Charles W. Thurston, Latin America Correspondent06.04.18

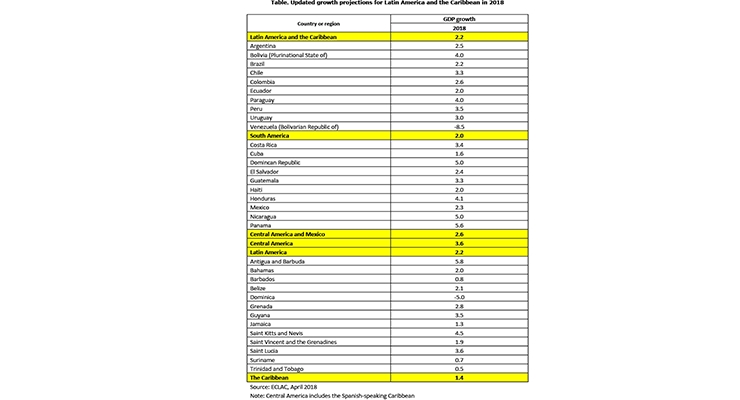

Growth prospects in Latin America have improved over the past year, adding another percentage point in gross domestic product expansion to the current rate of close to two percent, with much hotter five percent-plus growth eruptions in several isolated countries.

According to an April report by the World Bank, Latin America grew by 1.1 percent in 2017 and is expected to grow by 1.8 percent in 2018 and 2.3 percent in 2019. The bank noted that if statistics for free-falling Venezuela are excluded, the estimates for regional growth projection is for 2.6 percent this year and could be 2.8 percent in 2019. Within this regional performance, the Caribbean is expected to lead sub-regional growth, with an expansion of 3.5 percent this year and 3.4 percent projected for 2019.

Another April report, from the United Nation’s Economic Commission for Latin America and the Caribbean (ECLAC) also released an upbeat assessment of the potential growth in the region. “During 2018, greater dynamism in external demand is seen helping stimulate the economic activity of Latin America and the Caribbean. Likewise, domestic demand will play an important role in the acceleration of growth, although with differences among components,” Santiago-based ECLAC reported.

A NASDAQ report in May also suggests that macroeconomic factors are now in line for regional growth. “Latin America has struggled with recession, a politically sensitive climate, and high inflation, but is now on an upward swing,” the bourse reported.

This regional growth bodes well for the estimated $10 billion Latin America paint and coatings industry, which traditionally expands by one or two percentage points over GDP during expansion years. The largest international players are broadly positioned throughout the countries of the region, and able to take advantage of the bright spots while preparing for market recovery in others.

Continuing Investment Smooths Year-to-Year Sales

Long-term investment strategies have paid off in the region. “In particular, and even while continuing to be low, investment is expected to make a greater contribution (to growth) than in previous years, while private consumption will remain a relevant driver of domestic demand,” ECLAC reckons.

The numbers have played out well for major investors. “PPG has grown at a double-digit rate in Latin America in recent years, and is prepared to continue investing in the region to support further accelerated growth,” said Adriana Macouzet, PPG’s vice president and general manager for protective and marine coatings in Latin America.

PPG’s Mexico-based Comex unit, with its broad Central American distribution system, seems particularly well poised to capture market expansion revenues over the coming year. PPG reported in October that Latin America represents about 10 percent of its global net sales, with 14 facilities in five countries. “Organic sales also increased in the Latin American region (in 2017) versus the prior year, reflecting high end-use market demand,” the company’s latest annual report notes.

A good part of PPG’s success in the region is derived from its store network, which serves customers through more than 4,500 stores in Mexico, Central America and Brazil.

Sherwin-Williams, too, is well based in the region, citing 353 paint stores, 16 branches and eight facilities, along with a net sales increase for 2017 at net sales for the Latin America region up by 4.5 percent. “In Latin America, selling price increases enabled us to grow revenues in the full year, though underlying economic conditions in the region remained challenging. We continued to position ourselves for long-term growth, adding 14 new company-operated stores in the region. We also added 65 new dedicated dealers, bringing our total to more than 700,” the company’s latest annual report notes.

Sherwin-Williams also said that, “Our national and regional account program resulted in new business with South America’s largest hotel purchasing group, large retail facility owner-operators and big-box retailer store remodels. New accounts grew more than 30 percent over the prior year.”

