Gary Shawhan and Phil Phillips, Contributing Editors 04.12.19

Differentiation is an important attribute in strategy development and value creation. While this term is most often used in the context of a unique coating product or an additive technology, it also has much broader strategic implications.

“Differentiation” is something that coating manufacturers strive for to set them apart from competitors. In the broadest sense, companies not only want this term to relate to their products and services but also their overall image in the markets they serve. In this article, the focus is on the role of product differentiation in value creation and its retention.

The strategic implications that evolve over the product life cycle are also discussed.

As formulated coatings, differentiation commonly refers to the features and benefits provided by the use of such coatings in one or more market applications. When introducing a new coating to the market, the impetus behind it is in its ability to address one or more unmet needs that exist in the marketplace. This scenario provides the platform for the sales and marketing strategies and related business goals for the company within the targeted market spaces.

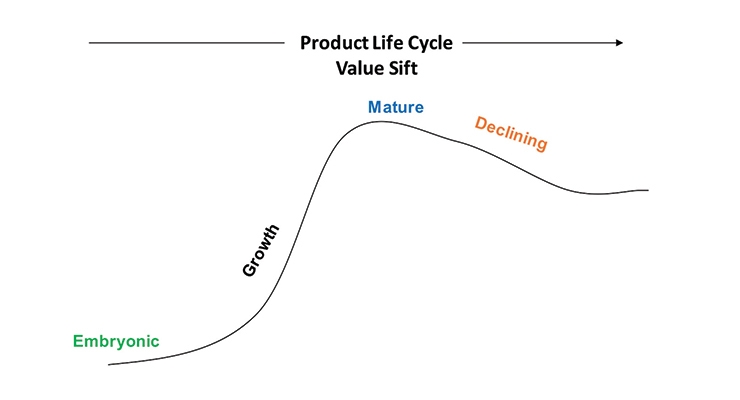

The traditional graphic (Figure 1) outlining the “life cycle” of a product also applies to the markets that they serve. This graphic also provides a basic template for the changes that need to be made in strategy as products (and the markets they serve) move through their life cycle.

In emerging markets, the structure of the business opportunity is often very fluid and contains a number of undefined elements and transitional issues. This not only creates opportunities for new products but bring with it risks as well. These risks include a greater likelihood that alternative coating products are introduced into the market by competitors early in its life which diminish its uniqueness Risks may also involve a shift in the performance criteria required during the early stages of the market introduction.

Importantly, it is during this “emerging phase” that the baseline is set for profitability and the value of differentiated coating technologies is established in the marketplace.

As markets begin to experience growth, the competitive framework starts to establish itself. This includes sharpening the list of competing suppliers of coatings who will serve these markets going forward. it also brings into focus other important business elements that begin to shape the overall competitive environment. Table 1 lists some of these “other” elements of supplier differentiation.

As individual markets evolve and begin to mature, these “other elements” take on increasing strategic importance in their ability to retain differentiation. They also provide the basis for strategic planning and a guide to identifying those aspects of the business that need to be strengthened to grow and retain a strong market position going forward.

Table 1: Other Elements of Differentiation Beyond Product Performance

• Technical and application engineering support

• Next generation product development planning

• Cost position in raw materials

• Total cost-of-ownership for the process

• Manufacturing cost position

• Geographic market reach

• Channel-to-market strength/distribution

• Brand identity

Next Generation Product Development

The inventiveness that goes into new product design through research and development is fundamental to establishing a differentiated position in the marketplace. The goals and objectives behind novel product development vary. In certain cases, new products are developed in response to specific customer problems or unmet needs within a given market segment. In other situations, they are the result of the creativity and vision that comes through anticipating transitions occurring in the marketplace. Such products development efforts are often embryonic and can be “disruptors or game changers” in the best of circumstances.

Market leaders and major suppliers need to plan for product obsolescence and anticipate changes in the markets that they serve. Continuing to “leap-frog” the competition through the introduction of next-generation coatings is an effective tactic for fending-off share encroachment from competitors. In dynamic markets, where there are unmet needs or transitions occurring that require new products, the path forward often centers on new product development. As growth markets begin to mature, the competitive environment becomes more crowded and there is less differentiation in performance between suppliers. Without a “next generation” product to stay ahead of the competition, differentiation strategies increasingly rely on items like technical support, total process cost-of-ownership, local supply/JIT, distribution, etc. to support and protect market position.

For entrepreneurial companies and start-up ventures, the strength of their business strategies is in the uniqueness of their products/technologies or services in relation to existing market standards. In these cases, the level of differentiation from the norm needs to be significant in order to provide a strong value proposition to the end-user. The more successful entrepreneurial companies often narrow their business focus, targeting those individual market applications and account targets where they can maximize resources while addressing time-to-market realities.

During the growth cycle, quality technical service and application engineering support, directed at individual customer needs, is a very important differentiator between suppliers. Product line configurations, substrate types coating application equipment and the overall production process all impact the way coatings perform in service. With new products, each of these elements frequently determines which products work best.

