Charles W. Thurston, Latin America Correspondent03.19.24

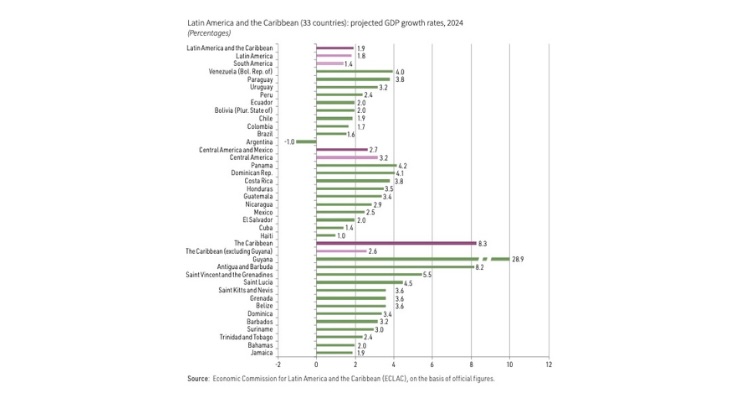

The economic growth of Latin America is relatively steady, but slow, with an overall expectation of gross domestic product (GDP) expansion of only 1.9% this year, down from 2.2% growth in 2022. This compares with global GDP expansion of 3% in 2023.

“All subregions are forecast to grow less than in 2023: projections are 1.4% for South America, 2.7% for Central America and Mexico, and 2.6% for the Caribbean, excluding Guyana,” according to the latest annual forecast by the United Nation’s Economic Commission for Latin America and the Caribbean (Eclac), in its December 2023 report, “Preliminary Overview of the Economies of Latin America and the Caribbean.”

Still, the outlook for growth in the paint and coatings industry is stronger, since sales in Latin America have traditionally expanded several percentage points faster than GDP growth.

“Mexico has the potential to attract between $50 billion and $60 billion per year in foreign direct investment. What matters is getting the government and the private sector onboard, so that together they can gauge where the investment is coming from, pinpoint those industries that are underperforming and build policies to make them more attractive,” reported BBVA, drawing on the bank’s late 2023 meeting on nearshoring.

While nearshoring has had dramatic positive effects on Mexico over the past year, the rest of Latin America presents challenges to the spread of nearshoring.

“Despite the fact that [Latin American] wages are now competitive with China and other destinations, other structural factors in LAC (Latin America and the Caribbean) — such as taxes, the cost of capital, the weak education level of the workforce, poor infrastructure policy, and social instability — all reduce the attractiveness of the region as a nearshoring destination,” observed the World Bank in October.

Major paint and coatings manufacturers in the region are gearing up for the nearshoring growth. “The fast-growing rate of construction and B2B business in Mexico and in Central America should be a driver to improve the market over the next three years,” said Marcelo Diniz Carneiro, the business director for PPG Architectural Coatings Latin America South and Central America, in a recent interview with Coatings World.

Central America, increasingly integrating with Mexico, is expected to deliver a 3.2% growth rate this year, while Mexico alone will grow by 2.5% this year, Eclac predicts. This bodes well for paint and coatings companies in the subregion.

“I would say that the consensus expectation for the Central American architectural coatings market for the next three years is around 4% to 5% market growth,” said Diniz, who is responsible for 12 countries in Latin America. “It's fair to say that we hope to outperform the market.”

“Amid low economic growth, limited macroeconomic policy space and a sluggish external sector, the economies of Latin America and the Caribbean are also experiencing a slowdown in their capacity to create jobs, and it is estimated that, by the end of 2023, the number of employed persons will have grown by 1.4%, which is 4 percentage points lower than the 5.4% recorded in 2022. This trend is expected to continue in 2024, when the number of employed persons is projected to grow by 1.0%,” said Eclac.

In turn, per capita GDP has barely moved up over the last few years. “Despite the uptick in economic activity, the region’s per capita GDP in the second quarter of 2023 has only regained the level of 30 quarters earlier, Eclac pointed out.

At the same time, inflation-affected consumer price changes have been volatile over the past year in many countries, ranging from 318% in Venezuela, to 138.3% in Argentina, to 50% in Surinam. The changes were far less in the other larger economies, with Brazil’s price change in 2023 at 5.2%, Mexico’s at 4.5% and Chile at 5.1%, per Eclac.

