Yogender Singh, India, Asia-Pacific Correspondent02.16.22

The last two years have not been the best of the times for the Indian (as well as global) paints & coating industry due to the COVID-19 pandemic. However, this has not put brakes on the new investments and capacity expansions in the Indian paints & coating industry. Almost all the major producers have announced and gone ahead with a slew of investments.

Dive Deeper: Sign Up To Be An Industry Insider

Coatings World examines the state of the Indian paint and coating industry and new investments and expansions carried out by Indian paint majors in 2021.

The decorative paint category constitutes almost 75% of the overall market and includes multiple categories like exterior wall paints, interior wall paints, wood finishes and enamels, as well as ancillary products like primers, putties, etc. The industrial paint category constitutes the balance of 25% of the paint market and includes a broad array of segments like automotive, marine, packaging, powder, protective and other general industrial coatings.

The Big Four of the paints industry – Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel India – account for more than 65% of the overall paints and coating market and 75% of the decorative paints market. The industrial segment is more fragmented, with these four companies accounting for 51% of the overall market.

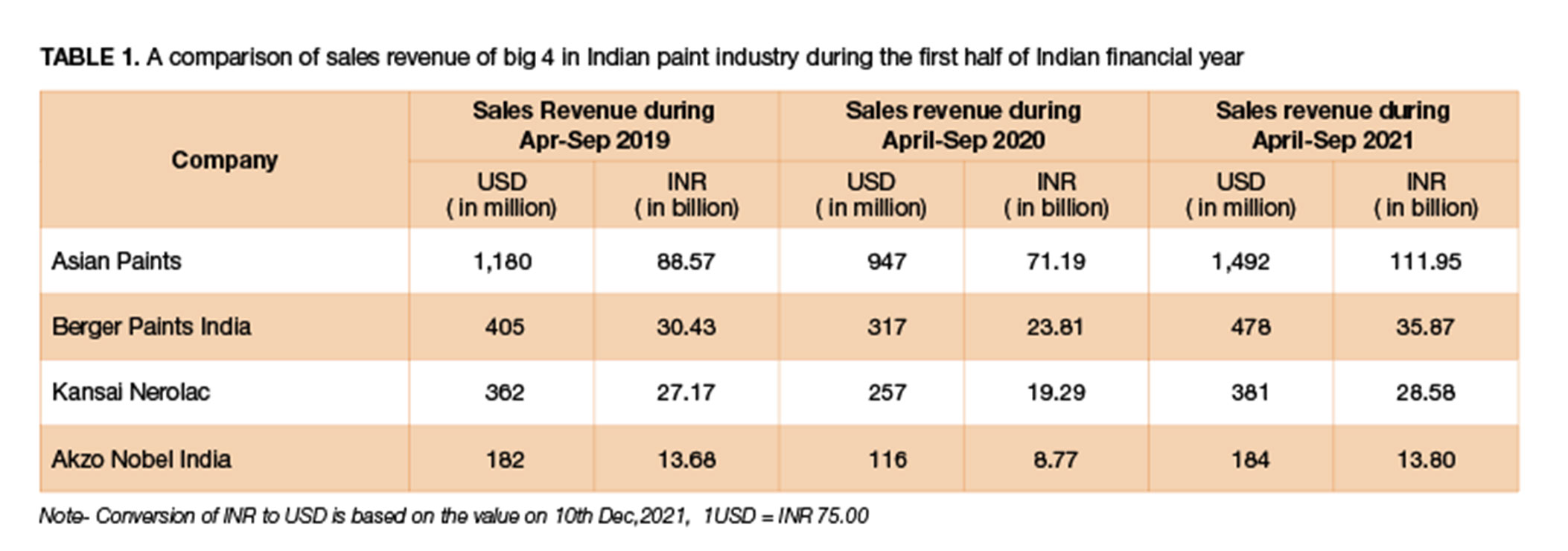

All four major players have been able to surpass the sales revenue of the pre-COVID era (April-September 2019) during the April-September 2021 period. Table 1 is a comparison of sales revenue of these four players for a six month period (April-September) during the last three years. Though, it would be very early to say that Indian industry has come out of the grip of COVID-19 induced slowdown, a major part of the total demand in last six months (April-September 2021) was due to pent up demand of 2020 and first three months of the current year.

The entry of Grasim Industries and JSW Group and expression of interest of expansions by existing two mid-sized producers (Indigo Paints and Shalimar Paints) is expected to change dynamics of Indian paint and coating manufacturing industry by the end of 2023.

Grasim Industries Ltd, one of the largest business conglomerates in the country, announced its entry in the paints sector in January 2021. Grasim would be investing USD 666 million (INR 50 billion) over the next three years with the aim to become the second largest player in the paints industry.

