Dan Watson, Contributing Writer10.02.17

Before you can begin to dissect, analyze and comprehend the status of the Chinese coating market you first should deal with the 800-lb. gorilla in the room, namely the Chinese Economy. We have watched the Chinese economy explode with annual GDP growth in the double-digit arena over the past two decades to where China surpassed the U.S. in 2014 to become the largest world economy by producing over $17.6 trillion in terms of goods and services. Just 14 years earlier the U.S. produced nearly three times as much as the Chinese. At the end of the day, China accounts for approximately 16.5 percent of the global economy versus the U.S. with 16.3 percent. However, it is important to note that although China’s economy may be the world’s largest, it’s still not the richest. GDP per head is still less than a quarter of U.S. levels. In recent years the Chinese have attempted to change the nature of their economy to depend less on exports and more on internal consumption. In so doing we have seen the growth rate decline from those double-digit numbers down to what the U.S. would consider great (6.7 percent - 6.9 percent).

Most economist feel that China is expected to keep its deep pockets open to both protect and boost its economy. China has done this before with positive results. However, if they choose this method now it will cost them (i.e. fiscal deficit will surpass budgeted target).

This year (2017) the Communist Party of China’s (CPC) will hold its 19th Party Congress in the autumn, making it one of the key political events to watch. Conventional wisdom would suggest that due to this important gathering that the government will provide the most dangerous part of the economy — massive, indebted quasi-state companies — with enough cash to continue powering through the year and that it will support banks so they can support the corporate sector and the country’s gross-domestic-product growth. In other words, things will stay stable. Move along, nothing to see here. The problem with this line of thought is it seems as if that’s not the stability the Chinese government really cares about. When Donald Trump was running for President his platform was built solid on the foundation of providing employment (i.e., JOBS). Believe it or not, this is the top priority of President Xi Jinping, but for very different reasons. An increase in unemployment often leads to social unrest. For Xi, things are looking fairly good, at least at this time of the year. Overall, net hiring looks good in China, as 43 percent of firms hired, up from 30 percent this time last year. In 2016 the government was still infusing the economy with a lot of cash.

Reportedly, earlier this year Xi told a group of Communist Party members of the economic and finance group not to worry if they didn’t hit their target of 6.5 percent GDP growth (down from 6.7 percent). In fact, it was reported that he told them not to try to hit it if doing so would create too much risk.

Essentially Xi is not scared of a slowdown in the economy, he’s more scared of the unrest that unemployment and a full-blown debt crisis could bring. Although this might soothe the nerves of party members it sent shivers up the spines of investors who are worried about growth but based on Xi’s comments can’t be sure the government will help them along. If Xi follows through with his comments it means that’s some companies may very well be losers. If you recall, there were 55 corporations that declared bankruptcy in 2016, up from 24 in 2015. Xi would most likely want to see less of this happening as we close out 2017.

As Xi moves forward with his economic reforms and desire for greater economic stability, he will have to confront a possible imbalance between China’s strengths and weaknesses (Fig 1).