“Regional inflation, excluding Argentina and the República Bolivariana de Venezuela, stands at 4.4%, compared to 6.4% in Organisation for Economic Co-operation and Development (OECD) member-countries and 8.6% in Eastern Europe,” noted the World Bank in its October report Wired: Digital Connectivity for Inclusion and Growth.

Despite the challenges to consumption expansion in Latin America, the long-term progress is positive, writes the World Bank. “[Consumer] debt service shock is taking place against a backdrop of an almost doubling of consumer credit as a percentage of GDP in many countries over the last 20 years, which may have contributed to consumption being a major driver of the recovery, but which also injects a new source of risk to the system that needs to be monitored,” the bank opined.

Among other multilaterals that are increasing lending in the region, the Caribbean Development Bank (CDB) has approved over $461 million in financing for projects in the subregion this year.

FDI into Latin America was fairly flat in 2023 at $92.3 billion, up from $92.0 billion in 2022. Mexico received that largest tranche of FDI in 2023, at $27.2 billion, followed by Brazil with $18.1 billion, and Chile with $16.3 billion, Eclac estimates.

This multilateral lending encourages direct foreign investment (FDI) in the region, especially when infrastructure projects, including housing, are involved.

“Between 2000 and 2022, total trade between China and Latin America rose from $12 billion to $310 billion — more than 25-fold — with an average yearly growth of 15.9%,” observed Deloitte in a November 2023 report. “For comparison, global trade value has increased by only 6% rate per year since 1995, when the World Trade Organization was created.”

Country by country, the impact of trade with China varies greatly. “In Latin America, the countries most exposed to a slowdown in the Chinese economy are those that have China as their main trading partner, namely Chile, Panama, Peru, Brazil and Uruguay. China absorbs 39% of Chile’s goods exports, it absorbs 32% of the trade of both Panama and Peru, and 27% of both Brazil and Uruguay. If, in addition, goods exports represent a significant part of a country’s economic activity, then its exposure is even greater,” Eclac reckoned.

The overall growth of Latin America’s international trade is shifting slightly toward exports and away from imports. By volume, the region saw a 3.1% increase in exports during 2023, while imports contracted by 3.3%, Eclac reported. The value of that trade saw even wider changes: export values in 2023 contracted by 1.5% compared with a 16.3% increase in 2022. Similarly, import values contracted by 6.0% in 2023, compared with an increase of 20.6% in 2022, the agency reported.

Abrafati has collected 28,000 samples of paint and coatings in the PSQ system, and conducted 83,000 quality tests on those samples, the group reports. These tests help assure the functionality of paints formulated for economic, standard, premium and super premium quality brackets. This helps demonstrate expected levels of coverage, for example, which ranges from a 29% improvement within the standard quality bracket over economic bracket coverage, to 57% better coverage in the premium bracket, to 114% better coverage in the super premium bracket, the association indicates.

“We've really been pushing the quality agenda across the region, though from a local perspective, Brazil, has really high standards. Brazil right now is the market that has really set the bar in terms of standards,” agreed Diniz.

“Our PPG portfolio is very skewed to premium,” Diniz added. The company supports its premium brands through more tailored in-store and online services for consumers, and through more comprehensive B2B support for commercial customers, he said.

Restructuring the national debt in Argentina is one way the new government will tame inflation. In March, Argentina refinanced over $50 billion worth of peso-denominated sovereign debt, representing 77% of the financial instruments that were scheduled to come due this year.

Once the government has reduced its deficit, currency controls that now peg the peso at 830 to the dollar are expected to be lifted, easing foreign trade.

