Dan Watson, Contributing Editor11.14.19

The world watched with great wonder at the phenomenal growth exercised over the past few decades by China.

China’s $25.3 trillion economy in 2018 made it the world’s largest. The EU came in as second, at $22 trillion. The U.S. ended up third ($20.5 trillion). Of course, production output is but one economic metric to consider.

We can’t overlook the fact that China has 1.38 billion people, more than any other country in the world. Even with its growth and output, China remains a relatively poor country in terms of its standard of living. For instance, China’s economy only produces about $18,100 per person. The U.S. produces about $62,500 per person.

It’s China’s low standard of living that attracts companies to come to China where they can pay Chinese workers less than American workers. The low wages help to make products produced in China cheaper, which lures more overseas manufacturers to consider outsourcing their production jobs to China.

To add further insult to injury, China then ships the finished goods back to countries such as the U.S., China’s largest trading partner, thus exasperating the trade imbalance that exists between the two countries.

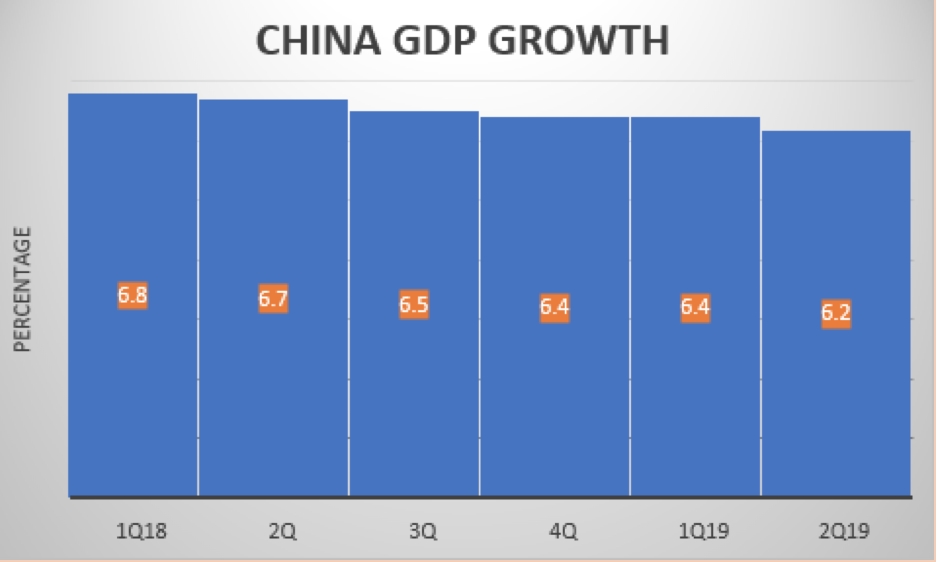

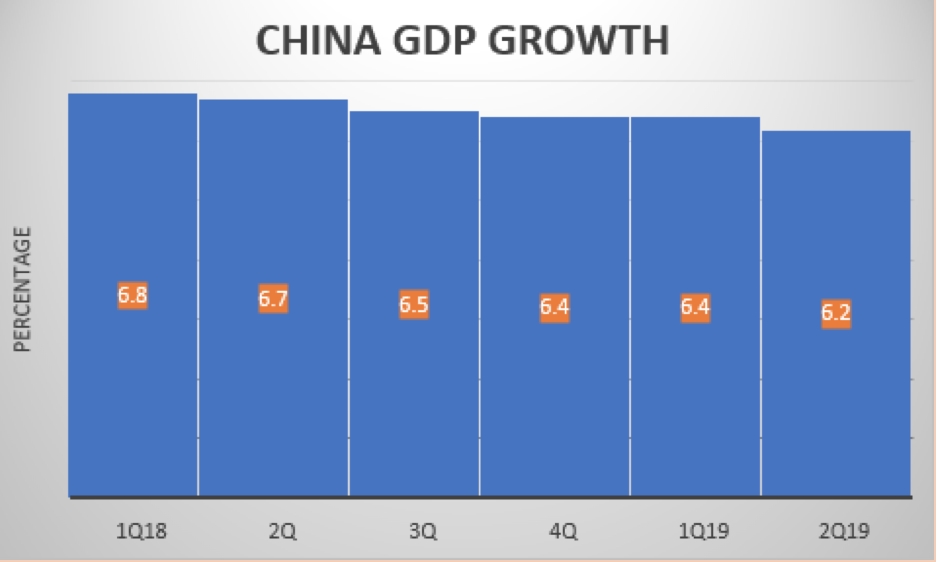

It would appear that the economic juggernaut of Asia hit a roadblock in regards to current and future growth. The ongoing trade war with the U.S. has had a significant impact on the economic health of China. The second quarter economic growth was the country’s slowest pace since the first quarter of 1992. As such, China is expected to experience its slowest growth in 27 years (see the chart below – 1Q 2018 through 2Q 2019).

Over the past few decades, the world has watched China exhibit double-digit growth year after year. That performance appears to be over.

Reacting to the tariffs imposed by the U.S., China’s economic growth has slumped to its lowest level in nearly three decades as the world’s second-largest economy feels the effects of a prolonged trade war with the U.S.

In the past, most U.S. presidents and political parties have yielded to China in the Trade War dispute. That’s not happening this time.

China’s manufacturing sector and the U.S. imposed tariffs are expected to drag down real GDP growth to 6.3 percent in 2019. China’s real GDP growth forecast in 2019 is revised down to 6.3 percent from 6.5 percent previously, its slowest in 27 years.

Many experts fully expect Beijing to take remedial action and increase stimulus spending and prop up the investments and exports to combat China’s weaknesses on private investment and tariffs with four key expectations.

