DowDuPont Inc. (DWDP: Buy, $74 PT)

Deep Dive on DOW + DD = DWDP = Buy

• Embrace the core; DowDuPont shares offer compelling value in our view. With the merger of equals (MOE) between Dow and DuPont having closed on 31 August, we unveil herein our fully integrated financial model and affirm DowDuPont’s status as our top large-cap pick in the chemicals sector. As we show in Figure 1, DowDuPont, Inc. (NYSE: DWDP) is now the largest chemical company in the world as measured by 2016 pro forma sales. That’s not a particularly good reason for active managers to own the stock and, in any event, management plans to break-up DowDuPont within 18 months to create multiple independent companies. What is more compelling in our view is the prospect of premium double-digit earnings growth at an appreciable discount to the group. In the pages that follow, we discuss next steps in terms of catalysts and address the key issues for each of the new entities to be created from DowDuPont.

• Three key drivers support a 3-year EPS CAGR of 11%. First, parallel paths of productivity initiatives at both Dow and DuPont (legacy Dow, Dow Corning, legacy DD and Dow-DuPont) could add $0.56 to DowDuPont 2018 EPS in our estimation. Second, we expect an EPS tailwind of ~$0.35 from new projects in 2018 as Dow’s new ethylene cracker at Freeport, TX ramps in 2H17, along with contributions from Sadara (Saudi). Third…

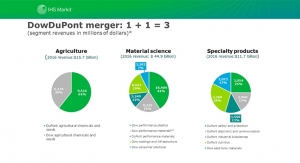

• We anticipate four key events by year end. These are committee recommendations regarding portfolio composition, receipt of pro forma financials, 3Q earnings results, and closure of the pending asset swap with FMC Corporation. In coming weeks, we expect to learn the recommendations of a joint committee formed to evaluate the precise composition of the three separate companies to be formed from DowDuPont: Agriculture Co., Material Science Co., and Specialty Products Co. For the purpose of our analysis herein…

• We rate DWDP shares Buy with a price target of $74. Given Dow’s previously pending combination with DuPont (DD) in a merger of equals (MOE), we have been assessing the value of DOW shares using a sum-of-the parts (SOTP) framework for the combined entity, DowDuPont, including synergies. In summary, we value DWDP shares at $74, which suggests upside potential of 14%, or nearly 17% inclusive of the dividend which is yet to be determined by the company’s new board of directors (Dow’s old dividend was $1.84 per annum, which would imply a yield of 2.7%).

• We recast our earnings estimates to reflect the combined DowDuPont portfolio. We estimate that 2018 EPS for DowDuPont will be $4.10. This number is lower than the $4.30 we had initially penciled in as we have increased our estimate for deal-related amortization due to better share price performance. Our estimate of $4.10 is driven by an EBITDA forecast of $19.3bn, which is composed of $11.5bn of legacy Dow EBITDA, nearly $6.0bn of legacy DuPont EBITDA, and estimated realized synergies of nearly $1.8bn. Our 3Q17 EPS estimate of $0.77 reflects three months of legacy DOW performance plus one month of legacy DuPont results, while our 4Q estimate of $0.72 reflects the first full quarter as a merger entity.

• We consider trading multiples attractive in light of premium growth prospects. In terms of EPS, DWDP shares trade for 15.8x our 2018 estimate of $4.10, which represents a 7% discount to the sector average of 17.0x. Likewise, DWDP shares command a multiple of 9.1x our 2018 estimate of EBITDA, a discount of 1.1 turns vs. the average for our group. A few additional notes regarding our base-case scenario…

(See full report for details)

"What is more compelling in our view is the prospect of premium double-digit earnings growth at an appreciable discount to the group."–Vertical Research Partners chemicals analyst Kevin McCarthy

Expert's Opinion

Analyst Looks at Dow/DuPont Merger, Unveils Integrated Financial Model

"What is more compelling... is the prospect of premium double-digit earnings growth at an appreciable discount..."

09.11.17

Related Expert's Opinion

-

-

Breaking News | Industry News

Dow, DuPont Complete Merger

“Today marks a significant milestone in the storied histories of our two companies..." – Andrew Liveris, executive chairman09.01.17

-

Analyst Provides Continued Insight on Hurricane Harvey Impact on Chemical Stocks

"Harvey...is wreaking havoc with the supply side of the U.S. chemicals industry" – analyst Kevin McCarthy.08.30.17

-

Market Trends & Forecast

IHS Markit Research Update—Chemical Company Analysis: Dow and DuPont Merger

As Dow & DuPont continue merger integration, activist investors drive company to seek outside counsel on proposed spin-offs.Dave Witte, Senior Vice President, Oil Markets, Midstream and Downstream and Rob Westervelt, Director, IHS Markit 08.10.17

-

Breaking News | Industry News