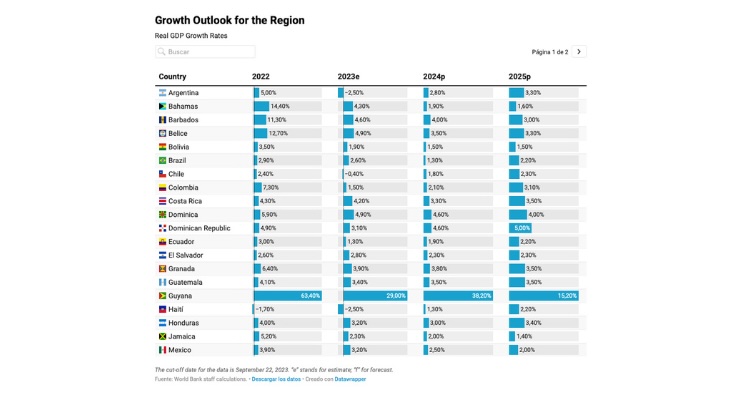

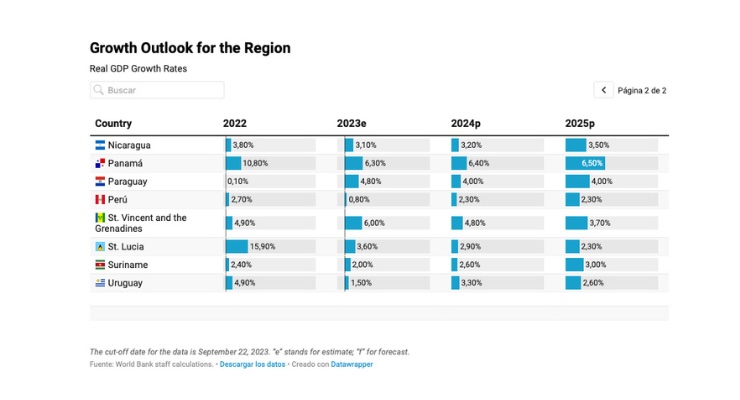

While the economy in Argentina was perceived to shrink by 2.5% in 2023, it is expected to turn the corner and grow by 2.8% this year and by 3.3% in 2025, according to an October 2023 analysis by the World Bank.

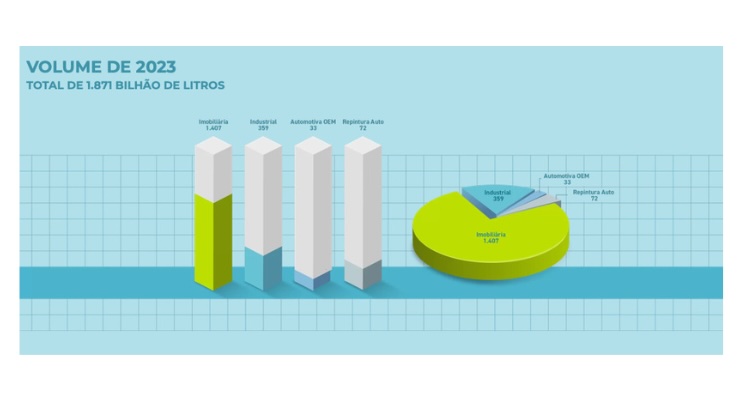

By market segment of consumption, 75.2% of national production is utilized within the architectural segment, while 19.2% is consumed within the industrial segment, 3.9% by the after-market automotive segment and 1.7% by automotive OEMs, Abrafati reports.

We expect the economic activity to return to trend GDP growth rates in 2024 on the back of more favorable interest rates, lower inflation and a more stable political outlook. These factors will boost private consumption, and investment will also recover slowly,” opined Fernando Larraín, vice president of communications, marketing, and studies at Santander Chile, in a February analysis.

According to World Bank figures and projections, Chile’s economy shrank by 0.4% in 2023, but will expand by 1.8% this year and by 2.3% in 2025.

Other banks agree. “Real GDP is expected to expand by 1.3% this year as macroeconomic policies gradually normalize. Private consumption, currently above pre-pandemic levels, is expected to moderate this year as households deleverage and labor market conditions soften, while private investment is expected to gradually recover, albeit remaining below pre-pandemic levels,” said International Monetary Fund staff at the conclusion of a country visit in February.

“Over the medium-term, real GDP growth is projected to converge to 3%, supported also by large-scale infrastructure projects, further recovery in private investment, and the economic gains from integrating Venezuelan migrants,” the IMF team reported.

Energy infrastructure will be a key driver to increased growth in the country, “Colombia’s ambitious climate and energy transition plans will require increased public and private investment. Shifting some of the spending envelope to infrastructure and climate-related projects would support Colombia’s objective of boosting its growth potential and being a global leader in the climate transition agenda,” the IMF reports.

Mexico’s economy, inextricably linked to that of the United States, will exhibit slower growth over the next few years, according to World Bank projections. The economy was pegged at a 3.2% expansion in 2023, and is projected to slow to 2.5% this year, and to 2.0% next year, the bank indicates.