First, it is expected that China will increase investment spending to make up for weakness in the private sector, which should help stabilize fixed-asset investment growth.

Second, China will likely announce more cuts to export tariffs and other fees associated with exporting goods to support the sector. Premier Li Keqiang said on July 10 that the government will roll out more export tax rebates and cut insurance fees for exporters, which will defray the likely discounts the government will otherwise have to provide to maintain export volume to the U.S.

Third, it’s expected that the Chinese government will announce measures to boost demand locally, and in particular, encourage the spending of disposable incomes of rural and urban residents.

Finally, from a strictly political perspective, China has a strong motivation to boost growth to show that the Chinese economy is stable and healthy.

It is believed in some circles that this will prevent Washington from taking a tougher line in upcoming trade negotiations as well as fortify China’s social stability and reduce the risk of unrest in the mainland.

To accomplish this final objective, it’s likely that China will devalue its yuan currency (CNY). You may wonder how that would help.

For example, a 10 percent devaluation of the CNY will halve a 25 percent tariff. Let’s say an item costs $1 originally. It is $1.25 with tariffs. A 10 percent devaluation means it now costs $0.90. Plus 25 percent tax, it is now only $1.125, instead of $1.25.

Using this approach, China can afford to defend its currency, but devaluing a country’s currency in such a subjective way is a double-edged sword.

Currency devaluation will indeed make Chinese exports cheaper and more competitive while making U.S. goods more expensive and less competitive. It will also lessen the blow of U.S. imposed tariffs.

However, exports of goods and services make up 20 percent of China’s gross domestic product but only 12 percent of U.S. GDP. So, the harm it will do to U.S. exports is somewhat limited.

When a country devalues its currency, it will inevitably face capital flight risk. That’s exactly what happened to China back in 2015. It is well known that China can and does control the value of its currency by setting a daily exchange rate for the yuan versus the U.S. dollar.

This is why, despite the strict capital control, China still saw more than U.S. $500 billion capital outflow back in 2015. Capital flight out of China even continued in 2016, though mostly due to the concern of currency devaluation.

So, where are we today with this “You tariff us, we will tariff you” approach?

