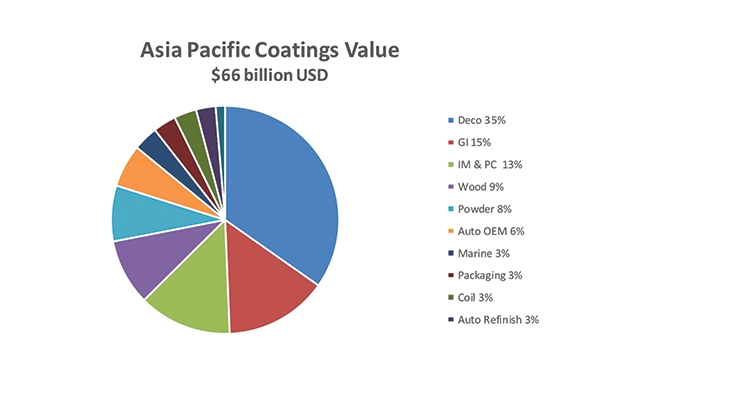

The largest segments of the Asia-Pacific coatings market are Decorative, General Industrial (GI), Industrial Maintenance & Protective Coatings (IM & PC), Powder and Wood. Combined these five segments are 80 percent of the value and 88 percent of the volume as the pie charts summarize.

Market Growth:

Asia-Pacific is expected to remain the fastest growing region in the global coatings market. Although, growth is expected to slightly decline from the growth seen in recent years. The factors having the most influence on the growth of the Asia-Pacific coatings market are GDP, construction activity, automotive builds and industrial production. All are expected to remain growing but just not at as high of a rate. The main reason for the lowering of growth expectations is that China’s expected economic growth is expected to gradually slow. From 2012-2017, China’s GDP grew at an annualized rate of 7.3 percent/yr. Going forward, from 2017-2022, China’s GDP is expected to grow at a rate of 6.15 percent/yr. It is still growing at a robust rate but just not quite as strong as it had been growing. India is expected to become the fastest growing economy in Asia with its GDP growth increasing from 6.9 percent from 2012-2017 to 7.9 percent from 2017-2022. The relatively fast-growing GDP is expected to result in India becoming the fasted growing coatings market in Asia. The patterns for construction, automotive and industrial production follow similar patterns to GDP: China is still showing growth at a high rate but not quite as high as we have become accustomed to and India’s growth is increasing.

Coatings Market by Country:

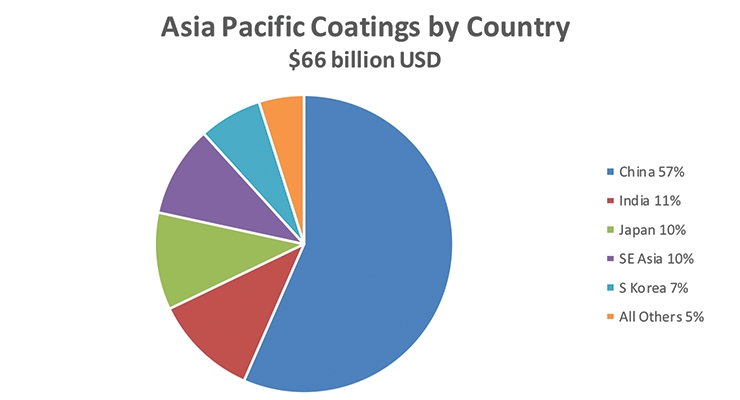

The countries with the largest coatings markets in Asia are China, India, Japan and South Korea. These four coatings markets account for 85 percent of the market. In 2016, India surpassed Japan as the second largest coatings market in Asia. We expect that the gap between India and Japan will continue to widen in the coming years.

Key Trends:

There are a number of key trends impacting the Asian coatings market. The first has already been discussed above. We expect growth to remain strong but not quite as strong as in previous years. We expect that from 2017-2019, volume to grow at 4.8 percent per year and value to grow at 5.8 percent per year.

Within the Chinese coatings market, the biggest factor impacting it is the increase in environmental regulations. China has been enforcing stricter environmental standards on its paint makers for both VOC content of its paint, as well as the emissions generated at the paint plants. The large cities like Beijing and Shanghai often have stricter environmental standards than the national ones. Another factor influencing the Chinese coatings market is that the Chinese government is targeting some very aggressive goals for Electric Vehicle (EV) market. EVs are targeted to be 10 percent of production in 2019 and 12 percent in 2020. It remains to be seen if China can meet these targets, but certainly the EV market will grow in China. As the EV industry grows in China, it will result in new materials coming into use in the Chinese automotive market as automakers attempt to lightweight their vehicles. This will increase the demand for coatings for plastic substrates for the automotive market.

Outside of China, there are several interesting trends that coatings companies may be able to capitalize on. In Japan, the overall coatings market is expected to remain flat but there may be pockets of growth in the construction industry related to the 2020 Tokyo Olympics that coatings manufacturers can profit from. The Indonesian coatings market is one of the faster-growing markets in Southeast Asia with growth expected to be 6.5 percent per year in the coming years. One segment that may grow faster than that overall rate in Indonesia is the marine coating segment due to the government’s plan of increasing passenger boats and water taxis to service Indonesia’s large number of islands.