Part of the formula for Mexico’s current growth is nearshoring, with most of this activity in Latin America centered in the country, thanks to its common border and open trade agreement with the United States. The impact of nearshoring has been largely recorded in the industrial segment, although the architectural segment is also recording rapid expansion.

In Guadalajara, just outside Mexico City, for example, office space sales rose by 75% during 2023 to 74,600 square meters, according to real estate investment firm CBRE. The growth in Guadalajara has earned it the moniker of Mexico’s Silicon Valley, according to Nearshore Americas.

“All subregions are forecast to grow less than in 2023: projections are 1.4% for South America, 2.7% for Central America and Mexico, and 2.6% for the Caribbean, excluding Guyana,” according to the latest annual forecast by the United Nation’s Economic Commission for Latin America and the Caribbean (Eclac), in its December 2023 report, “Preliminary Overview of the Economies of Latin America and the Caribbean.”

Still, the outlook for growth in the paint and coatings industry is stronger, since sales in Latin America have traditionally expanded several percentage points faster than GDP growth.

Nearshoring Opportunities

One relatively new economic development in the region that is adding to the bottom line is the nearshoring trend, which is centered in Mexico but also spreading to Central American and Caribbean countries.“Mexico has the potential to attract between $50 billion and $60 billion per year in foreign direct investment. What matters is getting the government and the private sector onboard, so that together they can gauge where the investment is coming from, pinpoint those industries that are underperforming and build policies to make them more attractive,” reported BBVA, drawing on the bank’s late 2023 meeting on nearshoring.

While nearshoring has had dramatic positive effects on Mexico over the past year, the rest of Latin America presents challenges to the spread of nearshoring.

“Despite the fact that [Latin American] wages are now competitive with China and other destinations, other structural factors in LAC (Latin America and the Caribbean) — such as taxes, the cost of capital, the weak education level of the workforce, poor infrastructure policy, and social instability — all reduce the attractiveness of the region as a nearshoring destination,” observed the World Bank in October.

Major paint and coatings manufacturers in the region are gearing up for the nearshoring growth. “The fast-growing rate of construction and B2B business in Mexico and in Central America should be a driver to improve the market over the next three years,” said Marcelo Diniz Carneiro, the business director for PPG Architectural Coatings Latin America South and Central America, in a recent interview with Coatings World.

Caribbean, Central American Growth Lead Region

On a subregional level, growth in the Caribbean is leading expansion in the Latin America region with an 8.3% expansion projected for this year, thanks to a whopping 28.9% GDP growth projection for Guayana, with its newly found oil reserves. Without Guyana, the Caribbean outlook is pegged at 2.6%.Central America, increasingly integrating with Mexico, is expected to deliver a 3.2% growth rate this year, while Mexico alone will grow by 2.5% this year, Eclac predicts. This bodes well for paint and coatings companies in the subregion.

“I would say that the consensus expectation for the Central American architectural coatings market for the next three years is around 4% to 5% market growth,” said Diniz, who is responsible for 12 countries in Latin America. “It's fair to say that we hope to outperform the market.”

Per Capita Growth Stalled, Job Formation Slow

The reasons for the slight slowdown in Latin American growth are many, but slow job formation, a major contributor to per capita GDP growth, is one key factor.“Amid low economic growth, limited macroeconomic policy space and a sluggish external sector, the economies of Latin America and the Caribbean are also experiencing a slowdown in their capacity to create jobs, and it is estimated that, by the end of 2023, the number of employed persons will have grown by 1.4%, which is 4 percentage points lower than the 5.4% recorded in 2022. This trend is expected to continue in 2024, when the number of employed persons is projected to grow by 1.0%,” said Eclac.

In turn, per capita GDP has barely moved up over the last few years. “Despite the uptick in economic activity, the region’s per capita GDP in the second quarter of 2023 has only regained the level of 30 quarters earlier, Eclac pointed out.

At the same time, inflation-affected consumer price changes have been volatile over the past year in many countries, ranging from 318% in Venezuela, to 138.3% in Argentina, to 50% in Surinam. The changes were far less in the other larger economies, with Brazil’s price change in 2023 at 5.2%, Mexico’s at 4.5% and Chile at 5.1%, per Eclac.

