Yogender Singh, India/Asia-Pacific Correspondent03.19.18

Coatings World: What differentiates Berger Paints from other paint producers in the country?

Abhijit Roy: Berger Paints has an open culture that believes that innovation is not the province of top leadership, but can come from anyone in the organization. All employees regardless of their place in the hierarchy are encouraged to give ideas that will improve business. This has helped foster innovation as well as develop a rich pipeline of innovations, a large number of which have been successful in the market and instrumental in Berger gaining market share. The leadership on its part encourages employees and backs ideas that have merit. Customer interactions, user feedback and research are some of the many tools used by marketing and R&D to develop product and service innovations. Reviews of internal systems and processes are routinely conducted to improve efficiencies, free up resources or reduce expenses.

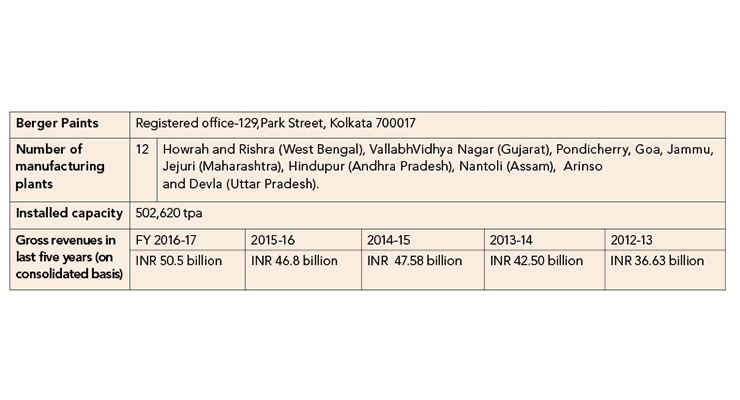

CW: Is your earlier announced expansion of Hindupur plant (from 80,000 tpa to 160,000 tpa) on schedule.

Roy: Yes, we are on schedule.

CW: Despite, the big size of the Indian industry, per capita consumption of paints and coatings is abysmally low in the country. How do you see the situation changing in the medium- and long-term?

Roy: The per capita consumption of paint in the country has been growing over the years. There are some structural issues like low distribution penetration and low level of urbanization that have impeded the growth of paint consumption. Urbanization that was at a low of 32 percent, is surging and is expected to touch 41 percent by 2030. Paint is a hugely underpenetrated category in India with less than 0.1 million retail outlets compared to relatively saturated categories like FMCG that have nearly 10 million outlets or Telecom that has an estimated 9 million outlets. However, the industry is cognizant of the need to grow the distribution and is working on it. This is a focus area for us at Berger Paints, and many of our gains in the past few years have been a net result of growth in distribution reach.

The growth drivers of the Indian paint industry are many. They range from rapid urbanization, to growing width and depth of distribution, to consumers upgrading to superior products e.g. distemper to emulsion, regular to premium emulsion etc.., to buildup of infrastructure in the form of new airports, cities, ports, to the growing automotive industry, to government backed initiatives like Affordable Housing, Housing For All and the PradhanMantriAwaasYojana.

Thus the medium- and long-term outlook for the Indian Paint Industry seems to be encouraging.

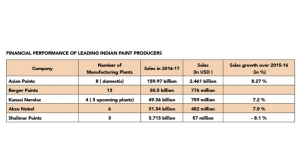

CW: What is the current size (volume and value) of Indian paint & coating industry? What is the split between architectural and industrial segment?

Roy: The size of the Indian Paint Industry would be approx. INR 50,000 Cr of which more than 75 percent is contributed by the architectural segment and the rest by the industrial segment. The industry has been growing at a CAGR in excess of 12 percent and volumes are in excess of 4.50 Mn MT (Million Metric Tons).

CW: How big is Indian marine coatings market. It seems, this is one of the most neglected sub-segments of the Indian paint and coating industry, do you agree?

Roy: The size of the marine coatings market is small, around Rs 250 Cr which is barely 2.5 percent of the paint and coatings industry in the country and is growing at a very slow pace. India has 12 major and 200 minor notified and intermediate ports and 95 percent of the country’s trade by volume is done through sea routes. But we are still only the 16th largest maritime economy.

So the size of the marine paints segment is not representative of the potential of the industry. Significant investments are needed in developing infrastructure at ports, terminals, shipyards, etc. We understand that the present government is keen on increasing India’s stake in world maritime trade and prepared to do all that is necessary. The Indian Navy for one has embarked on an ambitious plan to indigenously construct warships and submarines under the Make in India initiative.

CW: What according to you are the three largest challenges facing Indian paints and coating industry?