• China’s exports to America tanked 16 percent in August as U.S. tariffs sapped demand for Chinese goods in their biggest foreign market;

• Chinese imports of U.S. goods dropped by about 22 percent, suggesting American exporters are also suffering from the trade war;

• The declines will pile more pressure on Chinese authorities to stimulate the economy, days after they announced banks’ reserve requirements would be cut to their lowest level since 2007;

• Geely (GELYF), one of China’s biggest carmakers reported that its net profit probably plunged by 40 percent in the first half of the year. In June alone, the company’s car sales fell by 29 percent. Geely’s sales fell 33 percent in its home market;

• Global brands are suffering, too. Ford has reported that it sold nearly 22 percent fewer vehicles in China during the second quarter than in the same period a year ago. General Motors posted a 12 percent drop in vehicle sales in China for the quarter;

• Suppliers to the auto industry are feeling the pain. BASF slashed its profits forecast for the year, blaming weak car sales and trade tension between the U.S. and China;

• Reduced auto sales, reduced government stimuli spending on infrastructure has had a direct impact on all aspects of the Chinese coating industry (raw material suppliers, coating formulators, end-users). This isn’t likely going to improve anytime soon;

• With all this doom and gloom, look for the CNY to be devalued, again.

The several rounds of trade negotiations between the U.S. and China from last year to this year appear more like normal China’s delay tactics.

You might wonder “What is China waiting for?”

Don’t forget, Xi is a president for life, and as such he doesn’t face reelection. As the head of an authoritarian state, Xi has the final word on any subject. But Trump has to face an election in a country that is deeply divided politically.

It almost appears that China is willing to endure economic pain to a certain level as long as they can inflict sufficient pain on the U.S. economy and in so doing possibly influence the outcome of the U.S. election in 2020.

Speculation is that Xi is probably hoping for a change in U.S. leadership so he can negotiate with someone new in the White House and start the finger-pointing, no recrimination, no changes are made, cycle once again.

The bottom line here is that most experts fully expect little if any change to the current trade war until after the 2020 election. Since neither side wins anything in this war you do have to wonder what is keeping it alive. As you might expect, this is not a simple issue that can be quickly solved.

Looking back in history, China built its economic growth on low-cost exports of machinery and equipment. That was when massive government spending went into state-owned companies to fuel those exports.

These state-owned companies were and are less profitable than most private firms. Most generate a modest return of about 5 percent on assets compared to approximately 13 percent for most private companies.

From those early days, China fell in love with providing exports to the point that today they are addicted to that route.

Even today, China defends its export market with great fervor. There have been several moves by the central government to cut back dependence on exports and build a domestic economy along the lines of the U.S. and Europe.

However, that is not happening and recent actions by the Central Government appear to be in further support of their export market.

After some halfhearted attempts to cut back on the dependence of exports, in 2017 China regained its position as the world’s largest exporter when it exported a record $2.2 trillion of its production.

A year prior, the EU briefly took the No. 1 spot in 2016. It now is second, exporting $1.9 trillion. The U.S. is third, exporting $1.6 trillion.

According to Chinese records, in 2018, China shipped 18 percent of its exports to the U.S. That contributed to a $420 billion trade deficit. In that same year, China’s trade with Hong Kong (recorded as 14 percent), was almost as much as the U.S. However, its trade with Japan, which was at 6 percent, and South Korea, at 4.5 percent, was much less.

A confusing part of China’s Export involves China producing products for foreign businesses, including U.S. companies. Foreign businesses ship product-specific raw materials to China. Chinese factories then build the final products and ship them back to their respective countries like the U.S. In this way, a lot of China’s “exports” are technically American products.

China is the world’s largest exporter but is also the world’s second-largest importer.

In 2017, China imported $1.7 trillion. The U.S., the world’s largest, imported over $2.3 trillion. China imports from all countries but gets its essential raw material commodities primarily from Latin America and Africa.

These essential items include oil and other fuels, metal ores, plastics, and organic chemicals. According to industry statistics, China is the world’s largest importer of aluminum and copper.

