The increasing usage of decorative wall paints is expected to be an important driver for the industry. A rise in new infrastructure developments and renovation activities especially in the Asia Pacific and the Middle East, coupled with the rising expenditure power of the consumers has steered product demand in the construction sector over the past few years.

Water-based formulations have gained a significant space and recognition globally particularly on account of low environmental impact and improved economics. Water-based formulations enjoy the lion’s share accounting for over 50 percent of the total coatings volume consumed globally.

Waterborne formulations accounted for over 75 percent of total architectural coatings and are expected to increase significantly over the next seven years owing to stringent regulations regarding volatile organic compound (VOC) emissions in solvent-borne products. Increasing construction spending owing to escalating disposable income levels in the emerging economies of Asia Pacific and the Middle East are expected to be key factors for the market growth over the next seven years.

Growing production of the automotive products in emerging economies such as Thailand, China, India, and Indonesia in the Asia Pacific is also estimated to enhance the market growth from 2015 to 2024. Stringent rules and regulations by the European Union (EU) and the U.S. concerning the use of various ingredients while manufacturing these products act as a major restraint to the market growth.

Shifting consumer preferences towards eco-friendly and non-hazardous products have positively impacted the waterborne coatings industry growth. After the undercoat is applied, during the drying process the release of VOCs affects the environment. As the waterborne varnishes have a minimum lead residual and VOC, they have witnessed significant demand across various industrial sectors over the past few years.

Waterborne coatings are safer when compared to their counterparts as latter pose risks to the users who come in direct contact with the paints. Prolonged or higher exposure to the solvent-borne paints can cause a headache, irritation, allergies, and asthmatic reactions. The increased awareness about all health issues related to other coatings has also driven the growth of the waterborne coatings market.

Growing consumer preference for the waterborne coatings is attributed to glycol ethers and solvents with 80 percent water. Glycol ethers are preferred because of their properties like stain resistance, flexibility, hardness, corrosion resistance, toxicity and adhesion has enabled a rise in the demand of the industry.

Increase in the scope of the application of the electronics, marine, oil, wood, and metal packaging in the end use industries is expected to increase the product demand over the next couple of years. The surge in the demand for fax machines, copiers, printing machines, and laptops is also expected to be one of the primary reasons for industry growth.

The formation of foam during the manufacturing process, transportation and handling can act as a restraint to the waterborne coating market growth as foam residual is harmful to the environment.

The growth and profits of the waterborne coatings market can be hampered by associated viscosity and flow problems in comparison to the solvent based coatings. New technology for production can be developed by spending on the R&D and using agents which will inhibit foaming, can solve the flow issues thus, providing an attractive opportunity for the players of the industry.

The acrylic resin-based formulations accounted for over 80 percent of the waterborne coatings market share. The product category finds varied application in architectural and automotive refinishing applications on account of its exceptional exterior robustness along with the low cost of production. Waterborne coating formulations based on polyurethane resins was extensively used in the high-quality finishes in indoor and outdoor applications and is anticipated to show higher growth rates over the next couple of years.

The end-use industries such as the automotive and coal industries have increased the demand for PU based waterborne coatings which are expected to surge the market growth. Resin types such as polyvinyl chloride and epoxies are observed for their features of chemical and water resistance and adhesiveness. These type of resins find their applications in industrial finishes, electrical-insulation, office machine exteriors, and automobile interiors.

The acrylic resin-based formulations accounted for over 80% of the waterborne coatings market share. The product category finds varied application in architectural and automotive refinishing applications on account of its exceptional exterior robustness along with the low cost of production. Waterborne coating formulations based on polyurethane (PU) resins was extensively used in the high-quality finishes in indoor and outdoor applications and is anticipated to show higher growth rates over the next couple of years.

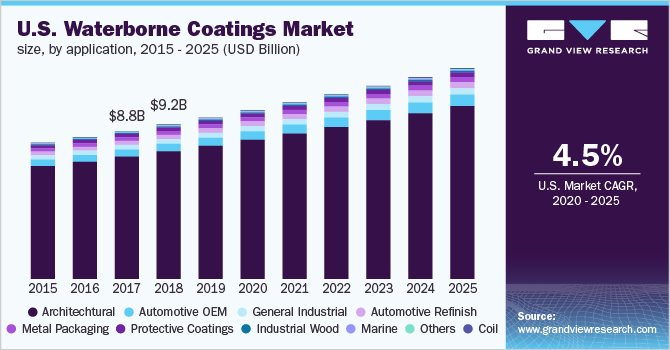

The end-use industries such as the automotive and coal industries have increased the demand for PU based waterborne coatings which are expected to surge the market growth. Resin types such as polyvinyl chloride and epoxies are observed for their features of chemical and water resistance and adhesiveness. These type of resins find their applications in industrial finishes, electrical-insulation, office machine exteriors, and automobile interiors.The waterborne coatings are used in metal packing, automotive OEM, architectural, protective coatings, and industrial wood. The architectural sector was the largest application segment in 2014 while accounting for over 85% share in the market and is expected to continue its growth in the coming years. The application in the architecture included lacquers and varnishes which are used to decorate and protect the external and interior frames and doors, window frames etc.

Increasing public awareness and government’s ban on the VOC content has also increased the product demand in major economies, as VOC creates toxic fumes, which contributes to the ozone layer depletion and poses fatal health risks.

The Middle East and African region are projected to witness above average growth rates in the civil constructions and infrastructure sector over the next decade. Shifting emphasis of several national governments in the GCC from hydrocarbon-based economy to other attractive industries such as medical & healthcare, education, and tourism is anticipated to spur infrastructure development projects in the region. This trend is likely estimated to steer the greener coating technologies over the forecast period.