Roy: The GST rate of 28 percent that is slowing demand is a challenge for the industry. The present tax rate appears to focus its attention on the aesthetic value of paint alone, while failing to recognize the role of paint in protecting valuable infrastructure, preventing degradation of assets, insulating homes from environmental damage among others. We are hopeful that in the months to come, the government will heed the need to rationalize the tax rate further.

Paint is in the RED category and setting up of new manufacturing plants in India comes with its own set of issues. Companies like Berger are extremely sensitive to environment degradation issues and proactively put in place all the equipment necessary to ensure zero-emission and effluent control and treatment. However, access to good locations for paint factories is difficult due to unfounded fears of pollution.

CW: Unorganized sector of Indian paint industry accounts for a huge share of the total pie of the Indian paint industry. Isn’t it an unhealthy trend? Has the share of this segment increased or decreased over the past few years?

Roy: This is not an unhealthy phenomenon. On the contrary this is a testament to the strong entrepreneurial drive in our countrymen. The barriers to entry into this industry are low and enterprising entrepreneurs identify and serve markets and market segments that can be served by a local play.

Secondly, India is a large paint market with consumers available at various price points and consuming a wide range of paint products within each category.At times, there are special requirements that are efficiently served by smaller local players.

Thirdly, distribution penetration is still inadequate in the industry and as a consequence, there are small geographies that are an attractive opportunity for a smaller player.

However, unlike a more fragmented market like China, in India the industry is relatively consolidated in the hand of the top-4 who holds close to 55 percent market share. This share continues to grow every year. Under GST, all the manufacturers are under the tax umbrella and no amount of tax arbitrage exists.

CW: What has been the impact of GST on your company and Indian paint andcoating industry? GST was expected to affect the unorganized sector producers in a negative way, what has been the impact of tax legislation on these producers?

Roy: The impact of GST was of course felt by the economy at large, as was expected from such a momentous revamp of the indirect tax structure. Our growth story remains intact as you will have seen from our recently declared results and so does the story of the entire paint industry.

The unorganized sector players in the industrial space have largely been impacted and brought into the tax net. The impact of this has allowed larger players to price themselves more competitively compared to them.

CW: Indians are considered among the most price sensitive consumers, globally. To what extent, a price hike necessitated by rising crude oil and titanium dioxide prices be a roadblock in the growth Indian paint industry in the current and coming years?

Roy: The Indian consumer is extremely value conscious but not a cheapskate. Going by past experience, they tend to take small price increases in their stride and demand is not unduly affected. We therefore do not anticipate a slowing in the demand story. Then again, the market has a large untapped potential that I referred to earlier while speaking of the industry growth drivers,which can absorb any temporary setback due to price increases.

CW: Green or environmental friendly paints have almost become a norm in the developed countries. What is Berger’s take on this sub-segment? Approximately what proportion of your total sales do these products constitute?

Roy: Berger Paints is the first paint major in India to receive “GreenProCertification” from CII-GPSC. We are one of the few organizations in the country that has taken up this initiative and achieved excellence in Green Performance. By achieving this coveted GreenPro Certification, Berger Paints has demonstrated their leadership and commitments towards Green. 30 of the largest water and solvent-based brands from the Berger stable are lead and heavy-metal free and have low VOC.

Abhijit Roy: Berger Paints has an open culture that believes that innovation is not the province of top leadership, but can come from anyone in the organization. All employees regardless of their place in the hierarchy are encouraged to give ideas that will improve business. This has helped foster innovation as well as develop a rich pipeline of innovations, a large number of which have been successful in the market and instrumental in Berger gaining market share. The leadership on its part encourages employees and backs ideas that have merit. Customer interactions, user feedback and research are some of the many tools used by marketing and R&D to develop product and service innovations. Reviews of internal systems and processes are routinely conducted to improve efficiencies, free up resources or reduce expenses.

CW: Is your earlier announced expansion of Hindupur plant (from 80,000 tpa to 160,000 tpa) on schedule.

Roy: Yes, we are on schedule.

CW: Despite, the big size of the Indian industry, per capita consumption of paints and coatings is abysmally low in the country. How do you see the situation changing in the medium- and long-term?

Roy: The per capita consumption of paint in the country has been growing over the years. There are some structural issues like low distribution penetration and low level of urbanization that have impeded the growth of paint consumption. Urbanization that was at a low of 32 percent, is surging and is expected to touch 41 percent by 2030. Paint is a hugely underpenetrated category in India with less than 0.1 million retail outlets compared to relatively saturated categories like FMCG that have nearly 10 million outlets or Telecom that has an estimated 9 million outlets. However, the industry is cognizant of the need to grow the distribution and is working on it. This is a focus area for us at Berger Paints, and many of our gains in the past few years have been a net result of growth in distribution reach.

The growth drivers of the Indian paint industry are many. They range from rapid urbanization, to growing width and depth of distribution, to consumers upgrading to superior products e.g. distemper to emulsion, regular to premium emulsion etc.., to buildup of infrastructure in the form of new airports, cities, ports, to the growing automotive industry, to government backed initiatives like Affordable Housing, Housing For All and the PradhanMantriAwaasYojana.