Asian Paints

India’s largest paint & coating producer, Asian Paints has announced in last week of November to invest USD 128 million (INR 9.60 billion) to expand the installed capacity at its facility situated at Ankleshwar in the state of Gujarat.

The proposed expansion will increase the installed capacity of paint from 130,000 KL to 250,000 KL and resins and emulsions from 32,000 MT to 85,000 MT. The expansion will be carried out on the existing land owned by the company and will be completed in the next two to three years.

Berger Paints

India’s second largest paint company — in terms of market share — Berger Paints is setting up its biggest-ever greenfield venture at Sandila Industrial Estate, near Luknow in the state of Uttar Pradesh with an investment of USD 93 million ( INR 7 billion), which would be operational during the first quarter of 2022.

Berger paints has recently expanded its installed capacity at Jejuri plant at Pune in the state of Maharashtra. Earlier, the company had an installed capacity of 9,000 tons per month of paints and 6,000 tons per month of resins. Post capacity expansion, the company has added 39,600 tons per annum of paints and 27,000 tons per annum of resins with an investment of USD 26 millio (INR 2 billion).

Kansai Nerolac

Kansai Nerolac is the largest industrial paint and third largest decorative paint company in India. While strengthening its position in these traditional markets, it continues to venture into new customer need areas, such as wood coating, adhesives, construction chemicals in decorative and floor coatings, transportation coatings, coil coatings, rebar coatings and super durable powders in the industrial coatings segment. These ventures have helped it expand its product portfolio and offerings.

During the financial year 2020-21, the company increased its installed capacity by 5.5%, taking it to 547 million liters per annum from the existing 518 million liters per annum.

