Gary Shawhan, Chemark Consulting03.11.24

Country Dynamics: India vs. China

Is India ready to take the lead from China in servicing the global supply chain? The answer to this question is perhaps.Certainly, China has provided sufficient reasons for companies to look elsewhere. Within Southeast Asia, India represents the second largest economy at $3.7 trillion. This contrasts with China, whose economy is valued at $17.7 trillion in 2023.

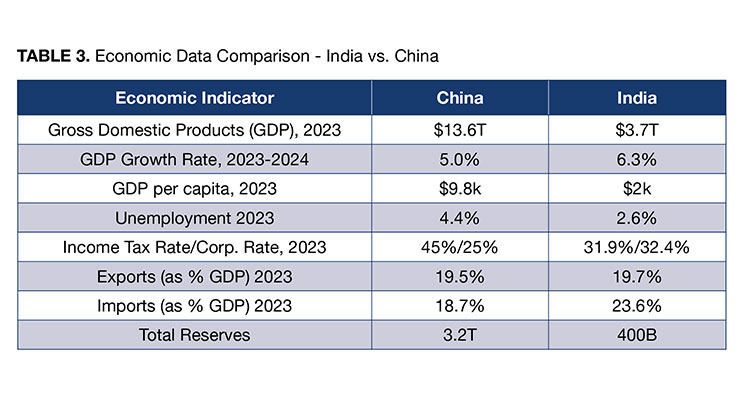

India is a country of 1.4 billion people vs. 1.5 billion for China. In 2023, India represented the world’s fifth largest economy (Table 3) as measured by GDP compared to that of China, which is second to the United States.

Today, India is a country that is on a strong economic growth curve. It has a large, energetic, young work force and a government that is committed to infrastructure development. The Indian government has also instituted policy changes favorable to supporting foreign direct investment. This includes initiating new clean energy policies more in line with global sustainability goals.

Deutche Bank has estimated that India’s GDP could almost double by 2030, approaching ~$7 trillion by 2030.

India’s GDP in 2023/2024 is pegged at 6.3%, slightly above earlier estimates for the year. China’s 2023 GDP is anticipated to be around 5% for the year. This estimate is down from an earlier forecast of around 5.5% as the Chinese economy has increasingly struggled to regain its past high level of economic growth. This downward trend is expected to continue into 2024 with an estimate of 4.5% GDP (or possibly lower) for China.

Other differences in the current business climate between India and China include: • India has an emerging economy with a young workforce that is ambitious and motivated to improve their economic position.

• India has fostered partnerships and a positive working relationship with most SE Asia countries that is far less contentious than their current relationships with the Chinese government. This has put India in a much more favorable position to challenge China as an alternative global source of supply.

One of the challenges facing India is the fragmentation and in-country segregation of regional territories and their governmental systems. Historically, regional sects have impeded India’s ability to move decisively with unilateral actions necessary to respond to business opportunities. Recent policy changes by the Indian government that are favorable to foreign investment are helping to eliminate this as an issue going forward.

India has also built a good working relationship with many of the other countries in the region. At a time when China is challenging the sovereignty and border security of many of the same SE Asia countries, India has established relationships with them by extending a helping hand and provided support on both defense and humanitarian issues.

China’s labor costs have risen steadily with the growth in its supply chain position. One consequence of this evolution is China has developed a large middle-class. In turn, this has created in-country competition for their global export business.

China has aggressively pursued direct investments in establishing manufacturing operations throughout SE Asia. This has allowed China to leverage their supply chain position by extending their manufacturing reach to neighboring countries that still possess a low-cost labor force.

China has also been aggressively investing in next generation automation to improve manufacturing efficiencies within existing Chinese facilities. This effort is designed to allow China to retain a net cost advantage, especially in the higher-tech, value-added markets.

China’s authoritarian government has provided a singular point of control for policy (including tariffs, allocations and lockdowns), business direction and investment. Early in its economic growth cycle this was an advantage. In recent years, this has increasingly become an impediment to foreign investment and to reliance on China as a supply chain partner.

Current Investment Climate: China vs. India

Foreign direct investments (FDI) into both Chinese and Indian companies experienced a decline in 2023. China’s State Administration of Foreign Exchange posted a third quarter, 2023 decline of $11.8 billion for foreign direct investments in non-Chinese companies. Compared to nine-month YTD 2022 vs. 2023, the decline in FDI for China was $10.8 billion or 8.4%. In comparison, the nine-month decline in foreign direct investments for India was 14.3% from 2022 to 2023 or $26.5 billion versus $31 billion.Reasons for the decline in FDI (for both China and India) include investor uncertainty about the economy overall and an increasingly conservative attitude by corporations toward offshore investments. This reluctance also extended to private equity and venture capital.