Thus the medium- and long-term outlook for the Indian Paint Industry seems to be encouraging.

CW: What is the current size (volume and value) of Indian paint & coating industry? What is the split between architectural and industrial segment?

Roy: The size of the Indian Paint Industry would be approx. INR 50,000 Cr of which more than 75 percent is contributed by the architectural segment and the rest by the industrial segment. The industry has been growing at a CAGR in excess of 12 percent and volumes are in excess of 4.50 Mn MT (Million Metric Tons).

CW: How big is Indian marine coatings market. It seems, this is one of the most neglected sub-segments of the Indian paint and coating industry, do you agree?

Roy: The size of the marine coatings market is small, around Rs 250 Cr which is barely 2.5 percent of the paint and coatings industry in the country and is growing at a very slow pace. India has 12 major and 200 minor notified and intermediate ports and 95 percent of the country’s trade by volume is done through sea routes. But we are still only the 16th largest maritime economy.

So the size of the marine paints segment is not representative of the potential of the industry. Significant investments are needed in developing infrastructure at ports, terminals, shipyards, etc. We understand that the present government is keen on increasing India’s stake in world maritime trade and prepared to do all that is necessary. The Indian Navy for one has embarked on an ambitious plan to indigenously construct warships and submarines under the Make in India initiative.

CW: What according to you are the three largest challenges facing Indian paints and coating industry?

Roy: The GST rate of 28 percent that is slowing demand is a challenge for the industry. The present tax rate appears to focus its attention on the aesthetic value of paint alone, while failing to recognize the role of paint in protecting valuable infrastructure, preventing degradation of assets, insulating homes from environmental damage among others. We are hopeful that in the months to come, the government will heed the need to rationalize the tax rate further.

Paint is in the RED category and setting up of new manufacturing plants in India comes with its own set of issues. Companies like Berger are extremely sensitive to environment degradation issues and proactively put in place all the equipment necessary to ensure zero-emission and effluent control and treatment. However, access to good locations for paint factories is difficult due to unfounded fears of pollution.

CW: Unorganized sector of Indian paint industry accounts for a huge share of the total pie of the Indian paint industry. Isn’t it an unhealthy trend? Has the share of this segment increased or decreased over the past few years?

Roy: This is not an unhealthy phenomenon. On the contrary this is a testament to the strong entrepreneurial drive in our countrymen. The barriers to entry into this industry are low and enterprising entrepreneurs identify and serve markets and market segments that can be served by a local play.

Secondly, India is a large paint market with consumers available at various price points and consuming a wide range of paint products within each category.At times, there are special requirements that are efficiently served by smaller local players.

Thirdly, distribution penetration is still inadequate in the industry and as a consequence, there are small geographies that are an attractive opportunity for a smaller player.

However, unlike a more fragmented market like China, in India the industry is relatively consolidated in the hand of the top-4 who holds close to 55 percent market share. This share continues to grow every year. Under GST, all the manufacturers are under the tax umbrella and no amount of tax arbitrage exists.

CW: What has been the impact of GST on your company and Indian paint andcoating industry? GST was expected to affect the unorganized sector producers in a negative way, what has been the impact of tax legislation on these producers?

Roy: The impact of GST was of course felt by the economy at large, as was expected from such a momentous revamp of the indirect tax structure. Our growth story remains intact as you will have seen from our recently declared results and so does the story of the entire paint industry.

The unorganized sector players in the industrial space have largely been impacted and brought into the tax net. The impact of this has allowed larger players to price themselves more competitively compared to them.

CW: Indians are considered among the most price sensitive consumers, globally. To what extent, a price hike necessitated by rising crude oil and titanium dioxide prices be a roadblock in the growth Indian paint industry in the current and coming years?

Roy: The Indian consumer is extremely value conscious but not a cheapskate. Going by past experience, they tend to take small price increases in their stride and demand is not unduly affected. We therefore do not anticipate a slowing in the demand story. Then again, the market has a large untapped potential that I referred to earlier while speaking of the industry growth drivers,which can absorb any temporary setback due to price increases.

CW: Green or environmental friendly paints have almost become a norm in the developed countries. What is Berger’s take on this sub-segment? Approximately what proportion of your total sales do these products constitute?

Roy: Berger Paints is the first paint major in India to receive “GreenProCertification” from CII-GPSC. We are one of the few organizations in the country that has taken up this initiative and achieved excellence in Green Performance. By achieving this coveted GreenPro Certification, Berger Paints has demonstrated their leadership and commitments towards Green. 30 of the largest water and solvent-based brands from the Berger stable are lead and heavy-metal free and have low VOC.