Conclusions:

We expect that the Asia coatings market will remain a strong market in the coming years. However, we do expect growth to continue to decline as the Chinese coatings market continues to mature. Also, the increase in environmental regulations within China and outside of Asia are expected to remain a factor influencing the market; both stricter enforcement of VOC regulations as well as coatings plant emissions is expected to remain in place in the coming years. Outside of China, we expect that the Indian paint and coatings market growth rate will remain strong and it will remain the fastest growing economy in Asia.

Global and Asian Coatings Markets

Before discussing, the Asian paint and coatings market, we would like to summarize the global paint and coatings market. Orr & Boss estimates the 2017 global coating market to be $147 billion and 41.8 billion liters. The value of the global market grew at 5.2 percent and volume grew at a rate of 4.3 percent from 2016 to 2017. The largest and most dynamic region of the global coatings industry is Asia-Pacific. Orr & Boss estimates the Asia-Pacific paint and coatings market to be $66 billion and 22.2 billion liters. The value of the Asian-Pacific coatings market grew at a rate of 6.5 percent and volume grew at a rate of 5.9 percent in 2017.

The chart below summarizes the 2016 and 2017 value of the global coatings market by region.

Segments of the Asia-Pacific Coatings Market

The largest segments of the Asia-Pacific coatings market are Decorative, General Industrial (GI), Industrial Maintenance & Protective Coatings (IM & PC), Powder and Wood. Combined these five segments are 80 percent of the value and 88 percent of the volume as the pie charts summarize.

Market Growth:

Asia-Pacific is expected to remain the fastest growing region in the global coatings market. Although, growth is expected to slightly decline from the growth seen in recent years. The factors having the most influence on the growth of the Asia-Pacific coatings market are GDP, construction activity, automotive builds and industrial production. All are expected to remain growing but just not at as high of a rate. The main reason for the lowering of growth expectations is that China’s expected economic growth is expected to gradually slow. From 2012-2017, China’s GDP grew at an annualized rate of 7.3 percent/yr. Going forward, from 2017-2022, China’s GDP is expected to grow at a rate of 6.15 percent/yr. It is still growing at a robust rate but just not quite as strong as it had been growing. India is expected to become the fastest growing economy in Asia with its GDP growth increasing from 6.9 percent from 2012-2017 to 7.9 percent from 2017-2022. The relatively fast-growing GDP is expected to result in India becoming the fasted growing coatings market in Asia. The patterns for construction, automotive and industrial production follow similar patterns to GDP: China is still showing growth at a high rate but not quite as high as we have become accustomed to and India’s growth is increasing.

Coatings Market by Country:

The countries with the largest coatings markets in Asia are China, India, Japan and South Korea. These four coatings markets account for 85 percent of the market. In 2016, India surpassed Japan as the second largest coatings market in Asia. We expect that the gap between India and Japan will continue to widen in the coming years.

Key Trends:

There are a number of key trends impacting the Asian coatings market. The first has already been discussed above. We expect growth to remain strong but not quite as strong as in previous years. We expect that from 2017-2019, volume to grow at 4.8 percent per year and value to grow at 5.8 percent per year.

Within the Chinese coatings market, the biggest factor impacting it is the increase in environmental regulations. China has been enforcing stricter environmental standards on its paint makers for both VOC content of its paint, as well as the emissions generated at the paint plants. The large cities like Beijing and Shanghai often have stricter environmental standards than the national ones. Another factor influencing the Chinese coatings market is that the Chinese government is targeting some very aggressive goals for Electric Vehicle (EV) market. EVs are targeted to be 10 percent of production in 2019 and 12 percent in 2020. It remains to be seen if China can meet these targets, but certainly the EV market will grow in China. As the EV industry grows in China, it will result in new materials coming into use in the Chinese automotive market as automakers attempt to lightweight their vehicles. This will increase the demand for coatings for plastic substrates for the automotive market.

Outside of China, there are several interesting trends that coatings companies may be able to capitalize on. In Japan, the overall coatings market is expected to remain flat but there may be pockets of growth in the construction industry related to the 2020 Tokyo Olympics that coatings manufacturers can profit from. The Indonesian coatings market is one of the faster-growing markets in Southeast Asia with growth expected to be 6.5 percent per year in the coming years. One segment that may grow faster than that overall rate in Indonesia is the marine coating segment due to the government’s plan of increasing passenger boats and water taxis to service Indonesia’s large number of islands.

Conclusions:

We expect that the Asia coatings market will remain a strong market in the coming years. However, we do expect growth to continue to decline as the Chinese coatings market continues to mature. Also, the increase in environmental regulations within China and outside of Asia are expected to remain a factor influencing the market; both stricter enforcement of VOC regulations as well as coatings plant emissions is expected to remain in place in the coming years. Outside of China, we expect that the Indian paint and coatings market growth rate will remain strong and it will remain the fastest growing economy in Asia.