In general, as the global economy recovers this trend in FDI is expected to reverse. For China (as noted earlier) the additional mitigating issues are likely to impact foreign direct investments, making recovery less certain.

Merger and Acquisition Activity

India and China have recently experienced a decline in M&A activity. For China, M&A activity (by value) in the third quarter of 2023 declined 83% from Q2 which was reported at $8.1 billion. As compared to Q3 2022, the value of M&A deals was down 65%.India’s M&A activity for Q3 2023 increased 25% from the previous quarter but was 3% lower when compared to the third quarter of 2022. For the full nine-month period, M&A activity was $65.6 billion YTD in 2023. This, however, was down 57% from the same period in 2022 reflecting the apprehension of investors based, in a large part, on the economy.

The Indian government is beginning to get behind the investment community wanting to establish manufacturing in their country. This is particularly true for high technology industries including consumer electronics, semiconductors, automotive and aerospace. As an example, Prime Minister Narendra Modi has pledged $10 billion to support investments in semiconductor capacity.

Recent investment activity highlights in India by key high-tech manufacturers include:

• Micron is planning an estimated $825 million investment in India for new semiconductor manufacturing facilities. AMD is also planning to invest $400 million in India over the next several years.

• Foxconn, a Taiwanese-based company and China’s largest single employer, already has nine production campuses and more than 30 factories already operating in India. Foxconn is also building several new facilities there, which includes a $360 million factory to manufacture phone-case components and a $240 million plant to manufacture semiconductors.

• Apple Inc., who has partnered with Foxconn in China on iPhone production, recently announced plans to double their investments and employment in India. This reflects Apple’s intent to move manufacturing out of China based on the current geopolitical climate. In Q3 2023, Apple reported absorbing the added costs for manufacturing the iPhone 15 in India to underscore their intent to reduce dependence on China.

• Boeing and Airbus both have various components and sub-assemblies manufactured in India. Boeing has indicated they have plans to increase manufacturing of components tied to market demand for new aircraft.

• Nissan is reportedly looking to expand their Indian-based domestic auto production to include exporting its in-country manufactured cars. Tesla Inc. is ready to invest up to $2 billion to set up a factory in India if the government cuts its import duty on its vehicles to 15% for the first two years of operations.

• Amazon intends to make a large investment in India. Amazon plans an additional $15 billion investment by 2030 with Amazon Web Services contributing $12.7 billion directed at India’s surging economy.

Outlook for Trade Relations Between India, China, and the U.S.

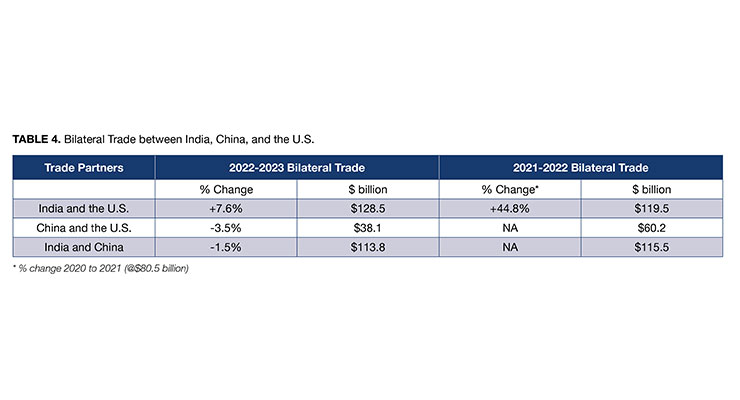

The shift in trade relations between China and India with the United States is beginning to be reflected in the import/export data for the last couple of years. For FY 2023, the U.S. became India’s largest trading partner. Exports to India from the U.S. for the period 2022-2023 rose to $78.3 billion and imports rose to $50.2 billion for the period.In comparison, bilateral trade between China and the United States for FY 2023 was $58.1 billion. This included US exports of $7.7 billion and imports of $50.5 billion.

This trend is expected to continue as relationships between the U.S. and India continue to strengthen.

SE Asia countries had increasingly relied on Chinese manufacturers as a key source of supply for various products and services. China also represented a major export market for their own goods.

Without a viable alternative, the impact to the economy of many SE Asia countries by even partially disengaging with China is a problem. India, as an emerging economy in the region, is now positioned to provide them a timely option.

Chinese companies, faced with the growing tensions between China and many of their traditional global export customers including the United States, are also modifying their supply chain strategies. China, as a sole source of supply, has become a risk to their own manufacturing infrastructure. Chinese companies are now looking to set up manufacturing in India or with other SE Asia countries.