South America Leads the Region

ECLAC also reported that the economies of South America are driving the regional growth with a two percent expansion predicted for this year compared with 0.8 percent in 2017.

PPG is particularly bullish on South America, in strong part due to Brazil’s recovery. “We are excited about the growth opportunities in Latin America: Brazil is heading to a record rate of light-vehicle production in 2018, and despite some uncertainties, the region is forecasted to grow at a higher pace, driven by the recovery of Brazil, and the stabilization of Argentina and Colombia,” said Macouzet.

Brazil’s “increased dynamism” will deliver a 2.2 percent growth rate this year to co-lead lead the sub-region with Argentina, predicted to growth by 2.54 percent this year, ECLAC reports.

Brazil accounts for 38 percent of the total 3.5 billion liter Latin American paint and coatings market by volume. The county also represents 31 percent of the regional $10 billion value, according to analysis last year by ChemQuest Group.

To better quantify and specify Brazilian customer interest in higher quality formulations, Dow performed a large multi-year analysis of Brazilian Internet searches for paint use last year, and produced broad consumer profiles. Dow found that among functional areas consumers are increasingly seeking are easy cleaning, anti-humidity, single or one coat, anti-soiling, anti-bacterial and soundproofing, according to Daniella Souza Miranda, director of the company’s Coating Materials & Performance Monomers business for Latin America.

Chemours is striving to move away from an old image of commodity supplier to one of system provider and consultant, noted Claudia de Alameida Antunes, the company business manager for titanium technologies in Brazil, based in Barueri, Sao Paulo state. As such the company is spending more time working with customers in Brazil to develop more efficient methods of utilizing a higher-quality product.

Apart from its world-class auto industry, Brazil’s construction sector reported growth of four percent in April of this year, compared with the same month in 2017, boding well for architectural paints and coatings.

Argentina also has had some success in inspiring new growth, reporting a 5.1 percent expansion in February; growth there is predicted to expand 3.5 percent this year. The government’s efforts to stabilize the economy are far from over, though, with inflation up to about 15 percent in March, as large flows of capital left the less-regulated financial markets early this year. At the same time, the government increased bond rates to 40 percent to help keep more investment in the country.

Among continuing investors in Argentina, PPG is expanding its operations. “Last year, opened a new 300-square-meter training center for automotive refinish professionals in Pilar, Argentina,” said Macouzet.

Colombia, too is attracting more investment, with a GDP expected to increase by 2.6 percent this year, according to ECLAC.

In Colombia, PPG expanded production capabilities for protective coatings during 2017, Macouzet said.

And Colombia’s Pintuco, part of Grupo Orbis, has begun the development of a domestic chain of Do-it-Yourself stores named Master Pro that will feature Pintuco’s full line of paints and coatings. The independent Pintucasa paint store network will continue to be expanded, as well, with a Pintucasa section planned inside each Master Pro store.

A host of smaller South American economies are reporting even more robust growth, including Bolivia and Paraguay, each with a predicted 2018 growth rate of four percent, Peru with a 3.5 percent rate, Chile with a 3.3 percent growth rate, and Uruguay with four percent GDP expansion this year, according to ECLAC.

In Peru, the national market for paint is estimated at $370 million, and investments that are continuing to help the country recovery from El Niño floods a year ago should boost the demand for architectural and industrial paints and coatings alike.

Mexico’s Future for Investment Uncertain

Mexico’s demand growth for paints and coatings has been driven by the long-standing North American Free Trade Agreement, or NAFTA. However U.S. President Donald Trump plans to renegotiate the deal to protect U.S. jobs, leaving some investors less sure about new investments in Mexico than in the past.

“The NAFTA negotiation remains the main challenge for the region, but we are confident that the productivity and quality of the local operations will help uphold the region as one of the most attractive for private investments,” said Macouzet.

In Mexico, over the past year PPG installed an automated production cell for plastic auto-parts coatings in San Juan del Rio, in Queretaro State, said Macouzet.

PPG notes that during 2017, “Latin America sales volumes expanded by a mid-single-digit percentage versus the prior year primarily due to above market growth in our automotive OEM coatings and general industrial coatings businesses. The automotive OEM coatings growth was driven by industry production expansion with the opening of new assembly facilities in Mexico. Regional sales volumes were lower in architectural coatings versus the prior year primarily due to lower sales volumes in Brazil and in Mexico due to the impact of the natural disasters during the third quarter.”