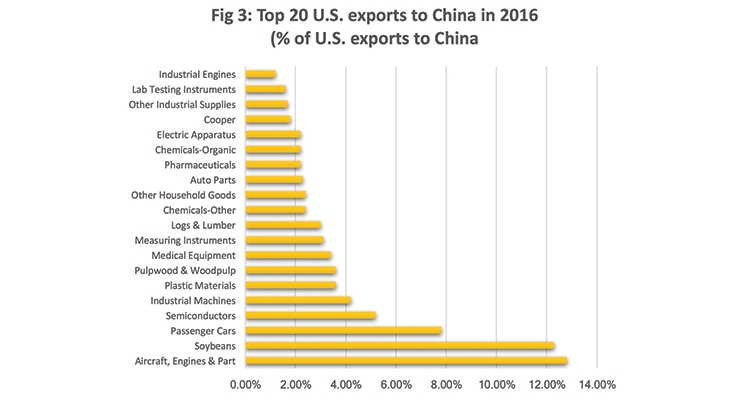

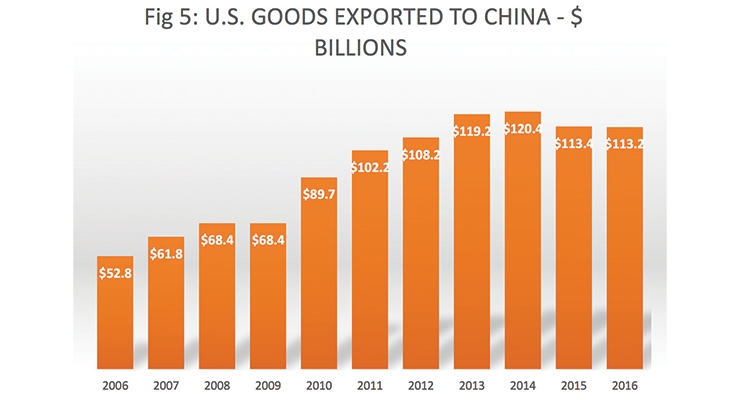

Enter the real world, “North Korea.” As much as Xi wants “stability” it seems that fate is destined to interfere with that objective. The ongoing conflict between North Korea (who gets 90 percent of their goods from China) and the U.S. has reached a boiling point with North Korea’s detonating a hydrogen bomb and threatening to proceed with additional missile testing. The frustration and tension of this situation resulted in President Donald Trump Tweeting this past Sunday (September 03) that the U.S. is considering cutting off trade with any country that maintains economic ties with North Korea. The remark was largely interpreted by most experts as a semi-veiled threat against North Korea’s main trading partner, China. Although those same experts feel that this threat from Trump is not a credible threat given that such an action would have severe negative effects on the U.S. economy, something that Trump doesn’t want to happen. However, what if such an action was taken, exactly how would it impact on both sides, based on actual 2016 data. Using CEIC and U.S. Census Bureau data the following (Fig 2 & 3) provides a snapshot of both sides.

It is noteworthy to point out that based on the 2016 data that the U.S. recorded a large trade deficit in those sectors where China exported the most goods. As such, it is likely that those export items which contributed to the deficit are the most vulnerable to any potential U.S. trade action. Trade analyst suggest that other potential targets would include solar panels, steel and aluminum.

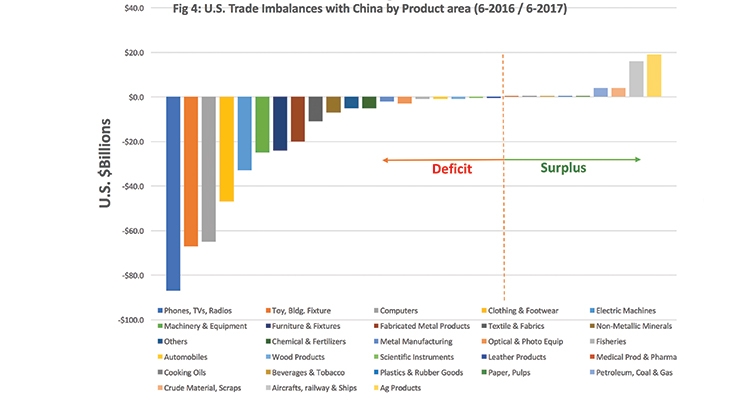

The following chart (Fig. 4) highlights the U.S. trade imbalances with China by product in the 12-month period leading up to June 2017.

So, what does this have to do with the Chinese coating industry you might be wondering. China exports huge amounts of labor intensive goods to the U.S., including toys, furniture, clothing and footwear, while electronics and high-tech products such as computers and mobile phones are also among the top ten most exported items. If you look at the top 10 or 12 exports from China, they all have one thing in common, they are all coated items and if trade is cut or decreased between China and the U.S. these products won’t be produced or coated which will result in an overall decrease in coatings used in the Chinese market.

The bottom line for this North Korean standoff is that neither China nor the U.S. want to escalate a conflict with North Korea. Neither party wishes to engage in an outright trade war in which both sides lose. The only power that seems to have any influence over Kim Jong-un is China who so far appears reluctant to exercise that influence. Instead, Xi keeps pushing for restraint by the U.S. in this matter, urging Trump to return to the negotiating table.