Suppliers who understand the nuances and unique aspects of a customer’ production line and can then adapt their product implementation plan to address these needs differentiate themselves. These suppliers often succeed when other suppliers fail.

As markets begin to mature it is the knowledge and relationships gained through the understanding of customers’ individual manufacturing operations that also helps protect the business relationship with customers. Just as important, it is this knowledge that allows an incumbent supplier to guide next-generation products that refresh their supply position.

Access and strength in the channels-to-market is an important aspect of a successful business strategy. In volume markets, such as OEM coatings, direct sales support is required. At the same time, JIT requirements bring in to play the importance of regional supply through local warehousing and distribution. Unique coating products that deliver identifiable performance advantages may not be commercially viable without the accompanying resources and the appropriate channel-to-market strengths.

Adequate channel-to-market positioning strongly favors the major coating suppliers when addressing main-steam, volume market applications. Entrepreneurial companies with new, exciting innovations need to take into account the impediments they face in targeting certain markets where the channel-to-market is controlled by the

major manufacturers.

Alternatively, niche markets or smaller, less structured coatings market segments become more accessible and better opportunities for entrepreneurial companies with a novel if not ‘game changing” products. In these situations, it is during the embryonic phase of strategy development and implementation that the viability of the selected target markets needs to be assessed. Implementing a successful, differentiated market introduction strategy in one or more of these market spaces requires careful consideration of the channel-to-market requirements that are needed to be successful. For smaller, entrepreneurial companies, this analysis often dictates eliminating some markets in the beginning. Focusing on those market applications and specific accounts that fit within the resources and capabilities of the company to supply the end-user increases the chance for success. As these products mature, the value of having a strong position in the channels-to-market does not diminish.

In the context of “Porter’s marketing positioning” concept, the market leader is one that holds the largest share of a market and with the highest margin. Market leaders have favorable purchasing power and complimentary brand strength. As market leaders, the challenge is to retain and strengthen this leadership role as the market proceeds toward maturity. Tactical introductions of next-generation products to fend-off competitive in-roads is a privilege of the market leader.

As markets grow and move toward maturity introducing product improvement that brings net operational cost savings to their customers is a very important tactic. Adding complimentary products and services that strengthen the company’s ability to provide process solutions to the customer becomes an important differentiator.

The market challenger is one that has lower margins and significantly less volume (typically 20% or less) than the market leader. Market challengers need differentiation in their product offerings to support an aggressive approach to growing their share. Depending on the strength of their product differentiation story, market challenges are put in the position of being price aggressive. Market challenger, however, also look for other elements of differentiation such as technical support or strategies related to the channels-to-market they employ to gain advantages over the market leader. In this scenario, market challengers have their greatest success as the market is experiencing early to strong middle-life-cycle growth. As the market begins to mature the opportunities to gain share from the market leader begin to diminish.

Market niches possess a strong, differentiated product/technology advantage in focused or narrow market application areas. They provide uniqueness in both their products and in their market expertise. These elements provide separation for such companies from other competitors. The result is that market niches have the highest profit margins and the strongest brand strength within specific market applications. Market niches need to set-the-table early in the product life cycle establishing and then building a differentiated identity for their company. Without this strength, they become a target for the market challenges and the market leader.

“Differentiation” is something that coating manufacturers strive for to set them apart from competitors. In the broadest sense, companies not only want this term to relate to their products and services but also their overall image in the markets they serve. In this article, the focus is on the role of product differentiation in value creation and its retention.

The strategic implications that evolve over the product life cycle are also discussed.

As formulated coatings, differentiation commonly refers to the features and benefits provided by the use of such coatings in one or more market applications. When introducing a new coating to the market, the impetus behind it is in its ability to address one or more unmet needs that exist in the marketplace. This scenario provides the platform for the sales and marketing strategies and related business goals for the company within the targeted market spaces.

The traditional graphic (Figure 1) outlining the “life cycle” of a product also applies to the markets that they serve. This graphic also provides a basic template for the changes that need to be made in strategy as products (and the markets they serve) move through their life cycle.

In emerging markets, the structure of the business opportunity is often very fluid and contains a number of undefined elements and transitional issues. This not only creates opportunities for new products but bring with it risks as well. These risks include a greater likelihood that alternative coating products are introduced into the market by competitors early in its life which diminish its uniqueness Risks may also involve a shift in the performance criteria required during the early stages of the market introduction.

Importantly, it is during this “emerging phase” that the baseline is set for profitability and the value of differentiated coating technologies is established in the marketplace.

As markets begin to experience growth, the competitive framework starts to establish itself. This includes sharpening the list of competing suppliers of coatings who will serve these markets going forward. it also brings into focus other important business elements that begin to shape the overall competitive environment. Table 1 lists some of these “other” elements of supplier differentiation.

As individual markets evolve and begin to mature, these “other elements” take on increasing strategic importance in their ability to retain differentiation. They also provide the basis for strategic planning and a guide to identifying those aspects of the business that need to be strengthened to grow and retain a strong market position going forward.