According to Chinese government figures recently released, the country’s gross domestic product grew at 6.2 percent in the quarter ended June, the slowest quarterly growth rate since 1992 and down from 6.4 percent in the previous quarter.

And the Chinese economy will continue to face “downward pressure” in the second half of this year. Many China experts believe that the Chinese economy is still in a complex and grave situation.

Global growth has slowed and external uncertainties are on the rise. Xi appears to be playing a game of “chicken” with his U.S. counterpart. China believes that it has the upper hand when it comes to trade negotiations, the U.S. believes the same. Hence, we have a standoff of two superpowers. The wrong move by either party could send global markets into a downward spiral and ignite a global recession.

Don’t forget, China is the largest foreign holder of U.S. Treasuries. In May 2019, it owned $1.11 trillion in Treasuries. That’s 27 percent of the public debt held by foreign countries. The U.S. debt to China is lower than the record high of $1.3 trillion held in November 2013. China buys U.S. debt to support the value of the dollar. This is because China pegs its currency, the yuan, to the U.S. dollar. It devalues the currency when needed to keep its export prices competitive.

China’s role as America’s largest banker gives it leverage. For example, China threatens to sell part of its holdings whenever the U.S. pressures it to raise the yuan’s value. Since 2005, China raised the yuan’s value by 33 percent against the dollar. Between 2014 and 2016, the dollar’s strength increased by 25 percent. The rise forced China to devalue the yuan. This ensured its exports would remain competitively priced with those from Asian countries that hadn’t tied their currency to the dollar.

There are several truths associated with the China-U.S. trade war.

1. The Chinese will not give up their export market; they will do everything possible to defend and expand that market. Simply put, they need the infusion of foreign exchange coming from exports. The U.S. tariffs will impact China exports who will in turn simply devalue their currency, thus mitigating the impact of the tariffs and at the same time impose more tariffs on U.S. goods.

2. The U.S. is serious this time. The U.S. President is betting his re-election on getting a fair and equitable trade agreement with China. There are many parts to that trade agreement such as protection of intellectual property owned by U.S. companies and the removal of unfair tariffs on imported U.S. products into China. In other words, China becoming more like the U.S. and Europe with an open and free trade market. The weakness on the U.S. side is a highly divided political landscape. A divided congress that will not cooperate with the President to bring this trade war to an end.

3. Neither the Chinese nor the U.S. are winning the Trade War. Both are being hit with negative economic outcomes.

4. We are truly a global market. As such, the China/U.S. trade war is not a local happening, it is being felt around the globe by every country in some fashion.

5. This trade war has to be resolved and quickly or it could ignite a world-wide recession.

U.S. and Chinese envoys are scheduled to meet in early October for more talks aimed at ending a tariff war that threatens global economic growth. Stock markets around the world rose on that announcement, which comes after both sides raised tariffs on Sept. 1, and the Dow Jones Industrial Average jumped more than 400 points after the U.S. market opened.

All of this sounds like good news but analysts say question marks remain over whether the two sides can reach a deal to remove tariffs introduced over the past 12 months.

From our perspective, there is a great deal to gain by the U.S. leadership to reach an end to this trade war before the upcoming 2020 election. That being said, there is a strong undercurrent of opposition coming from the competing political factions in the U.S. who feel that no trade deal would benefit them in

the election.

The Chinese leadership appears to have little motivation to solve this trade war dispute before the U.S. election. As stated earlier, speculation is that Xi wishes to let the trade war continue as he hopes it will influence the outcome of the 2020 election thus allowing him to negotiate with a more compliant U.S. leader.

Regardless of how things proceed between the U.S. and China, the likelihood of a quick resolution is very slim. As such, the Chinese Coating Industry (suppliers, formulators, etc.) will most likely see a further decline in sales, profits and market share in the coming year.

