Arnold Wang, China Correspondent10.03.18

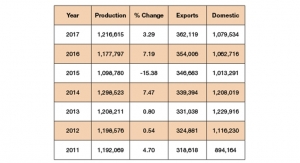

China produced 257 thousand tons of container coatings in 2017. The entire container industry reduced 120 thousand tons of VOC, an amazing achievement considering the entire industry released 150 thousand tons of VOC per year before widely adopting waterborne formulas. The dramatic change was the result of a big public commitment made by China Container Industry Association, an association led by several of the largest container companies in the world.

A story started from the signing of a public commitment.

China Container Industry Association held the signing ceremony of the VOCs Governance Self-Discipline Convention for their members in 2016, promising by April 1, 2017 the container industry would all switch from solvent-based coatings to waterborne coatings. With the signing of this agreement, a company whose container is still painted with solvent-based coatings will be fined 800 yuan for each container they produce. Its members include China International Marine Container Corporation (CIMC), who has approximately 50 percent share of the global container market. Together with another company, they hold over 75 percent share in the entire world.

China alone has approximately 95 percent share in the global container market.

As a result of this, the consequence of the commitment is huge. Millions of dollars have been invested to build new painting lines which can adopt waterborne coatings.

This top-down approach, normally making things much easier in China, shows great effectiveness. Previously, 40 percent of solvent-based container coatings were organic solvent. Besides this, during the paining process around 20 percent organic dilute agent needed to be added. It is estimated that after the container company applied waterborne coatings on their paint line, VOC release for painting a standard dry container can be reduced from 36kg/TEU to 5-8kg/TEU, equal to 80 percent decrease for VOC.

This is the first self-discipline promise made by a whole industry in China, giving waterborne coatings a great opportunity to take over a single market segment in a short period of time. The waterborne coatings companies fully took advantage of this opportunity and expanded their market share. What happened in the container coatings market led to the development of the whole industrial coatings market in China. Waterborne and high solid coatings have all seen fast development in these two years.

Structural change happened in upstream container coatings market

The companies in downstream markets normally can make requests to their upstream suppliers. The request is well listened to normally. In Western countries, this is called extended producer responsibility (EPR). What happened in the container industry is such a case. This led to structural changes in the container coatings market.

Niney-nine percent of the market for container coatings in China has been now taken over by waterborne coatings companies, which is amazing. And both domestic and foreign coatings are actively involved into this process. The primer coatings of waterborne coatings systems are normally zinc rich epoxy coatings or PVDC coatings. Valspar is one of the major producers of PVDC coatings, which is widely seen on the containers of Dongguan Maersk. But PVDC coatings have not widely been adopted by other container companies in China. The mid-coatings and top coatings are epoxy or acrylic coatings. Besides, 80 percent of top coatings for interior container wall is waterborne acrylic epoxy coatings. In 2017, Dowill Paint, a domestic container coatings company, achieved significant business growth. Their total sales reached more than two billion yuan and the company holds 45 percent share in the waterborne container coatings market. Not widely known is this company only has a total sales revenue of around 400 million yuan in 2016. In the first quarter of 2018, the company’s sales grew by 300 percent over the same period of 2017.

Dowill is not the only domestic container coatings company who realized exponential growth. Jointas’s waterborne container coatings has also experienced amazing growth. In the first half of 2018 the company’s waterborne coatings sales grew by 56.8 percent over last year. Their solvent-based bituminous coatings’ sales decreased by 30 percent over last year.

On the contrary, some large coatings companies were under higher cost pressures. Kansai’s waterborne coatings business also grew quickly in China. During the first quarter, the revenue of COSCO Kansai increased by 33 percent over the same period of 2017 to HK$516 million. It was mainly the result of the increase in their container coatings’ selling price. But significant increase in the cost of raw materials led to poor performance of their gross profit.

So it is true that the container producers are more willing to pay a higher price to waterborne coatings, but the rising of raw material prices has been eating up the profits of coatings companies, a phenomenon widely seen in the financial reports of most coatings companies.

New players join the game by establishing strategic partnership.

The fast expansion of waterborne container coatings lured some companies to quickly add new manufacturing capacities in China. Baojun New Material Co., Ltd has put into production of their new manufacturing base which can produce 50 thousand waterborne container coatings in Tianjin.

Valspar also increased their waterborne container coatings production by 80 thousand tons per year. Valspar has been partnered with Maersk for several years in China, and Maersk is also the first container company to fully adopt waterborne coatings in their container production in China.