Table 1: Other Elements of Differentiation Beyond Product Performance

• Technical and application engineering support

• Next generation product development planning

• Cost position in raw materials

• Total cost-of-ownership for the process

• Manufacturing cost position

• Geographic market reach

• Channel-to-market strength/distribution

• Brand identity

Next Generation Product Development

The inventiveness that goes into new product design through research and development is fundamental to establishing a differentiated position in the marketplace. The goals and objectives behind novel product development vary. In certain cases, new products are developed in response to specific customer problems or unmet needs within a given market segment. In other situations, they are the result of the creativity and vision that comes through anticipating transitions occurring in the marketplace. Such products development efforts are often embryonic and can be “disruptors or game changers” in the best of circumstances.

Market leaders and major suppliers need to plan for product obsolescence and anticipate changes in the markets that they serve. Continuing to “leap-frog” the competition through the introduction of next-generation coatings is an effective tactic for fending-off share encroachment from competitors. In dynamic markets, where there are unmet needs or transitions occurring that require new products, the path forward often centers on new product development. As growth markets begin to mature, the competitive environment becomes more crowded and there is less differentiation in performance between suppliers. Without a “next generation” product to stay ahead of the competition, differentiation strategies increasingly rely on items like technical support, total process cost-of-ownership, local supply/JIT, distribution, etc. to support and protect market position.

For entrepreneurial companies and start-up ventures, the strength of their business strategies is in the uniqueness of their products/technologies or services in relation to existing market standards. In these cases, the level of differentiation from the norm needs to be significant in order to provide a strong value proposition to the end-user. The more successful entrepreneurial companies often narrow their business focus, targeting those individual market applications and account targets where they can maximize resources while addressing time-to-market realities.

During the growth cycle, quality technical service and application engineering support, directed at individual customer needs, is a very important differentiator between suppliers. Product line configurations, substrate types coating application equipment and the overall production process all impact the way coatings perform in service. With new products, each of these elements frequently determines which products work best.

Suppliers who understand the nuances and unique aspects of a customer’ production line and can then adapt their product implementation plan to address these needs differentiate themselves. These suppliers often succeed when other suppliers fail.

As markets begin to mature it is the knowledge and relationships gained through the understanding of customers’ individual manufacturing operations that also helps protect the business relationship with customers. Just as important, it is this knowledge that allows an incumbent supplier to guide next-generation products that refresh their supply position.

Access and strength in the channels-to-market is an important aspect of a successful business strategy. In volume markets, such as OEM coatings, direct sales support is required. At the same time, JIT requirements bring in to play the importance of regional supply through local warehousing and distribution. Unique coating products that deliver identifiable performance advantages may not be commercially viable without the accompanying resources and the appropriate channel-to-market strengths.

Adequate channel-to-market positioning strongly favors the major coating suppliers when addressing main-steam, volume market applications. Entrepreneurial companies with new, exciting innovations need to take into account the impediments they face in targeting certain markets where the channel-to-market is controlled by the

major manufacturers.

Alternatively, niche markets or smaller, less structured coatings market segments become more accessible and better opportunities for entrepreneurial companies with a novel if not ‘game changing” products. In these situations, it is during the embryonic phase of strategy development and implementation that the viability of the selected target markets needs to be assessed. Implementing a successful, differentiated market introduction strategy in one or more of these market spaces requires careful consideration of the channel-to-market requirements that are needed to be successful. For smaller, entrepreneurial companies, this analysis often dictates eliminating some markets in the beginning. Focusing on those market applications and specific accounts that fit within the resources and capabilities of the company to supply the end-user increases the chance for success. As these products mature, the value of having a strong position in the channels-to-market does not diminish.

In the context of “Porter’s marketing positioning” concept, the market leader is one that holds the largest share of a market and with the highest margin. Market leaders have favorable purchasing power and complimentary brand strength. As market leaders, the challenge is to retain and strengthen this leadership role as the market proceeds toward maturity. Tactical introductions of next-generation products to fend-off competitive in-roads is a privilege of the market leader.

As markets grow and move toward maturity introducing product improvement that brings net operational cost savings to their customers is a very important tactic. Adding complimentary products and services that strengthen the company’s ability to provide process solutions to the customer becomes an important differentiator.

The market challenger is one that has lower margins and significantly less volume (typically 20% or less) than the market leader. Market challengers need differentiation in their product offerings to support an aggressive approach to growing their share. Depending on the strength of their product differentiation story, market challenges are put in the position of being price aggressive. Market challenger, however, also look for other elements of differentiation such as technical support or strategies related to the channels-to-market they employ to gain advantages over the market leader. In this scenario, market challengers have their greatest success as the market is experiencing early to strong middle-life-cycle growth. As the market begins to mature the opportunities to gain share from the market leader begin to diminish.

Market niches possess a strong, differentiated product/technology advantage in focused or narrow market application areas. They provide uniqueness in both their products and in their market expertise. These elements provide separation for such companies from other competitors. The result is that market niches have the highest profit margins and the strongest brand strength within specific market applications. Market niches need to set-the-table early in the product life cycle establishing and then building a differentiated identity for their company. Without this strength, they become a target for the market challenges and the market leader.