PPG also said that Latin America organic sales were up year-over-year, led by Mexico which grew at more than double the Mexican GDP growth rate. In Mexico, the PPG-Comex business added over 200 new concessionaire locations, and strong growth continued in the automotive industry due to the opening of new automotive assembly plants within the country in the past 18 months.

Among other investors in Mexico, AkzoNobel Specialty Chemicals is investing more than $14 million to expand production capacity and upgrade its organic peroxides facility in Los Reyes, Michoacán state. The investment is the latest in a series of recent investments there: In January 2017, the company finalized a $26 million organic peroxides expansion. The latest expansion project is expected to be completed by May 2019.

Similarly, a Stepan subsidiary in Mexico, reached an agreement with BASF Mexicana, to acquire its surfactant production facility in Ecatepec, in the State of Mexico, and a portion of its associated surfactants business.

And Sika last year agreed to acquire some assets of Grupo Industrial Alce in Mexico, extending its range of solutions for roofing and waterproofing customers.

Central America Grows Fastest Among Sub-Regions

Outstripping the performance of the countries to the south, the economies of Central America are expected to report the fastest sub-regional growth rate at 3.6 percent, compared with 3.4 percent in 2017.

The total Central American paint and coatings market is estimated at more than $400 million, according to one recent report.

Among the Central American countries, Panama seems poised to record the highest rate of expansion at 5.6 percent this year. PPG noted that Panama is helping to raise its regional sales forecast. PPG’s Glidden brand recently opened a store in Vista Alegre, Panama, and has plans to open more stores – both company owned and concessions – in the country.

The Panama growth performance is followed by Nicaragua at five percent, and Honduras at 4.1 percent, according to ECLAC.

Comex operates company-owned paint stores across Belize, El Salvador, Guatemala, Honduras, Costa Rica, Nicaragua and Panama. PPG anticipates additional annual revenue synergies in Central America via Comex of between $60 and $70 million by 2019, a PPG report indicates.

The Caribbean Recovers from Hurricanes Slowly

Overall growth in the Caribbean is still slow this year at 1.5 percent, weighed down by the -5 percent contraction in Dominica. Still, Antigua and Barbuda will lead Caribbean nation growth with a 5.6 GDP expansion this year, followed by the Dominican Republic with five percent, and Saint Lucia with 3.6 percent growth.

Recovery in Puerto Rico and the U.S. Virgin Islands from hurricanes over the past year is expected to boost sales in the region, especially for local manufacturers like Lanco & Harris , or Lanco Paints and Coatings, part of the Blanco Group, which has one plant in Puerto Rico.

Sherwin-Williams is well positioned in the Caribbean with 80 stores, two facilities and a branch.

Late last year, Specialty Polymers signed an agreement with Olivieri & Associates to be the company’s new sales agent in Puerto Rico, Dominican Republic and other locations in the Caribbean and in Costa Rica.

According to an April report by the World Bank, Latin America grew by 1.1 percent in 2017 and is expected to grow by 1.8 percent in 2018 and 2.3 percent in 2019. The bank noted that if statistics for free-falling Venezuela are excluded, the estimates for regional growth projection is for 2.6 percent this year and could be 2.8 percent in 2019. Within this regional performance, the Caribbean is expected to lead sub-regional growth, with an expansion of 3.5 percent this year and 3.4 percent projected for 2019.

Another April report, from the United Nation’s Economic Commission for Latin America and the Caribbean (ECLAC) also released an upbeat assessment of the potential growth in the region. “During 2018, greater dynamism in external demand is seen helping stimulate the economic activity of Latin America and the Caribbean. Likewise, domestic demand will play an important role in the acceleration of growth, although with differences among components,” Santiago-based ECLAC reported.

A NASDAQ report in May also suggests that macroeconomic factors are now in line for regional growth. “Latin America has struggled with recession, a politically sensitive climate, and high inflation, but is now on an upward swing,” the bourse reported.

This regional growth bodes well for the estimated $10 billion Latin America paint and coatings industry, which traditionally expands by one or two percentage points over GDP during expansion years. The largest international players are broadly positioned throughout the countries of the region, and able to take advantage of the bright spots while preparing for market recovery in others.

Continuing Investment Smooths Year-to-Year Sales

Long-term investment strategies have paid off in the region. “In particular, and even while continuing to be low, investment is expected to make a greater contribution (to growth) than in previous years, while private consumption will remain a relevant driver of domestic demand,” ECLAC reckons.