“Regional inflation, excluding Argentina and the República Bolivariana de Venezuela, stands at 4.4%, compared to 6.4% in Organisation for Economic Co-operation and Development (OECD) member-countries and 8.6% in Eastern Europe,” noted the World Bank in its October report Wired: Digital Connectivity for Inclusion and Growth.

Despite the challenges to consumption expansion in Latin America, the long-term progress is positive, writes the World Bank. “[Consumer] debt service shock is taking place against a backdrop of an almost doubling of consumer credit as a percentage of GDP in many countries over the last 20 years, which may have contributed to consumption being a major driver of the recovery, but which also injects a new source of risk to the system that needs to be monitored,” the bank opined.

Multilateral Banks Escalate Lending

One-way direct investment will grow in Latin America is through increased lending by multilateral banks. The Inter-American Development Bank, for example, recently approved a $3.5 billion capital increase for its private sector arm, IDB Invest, crucial for matched funding needs in loans. This increase will boost the latter’s lending ability to $19 billion per year from the about $8 billion per year, the bank said in a statement.Among other multilaterals that are increasing lending in the region, the Caribbean Development Bank (CDB) has approved over $461 million in financing for projects in the subregion this year.

FDI into Latin America was fairly flat in 2023 at $92.3 billion, up from $92.0 billion in 2022. Mexico received that largest tranche of FDI in 2023, at $27.2 billion, followed by Brazil with $18.1 billion, and Chile with $16.3 billion, Eclac estimates.

This multilateral lending encourages direct foreign investment (FDI) in the region, especially when infrastructure projects, including housing, are involved.

China Trade Impact

Trade with China has become a major factor in the national economies of Latin America, so the slowdown in China’s economy may have a dampening effect on the Latin America region over the near future.“Between 2000 and 2022, total trade between China and Latin America rose from $12 billion to $310 billion — more than 25-fold — with an average yearly growth of 15.9%,” observed Deloitte in a November 2023 report. “For comparison, global trade value has increased by only 6% rate per year since 1995, when the World Trade Organization was created.”

Country by country, the impact of trade with China varies greatly. “In Latin America, the countries most exposed to a slowdown in the Chinese economy are those that have China as their main trading partner, namely Chile, Panama, Peru, Brazil and Uruguay. China absorbs 39% of Chile’s goods exports, it absorbs 32% of the trade of both Panama and Peru, and 27% of both Brazil and Uruguay. If, in addition, goods exports represent a significant part of a country’s economic activity, then its exposure is even greater,” Eclac reckoned.

The overall growth of Latin America’s international trade is shifting slightly toward exports and away from imports. By volume, the region saw a 3.1% increase in exports during 2023, while imports contracted by 3.3%, Eclac reported. The value of that trade saw even wider changes: export values in 2023 contracted by 1.5% compared with a 16.3% increase in 2022. Similarly, import values contracted by 6.0% in 2023, compared with an increase of 20.6% in 2022, the agency reported.

Focus on Quality Aids Premium Lines

While the market slowly grows, paint and coatings producers in the region also are focusing on quality and on formulations, which help promote more premium bracket products. Brazil’s 20-year-old program to boost quality, Programa Setorial da Qualidade (PSQ) or sectoral quality program, has now been adopted by manufacturers responsible for 1 billion liters, or 90% of all paint and coatings produced in the country, according to the Associação Brasileira dos Fabricantes de Tintas, (Abrafati), the Brazilian association of paint manufacturers.Abrafati has collected 28,000 samples of paint and coatings in the PSQ system, and conducted 83,000 quality tests on those samples, the group reports. These tests help assure the functionality of paints formulated for economic, standard, premium and super premium quality brackets. This helps demonstrate expected levels of coverage, for example, which ranges from a 29% improvement within the standard quality bracket over economic bracket coverage, to 57% better coverage in the premium bracket, to 114% better coverage in the super premium bracket, the association indicates.

“We've really been pushing the quality agenda across the region, though from a local perspective, Brazil, has really high standards. Brazil right now is the market that has really set the bar in terms of standards,” agreed Diniz.

“Our PPG portfolio is very skewed to premium,” Diniz added. The company supports its premium brands through more tailored in-store and online services for consumers, and through more comprehensive B2B support for commercial customers, he said.