China’s $25.3 trillion economy in 2018 made it the world’s largest. The EU came in as second, at $22 trillion. The U.S. ended up third ($20.5 trillion). Of course, production output is but one economic metric to consider.

We can’t overlook the fact that China has 1.38 billion people, more than any other country in the world. Even with its growth and output, China remains a relatively poor country in terms of its standard of living. For instance, China’s economy only produces about $18,100 per person. The U.S. produces about $62,500 per person.

It’s China’s low standard of living that attracts companies to come to China where they can pay Chinese workers less than American workers. The low wages help to make products produced in China cheaper, which lures more overseas manufacturers to consider outsourcing their production jobs to China.

To add further insult to injury, China then ships the finished goods back to countries such as the U.S., China’s largest trading partner, thus exasperating the trade imbalance that exists between the two countries.

It would appear that the economic juggernaut of Asia hit a roadblock in regards to current and future growth. The ongoing trade war with the U.S. has had a significant impact on the economic health of China. The second quarter economic growth was the country’s slowest pace since the first quarter of 1992. As such, China is expected to experience its slowest growth in 27 years (see the chart below – 1Q 2018 through 2Q 2019).

Over the past few decades, the world has watched China exhibit double-digit growth year after year. That performance appears to be over.

Reacting to the tariffs imposed by the U.S., China’s economic growth has slumped to its lowest level in nearly three decades as the world’s second-largest economy feels the effects of a prolonged trade war with the U.S.

In the past, most U.S. presidents and political parties have yielded to China in the Trade War dispute. That’s not happening this time.

China’s manufacturing sector and the U.S. imposed tariffs are expected to drag down real GDP growth to 6.3 percent in 2019. China’s real GDP growth forecast in 2019 is revised down to 6.3 percent from 6.5 percent previously, its slowest in 27 years.

Many experts fully expect Beijing to take remedial action and increase stimulus spending and prop up the investments and exports to combat China’s weaknesses on private investment and tariffs with four key expectations.

First, it is expected that China will increase investment spending to make up for weakness in the private sector, which should help stabilize fixed-asset investment growth.

Second, China will likely announce more cuts to export tariffs and other fees associated with exporting goods to support the sector. Premier Li Keqiang said on July 10 that the government will roll out more export tax rebates and cut insurance fees for exporters, which will defray the likely discounts the government will otherwise have to provide to maintain export volume to the U.S.

Third, it’s expected that the Chinese government will announce measures to boost demand locally, and in particular, encourage the spending of disposable incomes of rural and urban residents.

Finally, from a strictly political perspective, China has a strong motivation to boost growth to show that the Chinese economy is stable and healthy.

It is believed in some circles that this will prevent Washington from taking a tougher line in upcoming trade negotiations as well as fortify China’s social stability and reduce the risk of unrest in the mainland.

To accomplish this final objective, it’s likely that China will devalue its yuan currency (CNY). You may wonder how that would help.

For example, a 10 percent devaluation of the CNY will halve a 25 percent tariff. Let’s say an item costs $1 originally. It is $1.25 with tariffs. A 10 percent devaluation means it now costs $0.90. Plus 25 percent tax, it is now only $1.125, instead of $1.25.

Using this approach, China can afford to defend its currency, but devaluing a country’s currency in such a subjective way is a double-edged sword.

Currency devaluation will indeed make Chinese exports cheaper and more competitive while making U.S. goods more expensive and less competitive. It will also lessen the blow of U.S. imposed tariffs.

However, exports of goods and services make up 20 percent of China’s gross domestic product but only 12 percent of U.S. GDP. So, the harm it will do to U.S. exports is somewhat limited.

When a country devalues its currency, it will inevitably face capital flight risk. That’s exactly what happened to China back in 2015. It is well known that China can and does control the value of its currency by setting a daily exchange rate for the yuan versus the U.S. dollar.

This is why, despite the strict capital control, China still saw more than U.S. $500 billion capital outflow back in 2015. Capital flight out of China even continued in 2016, though mostly due to the concern of currency devaluation.