The numbers have played out well for major investors. “PPG has grown at a double-digit rate in Latin America in recent years, and is prepared to continue investing in the region to support further accelerated growth,” said Adriana Macouzet, PPG’s vice president and general manager for protective and marine coatings in Latin America.

PPG’s Mexico-based Comex unit, with its broad Central American distribution system, seems particularly well poised to capture market expansion revenues over the coming year. PPG reported in October that Latin America represents about 10 percent of its global net sales, with 14 facilities in five countries. “Organic sales also increased in the Latin American region (in 2017) versus the prior year, reflecting high end-use market demand,” the company’s latest annual report notes.

A good part of PPG’s success in the region is derived from its store network, which serves customers through more than 4,500 stores in Mexico, Central America and Brazil.

Sherwin-Williams, too, is well based in the region, citing 353 paint stores, 16 branches and eight facilities, along with a net sales increase for 2017 at net sales for the Latin America region up by 4.5 percent. “In Latin America, selling price increases enabled us to grow revenues in the full year, though underlying economic conditions in the region remained challenging. We continued to position ourselves for long-term growth, adding 14 new company-operated stores in the region. We also added 65 new dedicated dealers, bringing our total to more than 700,” the company’s latest annual report notes.

Sherwin-Williams also said that, “Our national and regional account program resulted in new business with South America’s largest hotel purchasing group, large retail facility owner-operators and big-box retailer store remodels. New accounts grew more than 30 percent over the prior year.”

South America Leads the Region

ECLAC also reported that the economies of South America are driving the regional growth with a two percent expansion predicted for this year compared with 0.8 percent in 2017.

PPG is particularly bullish on South America, in strong part due to Brazil’s recovery. “We are excited about the growth opportunities in Latin America: Brazil is heading to a record rate of light-vehicle production in 2018, and despite some uncertainties, the region is forecasted to grow at a higher pace, driven by the recovery of Brazil, and the stabilization of Argentina and Colombia,” said Macouzet.

Brazil’s “increased dynamism” will deliver a 2.2 percent growth rate this year to co-lead lead the sub-region with Argentina, predicted to growth by 2.54 percent this year, ECLAC reports.

Brazil accounts for 38 percent of the total 3.5 billion liter Latin American paint and coatings market by volume. The county also represents 31 percent of the regional $10 billion value, according to analysis last year by ChemQuest Group.

To better quantify and specify Brazilian customer interest in higher quality formulations, Dow performed a large multi-year analysis of Brazilian Internet searches for paint use last year, and produced broad consumer profiles. Dow found that among functional areas consumers are increasingly seeking are easy cleaning, anti-humidity, single or one coat, anti-soiling, anti-bacterial and soundproofing, according to Daniella Souza Miranda, director of the company’s Coating Materials & Performance Monomers business for Latin America.

Chemours is striving to move away from an old image of commodity supplier to one of system provider and consultant, noted Claudia de Alameida Antunes, the company business manager for titanium technologies in Brazil, based in Barueri, Sao Paulo state. As such the company is spending more time working with customers in Brazil to develop more efficient methods of utilizing a higher-quality product.

Apart from its world-class auto industry, Brazil’s construction sector reported growth of four percent in April of this year, compared with the same month in 2017, boding well for architectural paints and coatings.

Argentina also has had some success in inspiring new growth, reporting a 5.1 percent expansion in February; growth there is predicted to expand 3.5 percent this year. The government’s efforts to stabilize the economy are far from over, though, with inflation up to about 15 percent in March, as large flows of capital left the less-regulated financial markets early this year. At the same time, the government increased bond rates to 40 percent to help keep more investment in the country.

Among continuing investors in Argentina, PPG is expanding its operations. “Last year, opened a new 300-square-meter training center for automotive refinish professionals in Pilar, Argentina,” said Macouzet.

Colombia, too is attracting more investment, with a GDP expected to increase by 2.6 percent this year, according to ECLAC.

In Colombia, PPG expanded production capabilities for protective coatings during 2017, Macouzet said.

And Colombia’s Pintuco, part of Grupo Orbis, has begun the development of a domestic chain of Do-it-Yourself stores named Master Pro that will feature Pintuco’s full line of paints and coatings. The independent Pintucasa paint store network will continue to be expanded, as well, with a Pintucasa section planned inside each Master Pro store.