The North Korea issue is a serious problem for both Xi and Trump. One that will impact on the upcoming CPC 19th party congress in China and on the upcoming 2018 mid-term elections in the U.S. Following the latest explosion of a hydrogen bomb by Jong-un, global markets were shaken with most of them showing a decline. If this unrest continues no doubt we will be seeing deteriorating market conditions in China, the U.S. and other global markets. This potential decline combined with the obvious slowdown of the Chinese economy points to a potential decrease in Chinese coating consumption over the next few years.

Given the fact that there are more than 8,000 coating producers in China, such a decline in consumption will bring about a much-needed consolidation of this industry. The Chinese government has decreed that they will deal a heavy hand in combating over capacity and non-sustainable businesses. The Chinese coating industry is well positioned for such an undertaking. If there is a consolidation within the Chinese coating industry this will be a win/win for producers and customers. Such a consolidation should give rise to a greater investment in R&D by local producers. At the moment, local R&D efforts by other than multinational participants are essentially nonexistent.

You can’t ignore the Chinese coating market. Some estimates have the total coatings market at 7.1-7.3 million tons valued at $137 billion with ink production at >500,000 tons. It’s important to note that although there has been significant growth in waterborne systems much of paint production remains solvent-based. In total, it represents the world’s second largest coating market. As I mentioned elsewhere, even today this market is dominated by solvent-based systems. In recent years there has been a marked increase in the switch to water-based systems both in the architectural and industrial coating segments. The move by Chinese authorities to reduce air pollution has been one of the major reasons for such a switch.

China is now the leading global producer of automobiles. The 2016 value of the coatings used in the OEM automotive market was believed to be about $ 1.44 billion. Future growth rates are variable but most experts believe it will exceed 7 percent/annum. Of course, that growth rate depends on the overall health of the Chinese Economy which appears to be in the hands of Xi and the upcoming CPC 19th Congress. Of course, we can’t forget what is happening in North Korea. 2017 is proving to be a stressful and rapid changing environment, something a little different from prior years. The bright spot appears to be a potential option for consolidation of the Chinese coating market.

Most economist feel that China is expected to keep its deep pockets open to both protect and boost its economy. China has done this before with positive results. However, if they choose this method now it will cost them (i.e. fiscal deficit will surpass budgeted target).

This year (2017) the Communist Party of China’s (CPC) will hold its 19th Party Congress in the autumn, making it one of the key political events to watch. Conventional wisdom would suggest that due to this important gathering that the government will provide the most dangerous part of the economy — massive, indebted quasi-state companies — with enough cash to continue powering through the year and that it will support banks so they can support the corporate sector and the country’s gross-domestic-product growth. In other words, things will stay stable. Move along, nothing to see here. The problem with this line of thought is it seems as if that’s not the stability the Chinese government really cares about. When Donald Trump was running for President his platform was built solid on the foundation of providing employment (i.e., JOBS). Believe it or not, this is the top priority of President Xi Jinping, but for very different reasons. An increase in unemployment often leads to social unrest. For Xi, things are looking fairly good, at least at this time of the year. Overall, net hiring looks good in China, as 43 percent of firms hired, up from 30 percent this time last year. In 2016 the government was still infusing the economy with a lot of cash.

Reportedly, earlier this year Xi told a group of Communist Party members of the economic and finance group not to worry if they didn’t hit their target of 6.5 percent GDP growth (down from 6.7 percent). In fact, it was reported that he told them not to try to hit it if doing so would create too much risk.

Essentially Xi is not scared of a slowdown in the economy, he’s more scared of the unrest that unemployment and a full-blown debt crisis could bring. Although this might soothe the nerves of party members it sent shivers up the spines of investors who are worried about growth but based on Xi’s comments can’t be sure the government will help them along. If Xi follows through with his comments it means that’s some companies may very well be losers. If you recall, there were 55 corporations that declared bankruptcy in 2016, up from 24 in 2015. Xi would most likely want to see less of this happening as we close out 2017.

As Xi moves forward with his economic reforms and desire for greater economic stability, he will have to confront a possible imbalance between China’s strengths and weaknesses (Fig 1).