So, where are we today with this “You tariff us, we will tariff you” approach?

• China’s exports to America tanked 16 percent in August as U.S. tariffs sapped demand for Chinese goods in their biggest foreign market;

• Chinese imports of U.S. goods dropped by about 22 percent, suggesting American exporters are also suffering from the trade war;

• The declines will pile more pressure on Chinese authorities to stimulate the economy, days after they announced banks’ reserve requirements would be cut to their lowest level since 2007;

• Geely (GELYF), one of China’s biggest carmakers reported that its net profit probably plunged by 40 percent in the first half of the year. In June alone, the company’s car sales fell by 29 percent. Geely’s sales fell 33 percent in its home market;

• Global brands are suffering, too. Ford has reported that it sold nearly 22 percent fewer vehicles in China during the second quarter than in the same period a year ago. General Motors posted a 12 percent drop in vehicle sales in China for the quarter;

• Suppliers to the auto industry are feeling the pain. BASF slashed its profits forecast for the year, blaming weak car sales and trade tension between the U.S. and China;

• Reduced auto sales, reduced government stimuli spending on infrastructure has had a direct impact on all aspects of the Chinese coating industry (raw material suppliers, coating formulators, end-users). This isn’t likely going to improve anytime soon;

• With all this doom and gloom, look for the CNY to be devalued, again.

The several rounds of trade negotiations between the U.S. and China from last year to this year appear more like normal China’s delay tactics.

You might wonder “What is China waiting for?”

Don’t forget, Xi is a president for life, and as such he doesn’t face reelection. As the head of an authoritarian state, Xi has the final word on any subject. But Trump has to face an election in a country that is deeply divided politically.

It almost appears that China is willing to endure economic pain to a certain level as long as they can inflict sufficient pain on the U.S. economy and in so doing possibly influence the outcome of the U.S. election in 2020.

Speculation is that Xi is probably hoping for a change in U.S. leadership so he can negotiate with someone new in the White House and start the finger-pointing, no recrimination, no changes are made, cycle once again.

The bottom line here is that most experts fully expect little if any change to the current trade war until after the 2020 election. Since neither side wins anything in this war you do have to wonder what is keeping it alive. As you might expect, this is not a simple issue that can be quickly solved.

Looking back in history, China built its economic growth on low-cost exports of machinery and equipment. That was when massive government spending went into state-owned companies to fuel those exports.

These state-owned companies were and are less profitable than most private firms. Most generate a modest return of about 5 percent on assets compared to approximately 13 percent for most private companies.

From those early days, China fell in love with providing exports to the point that today they are addicted to that route.

Even today, China defends its export market with great fervor. There have been several moves by the central government to cut back dependence on exports and build a domestic economy along the lines of the U.S. and Europe.

However, that is not happening and recent actions by the Central Government appear to be in further support of their export market.

After some halfhearted attempts to cut back on the dependence of exports, in 2017 China regained its position as the world’s largest exporter when it exported a record $2.2 trillion of its production.

A year prior, the EU briefly took the No. 1 spot in 2016. It now is second, exporting $1.9 trillion. The U.S. is third, exporting $1.6 trillion.

According to Chinese records, in 2018, China shipped 18 percent of its exports to the U.S. That contributed to a $420 billion trade deficit. In that same year, China’s trade with Hong Kong (recorded as 14 percent), was almost as much as the U.S. However, its trade with Japan, which was at 6 percent, and South Korea, at 4.5 percent, was much less.

A confusing part of China’s Export involves China producing products for foreign businesses, including U.S. companies. Foreign businesses ship product-specific raw materials to China. Chinese factories then build the final products and ship them back to their respective countries like the U.S. In this way, a lot of China’s “exports” are technically American products.

China is the world’s largest exporter but is also the world’s second-largest importer.

In 2017, China imported $1.7 trillion. The U.S., the world’s largest, imported over $2.3 trillion. China imports from all countries but gets its essential raw material commodities primarily from Latin America and Africa.