A host of smaller South American economies are reporting even more robust growth, including Bolivia and Paraguay, each with a predicted 2018 growth rate of four percent, Peru with a 3.5 percent rate, Chile with a 3.3 percent growth rate, and Uruguay with four percent GDP expansion this year, according to ECLAC.

In Peru, the national market for paint is estimated at $370 million, and investments that are continuing to help the country recovery from El Niño floods a year ago should boost the demand for architectural and industrial paints and coatings alike.

Mexico’s Future for Investment Uncertain

Mexico’s demand growth for paints and coatings has been driven by the long-standing North American Free Trade Agreement, or NAFTA. However U.S. President Donald Trump plans to renegotiate the deal to protect U.S. jobs, leaving some investors less sure about new investments in Mexico than in the past.

“The NAFTA negotiation remains the main challenge for the region, but we are confident that the productivity and quality of the local operations will help uphold the region as one of the most attractive for private investments,” said Macouzet.

In Mexico, over the past year PPG installed an automated production cell for plastic auto-parts coatings in San Juan del Rio, in Queretaro State, said Macouzet.

PPG notes that during 2017, “Latin America sales volumes expanded by a mid-single-digit percentage versus the prior year primarily due to above market growth in our automotive OEM coatings and general industrial coatings businesses. The automotive OEM coatings growth was driven by industry production expansion with the opening of new assembly facilities in Mexico. Regional sales volumes were lower in architectural coatings versus the prior year primarily due to lower sales volumes in Brazil and in Mexico due to the impact of the natural disasters during the third quarter.”

PPG also said that Latin America organic sales were up year-over-year, led by Mexico which grew at more than double the Mexican GDP growth rate. In Mexico, the PPG-Comex business added over 200 new concessionaire locations, and strong growth continued in the automotive industry due to the opening of new automotive assembly plants within the country in the past 18 months.

Among other investors in Mexico, AkzoNobel Specialty Chemicals is investing more than $14 million to expand production capacity and upgrade its organic peroxides facility in Los Reyes, Michoacán state. The investment is the latest in a series of recent investments there: In January 2017, the company finalized a $26 million organic peroxides expansion. The latest expansion project is expected to be completed by May 2019.

Similarly, a Stepan subsidiary in Mexico, reached an agreement with BASF Mexicana, to acquire its surfactant production facility in Ecatepec, in the State of Mexico, and a portion of its associated surfactants business.

And Sika last year agreed to acquire some assets of Grupo Industrial Alce in Mexico, extending its range of solutions for roofing and waterproofing customers.

Central America Grows Fastest Among Sub-Regions

Outstripping the performance of the countries to the south, the economies of Central America are expected to report the fastest sub-regional growth rate at 3.6 percent, compared with 3.4 percent in 2017.

The total Central American paint and coatings market is estimated at more than $400 million, according to one recent report.

Among the Central American countries, Panama seems poised to record the highest rate of expansion at 5.6 percent this year. PPG noted that Panama is helping to raise its regional sales forecast. PPG’s Glidden brand recently opened a store in Vista Alegre, Panama, and has plans to open more stores – both company owned and concessions – in the country.

The Panama growth performance is followed by Nicaragua at five percent, and Honduras at 4.1 percent, according to ECLAC.

Comex operates company-owned paint stores across Belize, El Salvador, Guatemala, Honduras, Costa Rica, Nicaragua and Panama. PPG anticipates additional annual revenue synergies in Central America via Comex of between $60 and $70 million by 2019, a PPG report indicates.

The Caribbean Recovers from Hurricanes Slowly

Overall growth in the Caribbean is still slow this year at 1.5 percent, weighed down by the -5 percent contraction in Dominica. Still, Antigua and Barbuda will lead Caribbean nation growth with a 5.6 GDP expansion this year, followed by the Dominican Republic with five percent, and Saint Lucia with 3.6 percent growth.

Recovery in Puerto Rico and the U.S. Virgin Islands from hurricanes over the past year is expected to boost sales in the region, especially for local manufacturers like Lanco & Harris , or Lanco Paints and Coatings, part of the Blanco Group, which has one plant in Puerto Rico.

Sherwin-Williams is well positioned in the Caribbean with 80 stores, two facilities and a branch.

Late last year, Specialty Polymers signed an agreement with Olivieri & Associates to be the company’s new sales agent in Puerto Rico, Dominican Republic and other locations in the Caribbean and in Costa Rica.