While major container companies keep upgrading their painting lines with new investments, as CIMC said they will do in the next future, coatings companies will keep following up by introducing new waterborne coatings technologies and new painting solutions in China.

A story started from the signing of a public commitment.

China Container Industry Association held the signing ceremony of the VOCs Governance Self-Discipline Convention for their members in 2016, promising by April 1, 2017 the container industry would all switch from solvent-based coatings to waterborne coatings. With the signing of this agreement, a company whose container is still painted with solvent-based coatings will be fined 800 yuan for each container they produce. Its members include China International Marine Container Corporation (CIMC), who has approximately 50 percent share of the global container market. Together with another company, they hold over 75 percent share in the entire world.

China alone has approximately 95 percent share in the global container market.

As a result of this, the consequence of the commitment is huge. Millions of dollars have been invested to build new painting lines which can adopt waterborne coatings.

This top-down approach, normally making things much easier in China, shows great effectiveness. Previously, 40 percent of solvent-based container coatings were organic solvent. Besides this, during the paining process around 20 percent organic dilute agent needed to be added. It is estimated that after the container company applied waterborne coatings on their paint line, VOC release for painting a standard dry container can be reduced from 36kg/TEU to 5-8kg/TEU, equal to 80 percent decrease for VOC.

This is the first self-discipline promise made by a whole industry in China, giving waterborne coatings a great opportunity to take over a single market segment in a short period of time. The waterborne coatings companies fully took advantage of this opportunity and expanded their market share. What happened in the container coatings market led to the development of the whole industrial coatings market in China. Waterborne and high solid coatings have all seen fast development in these two years.

Structural change happened in upstream container coatings market

The companies in downstream markets normally can make requests to their upstream suppliers. The request is well listened to normally. In Western countries, this is called extended producer responsibility (EPR). What happened in the container industry is such a case. This led to structural changes in the container coatings market.

Niney-nine percent of the market for container coatings in China has been now taken over by waterborne coatings companies, which is amazing. And both domestic and foreign coatings are actively involved into this process. The primer coatings of waterborne coatings systems are normally zinc rich epoxy coatings or PVDC coatings. Valspar is one of the major producers of PVDC coatings, which is widely seen on the containers of Dongguan Maersk. But PVDC coatings have not widely been adopted by other container companies in China. The mid-coatings and top coatings are epoxy or acrylic coatings. Besides, 80 percent of top coatings for interior container wall is waterborne acrylic epoxy coatings. In 2017, Dowill Paint, a domestic container coatings company, achieved significant business growth. Their total sales reached more than two billion yuan and the company holds 45 percent share in the waterborne container coatings market. Not widely known is this company only has a total sales revenue of around 400 million yuan in 2016. In the first quarter of 2018, the company’s sales grew by 300 percent over the same period of 2017.

Dowill is not the only domestic container coatings company who realized exponential growth. Jointas’s waterborne container coatings has also experienced amazing growth. In the first half of 2018 the company’s waterborne coatings sales grew by 56.8 percent over last year. Their solvent-based bituminous coatings’ sales decreased by 30 percent over last year.

On the contrary, some large coatings companies were under higher cost pressures. Kansai’s waterborne coatings business also grew quickly in China. During the first quarter, the revenue of COSCO Kansai increased by 33 percent over the same period of 2017 to HK$516 million. It was mainly the result of the increase in their container coatings’ selling price. But significant increase in the cost of raw materials led to poor performance of their gross profit.

So it is true that the container producers are more willing to pay a higher price to waterborne coatings, but the rising of raw material prices has been eating up the profits of coatings companies, a phenomenon widely seen in the financial reports of most coatings companies.

New players join the game by establishing strategic partnership.

The fast expansion of waterborne container coatings lured some companies to quickly add new manufacturing capacities in China. Baojun New Material Co., Ltd has put into production of their new manufacturing base which can produce 50 thousand waterborne container coatings in Tianjin.

Valspar also increased their waterborne container coatings production by 80 thousand tons per year. Valspar has been partnered with Maersk for several years in China, and Maersk is also the first container company to fully adopt waterborne coatings in their container production in China.

While major container companies keep upgrading their painting lines with new investments, as CIMC said they will do in the next future, coatings companies will keep following up by introducing new waterborne coatings technologies and new painting solutions in China.