Outlook for the Largest LatAm Country Economies

The cautiously positive outlook for the five largest Latin American economies follows, listed alphabetically:• Argentina

Inflation is the primary focus of the new government in Argentina, led by President Javier Milei. Inflation rose to 211% in 2023, the highest level in 32 years, according to the Instituto Nacional de Estadística y Censos, the federal statistics agency. As the inflation rate continues to fall this year, the projected 1% contraction in the economy may yield to positive growth in 2025.Restructuring the national debt in Argentina is one way the new government will tame inflation. In March, Argentina refinanced over $50 billion worth of peso-denominated sovereign debt, representing 77% of the financial instruments that were scheduled to come due this year.

Once the government has reduced its deficit, currency controls that now peg the peso at 830 to the dollar are expected to be lifted, easing foreign trade.

While the economy in Argentina was perceived to shrink by 2.5% in 2023, it is expected to turn the corner and grow by 2.8% this year and by 3.3% in 2025, according to an October 2023 analysis by the World Bank.

• Brazil

Brazil is expected to undergo 1.6% in economic growth this year, helping to boost the country’s $1.8 billion worth of paint and coatings sales. Abrafati pegs national production of paint and coatings at about 1.8 billion liters, of which $224 million worth were exported in 2023, while $188 million were imported. Overall volume rose by 3.4% in 2023 to 1.87 billion liters, up from 1.80 billion liters in 2022, the association reports.By market segment of consumption, 75.2% of national production is utilized within the architectural segment, while 19.2% is consumed within the industrial segment, 3.9% by the after-market automotive segment and 1.7% by automotive OEMs, Abrafati reports.

• Chile

Chile is one key Latin American country where predicted growth this year is a turnaround situation. “The Chilean economy was stagnant in 2023 but recent figures suggest that economic activity is beginning to pick up again.We expect the economic activity to return to trend GDP growth rates in 2024 on the back of more favorable interest rates, lower inflation and a more stable political outlook. These factors will boost private consumption, and investment will also recover slowly,” opined Fernando Larraín, vice president of communications, marketing, and studies at Santander Chile, in a February analysis.

According to World Bank figures and projections, Chile’s economy shrank by 0.4% in 2023, but will expand by 1.8% this year and by 2.3% in 2025.

• Colombia

The economy of Colombia is predicted to grow modestly this year, as modified government policies take hold and as planned investments in infrastructure rise. The growth in Colombia is expected to expand by 1% for each of the next few years, according to World Bank estimates.Other banks agree. “Real GDP is expected to expand by 1.3% this year as macroeconomic policies gradually normalize. Private consumption, currently above pre-pandemic levels, is expected to moderate this year as households deleverage and labor market conditions soften, while private investment is expected to gradually recover, albeit remaining below pre-pandemic levels,” said International Monetary Fund staff at the conclusion of a country visit in February.

“Over the medium-term, real GDP growth is projected to converge to 3%, supported also by large-scale infrastructure projects, further recovery in private investment, and the economic gains from integrating Venezuelan migrants,” the IMF team reported.

Energy infrastructure will be a key driver to increased growth in the country, “Colombia’s ambitious climate and energy transition plans will require increased public and private investment. Shifting some of the spending envelope to infrastructure and climate-related projects would support Colombia’s objective of boosting its growth potential and being a global leader in the climate transition agenda,” the IMF reports.

• Mexico

Mexico’s predicted economic expansion of 2.5% this year will be historically significant, suggests Banco Santander. “In 2024, Mexico is expected to achieve a growth rate higher than its 30-year average, despite the challenges posed by higher interest rates on investment and consumption at home, and lower growth in the United States, its major trading partner,” wrote Alonso Cervera, the executive director of Economic Studies & Public Affairs at Santander Mexico, in a February outlook.Mexico’s economy, inextricably linked to that of the United States, will exhibit slower growth over the next few years, according to World Bank projections. The economy was pegged at a 3.2% expansion in 2023, and is projected to slow to 2.5% this year, and to 2.0% next year, the bank indicates.

Part of the formula for Mexico’s current growth is nearshoring, with most of this activity in Latin America centered in the country, thanks to its common border and open trade agreement with the United States. The impact of nearshoring has been largely recorded in the industrial segment, although the architectural segment is also recording rapid expansion.

In Guadalajara, just outside Mexico City, for example, office space sales rose by 75% during 2023 to 74,600 square meters, according to real estate investment firm CBRE. The growth in Guadalajara has earned it the moniker of Mexico’s Silicon Valley, according to Nearshore Americas.