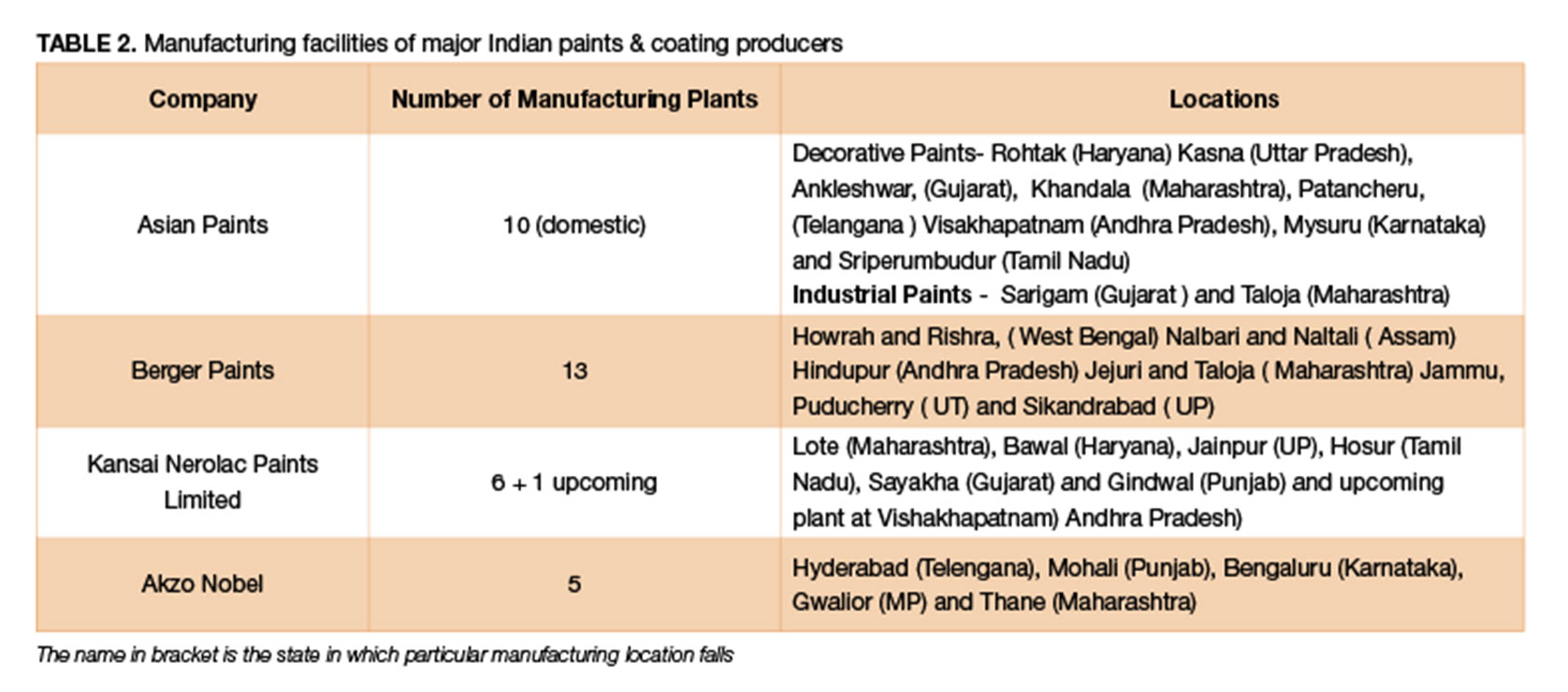

Kansai Nerolac will be setting up another production plant at Visakhapatnam in the state of Andhra Pradesh. Currently, the company operates a total of six production plants, all of which are strategically located near key original equipment manufacturers (OEMs), thus giving it a strong competitive edge.

Dive Deeper: Sign Up To Be An Industry Insider

Coatings World examines the state of the Indian paint and coating industry and new investments and expansions carried out by Indian paint majors in 2021.

An Overview of Indian Paints and Coating Industry

Barring the years 2020 and 2021, the Indian paint industry has historically grown in double digits. The country’s paints and coating industry is poised to grow at a healthy rate in the medium and long run.The decorative paint category constitutes almost 75% of the overall market and includes multiple categories like exterior wall paints, interior wall paints, wood finishes and enamels, as well as ancillary products like primers, putties, etc. The industrial paint category constitutes the balance of 25% of the paint market and includes a broad array of segments like automotive, marine, packaging, powder, protective and other general industrial coatings.

The Big Four of the paints industry – Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel India – account for more than 65% of the overall paints and coating market and 75% of the decorative paints market. The industrial segment is more fragmented, with these four companies accounting for 51% of the overall market.

All four major players have been able to surpass the sales revenue of the pre-COVID era (April-September 2019) during the April-September 2021 period. Table 1 is a comparison of sales revenue of these four players for a six month period (April-September) during the last three years. Though, it would be very early to say that Indian industry has come out of the grip of COVID-19 induced slowdown, a major part of the total demand in last six months (April-September 2021) was due to pent up demand of 2020 and first three months of the current year.

New Investments in Indian Paint & Coating Industry

In addition to capacity expansions and greenfield plants by existing paints and coating producers, Indian industry will see major investments by two new entrants.The entry of Grasim Industries and JSW Group and expression of interest of expansions by existing two mid-sized producers (Indigo Paints and Shalimar Paints) is expected to change dynamics of Indian paint and coating manufacturing industry by the end of 2023.

Grasim Industries Ltd, one of the largest business conglomerates in the country, announced its entry in the paints sector in January 2021. Grasim would be investing USD 666 million (INR 50 billion) over the next three years with the aim to become the second largest player in the paints industry.

Asian Paints

India’s largest paint & coating producer, Asian Paints has announced in last week of November to invest USD 128 million (INR 9.60 billion) to expand the installed capacity at its facility situated at Ankleshwar in the state of Gujarat.

The proposed expansion will increase the installed capacity of paint from 130,000 KL to 250,000 KL and resins and emulsions from 32,000 MT to 85,000 MT. The expansion will be carried out on the existing land owned by the company and will be completed in the next two to three years.

Berger Paints

India’s second largest paint company — in terms of market share — Berger Paints is setting up its biggest-ever greenfield venture at Sandila Industrial Estate, near Luknow in the state of Uttar Pradesh with an investment of USD 93 million ( INR 7 billion), which would be operational during the first quarter of 2022.

Berger paints has recently expanded its installed capacity at Jejuri plant at Pune in the state of Maharashtra. Earlier, the company had an installed capacity of 9,000 tons per month of paints and 6,000 tons per month of resins. Post capacity expansion, the company has added 39,600 tons per annum of paints and 27,000 tons per annum of resins with an investment of USD 26 millio (INR 2 billion).

Kansai Nerolac

Kansai Nerolac is the largest industrial paint and third largest decorative paint company in India. While strengthening its position in these traditional markets, it continues to venture into new customer need areas, such as wood coating, adhesives, construction chemicals in decorative and floor coatings, transportation coatings, coil coatings, rebar coatings and super durable powders in the industrial coatings segment. These ventures have helped it expand its product portfolio and offerings.

During the financial year 2020-21, the company increased its installed capacity by 5.5%, taking it to 547 million liters per annum from the existing 518 million liters per annum.

Kansai Nerolac will be setting up another production plant at Visakhapatnam in the state of Andhra Pradesh. Currently, the company operates a total of six production plants, all of which are strategically located near key original equipment manufacturers (OEMs), thus giving it a strong competitive edge.