Enter the real world, “North Korea.” As much as Xi wants “stability” it seems that fate is destined to interfere with that objective. The ongoing conflict between North Korea (who gets 90 percent of their goods from China) and the U.S. has reached a boiling point with North Korea’s detonating a hydrogen bomb and threatening to proceed with additional missile testing. The frustration and tension of this situation resulted in President Donald Trump Tweeting this past Sunday (September 03) that the U.S. is considering cutting off trade with any country that maintains economic ties with North Korea. The remark was largely interpreted by most experts as a semi-veiled threat against North Korea’s main trading partner, China. Although those same experts feel that this threat from Trump is not a credible threat given that such an action would have severe negative effects on the U.S. economy, something that Trump doesn’t want to happen. However, what if such an action was taken, exactly how would it impact on both sides, based on actual 2016 data. Using CEIC and U.S. Census Bureau data the following (Fig 2 & 3) provides a snapshot of both sides.

It is noteworthy to point out that based on the 2016 data that the U.S. recorded a large trade deficit in those sectors where China exported the most goods. As such, it is likely that those export items which contributed to the deficit are the most vulnerable to any potential U.S. trade action. Trade analyst suggest that other potential targets would include solar panels, steel and aluminum.

The following chart (Fig. 4) highlights the U.S. trade imbalances with China by product in the 12-month period leading up to June 2017.

So, what does this have to do with the Chinese coating industry you might be wondering. China exports huge amounts of labor intensive goods to the U.S., including toys, furniture, clothing and footwear, while electronics and high-tech products such as computers and mobile phones are also among the top ten most exported items. If you look at the top 10 or 12 exports from China, they all have one thing in common, they are all coated items and if trade is cut or decreased between China and the U.S. these products won’t be produced or coated which will result in an overall decrease in coatings used in the Chinese market.

The bottom line for this North Korean standoff is that neither China nor the U.S. want to escalate a conflict with North Korea. Neither party wishes to engage in an outright trade war in which both sides lose. The only power that seems to have any influence over Kim Jong-un is China who so far appears reluctant to exercise that influence. Instead, Xi keeps pushing for restraint by the U.S. in this matter, urging Trump to return to the negotiating table.

The North Korea issue is a serious problem for both Xi and Trump. One that will impact on the upcoming CPC 19th party congress in China and on the upcoming 2018 mid-term elections in the U.S. Following the latest explosion of a hydrogen bomb by Jong-un, global markets were shaken with most of them showing a decline. If this unrest continues no doubt we will be seeing deteriorating market conditions in China, the U.S. and other global markets. This potential decline combined with the obvious slowdown of the Chinese economy points to a potential decrease in Chinese coating consumption over the next few years.

Given the fact that there are more than 8,000 coating producers in China, such a decline in consumption will bring about a much-needed consolidation of this industry. The Chinese government has decreed that they will deal a heavy hand in combating over capacity and non-sustainable businesses. The Chinese coating industry is well positioned for such an undertaking. If there is a consolidation within the Chinese coating industry this will be a win/win for producers and customers. Such a consolidation should give rise to a greater investment in R&D by local producers. At the moment, local R&D efforts by other than multinational participants are essentially nonexistent.

You can’t ignore the Chinese coating market. Some estimates have the total coatings market at 7.1-7.3 million tons valued at $137 billion with ink production at >500,000 tons. It’s important to note that although there has been significant growth in waterborne systems much of paint production remains solvent-based. In total, it represents the world’s second largest coating market. As I mentioned elsewhere, even today this market is dominated by solvent-based systems. In recent years there has been a marked increase in the switch to water-based systems both in the architectural and industrial coating segments. The move by Chinese authorities to reduce air pollution has been one of the major reasons for such a switch.

China is now the leading global producer of automobiles. The 2016 value of the coatings used in the OEM automotive market was believed to be about $ 1.44 billion. Future growth rates are variable but most experts believe it will exceed 7 percent/annum. Of course, that growth rate depends on the overall health of the Chinese Economy which appears to be in the hands of Xi and the upcoming CPC 19th Congress. Of course, we can’t forget what is happening in North Korea. 2017 is proving to be a stressful and rapid changing environment, something a little different from prior years. The bright spot appears to be a potential option for consolidation of the Chinese coating market.