These essential items include oil and other fuels, metal ores, plastics, and organic chemicals. According to industry statistics, China is the world’s largest importer of aluminum and copper.

According to Chinese government figures recently released, the country’s gross domestic product grew at 6.2 percent in the quarter ended June, the slowest quarterly growth rate since 1992 and down from 6.4 percent in the previous quarter.

And the Chinese economy will continue to face “downward pressure” in the second half of this year. Many China experts believe that the Chinese economy is still in a complex and grave situation.

Global growth has slowed and external uncertainties are on the rise. Xi appears to be playing a game of “chicken” with his U.S. counterpart. China believes that it has the upper hand when it comes to trade negotiations, the U.S. believes the same. Hence, we have a standoff of two superpowers. The wrong move by either party could send global markets into a downward spiral and ignite a global recession.

Don’t forget, China is the largest foreign holder of U.S. Treasuries. In May 2019, it owned $1.11 trillion in Treasuries. That’s 27 percent of the public debt held by foreign countries. The U.S. debt to China is lower than the record high of $1.3 trillion held in November 2013. China buys U.S. debt to support the value of the dollar. This is because China pegs its currency, the yuan, to the U.S. dollar. It devalues the currency when needed to keep its export prices competitive.

China’s role as America’s largest banker gives it leverage. For example, China threatens to sell part of its holdings whenever the U.S. pressures it to raise the yuan’s value. Since 2005, China raised the yuan’s value by 33 percent against the dollar. Between 2014 and 2016, the dollar’s strength increased by 25 percent. The rise forced China to devalue the yuan. This ensured its exports would remain competitively priced with those from Asian countries that hadn’t tied their currency to the dollar.

There are several truths associated with the China-U.S. trade war.

1. The Chinese will not give up their export market; they will do everything possible to defend and expand that market. Simply put, they need the infusion of foreign exchange coming from exports. The U.S. tariffs will impact China exports who will in turn simply devalue their currency, thus mitigating the impact of the tariffs and at the same time impose more tariffs on U.S. goods.

2. The U.S. is serious this time. The U.S. President is betting his re-election on getting a fair and equitable trade agreement with China. There are many parts to that trade agreement such as protection of intellectual property owned by U.S. companies and the removal of unfair tariffs on imported U.S. products into China. In other words, China becoming more like the U.S. and Europe with an open and free trade market. The weakness on the U.S. side is a highly divided political landscape. A divided congress that will not cooperate with the President to bring this trade war to an end.

3. Neither the Chinese nor the U.S. are winning the Trade War. Both are being hit with negative economic outcomes.

4. We are truly a global market. As such, the China/U.S. trade war is not a local happening, it is being felt around the globe by every country in some fashion.

5. This trade war has to be resolved and quickly or it could ignite a world-wide recession.

U.S. and Chinese envoys are scheduled to meet in early October for more talks aimed at ending a tariff war that threatens global economic growth. Stock markets around the world rose on that announcement, which comes after both sides raised tariffs on Sept. 1, and the Dow Jones Industrial Average jumped more than 400 points after the U.S. market opened.

All of this sounds like good news but analysts say question marks remain over whether the two sides can reach a deal to remove tariffs introduced over the past 12 months.

From our perspective, there is a great deal to gain by the U.S. leadership to reach an end to this trade war before the upcoming 2020 election. That being said, there is a strong undercurrent of opposition coming from the competing political factions in the U.S. who feel that no trade deal would benefit them in

the election.

The Chinese leadership appears to have little motivation to solve this trade war dispute before the U.S. election. As stated earlier, speculation is that Xi wishes to let the trade war continue as he hopes it will influence the outcome of the 2020 election thus allowing him to negotiate with a more compliant U.S. leader.

Regardless of how things proceed between the U.S. and China, the likelihood of a quick resolution is very slim. As such, the Chinese Coating Industry (suppliers, formulators, etc.) will most likely see a further decline in sales, profits and market share in the coming year.